1. Market observation

Trump announced over the weekend that he would impose a 30% tariff on Mexican and EU products exported to the US from August 1. This sudden move immediately put pressure on the market, causing US and European stock futures to fall, while the market's risk aversion sentiment heated up, pushing up the prices of gold, the US dollar and Bitcoin. Analysts generally believe that this tariff is punitive and expressed concerns about the continued erosion of US policy credibility. This policy change has also added new uncertainty to the Fed's interest rate decision. The market's expectations for a September rate cut have quietly shifted from "a sure thing" to about 70%. Strong employment data has basically ruled out the possibility of a rate cut in July, making the June CPI to be released this week the focus of attention from all parties. Zachary Griffiths of CreditSights pointed out that the data will set the tone for the policy direction in the second half of the year, while Brandywine Global's portfolio manager believes that the resilience of the job market and the bubble of risky assets are not enough to support a rate cut. There are also differences within the Fed. Chairman Powell remains patient and hopes to assess the impact of tariffs, but some directors have also hinted that they hope to restart rate cuts as soon as possible.

In addition to focusing on this week's CPI data, China's second-quarter GDP, and the upcoming U.S. earnings season, the market also needs to pay close attention to the developments in the U.S. Congress. Congress has declared this week "Cryptocurrency Week" and plans to review the GENIUS Act, the CLARITY Act, and the CBDC ban bill, which may reshape the digital asset market landscape.

In Hong Kong, the strategy of stablecoin and asset tokenization is progressing steadily. Jeffrey Ding, chief analyst at HashKey, pointed out that Hong Kong has issued a limited number of the first batch of stablecoin licenses, focusing on cross-border payment applications to help developing countries cope with financial risks. Jeffrey believes that the "LEAP" framework in Hong Kong's Policy Statement 2.0 strikes a balance between innovation and robustness by optimizing laws, supporting start-ups and strengthening international cooperation, aiming to accelerate the construction of the digital asset ecosystem. Although there are challenges such as regulatory coordination, technical standards and anti-money laundering in the short term, in the long run, ETFs and commodity tokenization have the potential to attract capital inflows, but they need to improve the legal framework, ensure transaction security, enhance market acceptance, and clarify the legal status of assets and physical delivery mechanisms. In addition, the US GENIUS Act and the EU MiCA Regulation may provide important regulatory references for Hong Kong.

Bitcoin breaks through $121,500, setting a new record high. Analyst Web3Niels pointed out that $119,000 to $120,000 is the key resistance zone for Bitcoin. If it can successfully break through, it may test $135,000 to $140,000. If it is blocked, it may retest the support of $114,000 to $115,000. Daan Crypto Trades also observed that the market has accumulated a lot of liquidity in the range of $115,500 to $116,500 and above $120,000. According to Rekt Capital analysis, the second round of upward trend in Bitcoin price discovery has entered the second week, while the first round of upward trend lasted for 7 weeks. Meanwhile, Solana has risen by 12.87% in the past 30 days and successfully broke through $160 twice. Analysts CryptoDona7 and Ali Charts believe that the current price trend is similar to the upward trend after the breakthrough of $125 in April, when SOL peaked at $187 in May, and it is expected to hit $300 before August this time. Crypto Dubzy further pointed out that if SOL can break through $195, the subsequent target may be in the range of $257 to $305. Ali Charts emphasized that as long as the support of $145-155 is maintained, it can reach $200 to $250. In the short term, $185 is the key target price.

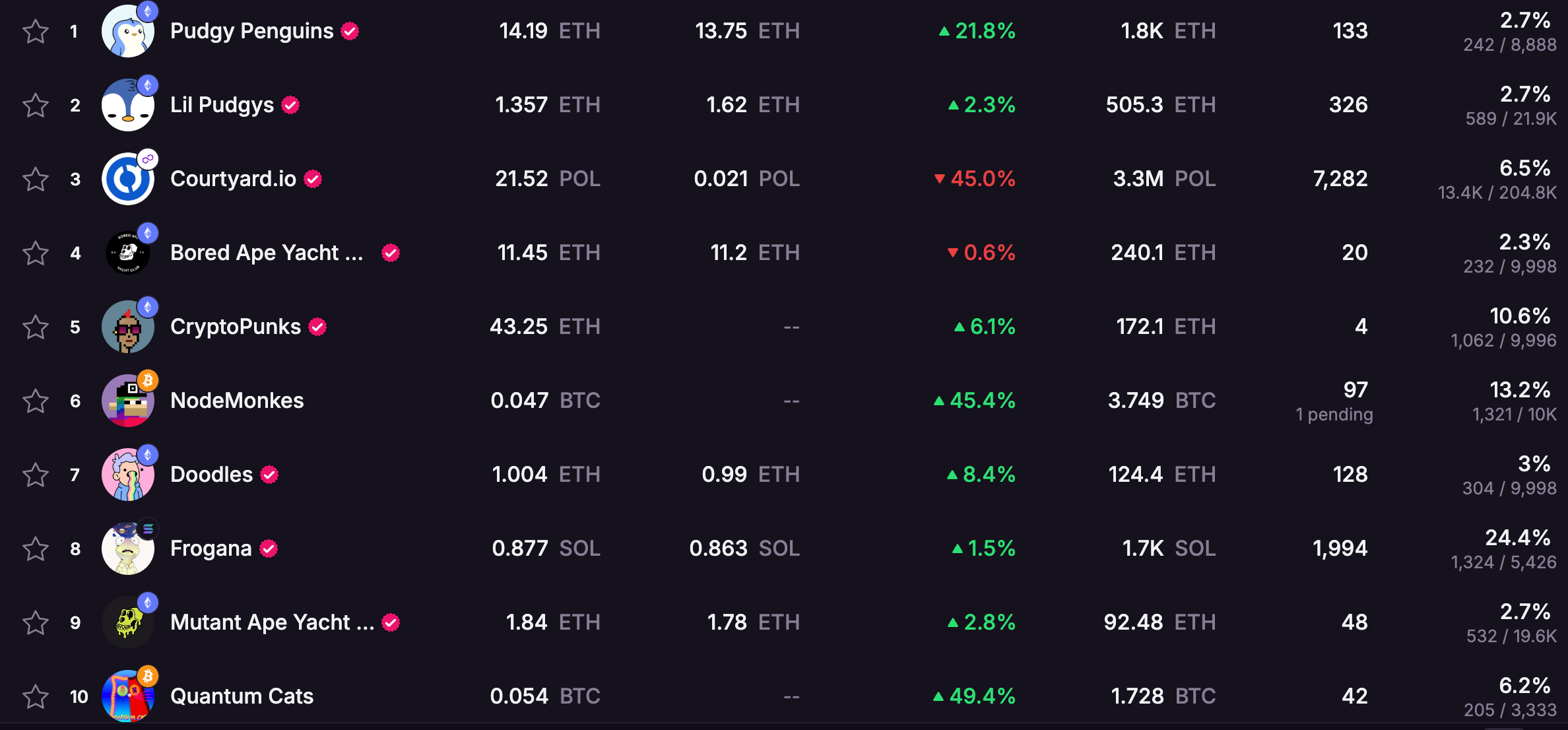

In terms of market dynamics, the performance of altcoins and meme coins shows highly speculative and community-driven characteristics. For example, after $BANANAS31 rose 10 times in a month, its price has almost returned to the starting point; the Chinese narrative "Wangchai" meme coin has nearly doubled in price within 24 hours, with a market value of up to 16.4 million US dollars. Although the 1inch team announced a buyback of tokens to boost prices, the selling behavior of its investment fund caused the price of the coin to fall back. There has been a phenomenal spread in the NFT field. The "avatar change craze" caused by Pudgy Penguins has swept Coinbase, OpenSea, MoonPay and other institutions. The current floor price of Magic Eden is 13.75 ETH. While the trading volume has reached the top, its floor price has soared 49.4% in the past week and 21.8% in 24 hours, far exceeding blue-chip projects such as BAYC and Azuki.

2. Key data (as of 12:00 HKT on July 14)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN, Magic Eden)

Bitcoin : $121,974 (+30.75% YTD), daily spot volume $42.164 billion

Ethereum: $3,048.51 (-8.76% YTD), with daily spot volume of $25.486 billion

Greed Index : 75 (greed)

Average GAS: BTC: 0.52 sat/vB, ETH: 2.22 Gwei

Market share: BTC 63.6%, ETH 9.7%

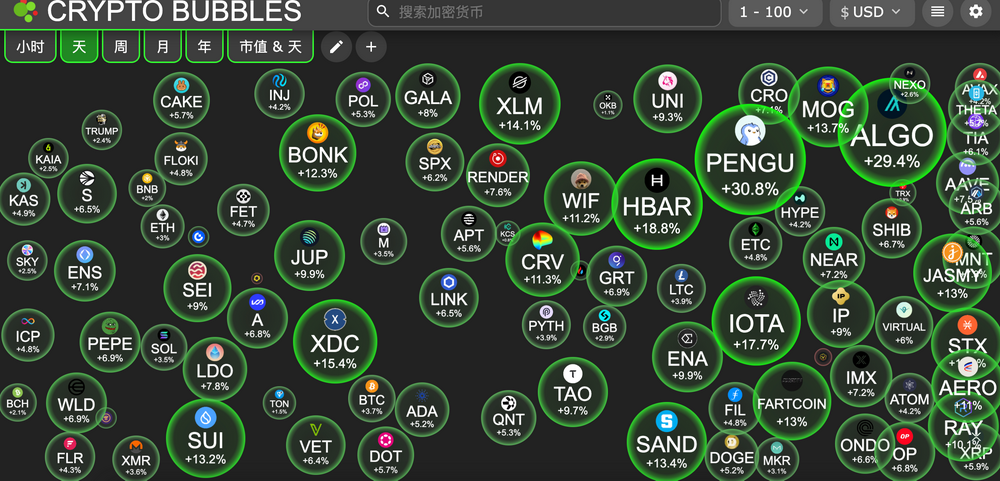

Upbit 24-hour trading volume ranking: XRP, XLM, PENGU, BTC, HBAR

24-hour BTC long-short ratio: 1.192

Sector gains and losses: NFT sector rose 8.98%; GameFi sector rose 6.12%

24-hour liquidation data: A total of 119,500 people were liquidated worldwide, with a total liquidation amount of US$684 million, including BTC liquidation of US$444 million, ETH liquidation of US$74.1226 million, and XRP liquidation of US$17.65 million

BTC medium- and long-term trend channel: upper channel line ($114,340.09), lower channel line ($112,075.93)

ETH medium and long-term trend channel: upper channel line ($2788.33), lower channel line ($2733.12)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 11)

Bitcoin ETF: +$1.03 billion, 7 consecutive days of net inflows

Ethereum ETF: +$205 million, 6 consecutive days of net inflows

4. Today’s Outlook

U.S. June unadjusted CPI annual rate : previous value 2.40%, forecast value 2.70% (July 15, 20:30)

U.S. June seasonally adjusted CPI monthly rate : previous value 0.10%, forecast value 0.30% (July 15 20:30)

Starknet (STRK) will unlock approximately 127 million tokens at 8 am on July 15, accounting for 3.53% of the current circulation, worth approximately $17.6 million;

The biggest gainers in the top 500 stocks by market value today: Ski Mask Dog (SKI) up 57.79%, Usual (USUAL) up 46.86%, Pudgy Penguins (PENGU) up 31.60%, Algorand (ALGO) up 29.80%, and XYO (XYO) up 29.15%.

5. Hot News

Macro Outlook This Week: CPI Judgment Day is Coming, Bitcoin May Continue to Set New All-Time Highs

SharpLink Gaming purchased another 16,374 ETH 7 hours ago, and its holdings have reached 270,000

Czech Central Bank Adds Coinbase to Portfolio, Increases Palantir Stake

SOON releases recovery plan to destroy 3% of total supply of tokens

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.