If microstrategies ignited Bitcoin's bull run in the previous cycle, then the engine of this round is undoubtedly "altcoin microstrategies." Continued buying by Ethereum treasury companies like SBET and BMNR not only pushed ETH's price from $1,800 in early May to $4,700, an increase of over 160%, but also established it as a new bellwether in market sentiment. Meanwhile, mainstream altcoins like SOL, BNB, and HYPE followed suit, creating a wave of companies centered around treasury increases, further fueling market expectations of a bullish rally.

However, as this model spreads, risk signals are gradually emerging. Recently, BNB treasury company Wint faces delisting risks, and Hype treasury company LGHL is rumored to be selling its tokens, raising market questions about the sustainability of the treasury strategy. What potential risks does this concentrated buying strategy harbor? While pursuing high returns, what hidden concerns should investors be aware of? This article will provide an in-depth analysis.

Corporate Game: Capital Only Chooses a Few Winners

This competition among "treasury companies" can be described as a life-and-death market elimination tournament.

Windtree Therapeutics (WINT) announced in July that it would establish a strategic reserve of BNB. However, due to weak fundamentals and a persistently low stock price, it ultimately received a delisting notice from Nasdaq on August 19th. Following the announcement, WINT's stock price plummeted, plummeting 77.21% in a single day to just $0.13, a 91.7% drop from its initial price of $1.58 following the announcement. For a small, clinical-stage biopharmaceutical company facing mounting quarterly losses and yet to achieve commercialization, delisting virtually means complete market marginalization.

In stark contrast, another newcomer is BNB Network Company (BNC, formerly CEA Industries). Backed by YZi Labs, BNC raised $500 million in private equity funding between late July and early August. CZ personally spearheaded the round, with participation from 140 leading investors, including Pantera Capital, Arrington Capital, and GSR. The company also appointed David Namdar, former co-founder of Galaxy Digital, as CEO, and Russell Read, former Chief Investment Officer of CalPERS (California Public Employees' Retirement System), to helm investment decisions. Almost overnight, BNC made the leap from a traditional small-cap stock to a legitimate BNB treasury company.

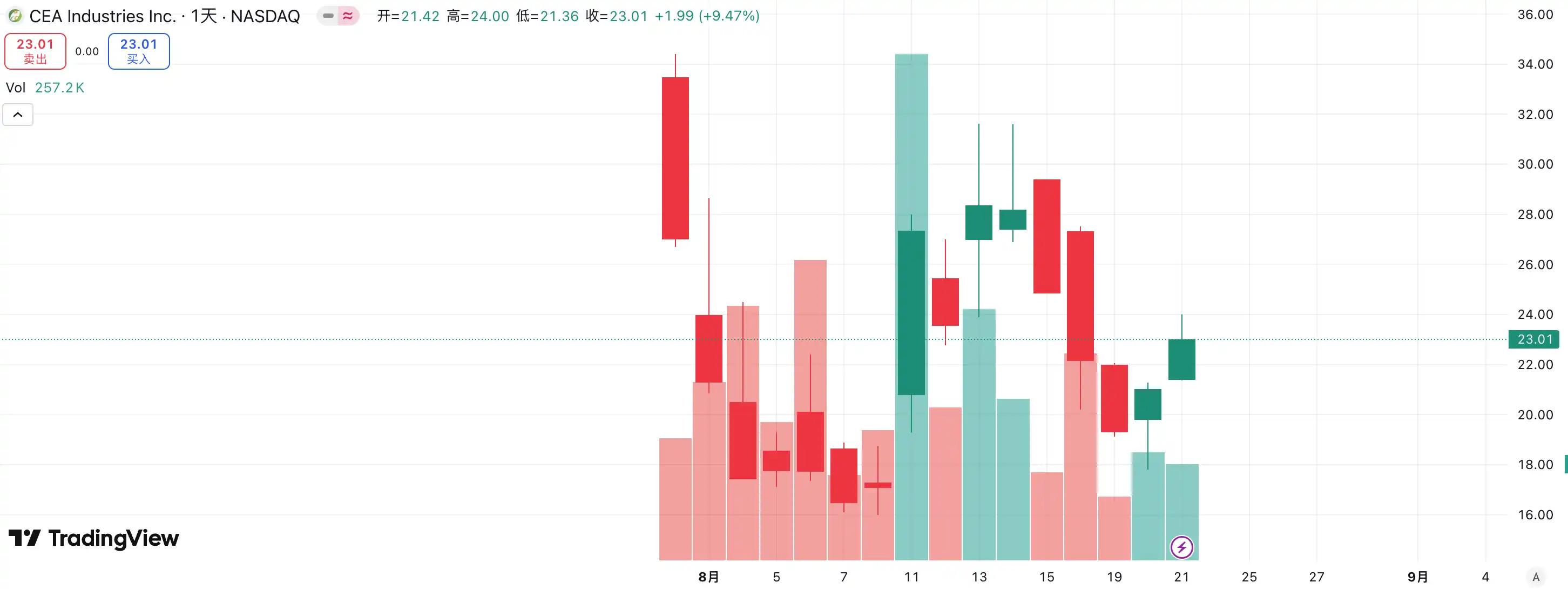

The choice of capital has already revealed the answer: WINT has become a discarded child, while BNC has become the new market leader. Data shows that BNC's stock price rose 9.47% yesterday, currently trading at $23.01, further strengthening its leading position in the "BNB Treasury Company" category. It can be said that this competition is not only a showdown of company fundamentals, but also a market vote on the company's narrative and resource integration capabilities.

Competition is also fierce among ETH treasury companies. As the first publicly listed company to coin the term "ETH micro-strategy," SBET, led by Joseph Lubin, leveraged its first-mover advantage and its ETH-as-a-spokesman narrative to quickly trigger intense fear of market euphoria in the early days of the market. Its price soared from $3 to over $120, becoming a benchmark for the alt-treasury model.

However, the rise of BMNR quickly reshaped the landscape. As a latecomer, it not only surpassed SBET in both buying power and funding, but also boasted the slogan "holding 5% of ETH," instantly capturing market attention. More crucially, BMNR enjoyed the public backing of established Wall Street investors like Tom Lee and Cathie Wood, quickly establishing a dominant position within institutions and the media. In contrast, while SBET enjoyed the backing of Web3 upstarts like Joseph Lubin, BMNR, allied with Wall Street's "old money," clearly lacked the voice and influence to influence it possessed.

The stock price trends of the two companies also confirm this divergence. During the August market, SBET's share price rose from $17 to $25, an overall increase of approximately 50%. BMNR's share price rose from $30 to $70, an increase of over 130%, significantly outperforming the former. As BMNR gradually gained recognition from mainstream investors and opinion leaders, the competitive landscape of ETH treasury companies has seen a clear shift in direction.

The lesson behind this competition is that the "treasury company" market has entered a phase where the strong will only get stronger. With the participation of institutional investors and leading capital, market resources are rapidly concentrating on a small number of companies with the ability to integrate capital, drive narratives, and maintain strong governance. Small companies face difficulties in surviving this model. Even if they promote the concept of "treasury," they cannot withstand the market's scrutiny of performance and financial strength. Ultimately, only a few winners, capable of absorbing capital and generating narratives, will remain, while those who are caught in bubbles and follow suit will be quickly eliminated.

Concerns about selling coins: Strategic reserves do not mean holding them forever

If Bitcoin's bull run is fueled by Michael Saylor's faith, then the "treasury bull" of altcoins seems even more realistic. Saylor has consistently declared that MicroStrategy "will never sell" its Bitcoin, and through continuous financing and purchases, he has generated a steady stream of buying and confidence in BTC. Despite this, the question of whether MicroStrategy will sell its coins remains a hot topic in the market. While altcoin treasury companies have followed this model, they have never issued a "no sale" commitment, raising even greater concerns about their stability in the market.

Recently, Lion Group Holding Ltd., the HYPE treasury company, was monitored to have sold $500,000 worth of HYPE tokens. Just a month ago, the company announced the launch of the HYPE treasury strategy after completing $600 million in financing. The goal is to position $HYPE as a core reserve asset and build a next-generation Layer-1 treasury portfolio by allocating tokens such as $SOL and $SUI. It also made it clear that it will continue to increase its holdings of these tokens in the future. However, the current reduction in holdings has caused the outside world to speculate on its asset allocation logic: Is this a tactical diversification adjustment, or a risk-averse response to the recent market decline? Although the sales volume is only $500,000, which is insignificant compared to the $600 million in financing, it is still worth sounding the alarm for the market.

Similar examples are not uncommon. Meitu invested approximately $100 million in Bitcoin and Ethereum, then cashed out when Bitcoin surpassed $100,000 at the end of 2024. The sale price was nearly $180 million, resulting in a profit of approximately $79.63 million. While Meitu is not a treasury strategy firm, this operation illustrates that when prices rise to a certain level, so-called "strategic reserves" can easily be transformed into a tool for profit-taking.

While the market hasn't seen a large-scale sell-off by treasury firms, the potential risks shouldn't be ignored. Whether driven by profit or fear of future market trends, treasury firms can become a source of selling pressure. Lion Group's divestment epitomizes this concern: as one of the first HYPE treasury strategy firms to enter the market, its sell-off undoubtedly serves as a warning. If the "treasury army" were to sell en masse, a stampede could erupt, and the bull market could grind to a halt under the pressure of its own engines.

mNAV Flywheel: Infinite Ammo or a Double-Edged Sword?

Caiku's financing flywheel is built on the mNAV mechanism, a reflexive flywheel logic that gives Caiku a seemingly unlimited supply of funds during a bull market. mNAV stands for Market Net Asset Value, calculated as the multiple of a company's market capitalization (P) relative to its net asset value per share (NAV). In the context of Caiku Strategy, NAV refers to the value of the digital assets it holds.

When the stock price (P) exceeds the net asset value per share (NAV) (i.e., mNAV > 1), the company can continue to raise funds and reinvest the proceeds in digital assets. Each additional issuance and purchase increases the per-share holdings and book value, further strengthening the market's confidence in the company's narrative and driving the stock price higher. Thus, a closed-loop positive feedback loop begins to turn: mNAV rises → additional issuance → purchase of digital assets → increased per-share holdings → increased market confidence → further stock price increases. It is precisely because of this mechanism that MicroStrategy has been able to continuously raise funds to purchase Bitcoin over the past few years without significantly diluting its shares.

However, mNAV is a double-edged sword. A premium can represent a high level of market confidence, or it can simply be speculation. Once mNAV converges to or falls below 1, the market shifts from a "thickening" logic to a "dilution" logic. If the token price itself falls at this point, the flywheel shifts from a positive rotation to a negative feedback loop, resulting in a double blow to market capitalization and confidence. Furthermore, treasury strategy companies' financing relies on the premium flywheel of mNAV. If mNAV remains at a discount for a long time, the space for additional issuance will be blocked. Small and medium-sized shell companies that are already stagnant or on the verge of delisting will see their businesses completely overturned, and the established flywheel effect will collapse instantly. In theory, when mNAV < 1, the more reasonable option for a company is to sell its holdings and repurchase shares to restore balance. However, this should not be generalized. Discounted companies can also represent undervaluation.

During the 2022 bear market, even when MicroStrategy's mNAV briefly dipped below 1, the company chose not to sell its coins for repurchases, but instead insisted on retaining all its Bitcoin through debt restructuring. This "holding on" strategy stems from Saylor's belief in BTC, viewing it as a core collateral asset that he "will never sell." However, this approach is not replicable by all treasury companies. Most altcoin treasury stocks lack stable core businesses, and their transformation into "coin buying companies" is merely a means of survival, not a foundation of conviction. If market conditions deteriorate, they are more likely to sell to cut losses or realize profits, potentially triggering a stampede.

How to avoid the potential risks of the DAT treasury model?

Prioritize companies that hoard BTC

The current treasury model is largely an imitation of MicroStrategy, with Bitcoin playing a fundamental role within it. As the world's only widely accepted decentralized digital gold, Bitcoin's consensus value is virtually irreplaceable. Whether it's traditional financial institutions or crypto-native giants, their allocations and expectations for Bitcoin remain below their long-term targets. For investors, choosing "BTC treasury companies" is often more stable than those that simply mimic altcoin treasury logic and offer a higher long-term confidence premium.

Pay attention to competitive relationships and prioritize leading stocks

Competition for niches in the capital market is fierce. Especially in narrative-driven models like treasury strategies, the market often prioritizes first place over second place. The competition between WINT and BNC demonstrates that once capital and institutional support converge on one side, the other is almost instantly marginalized. In this context, investors should focus on the "leading effect": the top player often secures more institutional funding, media coverage, and market trust, while second and third place players are easily overlooked.

For retail investors, if they lack confidence in individual stocks, it is simpler and more effective to directly invest in the cryptocurrency itself. In fact, even with fierce competition at the company level, ETH and BNB have both hit record highs and remain unaffected.

Focus on company fundamentals

One of the core issues with the DAT model is that many treasury companies are essentially shell companies, their core businesses long stagnant, profitability weak, and they rely almost entirely on cryptocurrency speculation for survival. This model may seem reasonable during a bull market, but once the market turns, it can quickly bleed due to a lack of cash flow support. Therefore, when selecting a target, investors must pay attention to the following:

- Company cash flow: Does it have the ability to generate its own revenue?

- Purchase cost: Is the average holding price high enough to maintain health during a correction?

- Position ratio: Is the proportion of digital assets in the company's net assets too high?

- Financing purpose: Are the raised funds mainly used to purchase coins, or are there actual business expansion?

- Debt-paying ability: Can the company remain stable when convertible bonds mature or stock prices come under pressure?

Companies that lack the ability to generate revenue may be very successful in a bull market, but when liquidity recedes, their ability to resist risks is extremely weak and they are likely to become the first victims of a stampede.

Summarize

Treasury strategies have undoubtedly injected the strongest fuel into this bull market, with a steady influx of OTC funds fueling altcoins like ETH's continued surge. However, the more seemingly "unlimited ammunition" appears, the more we must be wary of underlying bubbles and hidden dangers. History has proven that liquidity and narratives can fuel markets, but they cannot replace genuine value. While investors are optimistic about the current market, they must also remain calm and cautious. Only by maintaining rationality amidst the chaos can we remain resilient when the next bubble recedes.