Author: 100y.eth , Four Pillars

Compiled by Tim, PANews

Summary of key points

On August 13, 2025, Circle officially launched its proprietary Arc public blockchain: a Layer 1 network built specifically for the USDC stablecoin. Amidst the recent surge in stablecoin activity, Arc's launch has garnered widespread attention, marking Circle's official entry into the growing trend of issuing purpose-built blockchains.

Arc is committed to enabling businesses and institutions to more seamlessly access blockchain infrastructure while complying with regulatory requirements. This is achieved through three core capabilities: 1) using the USDC stablecoin as a gas token; 2) providing high scalability and instant transaction confirmation based on the Malachite consensus algorithm; and 3) supporting optional privacy features that can be enabled by users.

Arc adopts an operational strategy that is both similar to and distinct from USDT-centric blockchain solutions (such as Tether-backed Stable and Plasma). Its key differentiating advantages are:

The emergence of Arc has had a significant impact on the industry. This article delves into: 1) the differing development paths of Tether and Circle in the stablecoin network space; 2) whether competition between Circle and Tether will intensify; 3) the dynamics of other networks like Codex and 1Money Network; and 4) whether Arc's true competitor will be Tempo, rather than Stablecoin or Plasma.

1. Circle just launched Arc

Source: Circle

On August 13, 2025, Circle announced the launch of Arc, its self-developed USDC-native L1 blockchain, in its second-quarter financial report, simultaneously releasing a lightweight version of its technical documentation. Notably, just hours earlier that same day, Stripe, the world's largest payment service provider, officially launched its L1 blockchain, Tempo. The simultaneous release of these two fintech giants' dedicated blockchains on the same day makes August 13, 2025, a crucial milestone in the industry's development.

Circle's Arc has garnered such attention because the stablecoin space has recently become one of the hottest topics in the crypto community. Led by Stablecoin and Plasma, the stablecoin network projects backed by Tether's CEO and Bitfinex, several new Layer 1 public blockchains, including Codex and 1Money Network, are being developed specifically for stablecoins. Against this backdrop, the crypto community is increasingly anticipating Circle's related initiatives, and now, Circle has finally unveiled Arc.

So, is Arc, released by Circle today, just another first-layer network dedicated to serving USDC, no different from the various stablecoin networks that have emerged recently; or does it bring a differentiated gameplay that is completely different from other projects?

2.What is Arc?

Source: Arc

2.1 USDC Dedicated Chain

Before exploring the similarities and differences between Arc and other stablecoin networks, let’s first understand Arc itself.

Arc is an EVM-compatible blockchain purpose-built for USDC. Its goal is to enable businesses and institutions to conduct diverse financial activities on a scalable infrastructure, using stablecoins to pay predictable network fees while enjoying opt-in privacy features. To achieve this, Arc offers the following core features:

- USDC as the native GAS token: Allows users to use USDC as the default GAS token for all transactions, allowing them to pay low-volatility and predictable fees.

- Deterministic and Instant Finality: The Malachite consensus algorithm gives transactions finality in less than a second, providing a highly scalable infrastructure.

- Optional Privacy Solution: This solution integrates privacy protection technologies to provide customizable transparency options. Designed specifically for sensitive transaction scenarios, this solution aims to meet the compliance requirements of businesses and regulators while effectively supporting the operation of transaction monitoring systems.

2.2 The default GAS token is USDC, and any other token can be used for payment

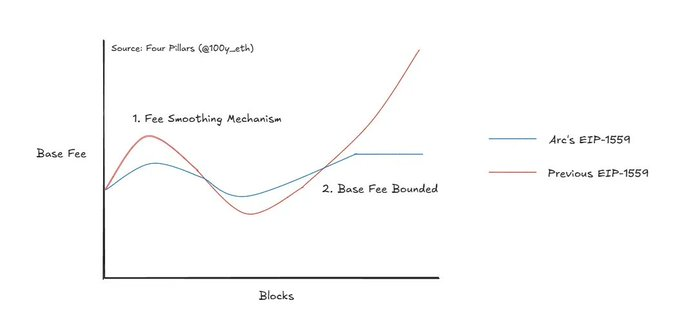

The Arc platform sets all transaction fees in USDC stablecoin by default and adopts the EIP-1559 fee model.

Arc has made several improvements to the EIP-1559 model. First, it introduces a "fee smoothing mechanism": This mechanism uses an exponentially weighted moving average algorithm to determine the fee for subsequent blocks by comprehensively considering fee data from past and recent blocks (older data is weighted exponentially less, more recent data is weighted more). While the traditional EIP-1559 model only considers usage from the previous block when determining the base fee for the next block, Arc significantly reduces base fee volatility by incorporating usage data from multiple historical blocks, including the previous one. The second improvement is a "base fee capping mechanism," which sets a fixed upper limit on the base fee, ensuring that fees do not increase indefinitely even during periods of Arc network congestion.

Circle Paymaster. Source: Circle

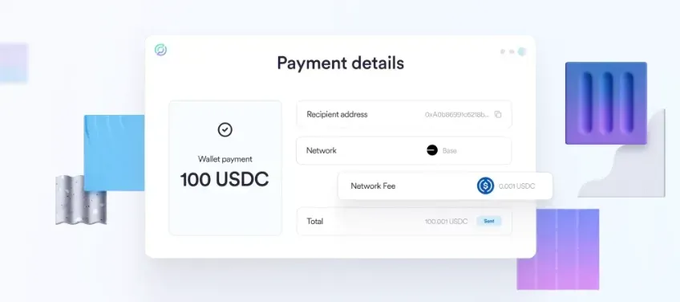

Arc not only supports USDC, but also allows the use of a variety of stable value tokens as fee tokens, including stablecoins pegged to other national currencies, deposit tokens, and central bank digital currencies. This feature is connected to Circle's payment custodian service.

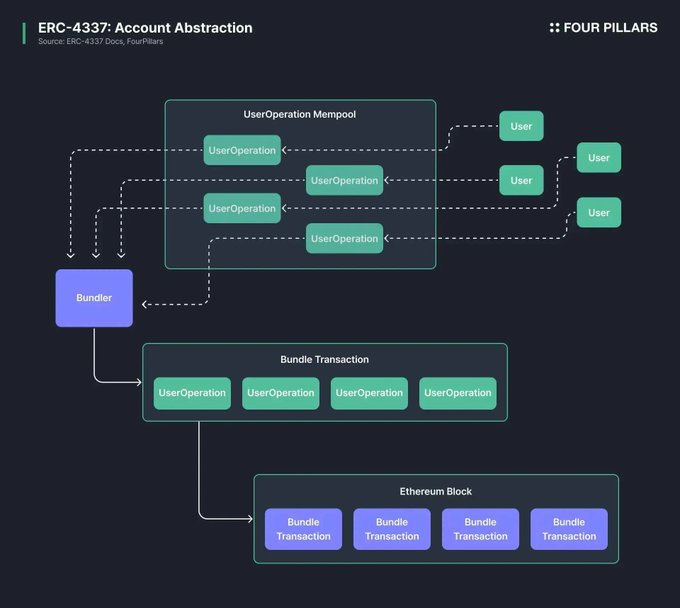

Circle Paymaster was originally a feature based on the ERC-4337 standard that allowed users to use USDC to pay transaction fees on other EVM blockchains without using the chain's native token. However, since Arc defaults to using USDC as the fee token, using the Paymaster feature can now also be used to pay transaction fees in tokens other than USDC.

The ERC-4337 standard is currently the most widely used account abstraction protocol. Without changing Ethereum's underlying protocol, it adds the Entrypoint, Bundler, and Paymaster functional modules, significantly lowering the implementation barrier to account abstraction. In this protocol, users no longer sign transactions directly, but instead sign independent objects called UserOps. These UserOps are stored in a separate off-chain memory pool, rather than the official Ethereum memory pool. The Bundler verifies these UserOps and bundles them into a single bundled transaction, which is then sent to a smart contract called the Entrypoint. The Entrypoint contract completes the verification and execution of all UserOps and the settlement of gas fees at once. At this point, the Paymaster module allows users to pay gas fees using other tokens.

As we've seen, Arc's fee model eliminates the need for institutional users to hold highly volatile tokens like ETH and SOL to pay transaction fees, significantly reducing the volatility of transaction fees. This not only improves business predictability but also significantly simplifies the company's financial accounting process.

During Arc’s early development stages, the fees collected will be injected into the Arc on-chain treasury to support the long-term development of the network.

2.3 Deterministic Instant Finality Powered by Malachite

For blockchain networks to become real-world financial systems, they must meet two key requirements: high scalability to handle large transaction volumes, and instant transaction finality that doesn't rely on probability. To achieve this, Arc brought in developers from Informal Systems and adopted the Malachite consensus algorithm.

Informal Systems, a Canada-based infrastructure company, has long been deeply involved in the Cosmos ecosystem, leading protocol design and development. Notably, the company's co-founders previously worked with Tendermint and the Interchain Foundation, bringing with them extensive experience in the technology behind the Tendermint BFT consensus protocol. In short, Informal Systems is the core team that continues Tendermint's legacy and is currently driving the development of its successor, CometBFT.

Malachite is a high-performance BFT consensus engine based on the Rust language, developed by Informal Systems. The Informal Systems Malachite team has joined Circle to jointly build the core consensus algorithm that underpins the Arc project.

Source: Informal Systems

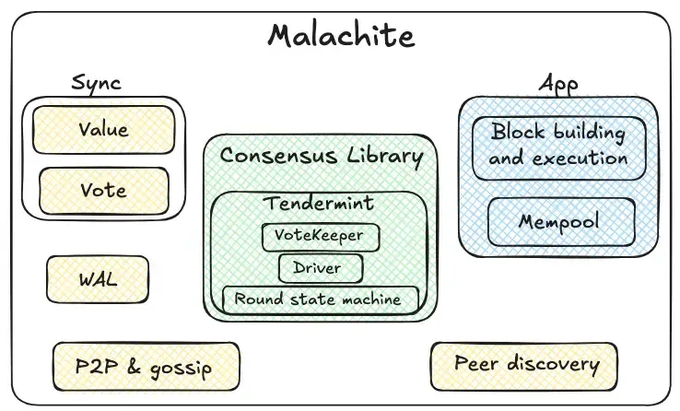

Compared to the existing CometBFT, Malachite has simplified its modules by removing unnecessary components and streamlining the kernel. As a result, the core library of Malachite is ultimately composed of three modules.

- Vote Keeper: Collects votes from network participants and tracks quorum progress

- Round State Machine: Implements the core logic of Tendermint voting rounds

- Driver: Operates the state machine in multiple rounds

Since the library makes no assumptions about the execution environment and does not restrict the type of application connected, its advantage is that it can provide a highly general consensus API interface.

Malachite not only provides a simple consensus library, but also provides an engine that allows developers to easily build production nodes. The technology also includes the following features:

- Synchronization: Synchronization of block proposals and voting data during the consensus process

- Write-Ahead Log: Fault Recovery and Data Integrity Guarantee

- P2P & Gossip communication: propagation of blocks, transactions, and voting messages between nodes

- Node discovery: Finding other nodes in the network

- Functional modules: block creation and execution logic, and transaction memory pool

Source: Arc

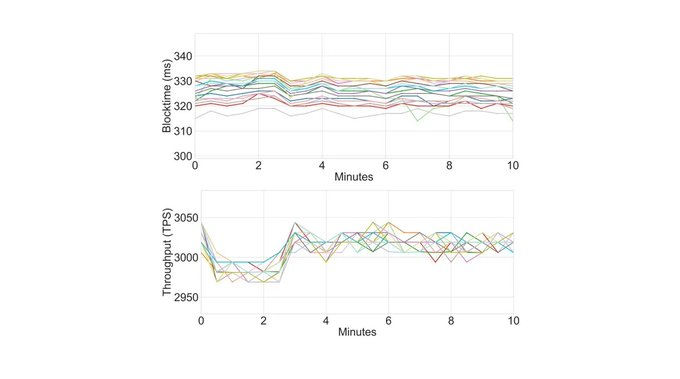

Thanks to its Rust-based implementation and streamlined modular design, Malachite has demonstrated exceptional performance in benchmarks, laying the foundation for Arc's scalability. In tests with 20 geographically distributed validators, Arc achieved 3,000 transactions per second and achieved finality within 350 milliseconds. Furthermore, Malachite's core implementation of the Tendermint BFT consensus algorithm ensures instant finality.

2.4 Optional Privacy Solutions for Sensitive Information Protection and Regulatory Compliance

A privacy feature that protects users' sensitive transaction information while allowing regulators to access account transaction information when necessary is an essential part of real-world financial infrastructure. To achieve this goal, Arc plans to add optional privacy protection features in upgrades after the mainnet launch.

Arc's early privacy roadmap includes the introduction of a "Confidential Transfer" feature. This feature will conceal transaction amounts while disclosing addresses, making them traceable by regulators and analytical tools. The goal is to maintain compatibility with existing blockchain analysis and monitoring systems. Specifically, Arc will ensure regulatory compliance by introducing "view keys," a mechanism that allows approved third parties such as auditors and regulators to obtain read-only access to specific transaction data. For institutions, this technology provides comprehensive visibility into all customer transactions, enabling compliance with regulatory requirements such as transaction monitoring and the Funds Transfer Rule.

To achieve this goal, Arc will provide an EVM precompiled contract that enables smart contracts to interact with a cryptographic backend. This backend will pioneer the use of Trusted Execution Environment technology to enable fast and verifiable private transactions, a significant difference from many existing privacy solutions. In the future, Arc plans to integrate multiple cryptographic technologies beyond TEEs, including zero-knowledge proofs, fully homomorphic encryption, and secure multi-party computation.

In its future privacy technology roadmap, Arc plans to go beyond simple encrypted transaction functions and upgrade to support "private state" and "confidential computing" technologies, thereby supporting advanced privacy application scenarios, such as:

- Private order book: The order book status is maintained on the exchange but not disclosed to the public.

- Financial Transaction Agreements: Keeping the Terms of a Transaction Confidential

- Automated fund management: The company's fund management logic is kept confidential.

3. A scenario similar to but different from Tether

The Arc solution launched by Circle this time is very similar to but different from the networks supported by Tether and focused on USDT (such as Stable and Plasma).

3.1 Same Script

3.1.1 Focus on the characteristics of stablecoins

Stable and Plasma are blockchain networks designed specifically for USDT. Key features include support for USDT as the default gas token, high scalability through underlying optimizations, and plans to offer optional privacy features. Furthermore, the network offers a zero-fee policy for simple USDT transfers.

For readers familiar with Stable and Plasma, a glance at Circle's Arc protocol might immediately lead you to think, "Wait, isn't this just Stable or Plasma functionality applied to USDC?" This is because Arc's three core features—1) using USDC as a fee token, 2) selective privacy, and 3) high scalability—are virtually identical to the key features of the previous two.

The key difference here is that Circle’s Arc Chain only supports USDC as a token for paying transaction fees and does not offer a fee-free policy for USDC transfer transactions.

3.1.2 Privacy is still a secondary priority

It's worth noting that, in addition to Circle's Arc Chain, Stable and Plasma also plan to offer optional privacy features for user data protection and regulatory compliance. However, these features are still in active development and will not be supported at the time of their initial mainnet launch. This is primarily due to the technical complexities of immediately implementing privacy features. It's unclear which stablecoin network will be the first to implement optional privacy features, and even if they are implemented, the actual user experience from the perspectives of users, businesses, and regulators remains to be seen.

3.2 Arc's own script

On closer inspection, Arc appears to be just another stablecoin network supporting USDC, but it actually has a unique design that sets it apart from existing stablecoin networks.

3.2.1 Integration of Circle Product Line

Source: Circle

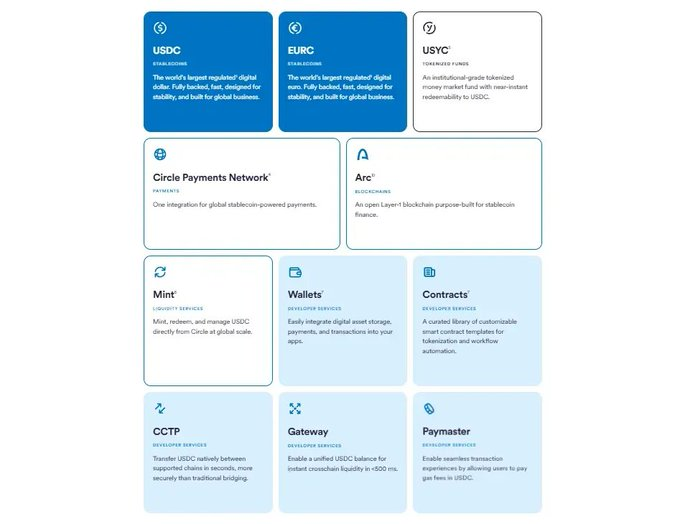

Arc's greatest advantage over other stablecoin networks lies in its flexible integration with other Circle services. Among stablecoin issuers, Circle is renowned for its vertical integration of a full range of stablecoin-related services. Arc offers a significantly improved user experience for USDC and EURC holders through integration with:

- USYC: An institutional-grade money market fund token backed by U.S. Treasury bonds. USYC will be supported on the Arc platform's first day of launch, allowing users to stake USYC and earn returns on various institutional-grade interest-bearing tokens on the Arc platform.

- Circle Payment Network: A global payment system based on stablecoins and blockchain technology, it can be thought of as a Web3 version of SWIFT. Once the Arc Network launches, institutions connected to the Circle Payment Network will be able to settle stablecoin transactions on the platform.

- Circle Mint: This platform allows issuers of USDC and EURC to easily mint and redeem stablecoins. In the future, users will be able to mint and redeem USDC and EURC directly through Circle Mint on the Arc platform in the fastest and most efficient way.

- Circle Wallet: Infrastructure that enables businesses to easily integrate Web3 wallets into their products, including Arc Chain-based assets.

- Circle Contracts: A smart contract platform for deploying, managing, and monitoring various stablecoin-based services. As Arc is an Ethereum Virtual Machine-compatible network, this functionality can be immediately leveraged for real-world applications.

- CCTP: A cross-chain transfer protocol that serves as the connectivity infrastructure, enabling users to easily transfer USDC and EURC across multiple networks. Arc will be able to interact with dozens of blockchain networks and transfer funds via CCTP. With Arc's sub-second transaction confirmations, cross-chain transfers to other networks will be significantly faster.

- Circle Gateway: This service aggregates users' USDC balances scattered across different networks into a unified total balance, enabling instant cross-chain transfers when needed. This allows users to conveniently manage assets between Arc and other public chains.

- Circle Paymaster: As previously discussed, this feature allows users to pay transaction fees with tokens other than USDC, or use the gas fee sponsorship feature on Arc.

3.2.2 Regulatory-friendly solutions

Unlike USDT, Circle's USDC not only complies with the US GENIUS Act but also primarily targets the US market. More importantly, a review of Arc's streamlined technical white paper reveals that Circle prioritized regulatory considerations when building Arc.

Source: BIS

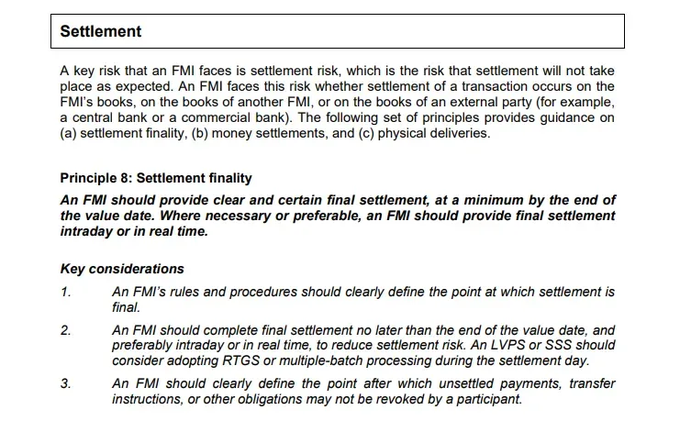

For example, the Arc technology white paper cites a report from the Bank for International Settlements (BIS) twice.

The first quote emphasizes that all Arc transactions have instant finality, which is in line with Principle 8: Settlement Finality in the Principles for Financial Market Infrastructures published by the Bank for International Settlements in 2012.

The second citation suggests that Arc’s permissioned validator set may have advantages under the Basel Committee on Banking Supervision’s “Framework for the Prudent Treatment of Crypto-Asset Risks,” published in 2022 by the Bank for International Settlements.

Therefore, it is clear that Arc was designed not only to serve as a Web3 network for USDC, but also that many of its regulatory elements have been carefully considered.

3.2.3 Built-in foreign exchange engine

Arc's technology roadmap envisions integrating an institutional-grade foreign exchange (FX) engine directly into its network. This FX engine will enable efficient and secure 24/7 FX settlement between trading partners across multiple countries.

In addition to smart contract-based trading, the system will also integrate an off-chain request for quote (RFQ) mechanism, enabling institutional investors to obtain foreign exchange quotes from market makers, compare prices, and quickly execute trades. This FX engine supports a variety of FX-related services, including cross-border payments, FX hedging, automated fiat-to-cryptocurrency exchange gateways, and stablecoin futures markets.

4. Final Thoughts

- Tether and Circle's divergence in stablecoin network strategy has already become apparent: Tether has chosen to support external projects like Stable and Plasma to build a dedicated USDT network, while Circle is committed to building its own USDT ecosystem. Each approach has its own advantages and disadvantages. The Tether model allows USDT-focused networks to rapidly expand their ecosystem while avoiding excessive constraints from Tether's corporate governance, but it struggles to fully align with Tether's strategy and could lead to ecosystem fragmentation. Circle, on the other hand, offers a more comprehensive user experience through highly integrated products, but strict adherence to corporate governance and compliance requirements may limit the speed of Arc's ecosystem development. The success or failure of each model will ultimately be determined by time and the market.

- Will Circle's competition with Tether intensify? Some may view Circle's launch of a new public blockchain focused on USDC as a sign of intensified competition between Circle and Tether. While this is a reasonable argument, it's somewhat simplistic. The launch of Arc is more about seamlessly connecting and enhancing Circle's existing product portfolio than entering an entirely new ecosystem. The competition between Circle and Tether is already intense, and the launch of Arc is not expected to significantly deepen it. Arc's true competitor may be closer to Stripe's Tempo than to Stable or Plasma platforms.

- What are the future prospects for Codex and 1Money Network? Prior to Circle's announcement of the Arc Network, the market lacked a dedicated, independent stablecoin network issuing USDC, leading to significant attention for Codex and 1Money Network. Of these two stablecoin-focused blockchains, Codex received strategic investment from Circle Ventures and natively supports USDC issuance, while 1Money Network is a Circle Alliance partner and utilizes Circle Mint. However, with Circle's official entry, these projects may be at a disadvantage in terms of market attention within the crypto community, and their subsequent market entry strategies remain unclear.

- Is Arc a competitor to Tempo? Chuk from Paxos offered an interesting perspective that I'd like to share. His tweet compared Circle's Arc to Stripe's Tempo, noting that the two companies employ completely different strategies and approaches: Stripe's offense, Circle's defense. These differences increase their respective potential for success.