Author: Bootly

The cryptocurrency market was hit hard at the very beginning of November.

Bitcoin not only fell below the key level of $108,000, but even briefly touched around $105,949, a single-day drop of more than 4%. With this decline, the total market capitalization of the entire cryptocurrency market shrank to around $3.51 trillion.

In addition, the established DeFi protocol Balancer suffered a major security breach today, with attackers stealing $128 million from its v2 vault. This vault manages $678 million in liquidity and is a critical infrastructure for the DeFi ecosystem. This series of bad news has many veteran users saying "this feels familiar," a scenario strikingly similar to the prelude to a previous bear market.

According to Coinglass data, in the past 24 hours, a total of 302,364 people worldwide were liquidated, with a total liquidation amount of $1.164 billion USD, comprising $1.082 billion USD of long positions and approximately $81.58 million USD of short positions. Of this, Bitcoin accounted for $298 million USD, Ethereum $273 million USD, SOL $144 million USD, and other cryptocurrencies accounted for $125 million USD.

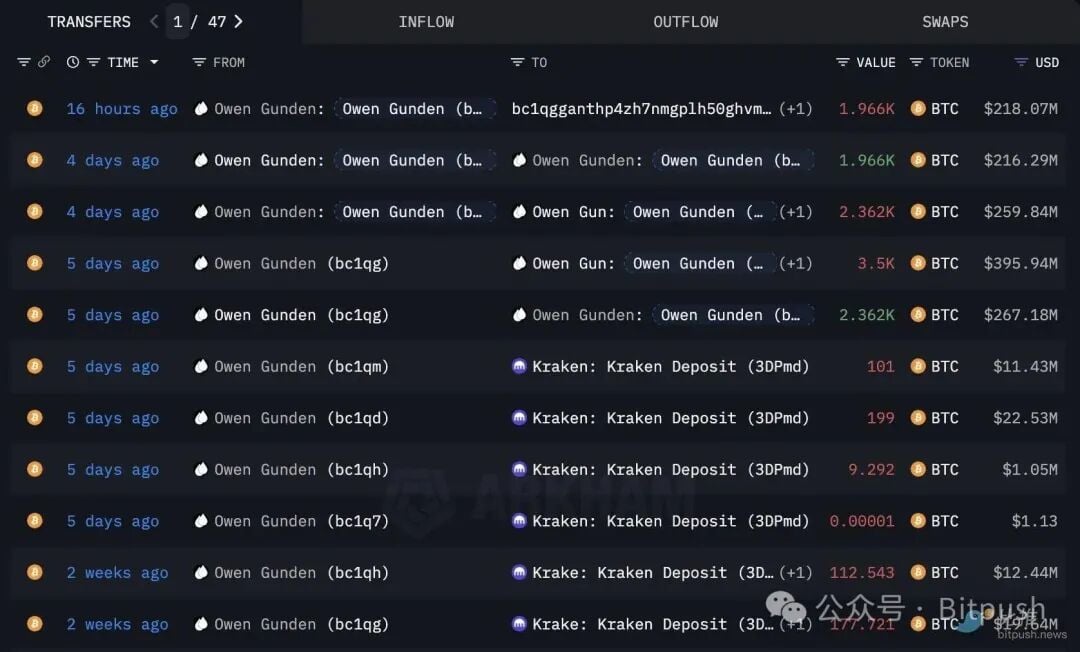

Giant whale unusual activity

CryptoQuant, an on-chain data provider, monitors data showing that undercurrents have been swirling within the market. Since October 1st, the well-known short-selling whale "1011short" has been continuously transferring 13,000 bitcoins, worth approximately $1.48 billion, to exchanges such as Kraken. Owen Gunden, an early investor from the Satoshi Nakamoto era, has also begun to move after years of silence, transferring 3,265 bitcoins to exchanges.

Specifically, the "1011short" wallet transferred 500 bitcoins to Kraken in a single transaction on November 2, corresponding to a market value of approximately $55 million; at the same time, it also deposited several smaller amounts of bitcoins into Hyperliquid in batches, with each transaction ranging from 70 to 150 bitcoins.

On-chain analysts point out that this phased, multi-channel transfer pattern is highly consistent with the trader's past operational logic of establishing short positions after market rebounds, indicating that he may be setting up for a new round of short selling.

Institutional funding shortage

Institutional investors' attitudes have also undergone a subtle shift. According to data compiled by SoSoValue, spot Bitcoin ETFs recorded a net outflow of $799 million last week, with a significant slowdown in inflows into BlackRock's IBIT product. This change contrasts sharply with the large influx of institutional funds last month.

In a tweet today, Glassnode further pointed out that there has been a significant change in the recent fund flows of BlackRock's spot Bitcoin ETF. Data shows that the weekly net inflow of BlackRock's spot Bitcoin ETF has dropped to "less than 600 BTC" over the past three weeks, a stark contrast to its strong performance during this upward cycle, when weekly inflows often exceeded "10,000 BTC", reflecting a significant slowdown in institutional demand.

In their market review released today, QCP Capital analysts offered another perspective on the current market's supply and demand dynamics. They pointed out that the market has actually absorbed approximately 405,000 Bitcoins of traditional selling pressure over the past month, yet the price has still not broken through effectively.

The analyst added, "Bitcoin's price is still oscillating within a multi-month consolidation range similar to that before the breakout in 2024, fueling speculation that this cycle is nearing its end. Whether this heralds a new cryptocurrency winter remains unclear."

Macroeconomic clouds loom

The macroeconomic outlook is equally concerning. US Treasury Secretary Bessett recently warned that the Federal Reserve's tightening policies may have already damaged some sectors of the economy. This statement has raised concerns about the Fed's motivations for a policy shift—if interest rate cuts stem from a deteriorating US economy, risk assets may face even greater pressure. While economists generally believe that a full-blown recession in the US is unlikely in the short term, this macroeconomic pressure is indirectly suppressing BTC demand by lowering overall market risk appetite.

Analyst Opinions

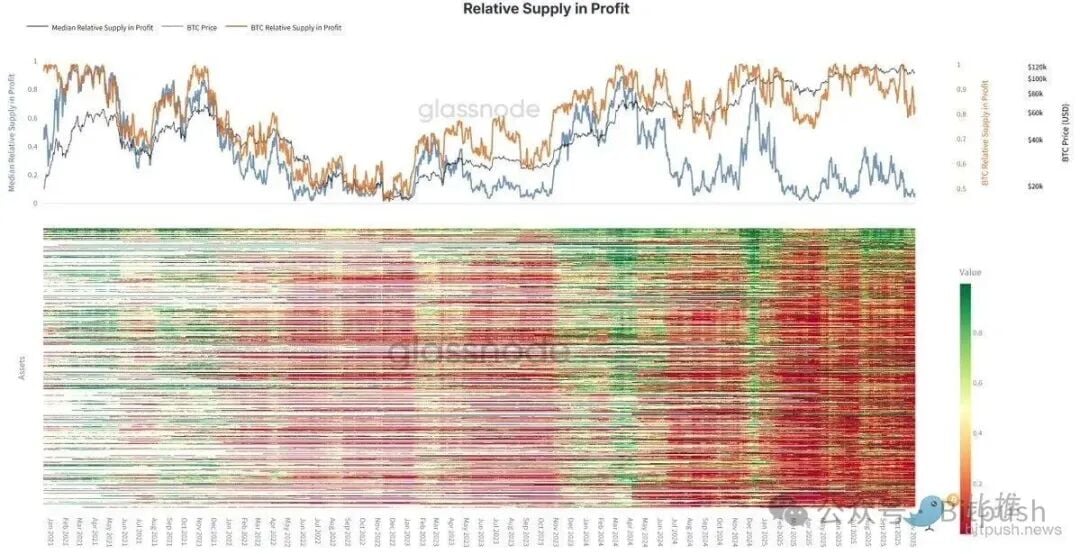

The altcoin market is facing a severe test. Glassnode analysts on the X platform point out that most altcoins continue to underperform Bitcoin, with supply and profit levels "only seen during the tariff war and the 2022 bear market." The analysts emphasize that investors who passively hold altcoins "have very likely already underperformed Bitcoin's benchmark."

Emir Ibrahim, an analyst at digital asset trading firm Zerocap, stated that after the liquidation turmoil at the end of October, Bitcoin is currently in a "consolidation phase," with the trading range narrowing to $108,000-$110,000. However, he also noted, "From a broader perspective, the current consolidation remains constructive. Historical data shows that November is Bitcoin's strongest performing month, with an average return of over 40% over the past decade."

Shawn Young, chief analyst at MEXC Research, believes that Bitcoin's key resistance level lies in the $111,000-$113,000 range. He analyzed, "A successful break above this resistance zone could trigger a new round of upward momentum, with an initial target of $117,000. Coupled with a favorable macroeconomic environment, it might even retest the all-time high of $126,000. We maintain our view that Bitcoin will reach the $125,000-$130,000 target range by the end of the year, followed by a period of high volatility consolidation."

While historical data shows November is typically a strong month for Bitcoin, this year's situation is clearly more complex. Multiple factors, including Federal Reserve policy expectations, institutional fund flows, and technical signals, are intertwined, creating significant uncertainty about the market outlook.

As of press time, Bitcoin was trading at $105,862.19, with the market closely watching further developments. This November is destined to be anything but calm for investors.