By Azuma, Daily Planet

Arthur Hayes’s calls may not be trustworthy, but his actual operations are really worth learning from for retail traders.

As the most well-known market forecaster in the industry, although Arthur Hayes is always bullish in the long run, he is ruthless when it comes to selling or wanting to sell, and he doesn't even care about the face of his industry boss. He predicts the market while crashing the market - see "When Arthur Hayes suddenly predicts the coin you bought, you should be careful" for details.

Hasu, head of strategy at Flashbots, once commented on Arthur Hayes: "If you get any long-term signals from Arthur Hayes, I really don't know what to say to you. He is one of the purest traders in this market."

HYPE——"Even though I see 126 times, I only eat 15%"

The recent Hyperliquid (HYPE) is a perfect example.

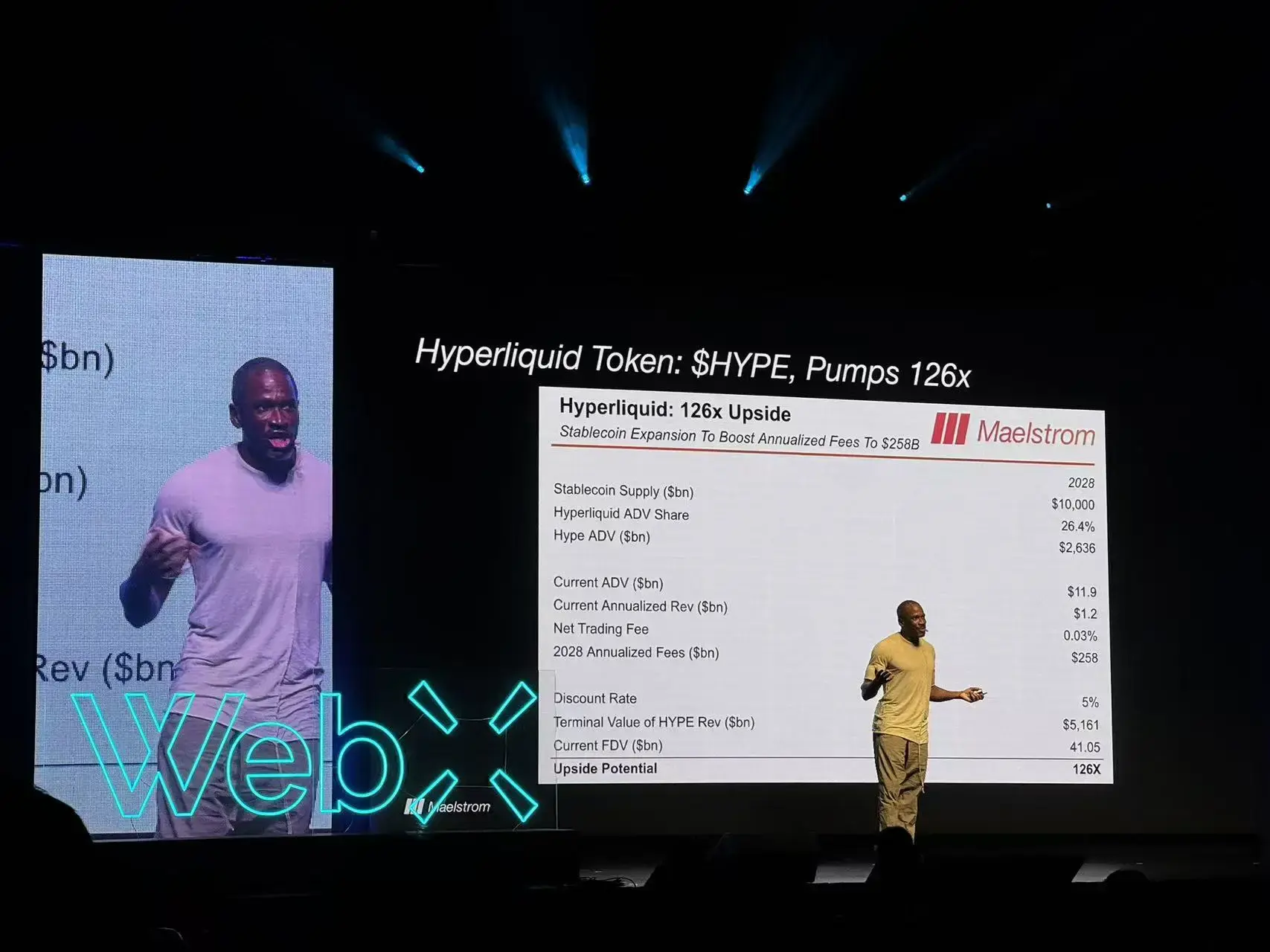

On August 25, Arthur Hayes gave a speech at WebX Japan to promote HYPE, which still has the potential to increase by up to 126 times - at the end of the day, the price of HYPE was about US$45.9.

Who would have thought that less than a month later, on September 21st, the day after HYPE hit a record high, Arthur Hayes liquidated 96,600 HYPE tokens, cashing out approximately $5.1 million. The average selling price was approximately $52.8, a mere 15% increase from the price when Arthur Hayes predicted a 126-fold increase.

Afterward, Arthur Hayes' family investment office, Maelstrom, released its rationale for selling HYPE: HYPE is about to face its true test. Starting November 29, 2025, 237.8 million HYPE tokens will begin to unlock linearly over 24 months. At $50 per token, this equates to $11.9 billion in team unlocks, with nearly $500 million in tokens entering the market each month. Analysis indicates that current buyback capacity can only absorb approximately 17% of the unlocked tokens, leaving an excess supply of approximately $410 million per month. Token unlocks are a potential "Sword of Damocles."

Arthur Hayes repeatedly joked about this, saying, "I'm dumping the stock to pay the deposit for the luxury Rari 849 Testarossa," and "126 times is still possible, but 2028 is still a long way off."

It's hard not to be shocked by Arthur Hayes's thick skin, but it's also hard not to agree with his accuracy in escaping the top.

On the day Arthur Hayes sold his shares, not only had HYPE hit a new all-time high, but the Perp DEX sector was also gaining popularity, becoming the dominant narrative in the industry. However, since Hayes's sale, HYPE has plummeted rapidly along with the broader market's weakening. As of this writing, it's currently trading at $44.18, even below the price at which Hayes had predicted a 126x return.

ETHFI — “This is true value capture. Oops, why is it suddenly listed on Upbit…”

Similar examples are not limited to the recent HYPE.

Just two days before Arthur Hayes sold HYPE, he also performed a similar operation on ether.fi (ETHFI).

Around 3:00 p.m. on September 18, Arthur Hayes was still enthusiastically interacting with his investment project ether.fi, praising the latter's economic model for allowing value to flow back to ETHFI holders.

Around 11:00 AM on September 19th, the South Korean exchange Upbit suddenly announced the listing of ETHFI. ETHFI surged to a high of $1.695 that day, reaching a nearly six-month high. Arthur Hayes didn't hesitate and immediately dumped 1.216 million ETHFI tokens, worth approximately $1.89 million.

Afterwards, the price of ETHFI fell back to around $1.2 as the market fell, and Arthur Hayes successfully escaped the top again.

ENA - A classic case study, revisited

When it comes to Arthur Hayes' classic examples of escaping the top, ENA is definitely worth mentioning.

Around December of last year, ENA had just completed its first round of price adjustments after its launch, with the price reclaiming $1, suggesting a continued upward trend. Arthur Hayes, at the time, had predicted that ENA would break through $10. However, at the same time as this prediction was being made, Hayes was rapidly selling off his ENA through exchanges like Binance and Bybit.

Everyone is familiar with ENA. After Arthur Hayes dumped the stock, ENA's trend weakened rapidly, and it once fell back to $0.22. Arthur Hayes then began to rebuild his position at the bottom in a leisurely manner, and it is expected that he could pocket tens of millions of dollars with this one entry and exit.

Recently, perhaps because he has re-established a sufficiently substantial ENA position, Arthur Hayes has started to frequently support ENA again - please be careful if there are any market fluctuations in the future.

Xiao Hei also failed: after smashing ETH, he had to take it back

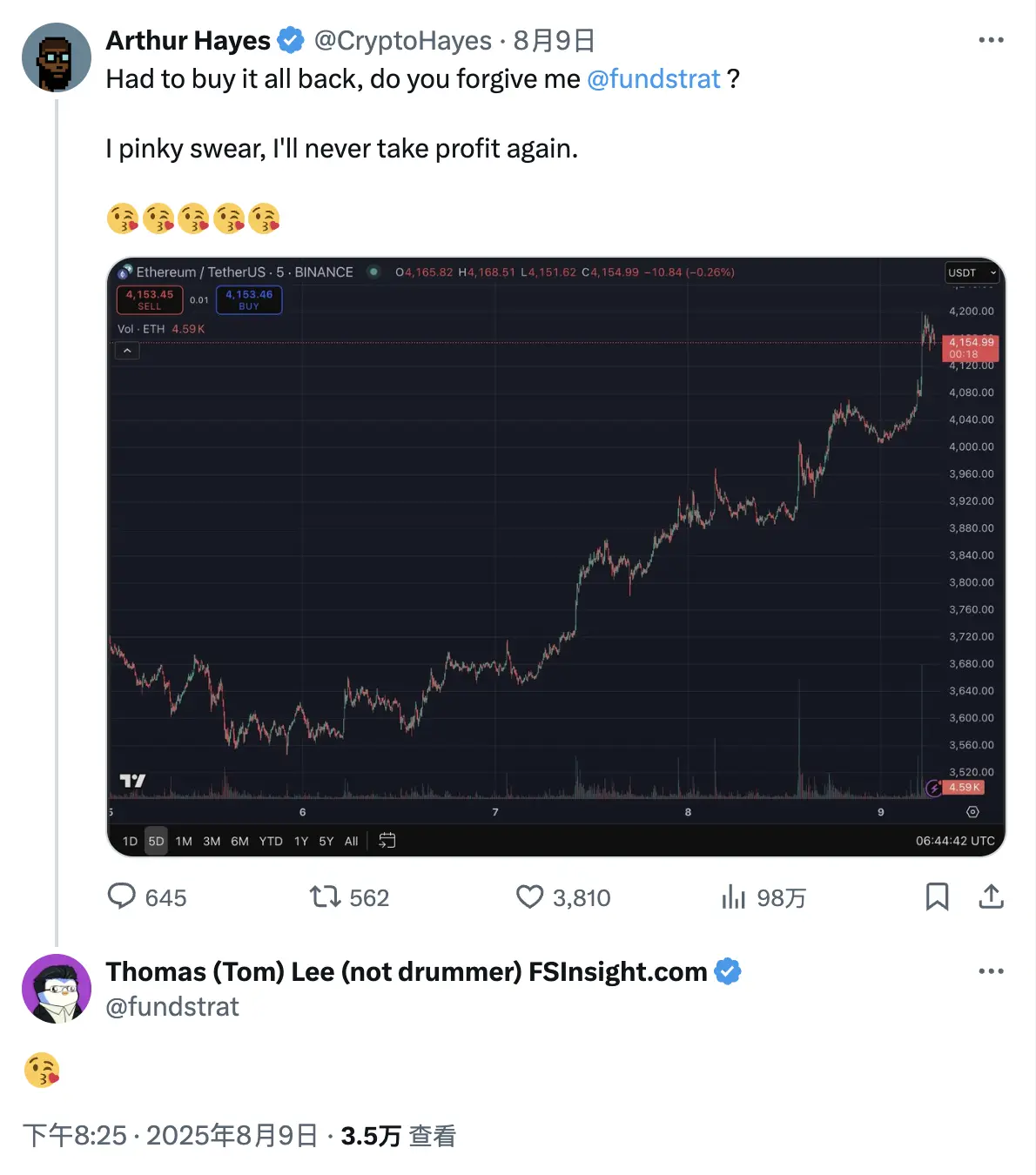

Although Arthur Hayes' record of escaping the top is excellent, it seems to be limited to the altcoin market where he has greater influence. On ETH, Arthur Hayes has failed many times this year.

During this round of ETH's strong upward surge, Arthur Hayes tried to escape the top many times, but was eventually defeated by the market and forced to raise the price to take back all his positions.

When talking about his operation of buying back at a higher price, Arthur Hayes even swore, "I will never take profits again"... But as a natural trader, few people would really believe what he said.

Recent trends: Sell ONDO

This morning, Arthur Hayes made another new move - last night his address received 26.28 million ONDO (worth about 24.7 million US dollars) from the Ondo project address, and then transferred them in batches to Coinbase, Bybit, Binance and OKX, and it is suspected that he is selling them.

Judging from ONDO’s current price position, although it is not the top, it is still at a relatively high level. Combined with Arthur Hayes’ past operation cases, perhaps ONDO holders need to pay closer attention to the price trend of the currency.