Compiled by Tim, PANews

I think people in this ecosystem don't learn from their mistakes. Remember how Trump ripped us off? If you haven't, this is a prime example.

Trump is nothing compared to what they are doing with WLFI. I see too many red flags to list here or I could fill a book with them. But here are just a few reasons why you should stay away from this project.

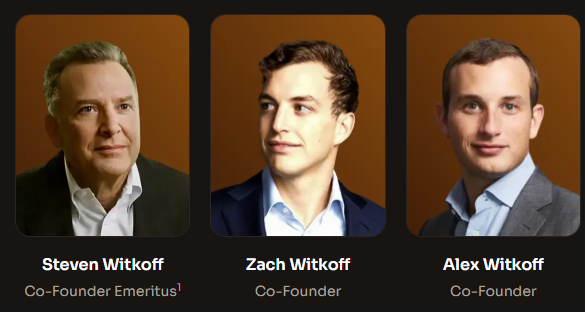

1. Team

When I first saw that picture, I was like, why are there nine co-founders? That seems suspicious.

No one on this team is trustworthy. Clearly, the Trump family is merely marketing the company, acting as a pure communications tool, with no indication of any involvement in operations or technical aspects. It's clear they don't understand these businesses, but they absolutely know how to profit from them.

Zach Witkoff, who has drawn particular attention due to his political credentials, said his company facilitated a $2 billion transaction with MGX (a UAE fund) using the USD1 stablecoin, raising concerns about a "money-for-privilege" exchange.

Chase Herro is better known in crypto circles as a self-proclaimed "internet scumbag." He's been incarcerated on drug charges, launched multiple crypto projects that ultimately became scams or were hacked, and sold "get-rich-quick" courses. This isn't the ideal co-founder for your project.

Then there's Zach Folkman, whose background is very similar to Herro's. He previously worked on the Dough Finance project, which was the site of a major DeFi vulnerability. Overall, he's a controversial entrepreneur who has even hosted dating and pickup workshops.

Of the nine co-founders, seven are sons of billionaires, and the other two have questionable backgrounds. This is definitely not a dream team.

2. Lies

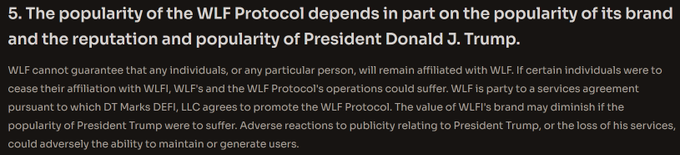

The worst part is they led you to believe this was a project designed and run by the Trump family, which it wasn't. They were just marketing it to reassure you. Their own disclosures essentially say the same thing.

Let me go a step further: The Trumps don't assume contractual liability. Legally, they have no responsibility. If someone were to abscond with the money tomorrow, the Trumps could legally distance themselves from the matter, and you wouldn't be able to hold them accountable.

So who is responsible?

Not surprisingly, it was Chase Herro and Zak Folkman, and their Puerto Rico-based entity, Axiom.

Although the Trumps bear no legal responsibility, they hold 22.5% of the supply and receive 75% of the proceeds. The Witkoffs receive 7.5% of the supply and 25% of the proceeds.

Herro and Folkman also received a share of the token distribution (though they didn't directly participate in the revenue sharing). Essentially, these two profiteers struck a deal with the Trump family. The Trumps took the lion's share, leaving the two with scraps. But even those scraps were still quite substantial for them.

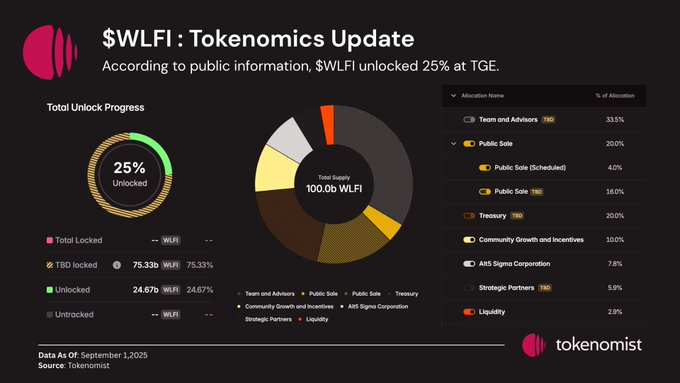

3.WLFI Token

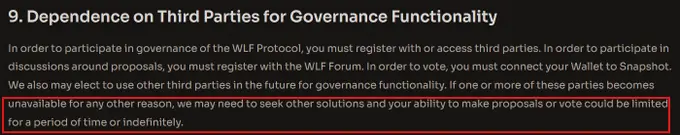

Honestly, this token is a joke. Six people holding 40% of the total supply is textbook centralization. Over 60% of the supply is held by fewer than 10 wallets, all controlled through multi-sig.

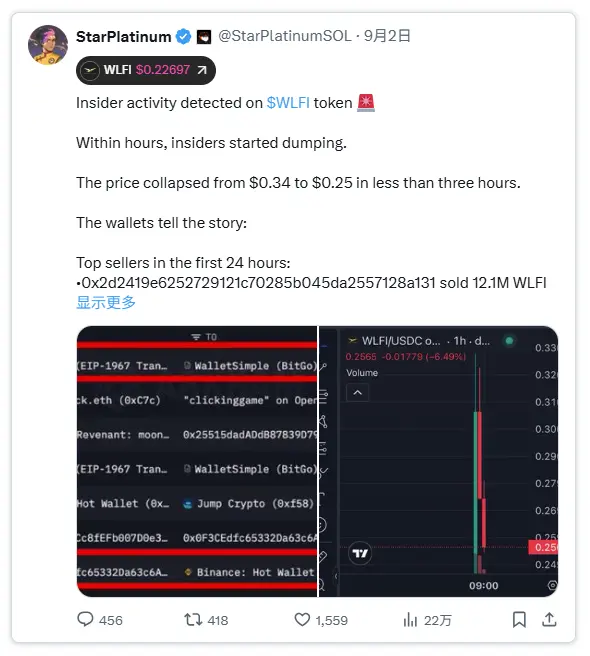

At launch, only 25% of the supply was in circulation. This, combined with the concentration of tokens in the hands of a small number of individuals, led to significant market volatility and extreme fragility.

In the first few hours, there was a massive contract liquidation, during which insiders sold heavily, cashing out hundreds of millions of dollars in just a few hours.

There was no transparency in the token distribution process, with the majority of tokens effectively available shortly after launch, giving insiders complete freedom to sell them at any time.

Practicality? Essentially zero. It's called a "governance token," but beyond that, it offers no clear functionality: no revenue sharing, no fee discounts, no returns, nothing. Furthermore, the official website clearly states that they can temporarily or permanently restrict your governance rights at any time. To put it bluntly, this is essentially governance in name only.

Some of you may propose using 100% of protocol fees for buybacks. If you cheer for this, remember that 60% of the supply is controlled by insiders. They profit in either case; as the WLFI price rises, their holdings increase in value, allowing them to sell at a higher price.

4. USD1 Token

USD1 is a stablecoin issued by WLFI. Just looking at its logo, you can tell it’s a joke.

Seriously, couldn't they have been more careful? This looks like something a seven year old made.

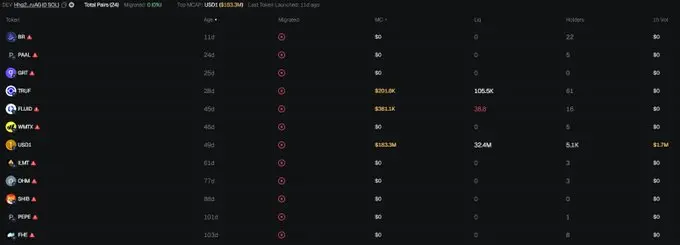

USD1 has a market capitalization of $2.7 billion, making it one of the largest stablecoins. However, this is primarily driven by capital allocation from large institutions rather than real user demand. 93% of its value is concentrated on the Binance exchange, indicating that the stablecoin has yet to achieve real-world adoption.

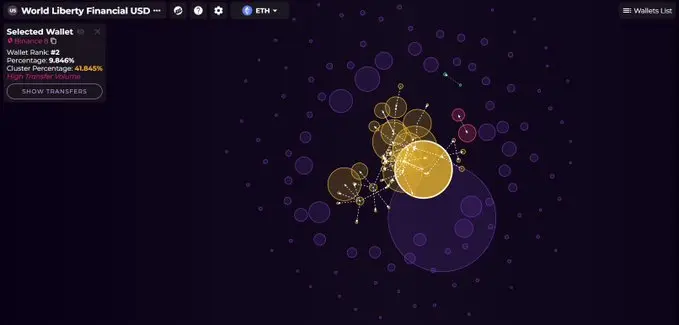

What shocked me the most was that the wallet that deployed USD1 on Solana also deployed a bunch of other shitcoins that had almost no transaction volume. The fact that they didn’t even bother to use a new address to cleanly deploy USD1, but instead used an address that was already associated with shitcoins, is quite telling.

5. Website

If you're still unsure, the easiest way to find out is to check the disclosures on the website. That's the only place they're even remotely honest. You'll quickly see they're trying to shift the blame, essentially telling you that this project isn't reliable and that you shouldn't be surprised if things go wrong.

The website is full of errors, broken links, typos, image layout issues... The website is poorly made, lacks professionalism, and exudes a perfunctory attitude.

Conclusion

WLFI is essentially Trump 2.0, a highly centralized meme coin with no purpose other than profiteering and zero innovation. Its sole purpose is to enrich the already wealthy. In just one day of research, I uncovered approximately 20 red flags, and for the sake of brevity, I've omitted many more.

My advice is: stay away. If you make a profit, take your profits and leave.

The popularity of this thing is purely due to Trump's brand effect. But to be honest, even if you ask Trump to explain what his own project is, I'm afraid he can't explain it clearly.