Author: Yue Xiaoyu

On-chain users can be roughly divided into three categories: airdrop players, DeFi players, and trading players.

Airdrop players: These players focus on participating in the airdrop activities of Web3 projects and obtain token rewards at low or even no cost. Their goal is usually short-term profit, and they are often called "money-grabbing parties."

DeFi players: This type of users are keen on DeFi, earning income by providing liquidity, staking, lending, arbitrage, etc., pursuing more stable long-term returns.

Trading players: In fact, this specifically refers to meme coin players, who mainly speculate and hope to catch the golden dog and get rich.

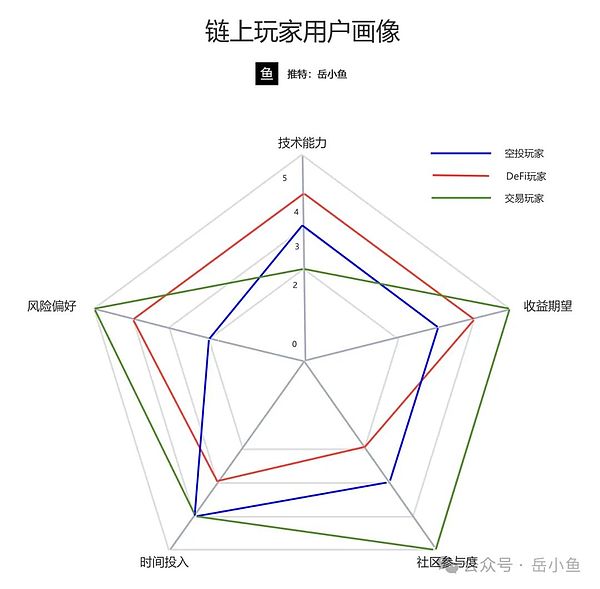

These three user groups have very distinct characteristics. I use radar charts to make a comprehensive comparison. You can see which type of player you are and which type of player you want to be.

Overall, it is divided into five comparative dimensions: technical capabilities, risk preference, time investment, community participation and profit expectations.

The rating range is 1-5 (1 is the lowest and 5 is the highest).

First, the conclusion:

Airdrop players: The radar chart shows a shape that leans towards "time investment", with medium technical capabilities and community participation, and low risk appetite and return expectations, forming a relatively balanced but inward-biased pentagon.

DeFi players: The radar chart highlights “technical capabilities” and “risk appetite”, with high expectations for returns but low community participation and time investment, forming a graph that expands outward but has a narrowing bottom.

Memecoin trading players: The radar chart is strongly biased towards "risk preference", "return expectations", and "community participation", with low technical capabilities, forming an overall outward-facing graph.

Consider combining this with your behavioral preferences:

If you have plenty of time, little capital and a low risk appetite, then you are suitable to become an airdrop player;

If you are a technology-driven person who likes research and has a certain amount of capital, then you can become a DeFi player;

If you are a person who likes speculation, can bear high risks and expects to get rich through trading, then you can consider becoming a meme coin player.

The following is a detailed analysis:

1. Airdrop players

Technical skills (3/5): You need to master basic blockchain operations (such as wallet usage, interactive test network), but you don’t need to have a deep understanding of smart contracts or complex DeFi mechanisms.

Risk preference (2/5): The risk is relatively low because the investment cost is usually just time and a small amount of gas fee, and there is no big loss if failure occurs.

Time investment (4/5): A lot of time is needed to research new projects and complete tasks (such as Discord activities, testing interactions) to ensure that you do not miss any airdrop opportunities.

Community participation (3/5): Active on platforms such as Discord and Twitter, but more for completing tasks rather than deeply participating in community culture.

Expected return (3/5): Expect to get considerable returns through airdrops, but due to the uneven quality of projects, the uncertainty of returns is high.

2. DeFi players

Technical skills (4/5): Need to understand complex DeFi protocols (such as Uniswap, Aave), fund pool mechanisms and risk management (such as impermanent loss).

Risk appetite (4/5): Willing to take higher risks (e.g. smart contract vulnerabilities, market volatility), but usually reduce losses through diversification.

Time investment (3/5): You need to monitor the market and adjust your strategy regularly, but not as frequently as short-selling players.

Community participation (2/5): More concerned with personal gains than community activities, participation is relatively low unless it involves governance voting.

Return expectations (4/5): Seeking a stable and relatively high annualized rate of return (such as 10%-100%), and not very interested in getting rich quickly in the short term.

3. Trading players

Technical skills (2/5): Simple operation, only basic wallet and trading knowledge is required, no in-depth technical understanding is required.

Risk Preference (5/5): Extremely high risk tolerance, willing to participate in projects with a high probability of "returning to zero", and pursue the dream of "hundred-fold coin".

Time investment (4/5): It mainly depends on market sentiment and hot spots, so you need to sit and scan the chain and pay attention to community dynamics at all times, which requires a lot of time investment.

Community participation (5/5): Highly active in the Memecoin community (such as Twitter, Telegram), driving up prices through hype and dissemination.

Profit expectations (5/5): Expecting extremely high returns (such as 100 times or even 1,000 times), but the success rate is extremely low, and it is more of a gambling mentality.

To sum up

No matter what type of player you are, there is no best, only the one that suits you best, so you have to find the track that suits you best.

For me, my learning path is:

From the very beginning of the airdrop players, you can also earn income while experiencing the product learning project;

Later DeFi players further understood the protocol and on-chain operations, and mined everywhere to earn profits;

Now, the on-chain trading players are catching up with the popular narratives and looking for the code to wealth on the chain.

My identity and positioning have changed many times, but what remains unchanged is that I have been constantly learning new things, constantly breaking through my own limitations, and striving to keep up with the rapid development of the industry.

Find the track that suits you and then just keep moving forward!