Author: Coingecko

Compiled by: Felix, PANews

At some point around 2140, no new bitcoins will be issued on the market. All 21 million bitcoins will be distributed, which means that bitcoin miners will only be rewarded in the form of transaction fees. Critics believe that transaction fees alone are not enough to maintain the security of the Bitcoin network.

Key Takeaways

- After 2140, the block subsidy will no longer exist. Bitcoin miners, who are essential for processing transactions and securing the network, will then be compensated solely through transaction fees paid by users.

- The gradual reduction in mining fees calls into question the long-term security of Bitcoin, as mining fees act as the “security budget” of the Bitcoin network.

- A reduction in the security budget could put the Bitcoin network at risk of a 51% attack and/or lead to greater centralization of the network.

- Bulls believe that the rise in the value of the Bitcoin asset and the increase in demand for blocks in the future will make a transaction fee-only market economically viable for Bitcoin miners.

Bitcoin’s most famous feature is its scarcity, which has earned it the title of “digital gold.” To ensure scarcity, the rewards paid to Bitcoin miners are gradually reduced every four years through the “Bitcoin halving.” But this mechanism poses a serious long-term challenge.

The Bitcoin network’s main incentive for miners, the reward for newly generated Bitcoins, the so-called block subsidy, will completely disappear in about 2140 through the Bitcoin halving mechanism mentioned above. The block subsidy essentially acts as Bitcoin’s security budget, paid to miners to ensure the security of the Bitcoin network. This raises the question:

Are the remaining transaction fee incentives sufficient to ensure the security of the network?

Understanding Bitcoin’s incentive model

To understand the challenges of the post-subsidy era, it is necessary to examine the current incentive mechanism that secures the Bitcoin network. Every ten minutes, a miner verifies a new block of transactions and receives a block reward, which is composed of two parts.

- Block Subsidy: This is the predetermined number of newly generated Bitcoins. When Bitcoin was first launched, the subsidy per block was 50 Bitcoins. This is reduced by half every four years, an event known as the Bitcoin halving. This mechanism distributes the 21 million Bitcoins over decades and is by far the main source of income for miners.

- Transaction Fee: This is the fee that users include in their transactions to incentivize miners to add them to a block. You can think of it as an extra "tip" paid to Bitcoin miners to help users who want to ensure their transactions go through, thus creating a competitive market environment. As of this writing, the average Bitcoin transaction fee is $1.30 per transaction.

Bitcoin Halving: Reducing the Issuance Rate

Each Bitcoin halving is a periodic efficiency test for the mining industry, as each halving actually cuts miners' revenue in half. This ensures that only the most efficient miners can make a profit, and less efficient miners may shut down, but the potential negative effect is that this may temporarily cause the computing power of the entire network to drop.

The Bitcoin network hashrate is the total computing power used to secure the Bitcoin network, and when Bitcoin miners stop working, the hashrate drops. A reduction in the network hashrate means that the Bitcoin network is more vulnerable to network attacks such as a 51% attack (where a single entity controls enough computing power to disrupt the blockchain).

Table 1: Predictable decay of Bitcoin block subsidy over time

Bitcoin block reward in 2025

To further illustrate the importance of the Bitcoin block subsidy to miners, here is a breakdown of the rewards received for successfully mining a Bitcoin block.

According to blockchain transaction fee data, each new Bitcoin block contains approximately 0.025 Bitcoin in transaction fees in July 2025. As of April 2024, the block subsidy is 3.125 Bitcoins.

In summary, the “salary” of a Bitcoin miner for mining a block is:

- Guaranteed reward (newly generated Bitcoin): 3.125 Bitcoin

- Additional "tip" (from transaction fee): about 0.025 bitcoins

Total revenue per block: approximately 3.15 bitcoins.

The “tips” in transaction fees are only a tiny fraction of a miner’s total revenue, which means that in a market that relies solely on transaction fees, miners will almost certainly not be able to make a profit.

Discussion on the economic feasibility of Bitcoin in the post-subsidy era

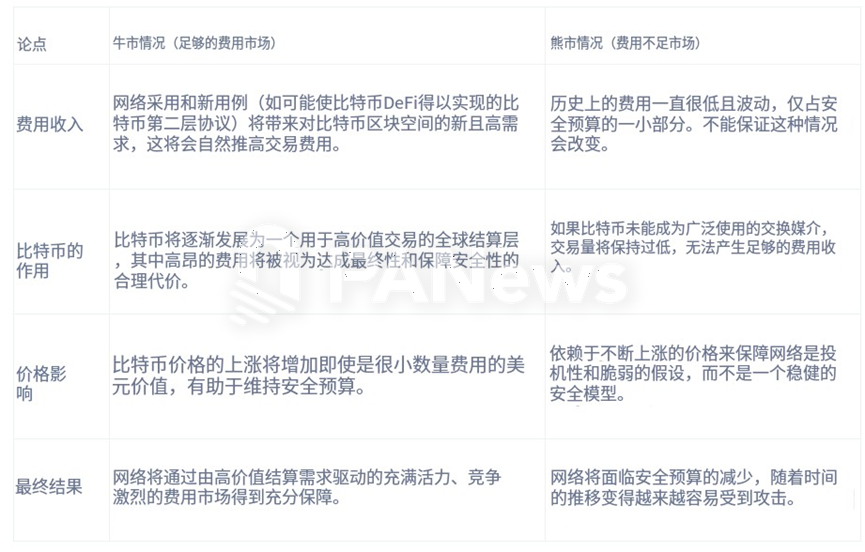

Bitcoin transaction fees alone are not enough to secure the Bitcoin network in the current market. However, bulls believe that by 2140, demand will drive transaction fees far above current levels, while bears foresee a crisis. The main arguments for each view are explored below.

Table 2: Summary of the arguments

The pessimistic argument: Security budget cuts

The basis for the pessimistic view is simple: historical trends in transaction fees do not show an increase large enough to compensate for the reduction in the subsidy. Critics worry that each halving will cut into the security budget, making the network gradually less secure.

Bullish Thesis: Strong Fee Market

Optimists believe that Bitcoin will be supported by its rising asset value and growing block demand. First, with the help of Bitcoin's deflationary design, the network will grow into a trillion-dollar asset class, so even a small percentage of Bitcoin transaction fees will generate significant income for miners in the future.

Second, there will be a fundamental increase in demand for block space itself, either in the form of large institutional settlements, Layer 2 rollups, or some new innovation yet to be discovered. Ultimately, these factors will drive transaction fees higher, making them economically viable in the future.

Potential risks of reduced security budgets

A decline in security budgets could cause a large number of Bitcoin miners to shut down, thereby reducing the total computing power of the Bitcoin network, which would trigger a series of potential risks and put pressure on the integrity of the network.

51% Attack

The most talked-about threat is a 51% attack, where an entity controlling more than half of the network’s hashrate is able to reverse transactions (double spends) or censor the network. The security budget is the primary line of defense; the higher the budget, the more hashrate it supports, and the more expensive the attack becomes. Today, such an attack is prohibitively expensive for a rational economic agent to launch, as it would likely cause the price of Bitcoin to crash, reducing the value of the attacker’s own hardware. However, a nation-state actor might be willing to incur such a loss to disrupt the network for geopolitical reasons. As security budgets fall, the cost of attack decreases, making this threat more likely in the long term.

Hashrate Fluctuation

A more immediate risk is miner capitulation, where a large number of miners shut down their machines due to the decline in revenue caused by the Bitcoin halving, causing a sharp drop in hashrate. Although the difficulty adjustment will correct this, the rapid withdrawal of miners may create a vulnerable window in the short term.

Bitcoin Innovation as a Solution

The Bitcoin community is actively developing solutions to promote network adoption and mitigate the risks posed by Bitcoin’s dwindling security budget. Here are some of those solutions.

Layer2 Solutions

One solution to the limited capacity of the Bitcoin chain is the L2 blockchain. L2 is a sub-blockchain built inside the main blockchain (here, Bitcoin), and transactions are transferred from the main blockchain to these L2s to increase transaction speed and reduce costs.

L2 solutions like Lightning Network enable Bitcoin to be used for everyday transactions, which has already achieved a certain degree of adoption in Vietnam. Vietnam's Bitcoin community "Bitcoin Saigon" often works with local merchants, cafes and markets to promote and support the use of Bitcoin payments supported by the Lightning Network. If L2 solutions are successful, it will push the Bitcoin network from professional applications to everyday applications, thereby increasing transaction fees on the Bitcoin main blockchain network.

Bitcoin Runes

RUNES, which became popular in 2024, is a token standard that leverages Bitcoin’s UTXO model (i.e., the balance in a wallet consists of a single block of unspent Bitcoins, just like coins and bills in a wallet) and the OP_RETURN opcode (a feature that allows small amounts of data to be embedded in Bitcoin transactions, similar to the memo field on a check). RUNES made it possible to create memecoins and community tokens on the Bitcoin blockchain. At its peak, RUNES pushed Bitcoin’s average transaction fee to an all-time high of $127 per transaction. Although interest in RUNES has faded, the innovation demonstrated the potential for new use cases to drive up Bitcoin transaction fees, paving the way for a future Bitcoin economy supported solely by fees.

The future of user experience

For the average user, interacting with Bitcoin will likely be a multi-layered experience. Sending transactions directly on layer 1 is expected to become expensive and only used for large transfers. For everyday transactions, users will almost certainly interact with Bitcoin through L2 solutions like the Lightning Network, which provides an instant and low-cost experience, or using Wrapped Bitcoin. This shift means that the user experience for micropayments will still be possible, but will be implemented on a different technical layer from the main blockchain.

Long-term outlook for investors

For investors, the end of the block subsidy creates a critical conflict between two of Bitcoin’s core properties: scarcity and security. Investors are attracted to Bitcoin’s fixed supply, but they must now face the reality that the network’s security is dynamic and will depend on the future of the fee market. If the network that underpins a scarce asset is perceived to be vulnerable, its long-term value becomes questionable. Ultimately, Bitcoin’s value derives not only from its technical properties, but also from the market’s collective confidence in its ability to remain secure.

in conclusion

The day the last new Bitcoin is mined will not be the end of Bitcoin, but the beginning of its ultimate test. The end of the block subsidy is the expected end state of the protocol, and the ecosystem has more than a century to adapt to this challenge. The long-term security of Bitcoin will be determined by a complex interaction of multiple forces: technical innovation of L2 solutions, the economic evolution of the fee market, and social consensus around Bitcoin as the global settlement layer.

Note that this article discusses possible concerns about Bitcoin in the distant future and is highly speculative given the century-long time gap between now and 2140.

Related Reading: One Year After the Bitcoin Halving: Why This Cycle Looks So Different