Author: 0xJeff

Compiled by Tim, PANews

Since our first article on mainstream AI trends in May, a lot has changed in the market:

- Market sentiment and the number of fair launch AI agent tokens both fell

- Narrative Shift

- Ecosystem participants are replaced by new ones

- The value proposition of the Web3 AI ecosystem is becoming clearer

- Institutions and whales face more AI investment opportunities

- Shift to real products and applications, not hype

- other

In this article, we will review and analyze the dynamics of the past few months, analyze current trends, sort out market leaders, judge the direction of industry development, and explore how to best position yourself for future trends.

Let's begin.

Life has been tough in the on-chain trenches since the beginning of this year.

First: We have too many tokens, spreading liquidity and attention thinly.

Second: There are too many people and AI-generated garbage on crypto Twitter, which distracts people from the quality content.

Third: The pullback is not as strong as before and will continue to fall

Fourth: The game version iteration is very fast. If you don’t pay attention at all times or have the correct information channels, it will be difficult to keep up with the pace.

Looking back at the first and second quarters, popular projects such as the Trump family Meme Coin, celebrity coins, ICM, creator coins, and Pump ICO attracted most of the market's active liquidity, leaving very little funds for the AI sector.

AI Agent Ecosystem: From Hype to Product Implementation

Because of this, good opportunities have become extremely scarce. Virtuals, the leading AI agent project with the largest number of developers, has become a highly anticipated ecosystem. Genesis's initial launch projects have performed quite well, with occasional popular projects achieving returns of 5-20x.

However, this situation only lasted for 1-2 months because, ultimately, the focus of this ecosystem is to hype up new projects. When there are no exciting new projects launched, the attention and hype will fade and the "points" will become worthless.

This change in sentiment has prompted investors and speculators to become more selective, focusing on product substance rather than market hype.

Two major AI agent trends are emerging:

1. Investors shifted their focus from Virtuals Genesis startups to selectively investing in high-quality Virtuals agency teams.

Some teams launched their tokens earlier but faced significant selling pressure and are now about to launch new major products or features.

There are also new teams launching more complete products on Virtuals. Instead of building a minimum viable product in two or three months, they launch the product immediately after the token issuance.

These include (but are not limited to) the following teams:

- ArAIstotle: AI fact-checking platform

- PredictBase: Decentralized Prediction Market

- Mamo: Personal Financial Assistant (developed by the Moonwell team)

- Billy Bets: Sports prediction agent, engine, and aggregation platform

- Backroom: An AI-Powered SocialFi App

The trend is likely to continue, that is, high-quality projects will still be scarce, but if you pay close attention to the dynamics of potential AI Agent teams on Virtuals, the probability of capturing the next 10-50 times return project will increase significantly.

2. Investors shift their focus from virtuals to other AI agent ecosystems with greater potential

CreatorBid has successfully won mindshare and investor favor with its high-quality listing strategy and the launch of AI products with clear practicality and real use cases through the Bittensor subnet.

Additionally, the team is focused on supporting existing teams through product, partnerships, and marketing, helping CreatorBid establish itself at the forefront of the AI agency ecosystem.

Players refer to Holoworld's launch platform as HoloDraw. Users can participate in the HoloDraw lottery by purchasing tickets (each ticket represents 0.5 SOL purchasing power on the bonding curve). 35% of the token supply is reserved for the HoloDraw lottery. If a user doesn't win a prize, they can participate in a secondary lottery for a consolation prize pool (5% of the supply). HOLO was successfully listed on the Upbit exchange at a fully diluted valuation of $1.5 billion, sparking enthusiastic community enthusiasm.

Other projects, such as OpenServ, are focusing on incubating their teams, aiming to launch products, attract users, and generate revenue before issuing tokens when the time is right. Meanwhile, OpenServ continues to develop its decentralized n8n product for consumers.

Next up: Top brokerage projects on Coinbase will continue to search for product-market fit in the prediction space, while Coinbase continues to focus on enhancing the value of BIDs (which is their current pain point).

Other ecosystems continue to take a product-first approach and their tokens may suffer, but once they launch a flagship use case, product, or team, token valuations are bound to rise.

Key ecosystems to watch: CreatorBid, OpenServ, Holoworld, Arc, Loomlay, ElizaOS

Beyond AI agents, capital is concentrated in a handful of narratives and verticals:

Decentralized AI: From Raw Intelligence to Intelligent Productization

DeAI remains the most favored sector by whales and institutional investors.

Decentralized computing remains the highest-grossing segment, with Aethir generating eight-figure annual revenue and Chutes processing 50-100 billion tokens daily through its open routing platform.

Privacy-preserving AI technology based on federated learning is rapidly gaining adoption. Flock is partnering with Web2 businesses and government agencies to build privacy-preserving AI solutions for vertical sectors, achieving both product-market fit and token-market fit. Recent collaborations include the United Nations Development Programme, the Hong Kong government's official AI service provider, and CIMG.

The Darwinian AI ecosystem is rapidly developing. Bittensor has expanded to 128 subnets, and Sentient has launched GRID, the world's largest collaborative intelligent network, and is building a Darwinian AI ecosystem using an "artifact" subnet architecture.

Projects such as FractionAI apply Darwinian AI to the gaming field, allowing users to deploy AI agents to compete in various scenarios, including Polymarket predictions, intelligent agent battles, tic-tac-toe, football, and more.

Prediction AI is nearing industrialization. Multiple Bittensor subnetworks demonstrate that large-scale decentralized intelligence creation can significantly improve model performance: the SN18 Zeus network, the SN44 scoring network, and the SN50 synthetic network all surpassed benchmarks and state-of-the-art models. SN44, in particular, monetized its signals using the Sire sports betting strategy (a top sports hedge fund deployed $300 million using its strategy).

One of the newest areas in DeAI is data, which mainly includes data annotation, human feedback reinforcement learning (RLHF) data services and evaluation (yes, this is the first and second area with the highest funding and adoption value in Web2).

Data labeling and reinforcement learning with human feedback (RLHF) are labor-intensive tasks. Web3 allows participants from any region to participate in labeling, annotation, rating, and feedback through token incentives, thereby reducing related costs.

Key players in this space include: SapienAI, FractionAI, PerleAI, PublicAI, SN52 Dojo, and Synesis One.

DeFi x AI (DeFAI): From Proof of Concept to Fully Autonomous Financial Agents

DeFAI's development journey: from the abstraction layer and the failed GPT-like interactive interface in the first quarter, to the realization of the personalized agent proof-of-concept to assist users in managing funds in the second quarter, and then to the full launch of a fully autonomous financial agent system in the third quarter, and the construction of a highly scalable and verifiable infrastructure.

With rapid technological advancements, projects like Giza are leading the way. Giza has achieved nearly $2 billion in agent trading volume and manages $20 million in agent assets around the clock.

The newly launched Swarm Finance + Pulse (Pendle Agent) marks the beginning of a new era of agents optimizing idle funds for users.

Almanak followed closely behind, using a highly scalable and verifiable infrastructure, and built a system architecture using agent groups and smart contracts (asynchronous tokenized vaults) so that AI does not directly manage user funds.

This fully protects investors from illusions, AI hackers, and vulnerability exploits, creating an environment where institutions and whales can safely deposit large amounts of funds. Almanak's quantitative creation platform also allows anyone to launch a quantitative strategy in minutes, rather than weeks.

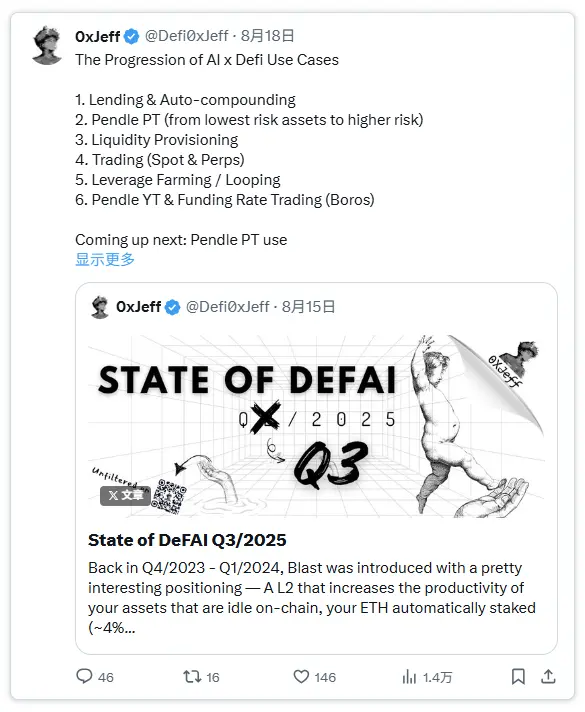

Progress on DeFAI use cases:

Key players to watch: Giza, Almanak, Cod3x, Theoriq

How will it develop next?

Prediction AI is one of the areas with the best asymmetric betting opportunities. The total addressable market (TAM) of prediction markets far exceeds that of Web3. For example, users from all walks of life log in to platforms such as Polymarket and Kalshi to make predictions on topics of their interest.

AI and tools built on prediction markets will be able to capture significant value from this sector's growth. In particular, consumer applications with user funnels and alternative prediction markets and brokers will stand out. Liquidity remains the biggest hurdle, but the emergence of AI market makers and treasury products is likely to help improve liquidity across various markets.

Data will be a key focus in the fourth quarter of this year. As "useful" data becomes increasingly scarce, Web3 data service providers will face stronger demand from Web2 and Web3 AI labs. Data is both the biggest moat and the biggest bottleneck.

AI agents and their ecosystem will continue to attract interest from both on-chain players and the crypto Twitter community due to their simplicity and fair launch. High-return opportunities will become increasingly scarce, but exceptional projects that stand out could still achieve 10-50x growth (though liquidity for these projects will remain quite thin, so proceed with caution).

DeFAI will develop to a stage where top players will become the key drivers of the massive TVL and trading volume of top DeFi protocols (AAVE, Pendle, Fluid, Uniswap, Aerodrome, etc.), covering more DeFi application scenarios, enabling more complex strategies, providing better execution capabilities, and building safer risk guardrails and infrastructure.

Conclusion

The cruelty of the battlefield will continue, a large number of tokens will die, attention will be dispersed, and some people will leave.

However, in this chaos, the foundation for the next wave of Web3 AI is being laid.

The next wave will be led by those who:

- Solve practical problems

- Attract highly sticky users

- Build products that withstand narrative shifts

Ironically, the biggest winners will initially seem mundane (boring infrastructure, privacy, data) until they suddenly aren’t.