Once again, I am impressed by the excellent design of Bitcoin.

DeepSeek R2 did not come out in May as rumored, but instead a minor version update of R1 was made on 5.28. Musk's Grok 3.5 was also repeatedly delayed, and it is not as good as Starship in terms of real sound.

Driven by the enthusiasm of massive capital, the scaling law in the large model field will complete its life cycle faster than Moore's Law of chips.

If software, hardware, and even human lifespans, cities, and countries all have upper limits on their scale effects, then the blockchain field must also have its own laws. As SVM L2 enters the coin issuance cycle and Ethereum returns to the L1 battlefield, I try to imitate the scale law and give an encrypted version.

Ethereum soft cap, Solana hard cap

We start with the scale of full node data.

A full node represents a complete "backup" of the public chain. Owning BTC/ETH/SOL does not mean that we own the corresponding blockchain. Only when we download the full node data and participate in the block generation process can we say "I own the Bitcoin ledger". Correspondingly, Bitcoin has also added a decentralized node.

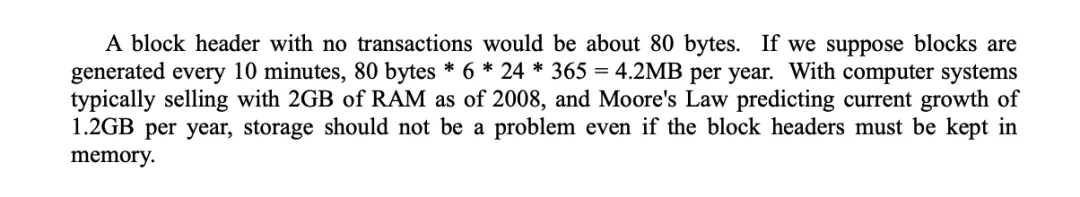

Solana's 1,500-node scale struggles to maintain a balance between decentralization and consensus efficiency. Correspondingly, its 400T full-node data scale leads all public chains/L2s.

Image description: Public chain full node data scale Image source: @zuoyeweb3

If not compared with Bitcoin, Ethereum is already very good at controlling data volume. Since the birth of the Genesis block on July 30, 2015, the data volume of Ethereum's full node has been only about 13 TB, far less than its "killer" Solana's 400 TB, while Bitcoin's 643.2 GB can be called a work of art.

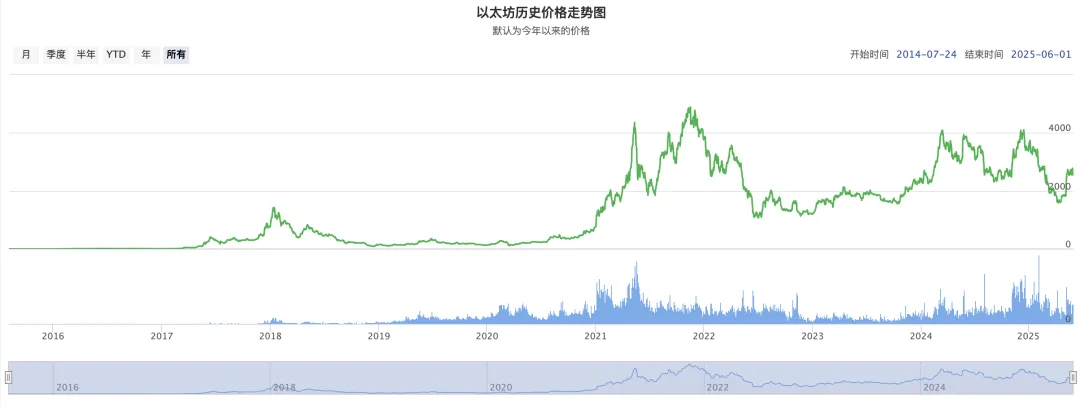

In the initial design, Satoshi Nakamoto strictly considered the growth curve of Moore's Law and strictly limited the data growth of Bitcoin to the expansion curve of the hardware. It has to be said that those who later supported the large blocks of Bitcoin could not stand because Moore's Law had already reached the edge of marginal effect.

Image caption: Comparison of Bitcoin node growth and Moore's Law Image source: Bitcoin White Paper

In the CPU field, Intel's 14 nm++ can be called an heirloom. In the GPU field, Nvidia's 50 series has not "significantly exceeded" the 40 series. As for the progress in the storage field, under the Xtacking architecture of Yangtze Memory, the scale of 3D NAND stacking has gradually peaked, and Samsung's 400 layers are the current expected high point of engineering.

In a word, the law of scale means that the underlying hardware of the public chain will no longer make great progress. It can even be said that this is not a short-term technical limitation, but the status quo will be maintained for a considerable period of time.

Faced with difficulties, Ethereum is obsessed with ecological optimization and reconstruction. Trillions of RWA assets are a must-win for it. Whether it is imitating Sony's self-built L2 or fully speeding up to embrace the Risc-V architecture, it is not about "finding a more extreme software and hardware collaboration", but sticking to its own advantages.

Solana has chosen to move towards the extreme speed of light. In addition to the current Firedancer and AlpenGlow, the super-large node scale has actually excluded individual participants. A 13 TB hard drive can still be assembled, and 400 TB is already a pipe dream. Even if Samsung, LG and Hynix factories are fighting fires every day, 600 GB of Bitcoin can theoretically be satisfied.

The only question is, what are the lower and upper limits of on-chain scale?

The Limits of Token Economy

AI did not embrace Crypto as expected, but this did not prevent the price of Virtuals from rising sharply. In fact, with blockchain in the left hand and AI in the right hand, they have become fellow travelers of MAGA of the current US government. 5G and the metaverse are both old, and the heroes still have to look at Sun Ge and stablecoins.

Let’s briefly discuss the various extreme indicators of the token economic system. Bitcoin, assuming no practical use, has a market value of $2 trillion, Ethereum $300 billion, and Solana $80 billion. We take Ethereum as the standard value, and the limit of the public chain economic system is $300 billion.

This does not mean that Bitcoin is overvalued, nor that new public chains cannot exceed this value, but it is highly likely that the market performance of a public chain is the current optimal solution, that is, "we believe that the current market performance is the most reasonable existence", so directly selecting this value is more effective than complex calculations. If it is not necessary, do not increase the entity.

We introduce two concepts from the book "Scale":

1. Superlinear scaling: When the system scales up, its output or benefit does not increase proportionally, but grows at a faster rate.

2. Sublinear scaling: When a system scales up, some of its indicators (such as cost, resource consumption, maintenance requirements, etc.) grow at a rate lower than the linear rate.

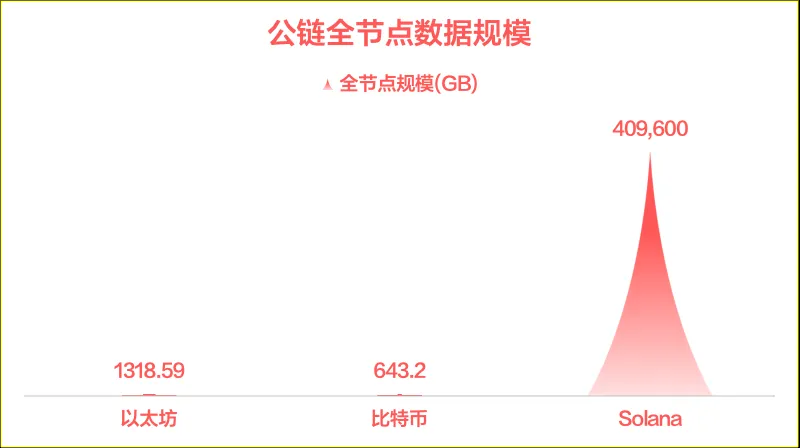

Image caption: Ethereum price trend Image source: BTC123

It is not complicated to understand the two. For example, Ethereum's growth from US$1 (2015) to US$200 (2017) is superlinear scaling, which takes about half the time of its growth from US$200 to ATH (2021), which is classic sublinear scaling.

Everything has its limits, otherwise blue whales, elephants, and North American redwoods would surpass themselves, but the earth's gravity is a hard ceiling that is difficult to overcome.

Keep drilling, has DeFi reached its limit?

The scale limit of DeFi can be included by Ethereum. Let’s turn to examine the rate of return, which is also the core proposition of DeFi. The driving force of entropy increase lies in the extreme pursuit of returns. We give three standards: UST’s 20% APY, DAI’s 150% excess pledge ratio, and the current 90D MA APY 5.51% calculation of Ethena’s sUSDe.

We can assume that DeFi’s yield capture ability has dropped from 1.5x to 5%, and even if calculated at 20% of UST, DeFi has reached its upper limit.

It should be noted that putting trillions of RWA assets on the chain will only reduce the average yield of DeFi, but will not increase it. This is in line with the sublinear scaling law. The extreme expansion of the system scale will not bring about the extreme increase in capital efficiency.

Please also note that there is a market motivation for DAI's 150% over-collateralization ratio: I can make additional profits beyond the 150% collateralization ratio, so assuming it as a market baseline is my personal opinion and may not be correct.

We can be rough and say that the current on-chain economic system, with token economy as the benchmark model, has an actual upper limit of US$300 billion in scale and a yield of around 5%. Again, this is not the upper or lower limit of the total market value or a single token, but the overall scale of tradable assets is just that large.

In fact, you cannot sell 2 trillion Bitcoins, and even US Treasury bonds cannot absorb such a large scale of sell-off.

Conclusion

Looking at the history of blockchain development since Bitcoin, the discrete trend between public chains has not been bridged. Bitcoin is increasingly decoupled from the on-chain ecosystem, and the failure of the on-chain reputation system and identity system has led to the over-collateralization model becoming the mainstream.

Whether it is stablecoins or RWAs, they are all leveraged on-chain assets, that is, off-chain assets naturally have higher credibility. Under the current on-chain scale law, we may also reach the upper limit of scaling law or Moore's Law. It has only been 5 years since DeFi Summer and 10 years since the birth of Ethereum.