Description: Lao Bai, an old leek who has not died for eight years, and the manager of the independent thinking community

1. Could you please introduce yourself?

Hello everyone, I'm Lao Bai. Since entering the industry, I've experienced three bull and bear cycles, slowly growing from a typical retail investor. That's why I call myself "The Old Leek Who Rids the Wind and Waves." Since 2021, I've dedicated myself full-time to Web3, no longer relying on a traditional job. This period has also accumulating wealth and experience. I now have the freedom to manage my time, maintain a balance between family and career, and truly master the ability to consistently earn money in the industry.

2. Could you please tell us about your past experience?

I started out in tech product training, working at Fortune 500 companies, state-owned enterprises, and internet startups, reaching positions as training director and regional general manager. Back then, I never imagined I'd one day enter the Web3 industry.

I first heard about Bitcoin in 2013. A friend told me it was a computer code used for bookkeeping. At the time, I completely didn't understand it and had no interest. What really got me started researching Bitcoin was at the end of 2016, when a colleague at a foreign company told me that Bitcoin could be profitable and explained the decentralized nature of virtual currencies. After researching the concepts and underlying logic of Bitcoin, I was deeply drawn to it and officially entered the Web3 industry.

In 2018, my friends and I joined the EOS community. Back then, the community was quite strong, at the forefront of the industry in terms of both activity and innovation. However, the 2019 conference held by EOS's parent company, Block.one, in New York City was a huge blow. The initial hype was intense, and everyone was expecting the project to boost the price. However, the conference ended abruptly after only half an hour, completely dampening everyone's enthusiasm and leaving me with a 90% loss.

At the time, I invested my heart and soul in this ecosystem, only to discover that the project had abandoned the community. This setback completely sobered me up from my idealism and made me realize that the overall crypto environment was still quite challenging, requiring a more sober and rational analysis. Ultimately, I abandoned EOS entirely and turned to the secondary market, establishing an investment strategy centered around mainstream coins like BTC and ETH. My overall investment strategy has since stabilized, with a greater emphasis on accumulation and long-term investment. It can be said that the EOS community's critical impact shaped my current prudent investment mindset, and it remains my most unforgettable experience in Web3.

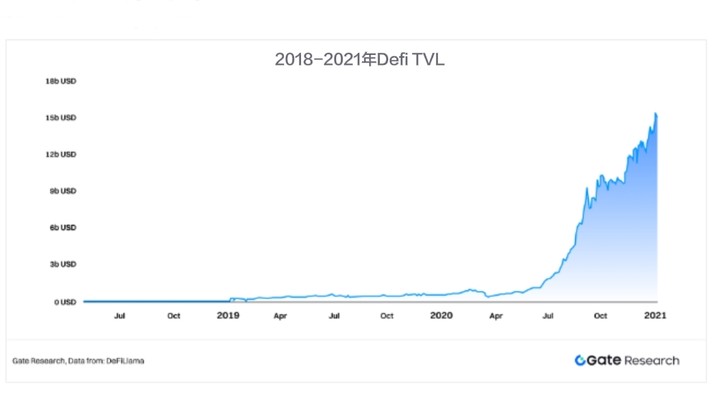

I benefited greatly from the 2021 DeFi Summer craze. My prior experience with blockchain enabled me to quickly understand projects and quickly catch up on hot topics like mining and airdrops. I participated in numerous projects, gaining a better understanding of the underlying nature of many projects and withdrawing calmly when I discovered they were in a bubble. This round of returns was primarily based on BTC and ETH, and I also participated in a number of DeFi Summer projects. The overall returns were substantial, which convinced me to quit my job in 2021 and pursue a full-time career in the Web3 industry.

I took a year off in 2022 and invested in some Web2 projects, but the pandemic didn't go as planned. At the beginning of 2023, with BTC and ETH prices around 20,000 and 1,200 U, I concluded the market had already experienced a year-long market correction, so I began gradually building positions. I also allocated a small portion of my funds to various hotspots, including staking, Layer 2, and inscriptions, which also yielded significant returns.

Core Content: I initially worked in tech training and was drawn to Web3 in 2016 by Bitcoin's decentralized logic. The most unforgettable moment was my 2018 investment in the EOS community, only to be abandoned by the project. The severe losses I experienced shook me from my idealism and fostered a more calm and prudent investment mindset. In 2021, I capitalized on staking and airdrop opportunities amid the DeFi boom, earning lucrative returns and transitioning full-time to Web3. In early 2023, I established low-priced positions in BTC and ETH, while also maintaining small positions in Layer 2, staking, and other hot topics for additional income.

3. Can you tell us about what you are doing?

I currently run my own Twitter and YouTube accounts. In my early on-chain experiences, I've gained valuable insights and insights as I go. By 2023 , both TikTok and AI were becoming increasingly popular. I felt that this kind of personal IP -based self-media was the future trend , and it would be a great opportunity to share my real-world trading experience. So, in 2023, I opened a Twitter account, using my real-world trading experience as a starting point to share my project progress.

After such a long period of experience, I feel I have a strong sense of the market, including actual market conditions and hot spots. For this reason, I created a YouTube account, mainly combining current affairs with secondary analysis at a more macro level. I have also hit some hot spots, such as predicting Trump's election in September 2024, and the sharp drop in the stock market in April this year due to Trump's tariff war.

Core content: I opened a Twitter account in 2023, using real-time trading as a starting point to share the project participation process, and gradually accumulated a keen sense of market rhythm and hot spots; then I opened a YouTube account to conduct secondary analysis from a more macro perspective combined with current affairs, and hit the hot spots many times.

4. Can you share with us the skills or areas in which you think you are particularly good?

First of all, I have a firm belief in the entire crypto industry, especially BTC. I always take BTC as the core and put the ultimate goal of investment on "earning more BTC".

Secondly, at the strategic level, I mainly grasp the macro cycle and make medium- and long-term allocations of large-position assets such as mainstream currencies such as BTC and ETH, while taking into account the continuous acquisition of short-term "critical" returns through participation in DeFi protocols, airdrops and MEME speculation.

Core content: My biggest advantage is that I focus on BTC and insist on long-term value investment, while taking into account strategic flexibility. I mainly grasp the macro cycle to make medium- and long-term allocations of mainstream currencies, and capture short-term gains through DeFi, airdrops and MEME.

5. Are there any sectors or tokens you’re optimistic about? Could you share your reasons for being optimistic?

I believe the essence of this bull market stems from policy-driven initiatives, particularly the US and Trump's demand for financial system upgrades. In other words, the upgrade of the US dollar system relies on the unique characteristics of cryptocurrencies. This is also the core reason why I believe the deep integration of Web3 and Web2 will be a major future trend.

From an investment perspective, I'm more focused on sectors with high certainty . First, major public chains like Bitcoin, Ethereum , and Solana have proven themselves time-tested and will continue to serve as the foundational foundation of the financial system. Second, the infrastructure built around these chains, including DeFi, oracles, decentralized exchanges (DEXs), lending protocols, and innovative tools, are essential building blocks for the gradual migration of traditional finance to blockchains. As this infrastructure matures, Web3 applications that truly integrate with Web2 will emerge, and products like RWA and payment systems will have significant opportunities.

Of course, in addition to these medium- to long-term investments, I also keep an eye on MEME sectors that are part of the original narrative. MEME booms are essential in every bull market. Their cycles are short, but the returns can be tenfold, a hundredfold, or even a thousandfold. The key is to have a keen sense of smell and maintain good discipline to reap relatively generous profits.

Core content: I am more optimistic about the large public chain ecosystem that has been tested by time and has high certainty, as well as Web3 applications that can be combined with Web2 and have greater room for growth. I will also pay attention to the MEME sector with native narratives, which has high returns but requires a keen sense of smell and good discipline.

6. How do you view investment? Do you have any investment methods you can share?

In my investment strategy, I have clear principles for position allocation . I allocate 80% of my funds to core assets like BTC and ETH. This large amount of capital is the guarantee of my long-term investment stability, and I rarely move it easily, only making adjustments every six months to a year at most. The early stages of a bull market are the best time to build a position. Of course, these mainstream coins are unlikely to only rise and not fall. When the price doubles, I will sell 50% to lock in the principal and wait for a significant drop before increasing my position. I adhere to the principle of "buy when the price drops, and don't buy when the price is stable" to ensure the stability of my large capital operations .

For early-stage projects, I use approximately 15% of my portfolio to participate in on-chain IPOs, crowdfunding, and mining for new projects. This type of investment requires strong research and in-depth understanding and judgment of the projects themselves, ensuring they possess long-term potential. While this carries a certain level of risk, it can also yield high returns if thorough research is performed.

Finally, I'll allocate 5% of my position to high-frequency, short-term trading and hot opportunities, such as fast-moving stocks like MEME. In these types of trading, no matter how high the price rises or how hot the market gets, I always adhere to the principle of "doubling my investment" to protect my principal first. However, when to sell all of my holdings depends on market sentiment, Twitter trends, social media discussions, and on-chain data. If signs of fatigue appear, sell at the top. For example, last year's AI MEME was very popular, and it remained hot from October to December. However, I find it difficult for a sector to maintain its popularity for more than a quarter, so January is definitely a crucial period to invest in.

Core Content: My overall investment strategy is primarily prudent, considering high-risk, high-return opportunities while ensuring the safety of principal. 80% of my funds are allocated to core assets such as BTC and ETH, adhering to the principle of buying when prices fall sharply and not buying when they remain low. 15% of my funds are invested in early-stage projects such as IPOs, crowdfunding, and mining, identifying high-potential targets through investment research. 5% is allocated to short-term and hot opportunities, such as MEME, adhering to the principle of "doubling my capital" and exiting the market based on market sentiment and data.

7. Do you have any questions you would like to share?

The most fundamental principle of my investment philosophy is stability . Many people hope to change their destiny through crypto, but I've always believed that stability is paramount. The longer you stay in this industry, the more you understand it and the more mature your mindset becomes. As long as you stay at the table, opportunities will always arise, and opportunities always come to those who are prepared.

Preparation means staying up-to-date on industry trends and developments, entering the market early or following suit at opportune moments. Over time, you'll gain a deeper understanding of market dynamics and operations, while also reaping long-term, stable returns. These gains come not just from investing, but from growing alongside the crypto market. This, I believe, is the most stable and effective way to profit.

Core content: My investment philosophy is to prioritize stability, continue to follow industry trends, and accompany market growth in the long term, so as to seize opportunities at the right time and achieve stable returns.

Web3 Profiles: Web3's first personal interview platform, it deeply explores the stories behind 100 industry KOLs, fund founders, entrepreneurs, and builders, focusing on their experiences in the cryptocurrency circle and their growth, and focusing on exploring their personal experiences, striving to make the personal experiences of the interviewees shine and show the most authentic personal growth stories.

Disclaimer: [Web3 Profile] disseminates content with a neutral attitude. This article does not constitute any investment advice and is for reference only.