Author: BUBBLE

In the past month, major projects have decided to launch their TGEs in September and October, as if by agreement. Led by STBL, 0G, and Aster, the wealth effects of new coins have been quite significant.

With the National Day holiday approaching, if you're not in the mood to watch the market, why not take some time to participate in new IPOs? BlockBeats has compiled a list of projects that have recently attracted much attention.

Momentum

Momentum is a decentralized exchange (DEX) invested by well-known VCs such as Sui, Coinbase, and Circle. On June 5 of this year, VCs such as OKX invested in strategic financing at a valuation of US$100 million.

Products include multi-signature fund management, token release and liquidity configuration. The team formerly worked on the multi-signature wallet MSafe (Momentum Safe). Because of its origin as a multi-signature wallet project, its products focus more on asset management security.

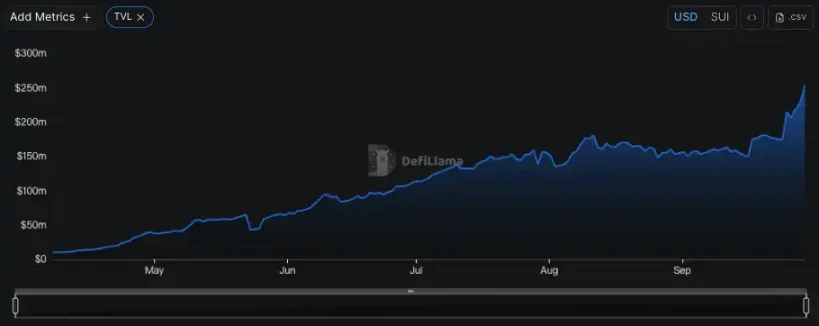

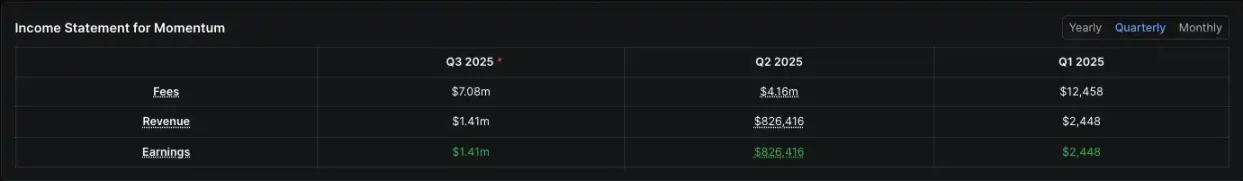

Since the testnet launch at the end of March, it has rapidly accumulated users and funds. Currently, the TVL has reached approximately $240 million, with cumulative trading volume exceeding $12 billion, over 1.7 million users, and 890,000 liquidity addresses. By Q3 of this year, transaction fees in a single quarter had exceeded $7 million.

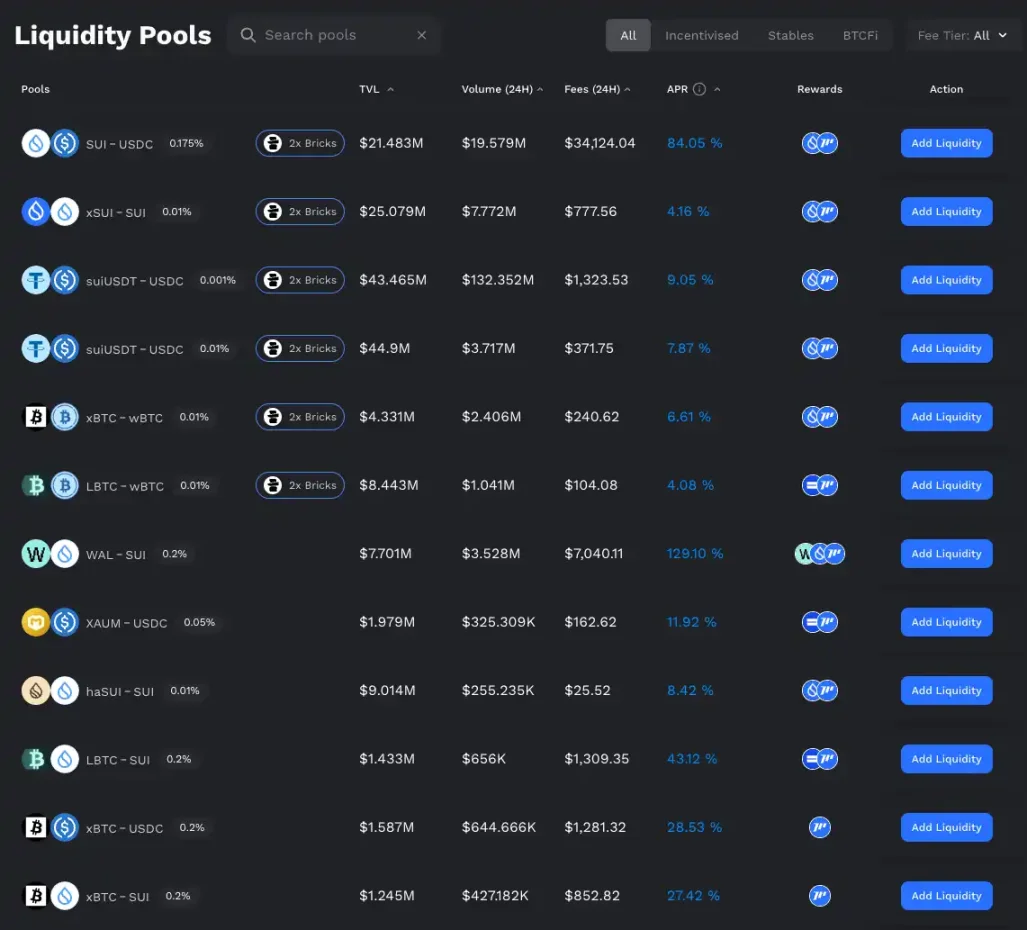

From September 26th to October 19th, Momentum teamed up with BuildingPad to launch the "HODL Yield Campaign", providing up to 155% annualized returns for liquidity pools such as SUI, stablecoins and Bitcoin. Participants can also receive double Bricks points rewards (pre-sale quotas and possible airdrop opportunities. The official statement is that current supporters will benefit first).

The process is not difficult to implement. Users only need to go to the Momentum HODL activity page on BuildingPad (the official Medium has detailed procedures), connect their wallet, and provide liquidity to the designated pool (such as SUI/USDC, xBTC/wBTC, etc.).

During the event, profits will be calculated proportionally. Users can inject funds into the pool using SUI or USD stablecoins. The system will automatically settle and distribute MMT and Bricks rewards after the event ends.

Yield Basis

Yield Basis is a Bitcoin-native yield protocol launched by Curve founder Michael Egorov. At the beginning of the year, it received $5 million in financing at a valuation of $50 million.

Yield Basis utilizes an automatic re-leveraging mechanism to generate transaction fee income for BTC liquidity providers while simultaneously mitigating the impermanent loss caused by AMM curvature risk. LPs can choose to receive BTC-denominated transaction fees directly or forgo them in exchange for YB token incentives. Locked veYB can participate in governance and share in protocol fees.

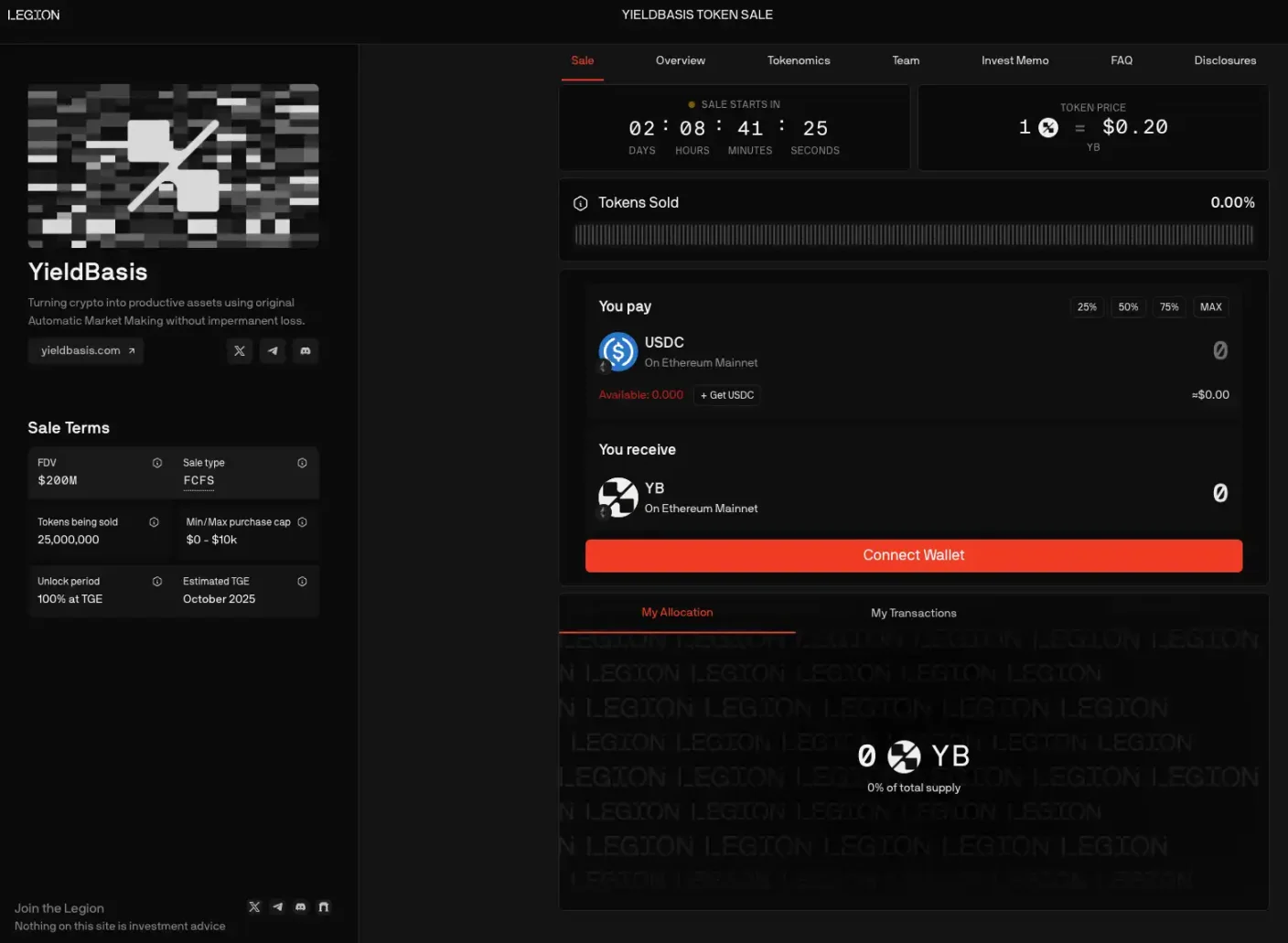

After a one-day delay, Kraken announced that it has partnered with Legion to select Yield Basis as the first project for its LaunchPad. Legion's "Legion Score" system allocates quotas based on on-chain behavior, social media activity, and developer contributions. This allows projects to screen out a significant number of multiple participants, ensuring that true builders and core users receive priority subscription shares. Coupled with Karken's access to an exchange, the market is highly interested in this collaboration.

The current pre-sale model is divided into two phases. First, 20% of the tokens are reserved for subscription by Legion high-scoring users (pre-deposits are currently open, and the project party will determine the amount based on your Legion score), and the remaining 80% are sold publicly on Kraken and Legion in an FCFS mode. $YB will be directly listed on Kraken after the sale ends.

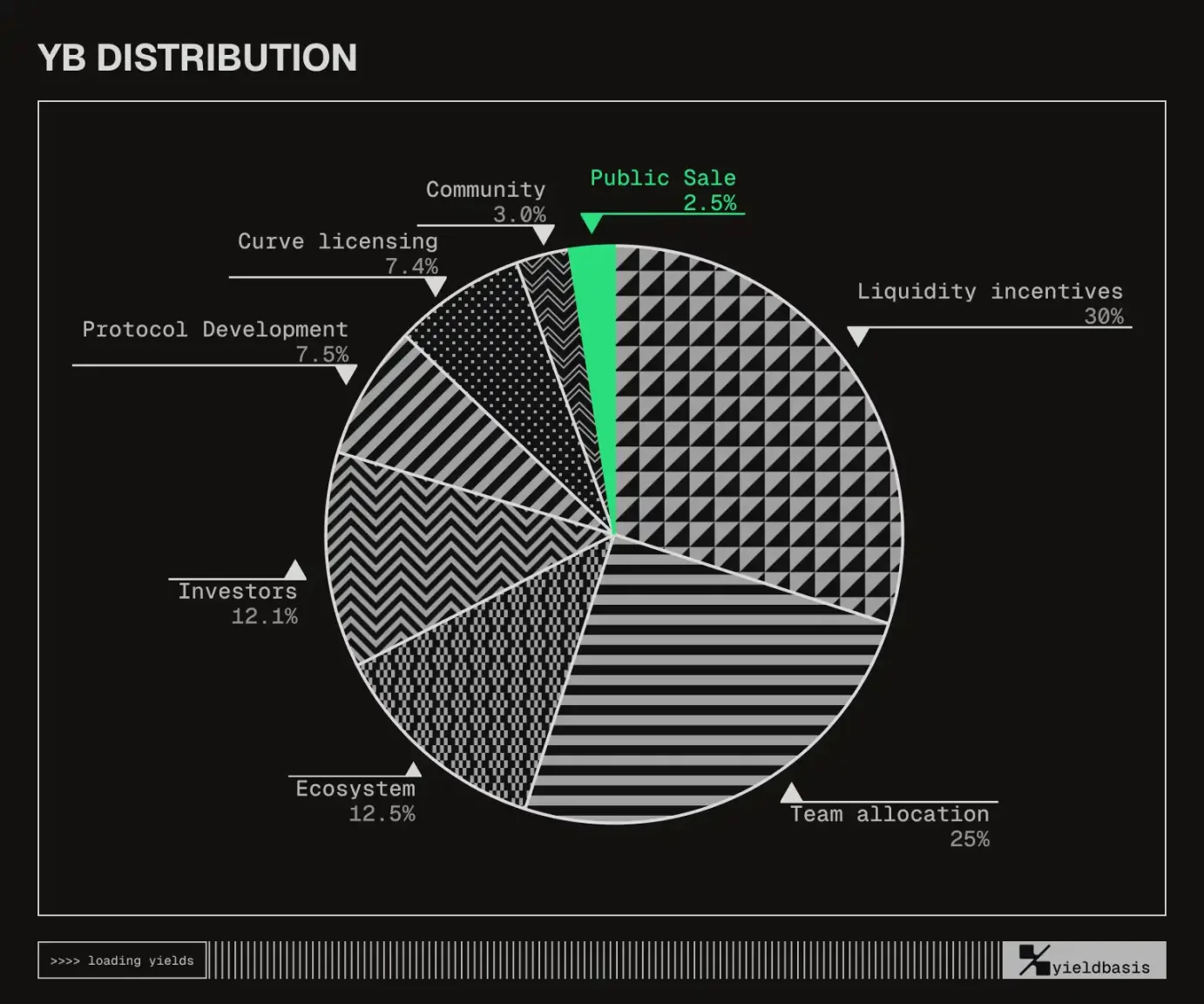

The total supply of 1 billion tokens is 2.5% (approximately 25 million tokens) of which the community sale is priced at a fixed price of $0.20, with a maximum purchase limit of $10,000 per user. Tokens will be distributed in a proportional manner: 30% for liquidity mining incentives, 25% for the team, 12.5% for ecosystem reserves, and 12.1% for investors. An additional 7.5% will be allocated to Curve protocol licensing fees, 7.4% will be reserved for developers, and 3% will be used for Curve governance incentives.

It's worth noting that Curve DAO has voted to issue accelerated funding for YB in crvUSD, which will be used to increase liquidity in the Bitcoin pool. While its initial funding valuation at the beginning of the year was only $50 million, support from the Curve community, Egorov's influence, and sentiment premiums from Kraken and Legion enabled YB to enter pre-sale at a valuation of $200 million, significantly higher than its previous internal funding valuation.

Canton Network

Canton Network is a public blockchain developed by Digital Asset for the institutional financial market, emphasizing privacy protection and synchronized clearing across multiple institutions. Since 2016, Digital Asset has raised nearly $400 million in eight rounds of funding, with traditional financial institutions such as Goldman Sachs, IBM, and JPMorgan Chase leading the investment. Its most recent Series E funding round, held on June 24th, attracted investment from crypto-native VCs such as Yzi Labs, Paxos, Polychain, and Circle.

We're navigating the increasingly intertwined landscape of TradeFi and blockchain. Many top financial institutions, including Goldman Sachs, Citigroup, JPMorgan Chase, HSBC, and BNP Paribas, have already begun testing and implementing this technology. Some real-world use cases have already been implemented, including the issuance of a €100 million digital native bond for the European Investment Bank (EIB) in November 2024 and the completion of tokenization trials with Euroclear and the World Gold Council in October 2024, involving assets including UK gilts, Eurobonds, and gold.

To further promote interoperability among applications within the Canton ecosystem, Canton has launched its native token, "Canton Coin" ($CC), as a payment and incentive tool to cover global synchronization service fees. Canton Coin can be issued by participants providing computing power or services to the network, rewarding application builders, users, and infrastructure providers.

Previously, the total supply of $CC was mined solely through node mining, capped at 100 billion in the first 10 years, followed by 2.5 billion annually thereafter. Currently, 28.48 billion have been mined. The distribution model, which initially provided 80% to super validators, will gradually decrease over time and as the network stabilizes, to just 5% after 10 years. Similarly, the share held by application providers and other ordinary validators will increase. Consequently, the liquidity of $CC in the secondary market is quite weak.

Canton Network has partnered with Temple in the ecosystem to launch a trading platform that allows users to buy, sell, and manage Canton Coin for the first time after completing KYC. However, it is still unknown how and whether retail investors can participate, and we need to wait for further announcements.

Currently, we can participate in the Canton Wallet airdrop, launched on September 28th by SEND, a wallet project within the Canton Network ecosystem. Officials have stated that for testing purposes, Canton Wallet will allocate a $CC quota to participating users (after completing a Google form verification). The specific process involves purchasing a SENDTAG, holding 7,000 $SEND, and staking 20u into the treasury. This may be the most convenient way for ordinary people to participate, but Canton Wallet will only airdrop 30% of its $CC earnings to users, which may not offer significant profit margins.