"Bitcoin's volatility has fallen to historic lows, making it more attractive than gold to institutional investors," JPMorgan Chase bluntly stated in its latest research report. The Wall Street giant made it clear that Bitcoin is significantly undervalued relative to gold.

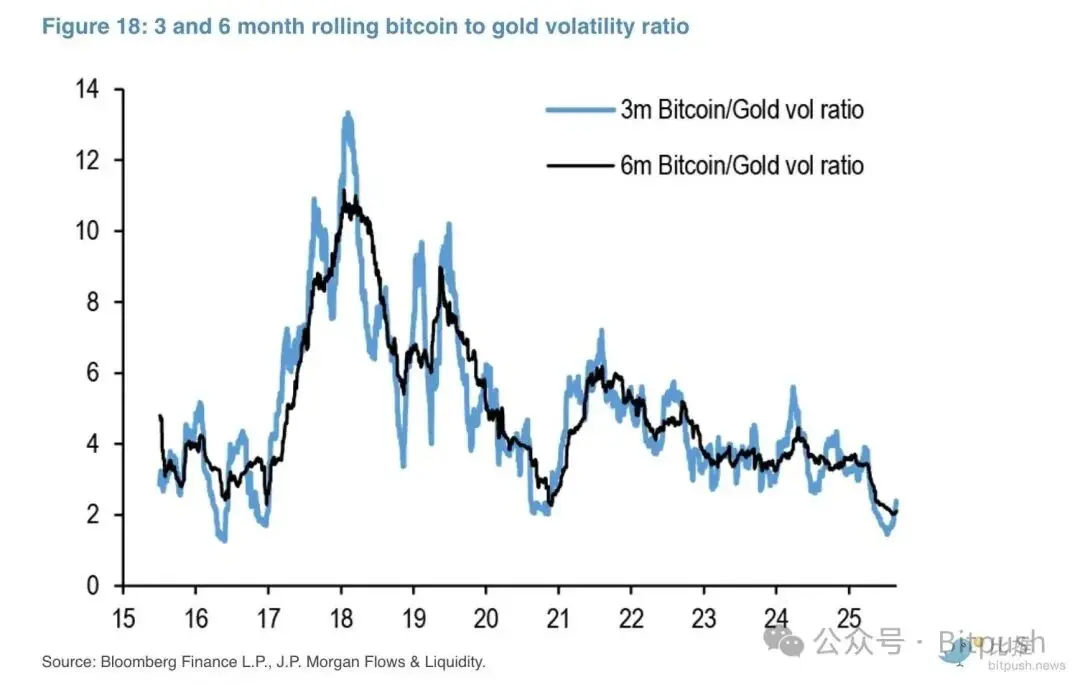

According to JPMorgan Chase analysis, Bitcoin's six-month rolling volatility has plummeted from nearly 60% at the beginning of the year to approximately 30%, a record low. Meanwhile, the volatility ratio of Bitcoin to gold has also fallen to a record low, with Bitcoin now only twice as volatile as gold.

Volatility plummets, and revaluation is underway

Volatility, a major barrier to full Bitcoin adoption among traditional institutional investors, is rapidly receding. A new report from JPMorgan analysts details this shift.

The sharp decline in Bitcoin volatility is not only a change in technical indicators, but also represents a significant increase in market maturity. The report points out that the decline in volatility directly reflects the shift in Bitcoin's investor base - from being dominated by retail investors to being dominated by institutional investors.

This shift is similar to the effect that central bank quantitative easing has on bond volatility. Corporate treasuries are acting as a kind of “central bank for Bitcoin,” reducing the circulating supply in the market by continuously buying and holding, thereby reducing price volatility.

JPMorgan Chase conducted a detailed comparison of Bitcoin and gold using a volatility-adjusted model. The analysis shows that Bitcoin's market capitalization would need to increase by 13% to match the $5 trillion in gold held by private investors. This calculation yields a fair value for Bitcoin of approximately $126,000, which still leaves significant room for growth compared to its current price.

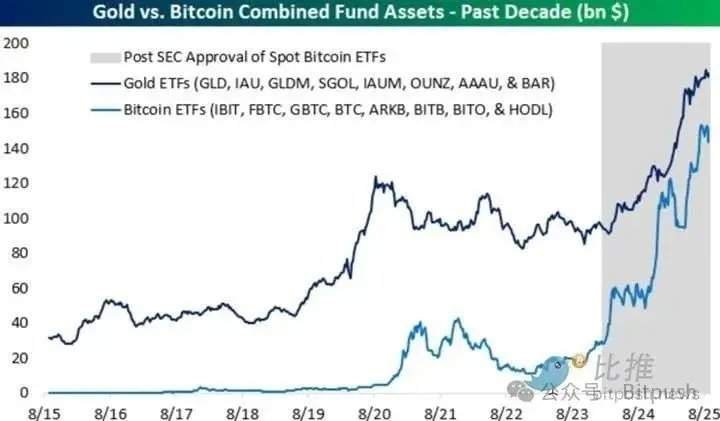

The ETF Wars: An Unprecedented Migration of Capital

If declining volatility is an intrinsic sign of Bitcoin's maturity, the approval and launch of a spot Bitcoin ETF is an external catalyst accelerating institutional adoption. This milestone has opened up unprecedented investment channels for both regular investors and institutions, directly triggering a competition between Bitcoin and gold in terms of assets under management (AUM).

The latest data from Bespoke Investment Group shows that the AUM of Bitcoin funds has reached about $150 billion, while the AUM of gold funds is about $180 billion. The gap between the two has narrowed to only $30 billion, showing an astonishing pace of catching up.

Looking at specific funds, the world's largest gold ETF, SPDR Gold Shares (GLD), holds approximately $104.16 billion in assets, while leading Bitcoin ETFs (such as BlackRock's IBIT) have accumulated approximately $82.68 billion in just one year. This not only reflects a shift in investment preferences but also demonstrates the growing importance of Bitcoin as a component of global asset allocation.

JPMorgan analysts believe: "Bitcoin is becoming increasingly attractive, especially for institutional portfolios. Declining volatility coupled with increased regulatory clarity has created a perfect environment for adoption."

Technology Outlook

Bitcoin prices rebounded slightly after JPMorgan released its report, but then retreated. According to TradingView data, Bitcoin had risen as much as 2.3% to around $113,479 at press time, before retreating about 1% to around $112,272.

Veteran trader Peter Brandt believes that despite Bitcoin’s recent rebound, the price must break through the key resistance level of $117,570 to completely break out of the medium-term bearish sentiment.

However, from a longer-term perspective, multiple technical indicators still point to a bullish outlook. Bitcoin's ability to hold above $110,000 suggests that institutional investors are steadily building positions on every pullback, which is building momentum for a volatile upward trend in the coming months.

The $126,000 target proposed by JPMorgan Chase may just be a new starting point. If Bitcoin continues to maintain its current pace of attracting institutional funds, the narrative of "digital gold" surpassing traditional gold may no longer be a theoretical deduction, but will gradually become a reality.