Written by: Umbrella

Recently, two traders in the Korean crypto market have become the focus of discussion in the crypto circle due to their amazing performance.

A trader with the online name Namseokhee bet on altcoins with high-leverage contracts on Binance, increasing the number of long positions from 75 to 105 in two weeks, with returns soaring from 134 times to 1,400 times, while his initial margin was less than $3,000.

Image source: @_FORAB

Another trader, Ohtanishohei (Otani Xiping), is a staunch E-guard who has continuously increased his long positions in ETH contracts over the past two weeks, with his profits increasing from $1.57 million to a maximum of $3.37 million.

Their outstanding performance not only ignited the enthusiasm of Korean investors, but also attracted the attention of the world to Korea's vibrant market.

Over the past six months, the Korean market has been increasingly mentioned in the crypto space, and its rise is no accident. In 2024, the top five cryptocurrency exchanges in South Korea had over $74.8 billion in funds under management, with $73 billion in assets under management. Their average daily trading volume exceeded that of South Korea's two largest stock exchanges.

Upbit, South Korea's largest cryptocurrency exchange, saw its daily trading volume surpass $10.2 billion, a 94.5% year-over-year increase. More notably, the Korean won accounts for 37% of global fiat-to-cryptocurrency trading, second only to the US dollar.

These figures all indicate that South Korea is not only a hub for crypto trading in Asia, but also occupies an increasingly important market position in the global market.

Betting on counterfeit coins, everyone is speculating on cryptocurrencies

When it comes to South Korea, many crypto investors may have a bad first impression. In 2022, the Terra project founded by Korean trader DoKwon once had a market value of 40 billion US dollars, but it instantly dropped to zero due to the out-of-control of the algorithmic stablecoin. Korean investors lost more than 6 billion US dollars, and BTC was affected and continued to fall from 40,000 US dollars in early May to 17,000 US dollars within two months.

This incident caused a 30% drop in trading volume on South Korea's two largest cryptocurrency exchanges, Upbit and Bithumb, and the Korean won's share of global cryptocurrency trading fell from 40% to 25%. Along with this, South Korea's position in the cryptocurrency market also declined.

In the second half of 2024, the prices of many altcoins soared after they were listed on Korean exchanges. This phenomenon has continued to this day. A few days ago, CYBER was listed on the Korean exchange Upbbit. Its price soared by more than 130% in a single day, and its trading volume surged by 500%. Its market value once exceeded US$170 million.

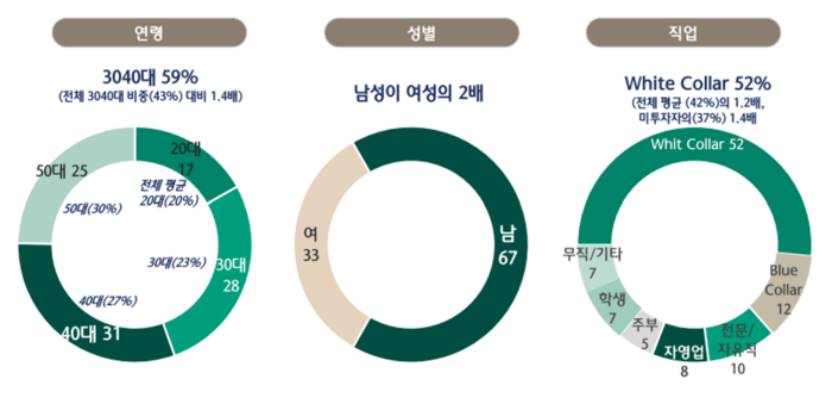

This data reflects that the enthusiasm of Korean crypto investors may be far beyond our imagination, which can also be confirmed from the data composition of Korean crypto investors.

According to the latest "Virtual Asset Investment Trend Report for the 20-50 Generation" released by the Hana Financial Research Institute, among 1,000 financial investors aged 20-50, 27% hold cryptocurrencies, accounting for 14% of their total financial assets, and as many as 70% of the respondents expressed their willingness to invest in cryptocurrencies in the future.

South Koreans are crazy about cryptocurrencies. According to data from the Bank of Korea in 2024, as of November 2024, 30% of South Korean residents have opened cryptocurrency exchange accounts, and two out of every ten government officials hold cryptocurrencies.

Behind the phenomenon of "everyone speculating in cryptocurrency" in South Korea is the current social background of South Korea and the government's changing attitude towards encryption.

Young people in South Korea are currently facing unprecedented social pressure.

According to data released by Statistics Korea, the youth unemployment rate in South Korea reached 5.5% in July 2025. South Korean youth are generally pessimistic about the economic outlook, and with upward mobility almost completely blocked, countless young people see cryptocurrency as their only chance to achieve class advancement.

This also explains why Korean crypto traders' trading strategies generally tend to be high-leverage trading. In popular Korean film and television cultural works, some classic lines are also a projection of this social phenomenon.

Image source: Korean popular TV series "Squid Game 2"

In terms of the South Korean government’s attitude towards the crypto market, the biggest good news for South Korean traders in recent times is Lee Jae-myung’s election as president of South Korea.

Lee Jae-myung is not only a winner in politics, but also one of the most staunch advocates of South Korea's crypto policy. In his "Commitment to the Korean Crypto Industry", he pointed out that he will promote the legalization of virtual asset spot ETFs and guide the large-scale Korean National Pension Fund to allocate crypto assets and build a Korean won stablecoin.

The attitudes behind these news all point to a common result: South Korea is making a "comeback" in the crypto market, and this time the storm may be more severe than ever before.

Tom Lee, the new Do Kwon of Korea?

The resurgence of the Korean crypto market is not only reflected in policy statements, but also in actual purchases by Korean investors. The following targets are often included in the "self-selected" list of Korean investors:

ETH

In the Korean crypto market, the crypto gold here is not BTC but ETH.

According to data from Upbit and Bithumb, two major South Korean cryptocurrency exchanges, ETH/KRW trading pairs led the way in trading volume over the past 24 hours, accounting for 18.06% and 12.1% of the total, respectively, with a total trading volume exceeding $1.26 billion. Upbit alone handled a staggering $111.1 billion in ETH trading volume in July.

This is inseparable from the fact that Tom Lee, chairman of the board of BitMine, the institution with the largest ETH holdings and a Korean-American, continues to call orders, injecting confidence into Korean crypto traders.

Combined with national sentiment, media hype, and the cryptocurrency label, Tom Lee is now considered by Korean crypto traders to be a figure comparable to LUNA founder DoKwon. Even legendary trader Eugene has mentioned Tom Lee in the community.

Image source: @_FORAB

BMNR

In addition to ETH, TomLee’s importance in the minds of Korean traders is also reflected in BMNR, the stock of ETH microstrategy company BitMine.

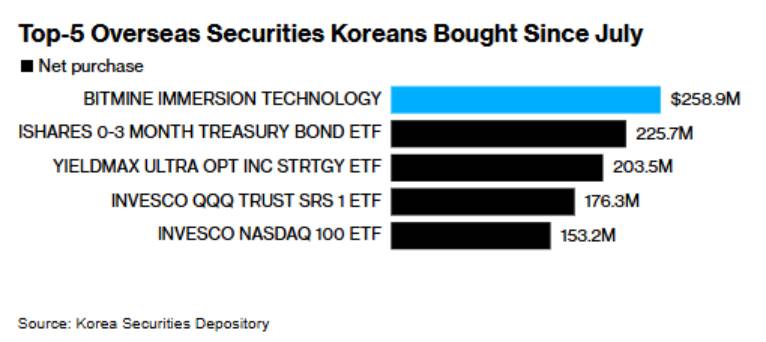

As of August 15th, BitMine held over 1.2 million ETH, valued at $5.3 billion, more than double the holdings of the second-place SharpLink. According to data from the Korea Securities Depository and Clearing Corporation, South Korean retail investors have accumulated a net purchase of over $259 million in BMNR since July, making it the most popular foreign security during that period.

In the eyes of countless Korean traders, BitMine has become a manipulator controlling the rise of ETH, while the US-listed BMNR has become a leveraged ETH. Compared to ETH, BMNR has seen a maximum increase of 66% since July 1st, which better aligns with the high-risk preferences of Korean crypto traders.

XRP

In addition to ETH, XRP is also a favorite target for Korean crypto investors. In the past 24 hours, the total trading volume of XRP on Upbit and Bithumb reached US$1.13 billion, which is only US$100 million less than ETH.

On May 26, the XRP-Korean won trading pair surpassed BTC and ETH to top the Korean won market. What's even crazier is that the price of XRP on Upbit rose to US$265 million at that time, exceeding the international market price by 3%.

Meanwhile, South Korea's largest cryptocurrency exchange, Upbit, holds over 5.9 billion XRP in reserves, nearly double that of Binance. Behind this frenzy, the SEC's withdrawal of XRP's securitization charges and its potential for cross-border payments are attracting South Korean investors. The Korean won's stablecoin policy is further driving demand, and retail investors are generally optimistic about XRP's future potential.

Return to the encryption stage

Driven by popular assets like ETH, BMNR, and XRP, South Korea's crypto market is returning to the crypto scene at an astonishing pace. From retail investors to institutions, from policy to culture, South Koreans appear to have embraced cryptocurrencies as a new engine of national development. However, this widespread enthusiasm for cryptocurrency and its highly leveraged trading strategies are not without their hidden dangers.

Just yesterday, August 14th, the crypto market plummeted after the release of US PPI data. Namseokhee, who had previously bet heavily on a unilateral upward trend, saw his positions turn from profitable to unprofitable, even experiencing his largest loss ever. While such extreme trading strategies are not recommended, the enthusiasm of South Korean crypto traders cannot be ignored.

Image source: @_FORAB

In short, the South Korean crypto market is making a strong comeback from Terra's shadow, becoming a force that global investors must pay attention to. In the near future, with the popularization of the Korean won stablecoin and the further implementation of pro-crypto policies, we are likely to see South Korea become the "crypto capital of Asia."