By Prathik Desai

Compiled by: Block unicorn

Britney Spears blasted from every radio station, The Matrix made us question reality, and teenagers around the world were busy burning CDs to create their own mixtapes. The internet was still clunky, requiring a jarring dial-up tone to access, but it was beginning to permeate everyday life. It was the late 1990s.

Search engines existed, but they looked and felt cluttered. Yahoo's directory resembled a phone book, while AltaVista and Lycos spit out long lists of links, quickly but disorganized. Finding the information you needed was often a daunting task.

Then a white screen appeared with a clean search box and two buttons—"Google Search" and "I'm Feeling Lucky." People tried it once and never left.

That was Google's first "magic trick." The result? Larry Page and Sergey Brin's creation made the word "Google" synonymous with the act of searching. When you forget some physics theory, you say, "Google it!" "Want to learn how to tie a perfect tie? Why not Google it?"

Suddenly, searching for facts, finding businesses, and even learning to program became automatic.

The company then repeated this strategy with Gmail, Android, and its cloud services. Each time, it took something chaotic and made it simple and reliable to the point of being boring.

In every category it now dominates, Google wasn't the first to enter, but quickly became the leader. Gmail wasn't the first email service, but it offered gigabytes of storage when competitors were still limiting it to megabytes. Android wasn't the first mobile operating system, but it became a mainstay of budget smartphones worldwide. Those who rejected it, in turn, were forgotten by the world. Remember Nokia?

The cloud wasn’t the first hosting solution, but it offered the reliability that startups and banks were willing to bet on.

In each category, Google has transformed a patchwork of primitive technologies into default infrastructure.

That was the past three decades. Today, Google is doing something contradictory.

It is preparing to build on an innovation once envisioned to displace these tech giants: blockchain. With its native blockchain layer, the tech giant is trying to replicate in the value world what it has achieved decades ago in the information world.

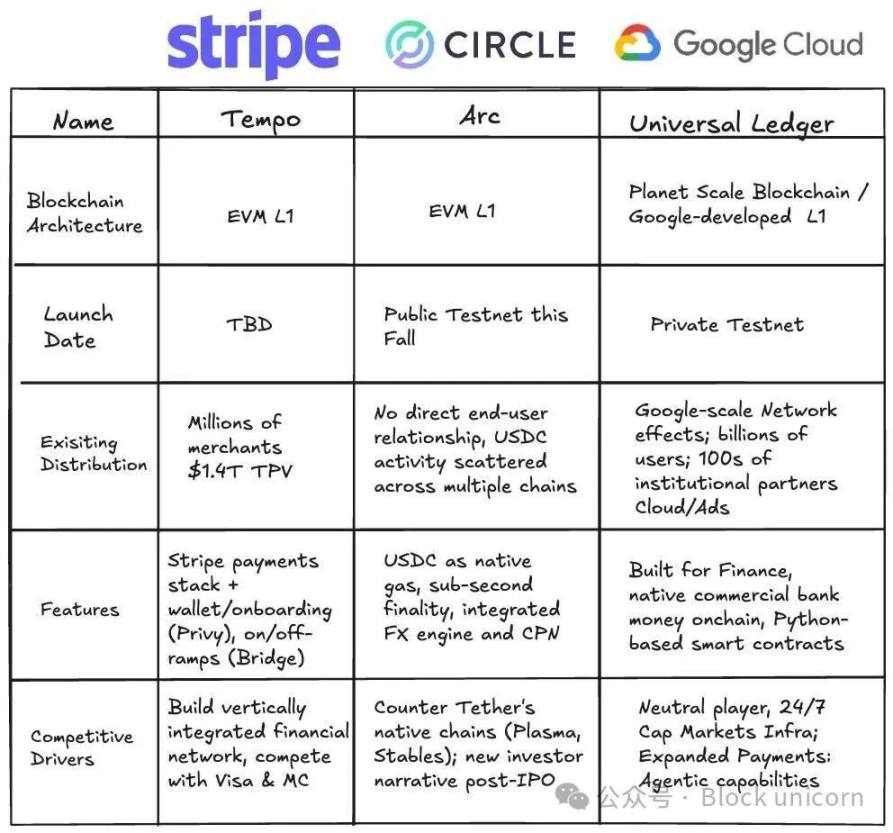

With Google Cloud Universal Ledger, the company hopes to provide financial institutions with an internal layer blockchain that is "efficient, trust-neutral, and supports Python-based smart contracts."

Leading global derivatives markets like CME Group are already using the chain to explore tokenization and payments, said Rich Widmann, head of Web3 strategy at Google.

Why build an in-house blockchain now?

Because the funding pipeline needs to be fixed.

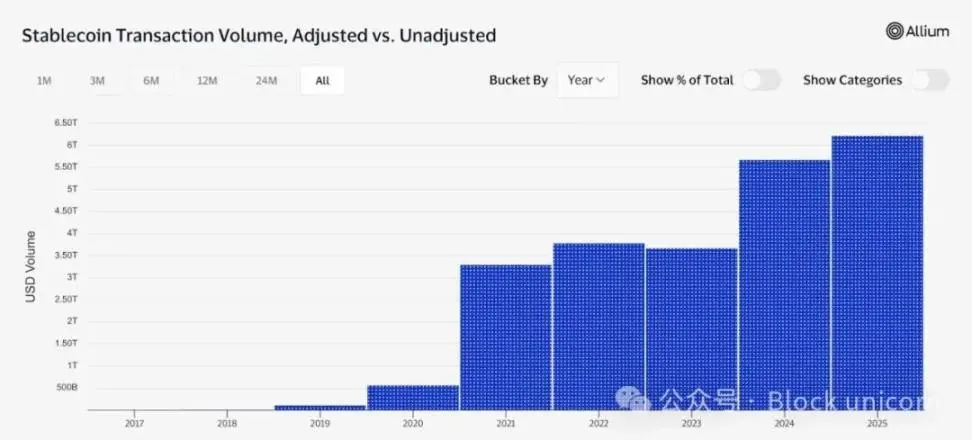

In 2024, the adjusted transaction volume of stablecoins exceeded $5 trillion, surpassing PayPal's $1.68 trillion annual transaction volume and second only to Visa's annual payment volume ($13.2 trillion).

However, cross-border payments still take days to settle, cost double-digit percentages, and rely on outdated systems. According to The Economist, if nothing changes, settlement inefficiencies are expected to cost $2.8 trillion annually by 2030.

Google wants to start with stablecoins, but its goals are much bigger. “Stablecoins are just the starting point. The real opportunity lies in tokenizing a wider range of real-world assets and building programmable financial applications on open infrastructure,” Google wrote in its blog post.

Who will use it?

The ledger is permissioned. All participants must pass Know Your Customer (KYC) verification. Smart contracts run in Python, a language already familiar to financial engineers. Access is via an API integrated into Google Cloud's existing services.

The industry is skeptical of its “neutral infrastructure” label. I’m not surprised when a tech giant that built its empire on centralized control of data now claims to offer a “neutral blockchain.”

What sets Google apart besides its scale? Wellman believes Google will become the platform upon which other financial companies will build. "Tether won't use Circle's blockchain, and Adyen probably won't use Stripe's. But any financial institution can work with GCUL."

Stripe’s Tempo naturally gravitates towards Stripe merchants. Circle’s Arc is built around USDC. Google’s selling point is that it has no competing payments or stablecoin businesses, so it can reliably offer a solution that other companies might adopt.

Google is also not the first in this category. Other corporate giants have built their own blockchains in the past.

Meta (formerly Facebook)'s Libra, later renamed Diem, promised a global stablecoin but never launched. Regulators blocked it, warning it could undermine monetary sovereignty. By January 2022, the project's assets were sold.

R3’s Corda and IBM’s Hyperledger Fabric built reliable platforms but struggled to scale beyond limited consortia. Both were permissioned blockchains that offered value to their sponsors but failed to steer the industry toward a shared path, ultimately resulting in fragmented operations.

The lesson is that if everyone believes one company controls the protocol, the web will fail. This is also the shadow hanging over Google.

But GCUL's first partner, CME Group, offers a clue to the direction. If Universal Ledger can handle the daily capital flows of the world's largest derivatives exchange, its appeal at scale will justify wider adoption. This also addresses the debate surrounding decentralization.

Google Cloud's customers already include banks, fintech companies, and exchanges. For them, connecting to the Universal Ledger via API may feel like adding another service rather than switching platforms. Google also has the resources to sustain projects abandoned by smaller consortiums due to budget constraints. Therefore, for institutions already embedded in Google's technology stack, adopting GCUL may be smoother than starting over elsewhere.

For retail investors, the impact will be more subtle: you won’t be logged into the Universal Ledger app, but you’ll still feel its presence.

Think of refunds that take days to arrive, stuck international transfers, and the delays that have become normalized. If the Universal Ledger succeeds, these problems could quietly disappear.

You can also expect this to expand into everyday products. Imagine being able to skip YouTube ads for just a few cents, without having to subscribe to YouTube Premium every month; getting additional Gemini queries for just a few cents; or paying for cloud storage for live streaming. The ad-subsidized internet could quietly shift to a pay-per-view model, giving users more choices rather than just one default.

For the first time, users may have the choice of exchanging their attention for services or paying a few cents. Businesses can experiment with previously unfeasible microtransactions, from streaming payments for cloud storage to providing premium search results on demand. If the GCUL model succeeds, Google's empire could shift from near-total reliance on advertising (which accounts for over 75% of its total revenue) to a more flexible, transaction-driven model.

The debate between decentralization and centralization will continue.

I don’t think developers will choose to build permissionless applications on GCUL. No one will build a yield farm or issue a memecoin on Google’s platform.

Institutions already using Google Cloud and other enterprise tools are likely to be the primary adopters of GCUL. The goals are clear and practical: to move value over the internet with lower friction, reduce the hassle of reconciliation, and provide a trusted payment rail for banks and payment companies.

As a retail user, I don't remember when I switched to Gmail. It simply became synonymous with email, just like Google became synonymous with web search. I didn't even know Google owned Android when I bought my first Android phone.

If the Universal Ledger becomes seamless infrastructure, you won’t care about decentralization. It’s just something that works.

But this does not eliminate risks.

Google is no stranger to antitrust scrutiny. US courts have previously ruled that the tech giant maintains a monopoly in search and advertising. Building financial rails will only intensify regulatory scrutiny. Libra's collapse demonstrates how quickly a project can unravel if central banks perceive their sovereignty as threatened.

Currently, Google's UCL is still on the testnet. The Chicago Mercantile Exchange (CME) has already joined, and other partners are actively pursuing it. Google plans to launch a wider rollout in 2026. But I believe this ambition is well-deserved.

Google is betting it can turn the flow of money into an infrastructure as boring, reliable, and invisible as typing words into a search box.

The story begins with a blank page and a search box. Its next chapter may be a ledger that no one sees but everyone uses.