Source: Coinbase

Compiled by: Golden Finance

Key Points

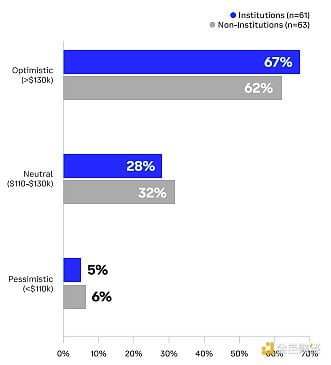

1. Most respondents are bullish on Bitcoin. Among the 124 respondents, 67% of institutional investors and 62% of non-institutional investors have a positive view on the prospects of Bitcoin in the next 3-6 months.

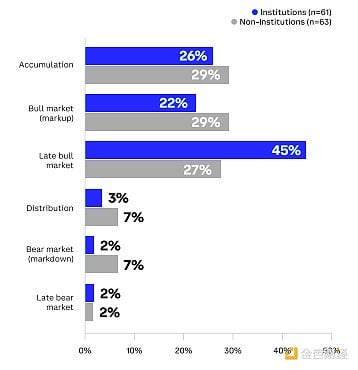

2. Investors have significant differences in their views on the current stage of the market cycle. Nearly half (45%) of institutional investors believe we are in the late stage of a bull market, while just over a quarter (27%) of non-institutional investors hold this view.

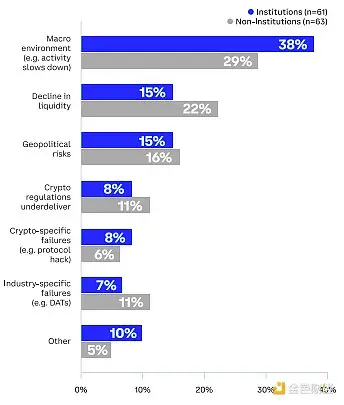

3. Both institutional investors (38%) and non-institutional investors (29%) view the macroeconomic environment as the biggest potential risk facing the cryptocurrency market in the next 3-6 months.

From September 17 to October 3, 2025, Coinbase surveyed more than 120 global investors to understand their views on cryptocurrency market trends, industry allocation, risk management, and other aspects.

Where are we in the cryptocurrency market cycle?

What are the expectations for Bitcoin in the next 3-6 months?

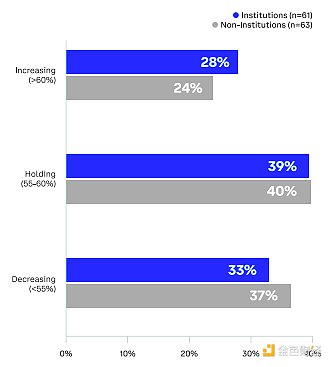

What changes are most likely to occur in Bitcoin’s market capitalization share (i.e., Bitcoin’s share of the total cryptocurrency market capitalization) over the next 3-6 months?

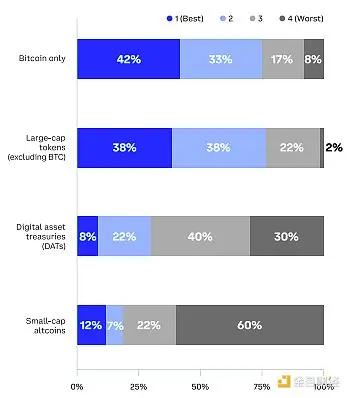

Institutional Investors: Please rank the following cryptocurrency sectors based on your expected performance over the next 3-6 months (1 being the best performer and 4 being the worst performer).

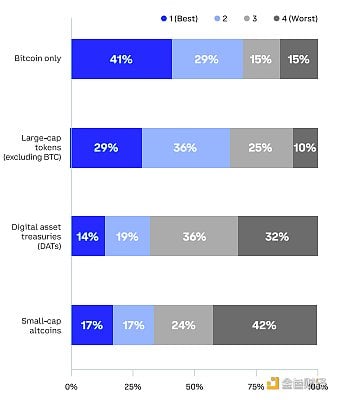

Non-institutional investors: Please rank the following cryptocurrency sectors based on your expected performance over the next 3-6 months (1 being the best performer and 4 being the worst performer).

What are the biggest potential risks facing the cryptocurrency market in the next 3-6 months?

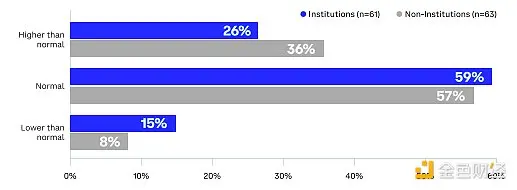

How does the current level of risk taken compare to the benchmark level?

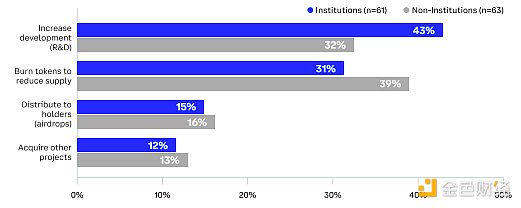

How would you most like crypto projects to handle their reserve funds?

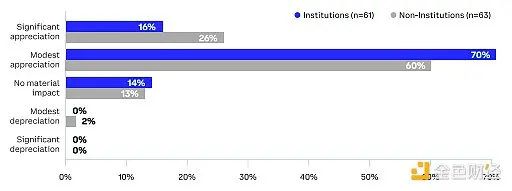

If the U.S. Securities and Exchange Commission (SEC) approves a cryptocurrency spot ETF, what impact do you expect this will have on cryptocurrency prices?

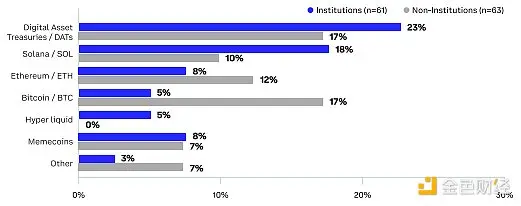

In your opinion, what is the most crowded trade in the current cryptocurrency market?