Author: BlockSec

In May 2025, the Hong Kong police smashed a virtual asset money laundering group worth US$15 million (approximately HK$117 million). The gang mainly split and transferred funds through the OTC channel in Tsim Sha Tsui.

Earlier, in the JPEX case that shocked Hong Kong, the Commercial Crime Bureau (CCB) revealed that a large amount of funds involved in the case were exchanged and transferred through OTC stores in Hong Kong, becoming an important link in the fraud chain.

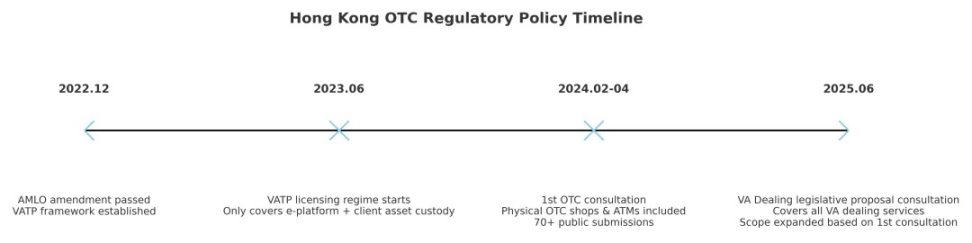

In June 2025, the Hong Kong government released the "Legislative Proposal to Regulate Dealing in Virtual Assets," a public consultation document proposing that all virtual asset trading services, including OTC services, be brought under a unified licensing and regulatory framework. While the proposal is still in the consultation phase and has not yet been formalized into legislation, it lays out a clear blueprint for the next steps in Hong Kong's virtual asset regulation—from the early licensing of VATP platforms, to the regulation of cryptocurrency exchanges, and finally to comprehensive coverage of virtual asset dealing services.

To sum it up in one sentence: In three years, Hong Kong's supervision has moved from the OTC "vacuum zone" to full chain supervision.

Phase 1 (2023): VATP will be brought under regulation, but OTC products will slip through the net.

At the end of 2022, Hong Kong passed the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance, and from June 2023, a licensing system will be implemented for virtual asset trading platforms (VATPs), which will be supervised by the Securities and Futures Commission (SFC).

VA Dealing Consultation Paper, 1.3

"In December 2022, ... a licensing regime for VA trading platforms ("VATPs") ... commenced operation in June 2023 ... must be licensed by the SFC unless otherwise permitted by the law." VADEALING_consultation_…

According to the definition of VA exchange:

- Matching virtual asset transactions between buyers and sellers through electronic facilities;

- Access to client assets (holding, controlling or arranging custody)

Therefore, the system at the time only targeted the "electronic platform + contact with customer assets" business, and OTC scenarios such as physical currency stores, counters, ATMs, etc. were not included, which led to a regulatory vacuum.

In the second phase (2024), customs licensing will be implemented, and cryptocurrency OTC will also need to be licensed.

From February to April 2024, the Financial Secretary and the Treasury Bureau (FSTB) launched the first round of consultation on the "Virtual Asset OTC Trading Services Licensing Regime", bringing physical OTC under regulation for the first time.

Main content:

- All virtual asset spot trading businesses in Hong Kong (physical or online) must be licensed;

- The Hong Kong Customs and Excise Department (CCE) is responsible for issuing licenses;

- Covers USDT, BTC and other fiat currency exchange and transfers;

VA Dealing Consultation Paper, 1.6(a)-(b):

"Scope and coverage: Any person ... services of spot trade of any VAs ... would have to be licensed by the Commissioner of Customs and Excise ("CCE"). Eligibility: A licensee would be required to be a locally incorporated company ..."

Phase 3 (2025): OTC will be incorporated into the VASP family and SFC will unify supervision

In June 2025, Hong Kong released the second round of the “Legislative Proposal to Regulate Dealing in Virtual Assets”, which upgraded the scope and depth of supervision:

- Scope expansion: covering complex services such as block trading, brokerage matching, settlement and exchange, and asset management;

- Regulatory adjustments: SFC will issue licenses, while HKMA will supervise banking/SVF business;

- Principle continuity: same business, same risks, same rules;

- Exemption arrangement: Issuers that only issue/redeem stablecoins in the primary market and have obtained permission from the HKMA are exempt.

VA Dealing Consultation Paper, 1.10:

"Under the proposed regime, any person ... providing the VA service of dealing in any VAs in Hong Kong is required to be licensed by or registered with the SFC... including conversion, brokerage, block trading..."

Reason for the change: This round of recommendations was developed based on the more than 70 written comments received in the first round of consultation. The government stated in the document that the comments focused on issues such as the high risks of OTC, cross-border money laundering loopholes, and insufficient regulatory coverage. Therefore, the original OTC regulatory recommendations were expanded to a broader "VA Dealing" framework.

VA Dealing Consultation Paper, 1.8:

"Following the conclusion of the first round of consultation, we received over 70 written submissions from various stakeholders... We have refined our proposal to expand the scope to VA dealing services to better address AML/CFT risks."

Important note: The content of this stage is still in the public consultation stage and has not yet been formally legislated. The final details may be adjusted during the legislative process.

Drivers behind policy changes

The three evolutions of Hong Kong's OTC regulatory policy did not occur in isolation, but were the result of multiple factors. There are at least three core drivers behind this:

Driver 1: Frequent occurrence of major cases exposes regulatory vacuum

In a $15 million money laundering case in May 2025, the ring used OTC (Over-The-Counter) trading platforms to split funds, bypass bank surveillance, and complete multiple cross-border transfers in a short period of time. In the JPEX case, the Commercial Crime Bureau (CCB) discovered that many investors' defrauded funds were exchanged for cash or stablecoins through local OTC shops, and then quickly transferred to overseas wallets.

These cases expose a problem: even if platform supervision is tightened, the anonymity and instant settlement characteristics of offline OTC can still circumvent supervision and become a risk channel for the "last mile".

Driver 2: International regulatory pressure and FATF standards

Since the 2019 update to Recommendation 15, the Financial Action Task Force (FATF) has explicitly required all jurisdictions to fully integrate virtual asset service providers (VASPs) into their anti-money laundering/countering the financing of terrorism (AML/CFT) frameworks. While Hong Kong met some FATF requirements when it first introduced VATP licensing, the "leakage" of OTC services has been repeatedly highlighted by international assessment agencies and partners. To maintain Hong Kong's credibility as an international financial center, regulators must address this loophole and ensure the effective implementation of the "same business, same risk, same rules" principle.

If Hong Kong wants to become an international virtual asset center, it must address AML/CFT risks.

Driver 3: Local public opinion drives policy upgrades

During the first round of OTC consultations in 2024, the government received over 70 written public comments from banks, compliance agencies, crypto companies, and law enforcement agencies. Most of the comments highlighted the high risks of anonymous OTC transactions; the difficulty in tracking cross-border capital flows; and the role of OTC as an intermediary in fraud and money laundering cases.

In its VA Dealing legislative proposal released in 2025, the government clearly stated that it was based on these feedbacks that the regulatory scope, which originally only covered OTC exchanges, was expanded to include the more complete VA Dealing full-chain business.

VA Dealing Consultation Paper, 1.8:

"Following the conclusion of the first round of consultation, we received over 70 written submissions from various stakeholders... We have refined our proposal to expand the scope to VA dealing services to better address AML/CFT risks."

Summarize

Once a hidden gem in Hong Kong's cryptocurrency market, OTC (Over-the-Counter) trading is now being brought into the open. From platform regulation in 2023, to the regulation of cryptocurrency shops in 2024, to the proposed full-chain "VA Dealing" framework in 2025, Hong Kong's virtual asset regulation is becoming more systematic and internationalized. The latest chapter in this process is currently under public consultation, awaiting final legislation.