Why is contract trading a money-printing machine for exchanges? Why do some exchanges dare to gamble against users? By understanding the mechanism and market dynamics of Bitcoin perpetual contract funding rates, readers will know how they fell into the "trap" set by the exchange step by step.

The 0.01% equilibrium, in the eyes of perpetual trading, is like the 0.618 Fibonacci sequence, so delicate and cutting

Disclaimer: The plot is purely fictional and any similarity is purely coincidental.

If you think I'm wrong, then you're right

Entertainment statement: This article is written with the utmost "malice" and is not directed at anyone. Just read it for fun.

introduction

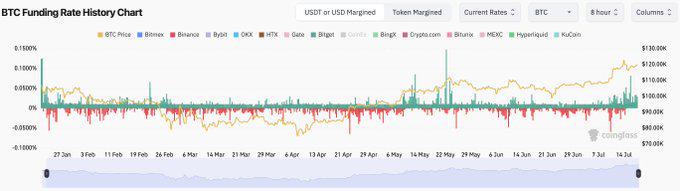

In the field of cryptocurrency derivatives trading, Bitcoin (BTC) perpetual contracts have become one of the most liquid and influential tools. Active traders often observe a unique phenomenon: in most market environments, the funding rate of BTC perpetual contracts seems to be stable at around 0.01%. This number is not random, nor is it a direct reflection of market sentiment, but rather the core result of the exquisite financial engineering design of perpetual contracts.

Reading Guide

From the underlying structure of perpetual contracts and the mathematical formula of funding rates to the market behavior of arbitrageurs and rate changes under extreme market conditions, my personal level is limited, so I will try my best to explain (conceal) the deep logic and market dynamics behind the equilibrium state of 0.01%.

For new traders or readers seeking theoretical foundations : It is recommended to read Sections 1 and 2 in order to understand the core mechanisms and formulas.

For professional traders and arbitrageurs : focus on Sections 3 and 5 to gain a deeper understanding of arbitrage mechanisms, exchange differences, and feasible trading strategies.

For risk managers : The analysis of extreme market conditions in Section 4 is crucial.

Section 1: Perpetual Contract Structure and Funding Rate Mechanism

To understand the origin of 0.01%, we must first understand the design intention and core mechanism of the perpetual contract as a financial instrument. The perpetual contract is designed to provide a trading experience similar to traditional futures, but cleverly avoids its main complexity - expiration and delivery.

1.1 The problem of no expiration date

Traditional futures contracts have a clear expiration date. As the expiration date approaches, the futures price will naturally converge to the spot price of the underlying asset through arbitrage behavior by market participants, and eventually the two prices will converge at the time of delivery. This expiration date is like a strong "price anchor point".

However, by eliminating the expiration date, perpetual contracts provide traders with the convenience of holding positions indefinitely. This also introduces a serious financial engineering problem: without the final anchor point of the expiration date, how to ensure that the price of the perpetual contract will not deviate significantly and permanently from its underlying asset (such as the spot price of BTC)? Without an effective anchoring mechanism, the price of the perpetual contract may drift indefinitely due to market speculation, thereby losing its fundamental value as a price discovery and hedging tool. This design is completely different from the mechanism in traditional financial markets where interest rates are determined by central banks and interbank markets. It is an endogenous market-based, point-to-point regulation system.

1.2 Funding Rate: The Core Solution for Price Anchoring

To solve this problem, the exchange designed a funding rate mechanism. The most important thing to understand about the funding rate is that it is not a fee charged by the exchange, but a regular fee exchange directly between long and short traders . The essence of this mechanism is a dynamic compensation system based on market deviation, and its only goal is to anchor the market price (mark price) of the perpetual contract to the spot index price of the underlying asset.

Here’s how it works:

When the perpetual contract price > spot price : the market is bullish and bulls dominate . At this time, the funding rate is usually positive . In order to curb excessive bullishness, the system stipulates that long position holders need to pay funding fees to short position holders. This increases the cost of going long, incentivizing traders to sell perpetual contracts or buy spot, thereby pulling the contract price back to the spot level.

When the perpetual contract price < spot price : the market is bearish and shorts dominate . At this time, the funding rate is usually negative . In order to curb excessive bearishness, the system stipulates that short position holders need to pay funding fees to long position holders. This increases the cost of shorting, incentivizing traders to buy perpetual contracts or sell spot, thereby pushing the contract price to the spot level.

This design embodies a clever governance idea: the exchange does not directly intervene in market prices, but establishes a set of incentive rules to allow market participants (especially arbitrageurs) to actively correct price deviations through their own profit-seeking behavior. This makes the entire system more flexible and self-correcting (incentive-based self-correction). Therefore, the funding rate is not only a function of the perpetual contract, but also the core engine that enables it to operate reasonably.

Section 2: Deconstructing the Funding Rate Formula: Interest Rate and Premium Components

To accurately answer the question "Why 0.01%?", we must delve into the mathematical structure of the funding rate. The 0.01% observed by users is not a floating value directly determined by market supply and demand, but is mainly determined by a fixed parameter preset by an exchange.

Most major exchanges, such as Binance and OKX, use a similar standardized formula to calculate funding rates:

Funding Rate = Premium Index + clamp (Interest Rate − Premium Index)

This formula clearly shows that the funding rate consists of two core parts: the premium index and the interest rate .

2.1 Premium Index: A direct reflection of market sentiment

The premium index is the completely market-driven part of the funding rate. It directly measures the difference between the perpetual contract price and the underlying spot index price. Its calculation method is usually complex and aims to reflect real buying and selling pressure and prevent market manipulation. For example, exchanges use depth-weighted bid/ask prices ( Impact Bid/Ask Price , which refers to the average transaction price of executing a larger order, which can better reflect market depth) for calculation and perform a moving average of the values over a certain period of time to smooth short-term fluctuations. Different platforms may have differences in calculation cycles and specific methods. Traders are advised to consult the official documents of specific exchanges for accurate information.

The premium index is positive : it means that the perpetual contract price is higher than the spot price, reflecting that the demand and willingness for long positions in the market are stronger than short positions.

The premium index is negative : it means that the price of the permanent contract is lower than the spot price, reflecting that the short-selling force in the market has the upper hand.

Essentially, the premium index is a barometer of the direction of leverage demand.

2.2 Interest Rate: The Source of 0.01%

This part is a direct answer to the user’s question. The value of 0.01% comes from the “interest rate” part of the funding rate formula. It is a parameter pre-set by the exchange, not an immediate result of market speculation.

Binance, OKX and Bybit : It is clearly stated in their documents that their interest rate is set at 0.03% per day (Binance is a fixed interest rate of 0.01% (8 hours)). Since the funding fee is settled every 8 hours (that is, 3 times a day), the interest rate at each settlement is 0.03%/3=0.01%.

So why would an exchange set such a fixed positive interest rate? This “interest rate” component is intended to simulate the concept of borrowing costs in the real world. For a BTC/USDT perpetual contract, this interest rate represents the difference in borrowing costs between the two currencies: the difference between the interest rate of the quote currency (USDT) and the interest rate of the base currency (BTC). In the context of traditional finance, a daily interest rate of 0.03% is equivalent to an annualized rate of approximately 10.95%, which is equivalent to a relatively high funding cost for US dollars, reflecting the inherent risk premium of holding highly volatile crypto assets.

That is to say, if you hold a contract position, you need to pay an annualized interest rate of approximately 10% for your "leveraged funds" - just like when you borrow money to buy coins, you have to pay interest for the use of funds.

This design has an important structural impact:

In a completely balanced market where long and short sentiments are completely offset, the premium index should theoretically be zero.

At this point, the funding rate formula becomes: funding rate = 0 + clamp (0.01% − 0), and the result is exactly 0.01%.

This means that even if there is no price deviation in the market, long positions still need to pay a 0.01% fee to short positions .

This design is not neutral. It imposes a small but continuous "cost of carry" on long positions, while providing a basic "holding income" for short positions. This asymmetric design, on the one hand, gently suppresses indefinite and stagnant leveraged long behavior; on the other hand, it also provides a stable basic income for market makers (who are often net short in the perpetual contract market to hedge risks), thereby encouraging them to provide liquidity to the market.

Section 3: The invisible hand of arbitrage: forcing a 0.01% equilibrium

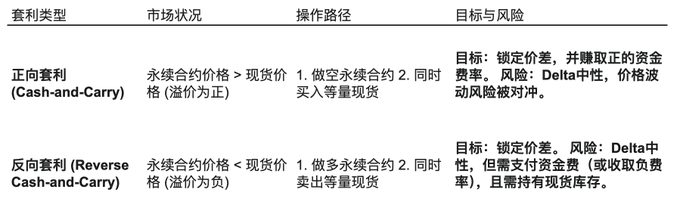

Now that we know that 0.01% is a preset benchmark interest rate, the next question is: Why most of the time, market forces (i.e., the premium index) do not break this benchmark and cause the rate to fluctuate greatly? The answer lies in a powerful and efficient market mechanism: arbitrage .

It is precisely because there are a large number of professional arbitrageurs in the market who continuously eliminate opportunities in the premium index that the interest rate component has become the dominant factor in the funding rate, making 0.01% the norm.

3.1 The creation and elimination of arbitrage opportunities

When there is any significant difference between the perpetual contract price and the spot price, a theoretical risk-free profit opportunity is born. Arbitrageurs use automated trading systems to capture and execute these opportunities in milliseconds.

Note 1: Delta neutrality means that the value of the portfolio is not affected by small changes in the price of the underlying asset.

Note 2: Assuming that no spot is purchased for hedging when opening a position, the jargon is called naked short/naked long.

This arbitrage behavior is also one of the important bridge scenarios connecting centralized finance (CeFi) and decentralized finance (DeFi). Arbitrageurs often transfer assets between the two to capture better interest rates or price spread opportunities (such as the well-known Winter, DWF, Jump, etc.).

3.2 The manifestation of market efficiency

Today’s crypto markets are highly institutionalized and filled with quantitative trading firms using complex algorithms. The fierce competition among these firms means that any significant price difference (i.e. a significant premium index) will be discovered and filled by arbitrage trading in an instant.

Therefore, the long-term stability of the funding rate observed by users at 0.01% is precisely the most powerful proof of the highly efficient market. Behind this stable number are the high-frequency transactions carried out by countless arbitrage robots at all times. They are like an "invisible hand" that constantly suppresses the premium index within a very small range close to zero.

Section 4: Deviation from the norm: When will the funding rate leave 0.01%?

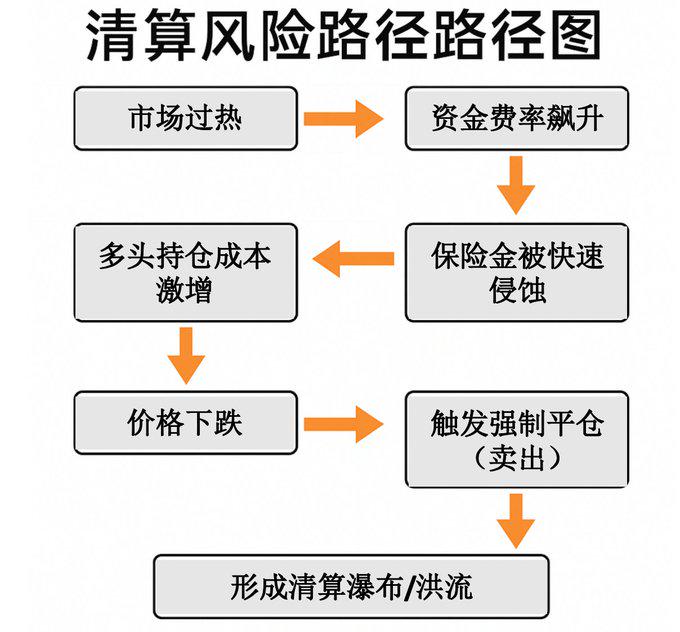

The equilibrium state of 0.01% is the performance of the market under "normal weather". Once the market enters an extreme sentiment or high-pressure environment, the supply and demand forces of leverage may temporarily overwhelm the arbitrageurs' correction ability, causing the premium index to become the dominant factor in the funding rate, causing it to deviate significantly from the benchmark.

4.1 Bull Market Frenzy (High Positive Funding Rate)

Mechanism : During a strong bull market, a large number of retail and institutional traders flooded into the market and established highly leveraged long positions. This "speculative frenzy" created huge buying pressure on perpetual contracts, pushing their prices up to levels far exceeding spot prices.

Result : The premium index becomes very large and positive, far exceeding the 0.01% interest rate benchmark. The total funding rate may soar to 0.1% or even higher per settlement cycle, making the cost of holding long positions extremely expensive.

4.2 Bear Market Panic (Negative Funding Rate)

Mechanism : During a market crash or panic selling, the opposite happens. Traders rush to short perpetual contracts to hedge risk or chase the downtrend, causing their prices to fall far below the spot price.

Result : The premium index becomes very large and negative. The funding rate then turns deeply negative, with shorts paying high fees to longs. This can be seen as a reward for those traders who "catch the falling knife" and dare to go long in the perpetual contract market when the market is extremely panic.

Chain Liquidation Risk Path Diagram (“Long/Short” Position Fuel)

4.3 The role of the “clamp” mechanism (Clamp Function)

In order to prevent funding rates from fluctuating too much under extreme market conditions, thereby triggering chain liquidations and undermining market stability, exchanges have introduced upper and lower limits on funding rates, namely a "clamp" or "cap/floor" mechanism.

Purpose : This is a key risk control tool to prevent the funding rate itself from becoming a catalyst for a market crash.

Implementation : The function of clamp(x, min_val, max_val) is to limit the value of variable x to between min_val and max_val. In the funding rate formula, clamp(interest rate - premium index, -0.05%, 0.05%) means that no matter what the result of the interest rate - premium index is, its final value used in the formula will be forced to be limited to the range of -0.05% to +0.05%. (Bitcoin is used as an example here, and the funding rate of altcoin is definitely more than 0.05%)

The existence of this clamping mechanism is a trade-off made by the exchange between pure market incentives and systemic stability, which is equivalent to a "circuit breaker". (Or, "restraint")

Section 5: Strategic Implications for Traders and Investors

A deep understanding of the funding rate mechanism is not a purely academic discussion, but practical knowledge that can be transformed into a powerful trading advantage.

5.1 Funding Rate: A Quantitative Indicator of Real-time Market Sentiment

The degree to which the funding rate deviates from the 0.01% benchmark is one of the purest and most real-time indicators of market leverage sentiment.

Sustained high positive rates : usually indicate extreme greed in the market, excessive leverage levels, and are a sign of an “overheated” market.

Sustained negative rates or deeply negative rates indicate extreme market panic and short-selling crowding, which is a signal of "surrender".

5.2 Calculating the “holding cost” of long-term positions

For investors who plan to hold leveraged long positions for the long term, the base fee of 0.01% is a direct cost that must be quantified.

Cost calculation : A trader holding a 5x leveraged BTC long position needs to pay $5 \times 0.01\% = 0.05\%$ of the notional position value as funding fee every 8 hours. This means a daily cost of $0.15\%$, and an annualized cost of up to $54.75\%$ (0.15%×365`).

Strategic considerations : This staggering cost can seriously erode profits from long-term positions. It is worth noting that this cost mainly affects swing and long-term traders who hold positions overnight, while day traders can completely avoid this fee if they close their positions before the funding fee is settled .

5.3 Triangular Arbitrage: Delta Neutral Strategy to Earn Funding Rate

The funding rate mechanism itself can also be used to create a relatively low-risk return strategy, namely the cash and holding arbitrage mentioned above.

Operation : 1) Buy 1 BTC in the spot market; 2) Short an equivalent 1 BTC contract in the perpetual contract market.

Profit source : The profit of this strategy comes entirely from the funding rate charged as a short position holder. In a normal market, this part of the profit is a stable 0.01% base rate. In the bull market frenzy, this part of the profit will become very considerable.

5.4 Using Extreme Fees as Reverse Trading Signals

Extreme funding rate levels can serve as a warning sign that a trend may be overextended and the probability of a reversal is increasing.

High fee rate warning : When the funding rate reaches a historical high, it means that longs are paying a very high price for leverage and market transactions become extremely crowded.

Negative rate opportunities and cases : When the funding rate reaches a deep negative value, it means that market pessimism has reached its peak. A typical case is the market crash on May 19, 2021 , when the price of Bitcoin plummeted by nearly 40%, causing the funding rate to be deeply negative for several months. For contrarian investors, this signal marks the peak of market panic and becomes an important leading indicator of the subsequent market bottoming out and rebound.

in conclusion

In this high-frequency gaming market, 0.01% is not an isolated interest rate parameter, but a product of the dynamic balance between market efficiency and capital incentives. It originates from the benchmark interest rate set by the exchange and is maintained through an efficient arbitrage market , ultimately becoming a valuable indicator for measuring market sentiment in extreme market conditions .

It is not static, but a harmonious market note played by countless robots and human traders in billions of operations. A deep understanding of this mechanism is a must for every serious market participant from entry to mastery.

May we always maintain a heart that respects the market.