By Arthur Hayes, Founder of BitMEX

Compiled by: BitpushNews

US Treasury Secretary Scott Bessent deserves a new nickname. I once called him "BBC," short for "Big Bessent Cock." While his aggressive actions are reshaping the global financial system, that title doesn't fully capture his impact. I believe a more apt title is needed to describe the impact he will have on two key areas: the eurodollar banking system and foreign central banks.

Like the serial killer in The Silence of the Lambs—a classic worth a late-night viewing for any novice—Scott "Buffalo Bill" Bessant is poised to reshape the eurodollar banking system and seize control of foreign non-dollar deposits. In ancient Rome, slaves and elite legionnaires maintained the Pax Romana; in modern times, the hegemony of the US dollar maintains the Pax Americana. The "slavery" in the Pax Americana doesn't refer solely to the historical African slaves transported to the Americas; today, it takes the form of monthly debt repayments—generations of young people willingly incurring crippling debts to obtain worthless academic credentials in the hopes of landing jobs at top firms like Goldman Sachs, Sullivan & Cromwell, or McKinsey. This form of control is far more widespread, insidious, and effective. Unfortunately, with the advancement of artificial intelligence, these heavily indebted individuals may face unemployment.

Let me interrupt for a moment.

This article will discuss the dollar's control over the global reserve currency under "Pax Americana." Successive U.S. Treasury Secretaries have wielded this financial cudgel with varying success. Their most notable failure was their inability to prevent the formation of the eurodollar system.

The eurodollar system emerged in the 1950s and 1960s, initially intended to circumvent US capital controls (such as Regulation Q), circumvent economic sanctions (the Soviet Union needed a place to store US dollars), and provide banking services for non-US trade flows during the global economic recovery after World War II. Monetary authorities at the time could have recognized the need to provide US dollars to foreign countries and allowed major US financial institutions to undertake this service, but domestic political and economic considerations forced them to take a hard line. Consequently, the eurodollar system continued to expand over the following decades, becoming a formidable financial force. Estimates indicate that eurodollar deposits held in non-US bank branches worldwide range from $10 to $13 trillion. These capital flows triggered numerous postwar financial crises, each requiring the printing of money to rescue the market. The Atlanta Federal Reserve published a paper in August 2024 titled "Offshore Dollars and US Policy" that analyzed this phenomenon.

For "Buffalo Bill" Bessant, the eurodollar system presented two major problems. First, he had little idea of the size of the eurodollar system or what these funds were used for. Second, and more crucially, these eurodollar deposits were not being used to purchase his low-quality U.S. Treasury bonds. So, was there a way for Bessant to address both of these issues simultaneously? To answer this question, let's briefly review the foreign exchange holdings of non-U.S. retail depositors.

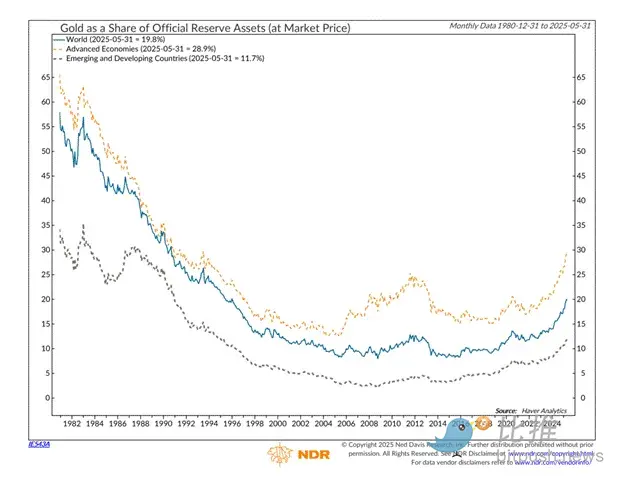

De-dollarization is real. It began to accelerate significantly in 2008, when US financial leaders chose to use unlimited quantitative easing (QE Infinity) to rescue banks and financial institutions facing collapse due to misguided bets, rather than allowing them to fail naturally. A useful indicator of global central banks' response to holding trillions of dollars in dollar-denominated assets is the proportion of gold in their foreign exchange reserves. A higher proportion of gold in reserves indicates lower trust in the US government.

As can be observed, since the financial crisis in 2008, the proportion of gold in central bank reserves has bottomed out and begun to show a long-term upward trend.

This is the TLT US ETF, which tracks US Treasury bonds with maturities of 20 years or longer and divides their prices by the price of gold. I've indexed it to 100 starting in 2009. Since 2009, the value of US Treasury bonds relative to gold has fallen by almost 80%. The US government's monetary policy is to bail out its domestic banking system at the expense of both domestic and foreign creditors. No wonder foreign central banks are hoarding gold, like Scrooge in "Donald Duck." US President Trump intends to adopt a similar strategy, but in addition to targeting bondholders, he also believes in taxing foreign capital and trade flows through tariffs to "Make America Great Again."

Bessant actually has a hard time convincing central bank reserve managers to buy more Treasury bonds. However, there's a large population in the Global South that lacks access to dollar-denominated financial services and desperately wants a positive-yielding dollar account. As you know, all fiat currencies are rubbish compared to Bitcoin and gold. Yet, within the fiat currency system, the dollar remains the best choice. Domestic regulators, who control the majority of the global population, force their citizens to hold high-inflation, low-quality currencies and restrict their access to the dollar financial system. These people buy Bessant's Treasury bonds simply to escape their own struggling domestic bond markets. So, can Bessant provide banking services to these people?

I first visited Argentina in 2018 and have been back almost every year since. This chart shows the ARS/USD index (base value 100) since September 2018. Over seven years, the Argentine peso has depreciated 97% against the US dollar. Now, when I go there, I mostly ski, and I pay all service staff in USDT.

"Buffalo Bill" Bessant has found a new tool to solve his problem—a dollar-pegged stablecoin. The US Treasury is now promoting the development of such stablecoins, with the Empire supporting specific issuers to help them capture the eurodollar system and retail deposits in the Global South. To understand this, I will first briefly describe the structure of an "acceptable" dollar-pegged stablecoin and then discuss its impact on the traditional banking system. Finally, and most importantly for the crypto community, I will explain why the global adoption of dollar-pegged stablecoins supported by Pax Americana will drive the long-term growth of decentralized finance (DeFi) applications, particularly Ethena, Ether.fi, and Hyperliquid.

As you know, we at Maelstrom don't work for free. We have bags and bags full of stuff, and we never run out.

If you're still not sold on stablecoins, I'd like to mention Codex, a new stablecoin infrastructure project we're currently advising on. I believe it will be the best performing token from its upcoming TGE (Token Generation Event) to the end of this cycle.

What are “acceptable” stablecoins?

A dollar-pegged stablecoin is similar to a narrow bank. The issuer accepts dollars and invests them in risk-free bonds. In nominal dollar terms, the only risk-free bond is the U.S. Treasury. Specifically, because stablecoin issuers must be able to provide physical dollars upon redemption, they invest only in short-term Treasury bills (T-bills), which mature in less than a year. With virtually no duration risk, they trade almost identically to cash.

Take Tether USD (USDT) as an example:

- The Authorized Participant (AP) transfers US dollars to Tether’s bank account.

- Tether creates 1 USDT for every 1 USD deposited.

- To make these dollars generate interest, Tether purchases Treasury bills (T-bills).

For example: If the AP remits $1,000,000, they will receive 1,000,000 USDT.

Tether uses this $1,000,000 to purchase an equal amount of T-bills.

USDT itself does not pay interest, but these T-bills actually pay the Federal Reserve Funds Rate, which is currently around 4.25%~4.50%.

As a result, Tether earned a Net Interest Margin (NIM) of 4.25% to 4.50%.

To attract more deposits, Tether or related financial institutions (such as crypto exchanges) will pay a portion of NIM to users who are willing to stake USDT. Staking means locking USDT for a period of time in exchange for interest income.

The redemption process for stablecoins is as follows:

- Authorized Participants (APs) send USDT to Tether’s crypto wallet.

- Tether sells T-bills according to the corresponding USD amount of USDT.

- Tether transfers $1 for each USDT to the AP’s bank account.

- Tether destroys the corresponding USDT, removing it from circulation.

Tether’s business model is very simple: receive US dollars, issue digital tokens on a public blockchain, invest the US dollars in T-bills and earn the net interest margin (NIM).

Bessent will ensure that stablecoin issuers tacitly supported by the Empire State can only deposit their dollars in chartered US banks or invest them in Treasury bonds. No "bells and whistles" required.

The impact of the eurodollar system

Before the advent of stablecoins, the U.S. Federal Reserve and the Treasury consistently bailed out eurodollar banking institutions when they ran into trouble. A well-functioning eurodollar market was crucial to the overall health of the empire. Now, however, Bessent had a new tool to absorb these capital flows. At a macro level, he had to provide the right incentives for eurodollar deposits to be on-chain.

For example, during the 2008 global financial crisis, the Federal Reserve secretly lent billions of dollars to foreign banks starved of dollars by the collapse of subprime mortgages and related derivatives. Consequently, eurodollar depositors widely believe that the US government implicitly guarantees their funds, even though they are technically outside the US regulatory system. If it were announced that non-US bank branches would not receive assistance from the Fed or Treasury in future financial crises, eurodollar deposits would be funneled into the arms of stablecoin issuers. If that sounds like hyperbole, a Deutsche Bank strategist publicly questioned whether the US would use dollar swap lines to force Europe to comply with the Trump administration's demands. Trump is undoubtedly eager to weaken the eurodollar market by effectively "de-banking" it—the very institutions that de-banked his family business after his first term are now seeking revenge. Karma, indeed, is cruel.

Without this guarantee, eurodollar depositors will, out of self-interest, shift their funds into dollar-pegged stablecoins like USDT. Tether's assets are held entirely in US bank deposits or Treasury bonds (T-bills). Legally, the US government guarantees all deposits at the eight "too big to fail" (TBTF) banks; following the 2023 regional banking crisis, the Federal Reserve and the Treasury Department effectively guaranteed deposits at all US banks or their branches. The default risk of T-bills is virtually zero because the US government can never voluntarily go bankrupt—it can always print dollars to repay bondholders. Therefore, stablecoin deposits are risk-free in nominal US dollars, while eurodollar deposits are no longer.

Soon, USD-pegged stablecoin issuers will see $10-13 trillion in inflows, which will then purchase T-bills. Stablecoin issuers will become large, price-insensitive buyers of Bessent-issued treasuries!

Even if Federal Reserve Chairman Powell continues to obstruct Trump's monetary agenda, refusing to lower the federal funds rate, end balance sheet reduction, or restart quantitative easing, Bessent can still offer T-bills at a rate below the federal funds rate. He can do this because stablecoin issuers must purchase his product at the offered rate to profit. In a few steps, Bessent controls the front end of the yield curve. The continued existence of the Federal Reserve is meaningless. Perhaps a statue of Bessent will stand in a square in Washington, D.C., in the style of Cellini's "Perseus Beheading Medusa" and be titled "Bessent with the Head of the Jekyll Island Monster."

The impact of the Global South

American social media companies will become Trojan horses, undermining the ability of foreign central banks to control the money supply of ordinary citizens. In the Global South, the penetration of Western social media platforms (Facebook, Instagram, WhatsApp, and X) is almost universal.

I've lived in the Asia-Pacific region for half my life, and a crucial part of investment banking in the region is converting depositors' local currencies into US dollars or US dollar equivalents (such as Hong Kong dollars) so that the funds can earn US dollar yields and invest in US stocks.

The local monetary authority implemented a "whack-a-mole" regulatory approach against traditional financial institutions (TradFi) to stem capital outflows. The government needed to control the funds of ordinary citizens and relatively apolitical wealthy individuals in order to absorb them through inflationary taxes, prop up underperforming national enterprises, and provide low-interest loans to heavy industry. Even if Bessent had wanted to use major US financial center banks as a gateway to provide banking services to those in urgent need of funds, local regulations prohibited it. However, there was another, more effective way to access these funds.

Outside of mainland China, everyone uses Western social media companies. What if WhatsApp launched a cryptocurrency wallet for every user? Within the app, users could seamlessly send and receive approved dollar-pegged stablecoins like USDT. What if this WhatsApp stablecoin wallet could also transfer funds to any wallet on any public blockchain?

Here’s a fictitious example of how WhatsApp could provide digital dollar accounts to billions of users in the Global South:

Fernando, a Filipino, runs a click farm in a rural area, generating fake followers and views for social media influencers. Since his clients are all outside the Philippines, receiving payments is difficult and expensive. WhatsApp has become his primary payment method, as it provides a wallet for sending and receiving USDT. His clients also use WhatsApp and are happy to avoid the inefficient banking system. This arrangement is satisfactory to both parties, but it effectively bypasses the local Philippine banking system.

After a while, the Bangko Sentral ng Pilipinas noticed a massive loss of bank funds. They realized that WhatsApp had already widely promoted the dollar-pegged stablecoin domestically, effectively leaving the central bank with a loss of control over the money supply. However, there was little they could do. The most effective way to prevent Filipinos from using WhatsApp was to cut off access to the internet. Even attempts to pressure local Facebook executives proved futile. Mark Zuckerberg ruled Meta from his sanctuary in Hawaii and had received approval from the Trump administration to promote stablecoin functionality for Meta users worldwide. Any legal restrictions on the internet for American tech companies would have drawn threats of increased tariffs from the Trump administration. Trump had already explicitly threatened the European Union with higher tariffs if it did not repeal its "discriminatory" internet legislation.

Even if the Philippine government removes WhatsApp from the Android and iOS app stores, determined users can easily circumvent the blockade with a VPN. Of course, any friction will hinder usage, but social media is essentially an addictive drug for the masses. After more than a decade of constant dopamine rush, ordinary people will find any way to continue using the platforms.

Finally, Bessent could use sanctions. Asian elites, with their wealth stored in overseas dollar-denominated banking centers, naturally do not want their wealth devalued through their own monetary policies. Do what I say, not what I do. Imagine Philippine President Bongbong Marcos threatening Meta. Bessent could immediately retaliate by imposing sanctions on him and his cronies, freezing billions of dollars in overseas assets unless they yield and allow stablecoins to proliferate in their country. His mother, Imelda, knew the reach of the US legal system well. She and her late dictator husband, Ferdinand Marcos, faced RICO charges for embezzling Philippine government funds to purchase New York real estate. Bongbong Marcos certainly doesn't want to go through a second round of turmoil.

If my argument is correct that stablecoins are a core tool of Pax Americana to expand the use of the dollar, then the empire will protect American tech giants from local regulatory retaliation while providing dollar banking services to ordinary people, with little recourse from those governments.

Assuming my prediction is correct, how big is the potential total addressable market (TAM) for stablecoin deposits from the Global South? The most advanced group of countries in the Global South is the BRICS. China is excluded because it has banned Western social media companies. The question is, roughly how large is the size of local currency bank deposits? I consulted Perplexity, and they gave a figure of $4 trillion. I know this might be controversial, but if you include the "eurozone" countries that use the euro, I think it's reasonable. The euro is already on its last legs under Germany-first and France-first economic policies, and the eurozone will sooner or later break up. With future capital controls, by the end of this century, the euro's only practical use may be paying for tickets to Berghain and the minimum bill at Shellona.

Adding the $16.74 trillion in European bank deposits, the total is close to approximately $34 trillion, which means the potential stablecoin deposit market is extremely large.

Do it big, or be done away with by the Democrats

Buffalo Bill Bessent faces a choice: go all out or let the Democrats win. Does he want the Red Team to win the 2026 midterms and, more importantly, the 2028 presidential election? I believe he does, and the only way to achieve that is to support Trump in providing more benefits to ordinary people than the Mamdans and AOCs. Therefore, Bessent needs to find a buyer for Treasury bonds who doesn't care about price. He clearly believes stablecoins are part of the solution, as evidenced by his public support for the technology. But he has to commit to it.

If the global South, the eurozone, and Europe’s Eurodollars do not flow into stablecoins, he will have to use his own “heavyweight measures” to force the funds to flow in. This means either flowing into dollars as required or facing sanctions again.

- Purchasing power of government bonds generated by dismantling the Eurodollar system: $10–13 trillion

- Purchasing power of retail deposits in the Global South and the Eurozone: $21 trillion

- A total of approximately US$34 trillion

Obviously, not all funds will flow into dollar-pegged stablecoins, but at least we can see a huge potential addressable market.

The real question is, how will this $34 trillion in stablecoin deposits drive DeFi usage to new heights? And if there’s good reason to believe DeFi usage will grow, which crypto projects will benefit the most?

The logic behind the influx of stablecoins into DeFi

The first concept to understand is staking. Assume that some of this $34 trillion is already in stablecoins. For simplicity, let's assume that all inflows go into Tether's USDT. Due to intense competition from other issuers like Circle and large TBTF banks, Tether must distribute some of its net interest margin (NIM) to holders. They do this by partnering with certain exchanges to allow USDT staked in exchange wallets to earn interest, paid in the form of newly minted USDT.

Here’s a simple example:

Fernando in the Philippines has 1,000 USDT. The Philippine exchange PDAX offers a 2% staking yield. PDAX creates a staking smart contract on Ethereum. Fernando sends 1,000 USDT to the smart contract address, and the following occurs:

- His 1,000 USDT becomes 1,000 psUSDT (PDAX-staked USDT, PDAX's liabilities). Initially, 1 USDT = 1 psUSDT, but as interest accumulates daily, psUSDT gradually appreciates in value. For example, using a 2% annual interest rate and simple interest calculation of ACT/365, psUSDT increases by approximately 0.00005 per day. After one year, 1 psUSDT = 1.02 USDT.

- Fernando receives 1,000 psUSDT to his exchange wallet.

A powerful thing happened: Fernando locked his USDT in PDAX in exchange for psUSDT, an interest-bearing asset. psUSDT can now be used as collateral in the DeFi ecosystem, redeeming other cryptocurrencies, lending, and trading leveraged derivatives on DEXs.

One year later, if Fernando wants to redeem his psUSDT back to USDT, he simply unstakes it on the PDAX platform. The psUSDT is destroyed, and he receives 1,020 USDT. The additional 20 USDT in interest comes from the partnership between Tether and PDAX. Tether uses the NIM earned from its Treasury bond portfolio to create additional USDT, which it pays to PDAX to satisfy its contractual obligations.

As a result, both USDT (base currency) and psUSDT (yield-generating currency) have become acceptable collateral in the DeFi ecosystem. This means that a portion of overall stablecoin flows will flow into DeFi applications (dApps). Total Value Locked (TVL) measures this interaction. Users must lock up funds when operating in DeFi dApps, and this amount of funds is reflected in TVL. TVL is a leading indicator of trading volume and future revenue, and a crucial indicator for predicting future cash flows for DeFi dApps.

Before analyzing how TVL affects the future revenue of a project, I will first explain the main assumptions used in the following financial model.

Model assumptions

Below, I present three simple yet powerful financial models that estimate target prices for Ethena (token: $ENA), Ether.fi (token: $ETHFI), and Hyperliquid (token: $HYPE) by the end of 2028. I choose to forecast to the end of 2028 because that's when Trump leaves office. My baseline assumption is that a Blue (Democratic) president is slightly more likely to be elected than a Red (Republican) president. This is because, in less than four years, Trump will be unable to fully rectify the losses inflicted on his supporters by half a century of monetary, economic, and foreign policy. Worse still, no politician fully delivers on their campaign promises. Consequently, voter turnout among Red voters will decline.

Red Team grassroots voters lack enthusiasm for Trump's successor and will not turn out in sufficient numbers to vote, thus being outnumbered by Blue Team voters, childless and cat-obsessed, who are swayed by Trump Delusion Syndrome (TDS). Any Blue Team member who comes to power will likely implement self-defeating monetary policies due to TDS, simply to prove their difference from Trump. Ultimately, however, no politician can resist money printing, and dollar-pegged stablecoins have become the ideal buyers of short-term Treasury bonds, regardless of price. Therefore, while the new president may not initially fully support stablecoins, he will soon find that without these capitals, he is unable to move forward and will ultimately continue the aforementioned policies. This policy vacillation will trigger the bursting of the crypto bubble and lead to an epic bear market.

Furthermore, the numbers in my model are enormous. This is a once-in-a-century transformation of the global monetary system. Unless we're on lifelong intravenous stem cell injections, most investors may never encounter a similar event again. The potential gains I predict far exceed SBF's amphetamine habit. Driven by the popularity of dollar-pegged stablecoins, the DeFi ecosystem will experience an unprecedented bull run.

Because I like to use decimal numbers ending in zero for my projections, I estimate that the total circulating supply of dollar-pegged stablecoins will reach at least $10 trillion by 2028. This is so large because the deficit Bessent must finance is extremely large and growing exponentially. The more Bessent finances with Treasury bonds, the faster the debt piles up, as he must roll over the debt every year.

The next key assumption is where Bessent and the new Fed Chair after May 2026 will set the federal funds rate. Bessent has publicly stated that the federal funds rate is 1.50% higher, while Trump has often called for a 2.00% rate cut. Given the tendency for policy to overshoot, I believe the federal funds rate will ultimately and quickly settle around 2.00%. This number is not based on any strict criteria; like established economists, we make our own improvisations, so my numbers are as reliable as theirs. Political and economic realities demand cheap funding from the empire, and a 2% rate perfectly meets that need.

Finally, my forecast for the 10-year Treasury yield: Bessent's target of 3% real growth, combined with a 2% federal funds rate (theoretically representing the long-term level of inflation), yields a 10-year yield of about 5%. I will use this yield to calculate the present value of the terminal cash flows.

Based on these assumptions, we can derive the terminal value of the accumulated cash flows. Because these cash flows can be used for token repurchases, they serve as the fundamental value of a particular project. This is how I estimate and forecast FDV (Fully Diluted Value). I then compare the model's predictions to the current market value, clearly illustrating the potential upside.

All model inputs are shown in blue and outputs in black.

Spend it out

The most important action for new stablecoin users is using them to purchase goods and services. People are already accustomed to tapping and paying at checkout systems with their phones or debit/credit cards. Stablecoins must be just as convenient and easy to use. Is there a project that allows users to deposit stablecoins into decentralized applications (dApps) and spend them just like using a Visa debit/credit card? Of course there is: Ether.fi Cash.

Global users can register in just minutes, and once they complete the onboarding process, they'll receive their own Visa-backed stablecoin spending card. You can use it on your phone or with a physical card. Once you deposit your stablecoins into your Ether.fi wallet, you can spend them anywhere Visa is accepted. Ether.fi even offers a credit line based on your stablecoin balance, accelerating your spending power.

I'm both an advisor and investor in the Ether.fi project, so I'm obviously biased, but I've been waiting for a low-fee offline crypto spending solution for over a decade. Whether I use an Amex or an Ether.fi Cash card, the customer experience is virtually identical. This is crucial because it's the first time many people in the Global South can use stablecoins and Ether.fi to pay for goods and services worldwide.

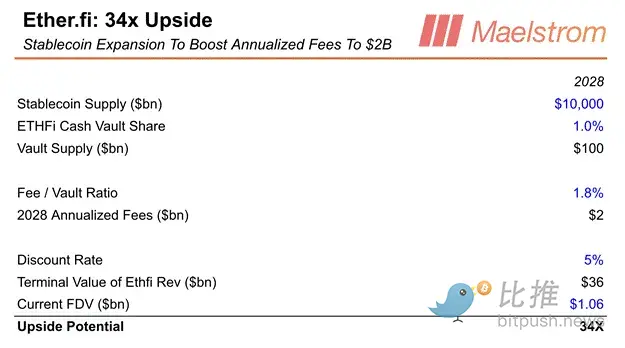

The core focus is to build it into a financial supermarket, offering a wide range of traditional banking products. Ether.fi can then offer depositors even more value-added products. The key ratio I use to forecast future cash flows is the "Fee/Vault Ratio": how much revenue does Ether.fi generate for every dollar of stablecoin deposited? To come up with a defensible figure, I consulted the latest annual report of JPMorgan Chase, the world's best-managed commercial bank. On $1,060.4 billion in deposits, they generated $18.8 billion in revenue, a fee/vault ratio of 1.78%.

Ether.fi Cash Deposit Ratio: This metric indicates how much of the stablecoin is held in the cash vault. Currently, the deposit ratio is 0.07%, just four months after the product launched. Given the recent launch, I believe this ratio is expected to grow to 1.00% by 2028.

Based on this, I believe $ETHFI has the potential to rise 34x from its current price.

Now that ordinary users (plebes) can spend stablecoins, is there a way to earn a higher return than the federal funds rate?

Lending opportunities

As more people start using stablecoins to buy coffee, they naturally want to earn interest. As I mentioned earlier, issuers like Tether will distribute a portion of the net interest margin (NIM) to holders, but this amount will be small; many depositors will seek higher returns without taking on excessive additional risk. So, within the crypto capital market, are there inherent returns that new stablecoin users can capture? The answer is yes, and Ethena offers the opportunity for higher returns.

In the crypto capital market, there are only two ways to safely borrow and lend money: to speculators for derivatives trading, or to crypto miners. Ethena focuses on lending to speculators, hedging long crypto positions by shorting crypto/USD futures and perpetual swaps. This is a strategy I called "cash and carry" when I promoted it at BitMEX. I later wrote an article titled "Dust on Crust," urging entrepreneurs to package this trade into a synthetic dollar, high-yield stablecoin. Ethena founder Guy Young read the article and assembled a top-notch team to implement it. Maelstrom subsequently became a founding advisor. Ethena's USDe stablecoin quickly accumulated approximately $13.5 billion in deposits in 18 months, becoming the fastest-growing stablecoin and currently ranking third in circulation, behind Circle's USDC and Tether's USDT. Ethena’s growth is so rapid that by next St. Patrick’s Day, it will become the second-largest stablecoin issuer after Tether, giving Circle CEO Jeremy Allaire a chance to drink a glass of Guinness.

Due to counterparty risk on exchanges, speculators typically pay higher interest rates on USD to go long on crypto assets than on Treasury bonds. When I created perpetual swaps with the BitMEX team in 2016, I set a neutral interest rate of 10%. This means that if the perpetual swap price equals the spot price, longs will pay shorts a 10% annualized interest rate. Every perpetual swap exchange modeled after BitMEX has adopted this 10% neutral rate. This is significant because 10% is significantly higher than the current 4.5% cap on the federal funds rate. Therefore, the yield on staked USDe is almost always higher than on Fed Funds, offering new stablecoin depositors willing to take on a small amount of additional risk the opportunity to double the returns, on average, that of Buffalo Bill Bessent.

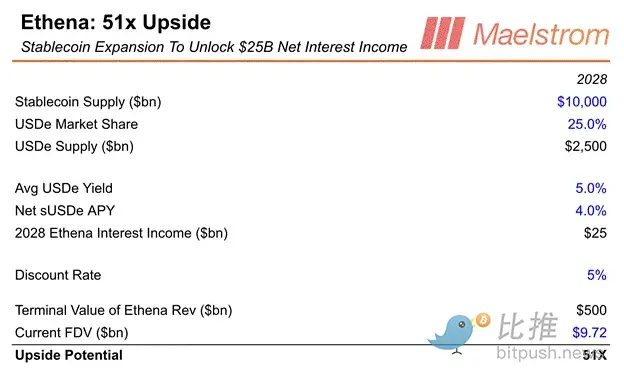

Some (but not all) of the new stablecoin deposits will be held on Ethena, earning a higher yield. Ethena takes a 20% commission from the interest income. Here’s a simple model:

USDe Market Share: Currently, Circle's USDC holds a 25% market share of circulating stablecoins. I believe Ethena will surpass Circle, and over time, we see marginal USDC deposit outflows being absorbed by USDe. Therefore, my long-term assumption is that USDe will capture a 25% market share after Tether's USDT.

Average USDe yield: In my long-term scenario, USDe supply reaches $2.5 trillion, which will exert downward pressure on the basis between derivatives and spot. As Hyperliquid becomes the largest derivatives exchange, they will lower the neutral interest rate to increase demand for leverage. This also means a significant increase in open interest (OI) in the crypto derivatives market. If millions of new DeFi users have trillions of dollars in stablecoin deposits at their disposal, they are fully capable of driving open interest into the trillion-dollar realm.

Based on this, I believe that $ENA has the potential to increase in value 51x from its current levels.

Now that ordinary people can earn more interest income, the question is: how can they trade their way out of the poverty caused by inflation?

Trade it

One of the worst effects of global currency debasement is that it forces everyone to become speculators in order to maintain their living standards—if they don’t already have a large portfolio of financial assets. As more people who have long suffered from the devaluation of fiat currencies begin saving on-chain through stablecoins, they will trade the only asset class that offers them a chance to escape poverty through speculation: cryptocurrencies.

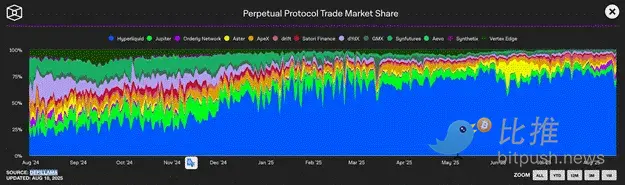

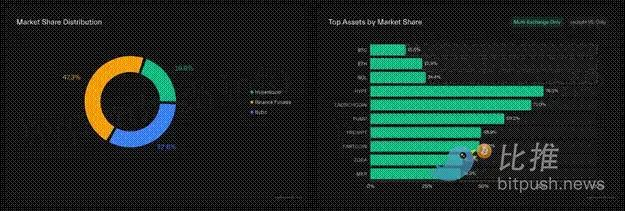

Currently, the leading platform for on-chain trading is Hyperliquid (token: $HYPE), which holds a 67% market share in the decentralized exchange (DEX) market. Hyperliquid is so transformative, its growth rate even outpacing centralized exchanges (CEXs) like Binance. By the end of this cycle, Hyperliquid is expected to become the largest crypto exchange, and Jeff Yan may be richer than Binance founder and former CEO CZ.

The king is dead, a new king shall come!

The theory that DEXs will eat away all other types of exchanges is not new, but what sets Hyperliquid apart is the team's execution. Jeff Yan assembled a team of about ten people and delivered product iteration at a speed and quality exceeding any other team in the industry, centralized or decentralized.

The simplest way to understand Hyperliquid is to think of it as a decentralized version of Binance. Since Tether and other stablecoins primarily support Binance's funding channels, Binance can be considered Hyperliquid's predecessor. Hyperliquid also relies entirely on the stablecoin infrastructure for deposits, but provides an on-chain trading experience. With the launch of HIP-3, Hyperliquid is rapidly transforming into a permissionless derivatives and spot trading powerhouse. Any application desiring a highly liquid limit order book with real-time margin management can integrate the required derivatives markets through HIP-3.

I predict that by the end of this cycle, Hyperliquid will become the largest crypto exchange, and the growth of stablecoins to $10 trillion in circulation will further accelerate this development. Using Binance as an example, we can predict Hyperliquid's average daily trading volume (ADV) based on the level of stablecoin supply.

Currently, Binance's perpetual swaps have an average daily trading volume of $73 billion, with a total stablecoin supply of $277 billion, representing a 26.4% share. In the model, this percentage will be represented as Hyperliquid's ADV market share.

I believe $HYPE has the potential to rise 126x from its current level.

Finally, I would like to introduce one of the stablecoin projects that I am most looking forward to, which is about to launch a token issuance.

Enterprise applications of stablecoins

As millions, or even billions, of users begin using stablecoins, how can businesses capitalize on this payment method? Most businesses globally still face high fees and banking restrictions when it comes to payments. As more users hold stablecoins, businesses can bypass traditional banks and make payments more conveniently. This requires an easy-to-use technology system that allows businesses to accept stablecoin payments, pay suppliers, pay taxes, and manage cash flow.

Codex is one such project, launching a blockchain specifically designed for stablecoins. While not an issuer itself, Codex provides a stablecoin and fiat payment solution for businesses, enabling seamless conversion between stablecoins and fiat. Back at Fernando and his click farm, he needs to pay his employees in pesos to their local bank accounts. Through Codex, he can convert the stablecoin portion of his customers' payments into pesos and deposit them directly into their bank accounts. Codex has already implemented this functionality, achieving $100 million in trading volume in its first month.

More importantly, Codex has the potential to provide credit support to small and medium-sized enterprises. Currently, it only provides short-term credit to the most secure payment service providers, but in the future, it will be able to provide long-term loans to SMEs. If businesses fully implement blockchain and use Codex to process payments, they will achieve "triple bookkeeping"—revenue and expenses are fully recorded on-chain. This will allow lenders to reliably assess a business's financial health in real time and provide loans with confidence. Currently, traditional banks typically only provide loans to large corporations or wealthy individuals with political connections, making it difficult for SMEs to obtain financing.

I envision Codex initially serving the Global South, then expanding to developed countries outside the U.S. By providing loans to small and medium-sized enterprises through a stablecoin infrastructure, Codex is poised to become the first true crypto bank.

Codex is still in its early stages, but if successful, it will significantly benefit users and token holders. Before joining Maelstrom as an advisor, I ensured the founding team was prepared to adopt a token economics strategy similar to Hyperliquid, where revenue flows directly back to token holders. With real trading volume and an upcoming token launch, Codex presents a great opportunity to enter the stablecoin infrastructure space.

Buffalo Bill Bessent's Strategy

Buffalo Bill Bessent's control over the global Eurodollar and non-dollar deposits depends on the US government's fiscal policies. I believe Bessent's boss, US President Trump, has no interest in cutting spending or balancing the budget. His goal is simply to win the election. Political winners in late capitalist democracies often win votes by handing out benefits. Therefore, Bessent will make aggressive moves in the fiscal and monetary spheres, and no one will be able to stop him.

As the US deficit continues to expand and Pax Americana's global hegemony weakens, the market is reluctant to hold weak dollar debt. Bessent's use of stablecoins to absorb government bonds has become a necessary means.

He will use sanctions extensively to ensure that dollar-denominated stablecoins absorb funds flowing out of the Eurodollar and non-U.S. retail banks. At the same time, he will mobilize tech giants (like Zuckerberg and Musk) to promote stablecoins and make them accessible to users around the world. Even if local regulations prohibit them, they will be protected by the U.S. government.

Possible trends

If I am correct, we may see the following trends:

- Offshore Eurodollar market draws regulatory attention

- The Fed's dollar swap lines with the Treasury are tied to U.S. tech companies entering the digital market.

- Stablecoin issuers must hold US dollars or government bonds

- Encourage stablecoin issuers to list in the United States

- US tech companies add crypto wallet features to social media apps

- The Trump administration has actively supported the use of stablecoins

Maelstrom will continue to heavily invest in stablecoins, holding $ENA, $ETHFI, and $HYPE. Meanwhile, Codex will become a core project for stablecoin infrastructure.

Last sentence: Please hand me the dollar "lotion", my skin is a little dry and cracked.