Text: Sleepy.txt

Bridge, the stablecoin issuance platform under Stripe, one of the world's largest online payment infrastructures, has launched the native stablecoin MetaMask USD (mUSD) for MetaMask, a wallet application with more than 30 million crypto users.

Bridge is responsible for the entire issuance process from reserve custody, compliance audits to smart contract deployment, while MetaMask focuses on polishing the front-end product interface and user experience.

This cooperation model is one of the most representative trends in the current stablecoin industry. More and more brands are beginning to choose to outsource the complex issuance process of stablecoins to professional "OEM factories", just like Apple outsources the production of iPhones to Foxconn.

Since the iPhone's inception, Foxconn has almost always been responsible for core production. Today, approximately 80% of the world's iPhones are assembled in China, with over 70% of these produced in Foxconn factories. At one point, Foxconn Zhengzhou employed over 300,000 workers during peak season, earning it the nickname "iPhone City."

The cooperation between Apple and Foxconn is not a simple outsourcing relationship, but a typical case of division of labor in modern manufacturing.

Apple focuses its resources on user-centric aspects, such as design, system experience, brand narrative, and sales channels. Manufacturing does not provide a differentiating advantage for the company, but rather involves significant capital expenditure and risk. Consequently, Apple has never owned its own factories, instead outsourcing production to specialized partners.

Foxconn has built core capabilities in these "non-core" areas. They build production lines from scratch, manage raw material sourcing, process flow, inventory turnover, and shipping cadence, and continuously reduce manufacturing costs. They have established a comprehensive set of industrial processes for supply chain stability, delivery reliability, and production capacity flexibility. For brand clients, this means the foundation for frictionless expansion.

The logic behind this model is division of labor and collaboration. Apple doesn't have to bear the fixed burden of factories and workers, and it can also avoid manufacturing risks during market fluctuations. Foxconn, on the other hand, leverages economies of scale and multi-brand capacity utilization to extract overall profits from extremely low per-unit profits. Brands focus on creativity and consumer outreach, while contract manufacturers shoulder the responsibility of industrial efficiency and cost management, creating a win-win situation for both parties.

This hasn't just changed the smartphone industry. Since the 2010s, computers, televisions, home appliances, and even automobiles have all gradually shifted to a contract manufacturing model. Companies like Foxconn, Quanta, Wistron, and Jabil have become key nodes in the restructuring of the global manufacturing industry. Manufacturing has become modularized and packaged, transforming it into a capability that can be scaled and sold externally.

More than a decade later, this logic began to be transplanted to a seemingly unrelated field: stablecoins.

On the surface, issuing a stablecoin requires only on-chain minting. However, the work behind making it truly operational is far more complex than one might imagine. Compliance frameworks, bank custody, smart contract deployment, security audits, multi-chain compatibility, account system integration, and KYC module integration all require long-term investment in both financial strength and engineering capabilities.

We previously broke down this cost structure in detail in "How Much Does It Cost to Issue a Stablecoin?" For an issuing institution starting from scratch, initial investment often reaches millions of yuan, often consisting of inexhaustible, fixed expenses. After launch, annual operating costs can reach tens of millions of yuan, covering various components such as legal, auditing, operations and maintenance, account security, and reserve management.

Today, some companies are beginning to package these complex processes into standardized services, providing plug-and-play solutions to banks, payment institutions, and brands. While they may not appear in the spotlight themselves, their presence is often visible behind the issuance of a stablecoin.

Foxconn has also begun to appear in the world of stablecoins.

The Foxconns of the Stablecoin World

In the past, launching a stablecoin meant juggling three roles: financial institution, technology company, and compliance team. Projects needed to negotiate with custodian banks, build cross-chain contract systems, complete compliance audits, and even navigate licensing issues in various jurisdictions. For most companies, this hurdle was too high.

The "foundry" model emerged to address this problem. A "stablecoin foundry" is an organization that specializes in issuing, managing, and operating stablecoins for other businesses. They aren't responsible for building the end-user brand, but rather for providing the complete infrastructure behind the scenes.

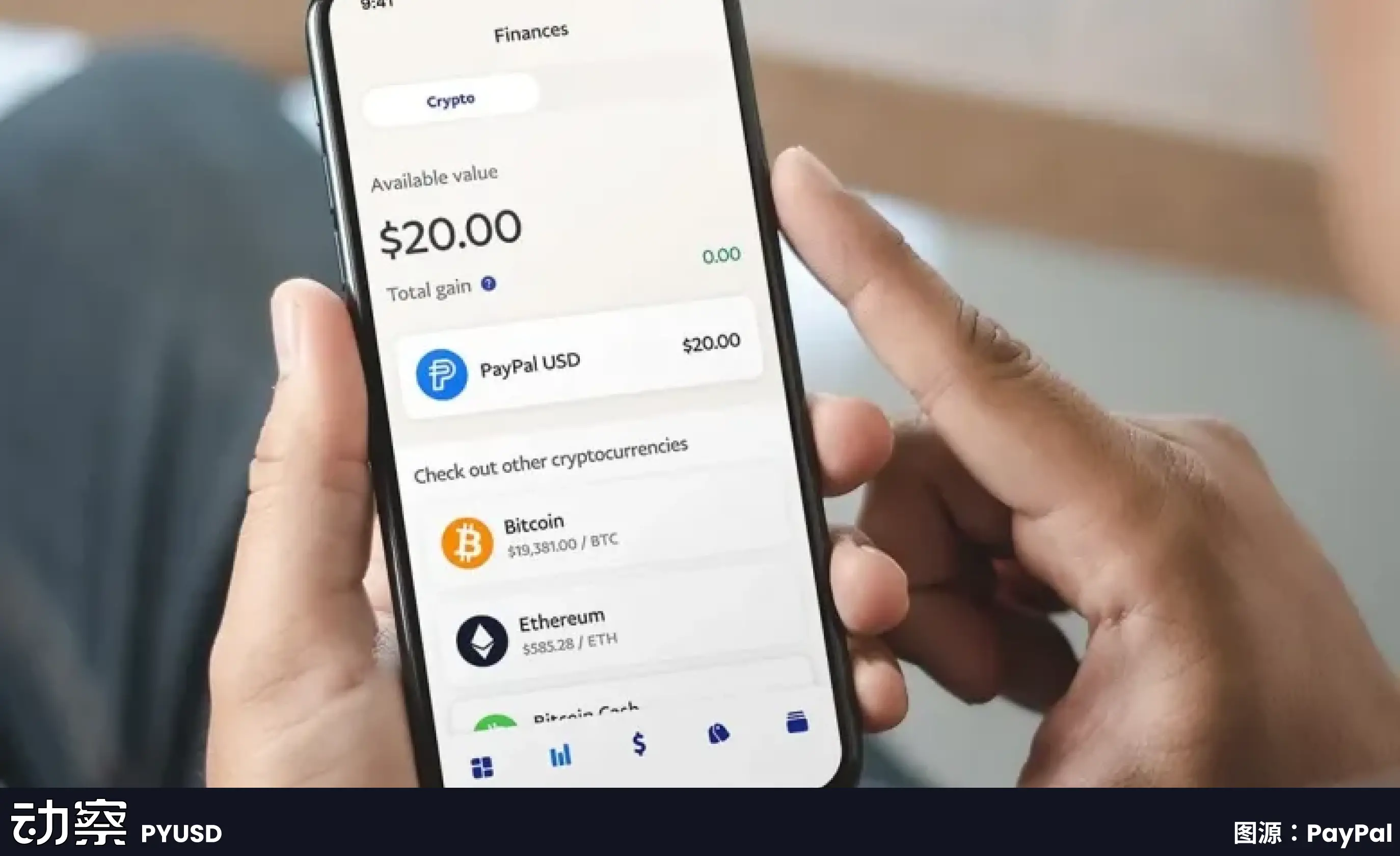

These companies are responsible for building a complete infrastructure, from front-end wallets and KYC modules to back-end smart contracts, custody, and auditing. Clients only need to specify the desired currency and the markets in which they want to launch; the foundry handles all the other steps. Paxos played this role when partnering with PayPal to launch PYUSD: custodian of US dollar reserves, on-chain issuance, and compliance integration. PayPal only needed to display the "stablecoin" option on the product interface.

The core value of this model is reflected in three aspects.

The first is cost reduction. If a financial institution were to build a stablecoin system from scratch, the initial investment could easily reach millions of dollars. Compliance licensing, technical research and development, security audits, and bank partnerships all require separate investments. By standardizing processes, foundries can reduce the marginal cost per customer to a level far lower than building their own.

The second is time savings. While traditional financial products often take years to launch, a fully self-developed stablecoin project can take 12–18 months to implement. The OEM model allows clients to launch products within a few months. Stably's co-founder has publicly stated that their API access model allows a company to launch a white-label stablecoin in just a few weeks.

The third issue is risk transfer. The biggest challenge for stablecoins lies not in technology, but in compliance and reserve management. The Office of the Comptroller of the Currency (OCC) and the New York State Department of Financial Services (NYDFS) have extremely strict regulatory requirements for custody and reserves. For most companies hoping to test the waters, shouldering the full compliance responsibility is unrealistic. Paxos has secured major clients like PayPal and Nubank precisely because it holds a New York State trust license, which allows it to legally custody US dollar reserves and fulfill regulatory disclosure obligations.

Therefore, the emergence of stablecoin foundries has, to some extent, changed the industry's entry barriers. Previously, the high initial investment that only a few giants could afford can now be split, packaged, and sold to more financial or payment institutions with demand.

Paxos: Turning processes into products and compliance into business

Paxos' business direction was determined early on. It doesn't emphasize branding or market share, but rather focuses on building capabilities around one key goal: turning the issuance of stablecoins into a standardized process that others can choose to purchase.

The story begins in New York. In 2015, the New York State Department of Financial Services (NYDFS) opened a digital asset license, and Paxos became one of the first limited purpose trust companies to receive it. That license was more than just symbolic; it empowered Paxos to custody client funds, operate blockchain networks, and perform asset settlements. Such qualifications are rare in the United States.

In 2018, Paxos launched the USDP stablecoin, subjecting its entire process to regulatory scrutiny: reserves were held in banks, audits were disclosed monthly, and minting and redemption mechanisms were written on-chain. This approach wasn't widely adopted due to high compliance costs and slow implementation. However, it did establish a clear and controllable structure, breaking down the stablecoin creation process into standardized modules.

Later, Paxos did not focus on promoting its own currency, but packaged this set of modules into a service and provided it to others.

The two most representative customers are Binance and PayPal.

BUSD is a stablecoin service provided by Paxos for Binance. Binance controls the brand and traffic, while Paxos assumes issuance, custody, and compliance responsibilities. This model operated smoothly for several years until 2023, when the New York Department of Finance (NYDFS) ordered Paxos to cease new minting, citing inadequate anti-money laundering (AML) reviews. This incident only served to highlight Paxos's role in issuing BUSD.

A few months later, PayPal launched PYUSD, still listing Paxos Trust Company as the issuer. PayPal had users and a network, but lacked regulatory credentials and had no intention of building its own. Through Paxos, PYUSD was able to launch legally and compliantly, entering the US market. This was a prime example of Paxos's "OEM" capabilities.

Its model is also being replicated overseas.

Paxos obtained a major payment institution license from the Monetary Authority of Singapore (MAS) in Singapore, using this license to launch its USDG stablecoin. This marked the first time Paxos completed the entire process outside the United States. The company also established Paxos International in Abu Dhabi to focus on overseas operations and launched the yield-bearing USDL stablecoin, using a local license to avoid US regulation.

The purpose of this multi-jurisdictional structure is very direct: different customers and different markets require different compliant and feasible issuance paths.

Paxos hasn't stopped issuing stablecoins. In 2024, it launched a stablecoin payment platform, began handling corporate collection and settlement services, and participated in the establishment of the Global Dollar Network, hoping to connect stablecoins from different brands and systems and facilitate clearing. It aims to provide a more complete backend infrastructure.

However, the closer one gets to regulation, the more vulnerable they become to scrutiny. The NYDFS once singled out Paxos for inadequate anti-money laundering due diligence in the BUSD project. Paxos was fined and required to submit rectifications. While this wasn't a fatal blow, it did demonstrate that Paxos's path was destined to be neither lightweight nor ambiguous. It could only continue to strengthen its compliance efforts and define clear boundaries. It incorporated every regulatory requirement and every security step into its product process. When others use it, they simply attach their brand and issue a stablecoin. Paxos handles the rest. This is its positioning, and it represents a business model that deeply integrates technology and regulation.

Bridge: Stripe's heavyweight foundry

The addition of Bridge marks the emergence of a true giant in the stablecoin foundry market for the first time.

It was acquired by Stripe in February 2025. Stripe is one of the world's largest online payment infrastructures, processing hundreds of millions of transactions daily and serving millions of merchants. Stripe's established expertise in compliance, risk management, and global operations has now been ported to the blockchain through Bridge.

Bridge's positioning is straightforward: providing businesses and financial institutions with comprehensive stablecoin issuance capabilities. Rather than simply outsourcing technology, it modularizes and packages mature aspects of the traditional payment industry into standardized services. Bridge handles reserve custody, compliance audits, and contract deployment. Clients simply call an API to integrate stablecoin functionality into their front-end products.

The MetaMask collaboration is a prime example. As one of the world's largest Web3 wallets, with over 30 million users, it lacks financial licenses and reserve management credentials. Through Bridge, MetaMask was able to launch mUSD in a matter of months, rather than spending years building regulatory compliance and financial systems.

Bridge's business model is platform-based. Rather than tailoring products to individual clients, it aims to build a standardized issuance platform. This approach aligns with Stripe's approach to payments: using APIs to lower barriers to entry allows clients to focus on their core business. Just as countless e-commerce companies and apps once integrated credit card payments, businesses can now use a similar approach to issue stablecoins.

Bridge's advantage comes from its parent company. Stripe has established a global network of compliance partners, facilitating Bridge's entry into new markets. Stripe's existing merchant network also provides a natural potential customer base. For businesses interested in exploring stablecoins but lacking on-chain technology or financial expertise, Bridge offers a ready-made solution.

However, there are limitations. As a subsidiary of a traditional payment company, Bridge may be more conservative than crypto-native companies, and its iteration speed may not be fast enough. Stripe's brand influence in the crypto community is also far less than in the mainstream business world.

Bridge's market positioning is more inclined towards traditional finance and corporate clients. MetaMask's choice of this reflects its need for a trusted financial partner, not just a technology provider.

Bridge's entry signals that the stablecoin foundry business is gaining attention from traditional finance. With the entry of more players with similar backgrounds, competition in this sector will intensify, but it will also drive the industry towards maturity and standardization.