Written by Eric, Foresight News

After the US market closed on the 30th, local time, Strategy, the first company to publicly trade Bitcoin DAT, released its third-quarter financial report. The report showed that Strategy's third-quarter revenue was $3.9 billion, net profit was $2.8 billion, and diluted earnings per share were $8.42.

As of October 26, 2025, local time, Strategy held 640,808 Bitcoins, with a total value of $47.44 billion, and the cost per Bitcoin rose to $74,032. Year-to-date Bitcoin yielded 26% in 2025, generating $12.9 billion in revenue. Strategy CFO Andrew Kang stated that based on a year-end Bitcoin price forecast of $150,000, Strategy's full-year 2025 operating revenue is projected at $34 billion, net profit at $24 billion, and diluted earnings per share of $80.

Strategy's Bitcoin-related data is largely public and unlikely to cause significant market reaction. However, based on today's Bitcoin price rebound and the company's optimistic outlook, Strategy's stock price rebounded both yesterday after hours and today before opening. As of writing, the MSTR price has rebounded from yesterday's closing price of $254.57 to around $272.65 pre-market.

According to its financial report, Strategy raised a total of $5.1 billion in net proceeds through its common stock, STRK, STRF, SRD, and STRC share offerings in the three months ending September 30, and as of October 26, Strategy still had $42.1 billion in available funding.

It's worth noting that Bitcoin's current price is more than 40% higher than its year-to-date low, while MSTR's closing price yesterday was only about 6% lower than its year-to-date low. Although yesterday's after-hours and today's pre-market price movements suggest that the market still approves of the earnings report in the short term, investors are actually beginning to have concerns about Strategy, or rather, DAT's business model.

mNAV is nearing the brink of death.

According to StrategyTracker data, Strategy's mNAV (market capitalization to the total value of its Bitcoin holdings) has reached 1.04. Even when calculated based on diluted shares, the figure is only 1.16, very close to 1. If mNAV reaches 1 or even falls below 1, it means that buying the company's stock is no longer as valuable as directly purchasing the corresponding cryptocurrency.

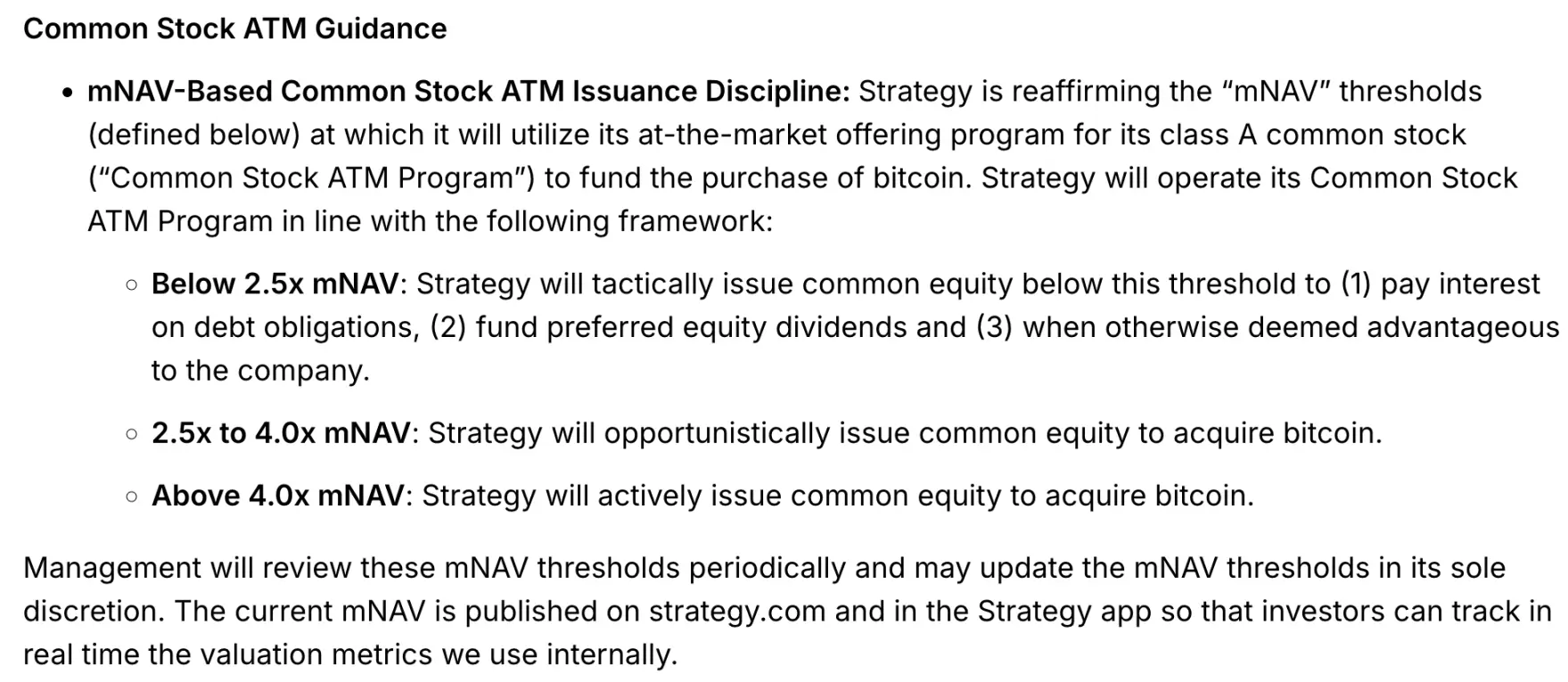

During its earnings call at the end of July, Strategy pledged that it would not issue new MSTR common stock when the mNAV was below 2.5 times unless it was to pay preferred stock dividends or debt interest. However, just two weeks later, it removed this restriction and added a conditional exception clause in its 8-K filing: "If the company believes that an issuance is beneficial, it may continue to issue shares when the mNAV is below 2.5 times."

In its recent financial report, Strategy also reinterpreted the rules for issuing common stock ATMs:

While issuing common stock when mNAV is below 2.5 still prioritizes debt interest payments and preferred stock dividends, the reality is that it's now possible to finance Bitcoin purchases using common stock ATMs when mNAV is below 2.5, and financing methods for purchasing Bitcoin are no longer limited to common stock ATMs. Strategy calculates an mNAV of 1.25 in its official data, higher than third-party statistics. Although Strategy's calculation method is more complex, ordinary investors actually value the ratio of total market capitalization to the total value of their Bitcoin holdings, which is 1.04.

Furthermore, Strategy has reserved the possibility of adjusting the mNAV baseline, which undoubtedly adds more variables. Strategy purchased 81,785, 69,140, and 42,706 Bitcoins in the first three quarters of this year, respectively. The continuous rise in Bitcoin's price was accompanied by a gradual decrease in purchases, indicating that Strategy had already foreseen the potential problems.

If Strategy's mNAV falls below 1, it could significantly impact the overall value of DAT. A few days ago, ETHZilla, the Ethereum DAT company, opted to sell $40 million worth of Ethereum for a share buyback, aiming to boost its mNAV. On the same day, Metaplanet, the world's second-largest Bitcoin DAT company and a Japanese listed company, also announced a share buyback plan. Although this plan doesn't involve selling its Bitcoin holdings, the pressure on mNAV has already caused the world's two largest publicly disclosed Bitcoin buyers to slow down their purchases.

Removed from the Nasdaq 100 index?

During the US stock market trading session last night Beijing time, some investors in the Web3 community speculated that Strategy might be removed from the Nasdaq 100 index by the end of this year due to MSTR's recent weak performance.

Strategy was officially selected as a component stock of the Nasdaq 100 index last December, which briefly boosted its stock price to over $500. Although the price of Bitcoin subsequently reached new highs, MSTR did not surpass that high.

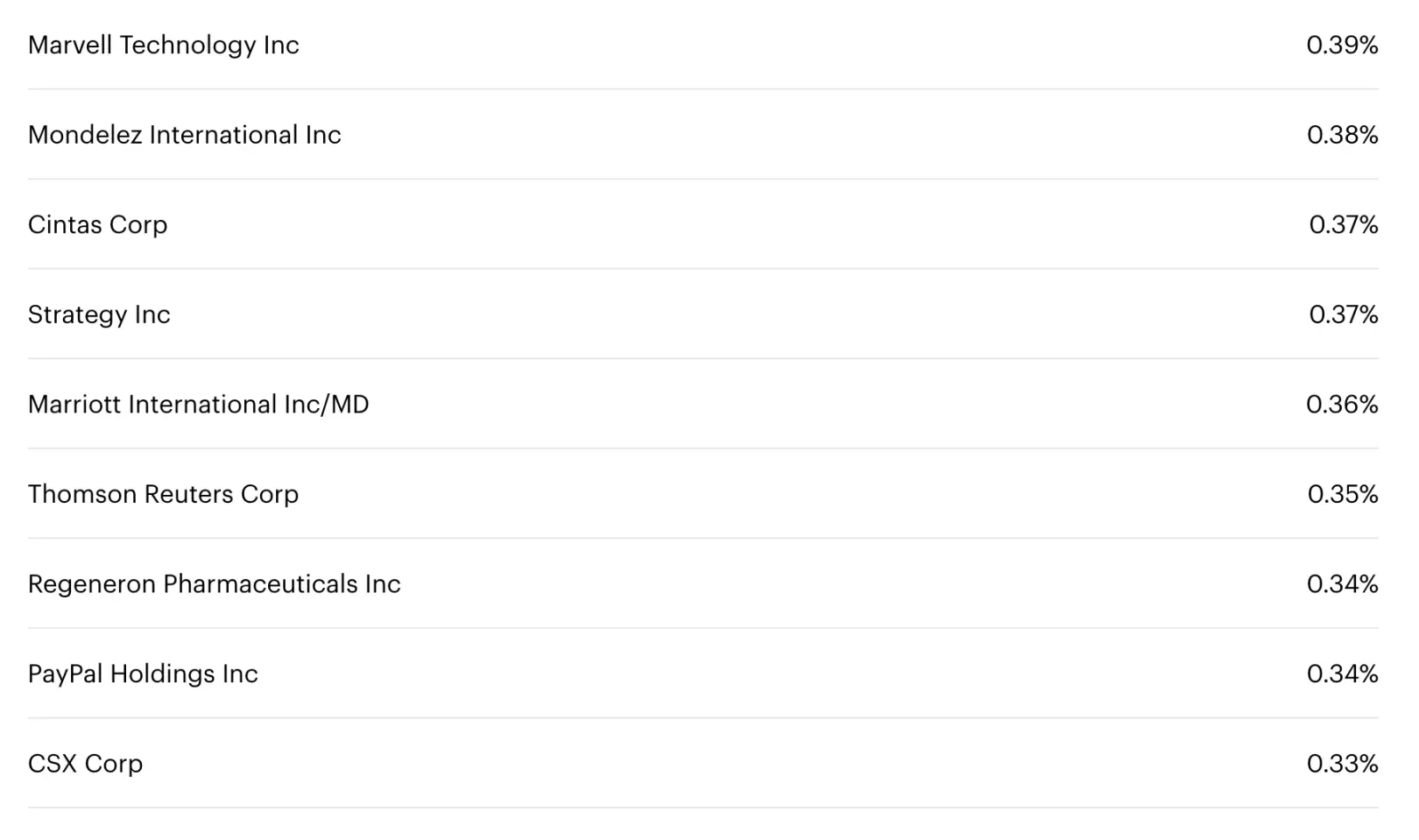

In reality, the possibility of Strategy being removed from the Nasdaq 100 this year is almost zero. Aside from basic situations such as transforming into a financial company, changing listing location, insufficient liquidity, or violating listing rules, a stock is typically removed from the Nasdaq 100 only if its market capitalization ranking falls directly below 125th or remains outside the top 100, or if its weighting is below 0.1% of the total market capitalization for two consecutive months, and a suitable replacement is available.

According to QQQ's holdings, Strategy's current weighting is approximately 0.37%, and its market capitalization has not fallen out of the top 100. The year-end index adjustment is based on data from the end of October, suggesting that Strategy remains safe this year.

There was a surge in DAT (Data Technology, Alibaba, Tencent) companies in the market this year, but it's important to note that these companies operate on a market consensus rather than a financial mechanism, and their market capitalization is not necessarily lower than the value of their assets. A good example is an article published by the Daily Economic News in August this year: Sohu, an early internet giant, had a market capitalization that, for a long time, was less than its cash holdings and the value of its office buildings.

Strategy can still function for now because new entrants continue to join the game based on DAT's status as the "originator," and it also restrains a large number of vested interests based on its status as the "originator." However, if the market suddenly abandons its acceptance of this "game mechanism," the strategy of investors continuously buying new shares and cashing out at higher prices by maintaining a stable ratio between the company's market capitalization and the value of their Bitcoin holdings will become invalid. The risks involved may be greater than most people imagine.

Even if this mechanism continues, the persistently high attention and funding attracted by AI could lead to continued weakness in Bitcoin prices, putting significant pressure on Strategy in the short term. While the continued implementation of the DAT model would have a positive impact on the industry, it's crucial to be vigilant against the short-term risks associated with stress testing.

After all, the 2.8 billion profit is just investment income, and there are never any winners in investing.