Author: Gao Xian, FinTax

1 Introduction

In recent years, Bhutan has leveraged its geographical advantages in hydropower and a state-driven strategic development model to continuously build Bitcoin mining farms, sparking a "green mining revolution." According to data released by Arkham Intel on June 27, 2025, the country has accumulated 12,062 Bitcoins since 2020, making it the world's third-largest sovereign Bitcoin holder. This reserve represents approximately 40% of Bhutan's gross domestic product (GDP), making it one of the countries with the largest exposure to cryptocurrency assets globally. In July 2025, Bhutan launched a nationwide cryptocurrency payment system, allowing tourists to use cryptocurrency to pay for visa fees, flights, and local goods, becoming one of the first countries to enable cryptocurrency payments across its entire tourism ecosystem. Binance CEO Richard Tang wrote to Bhutan, acknowledging that Bhutan is forging a path for cryptocurrency innovation and paving its national vision with trust. However, in stark contrast to Bhutan's rapidly booming cryptocurrency industry, the country's somewhat crude and nascent cryptocurrency tax and regulatory system remains in its infancy.

2 Bhutan’s Characterization and Basic Tax Policy on Cryptocurrency

2.1 Qualitative Analysis of Cryptocurrency

Bhutan has a relatively cautious approach to cryptocurrencies, not considering them legal tender but rather as assets subject to regulatory restrictions. However, this hasn't prevented Bhutan from developing an increasingly open attitude toward crypto assets. In particular, in January 2025, Bhutan's special administrative region, Gelephu Mindfulness City (GMC), announced plans to include Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) in its strategic reserve framework (at the regional level). This is a groundbreaking initiative, with legal and implementation details still under development. This signifies that Bhutan's characterization of cryptocurrencies has transcended ordinary commodities or property, elevating them to the level of national strategic reserve assets.

2.2 Basic tax policies and their international comparison

2.2.1 Overview of Bhutan’s Tax System

Bhutan's tax system modernization began relatively late, with the government gradually introducing monetized taxation starting in the 1960s. The 2001 Income Tax Act established a modern, comprehensive income tax system covering both personal and corporate taxes, while the 2000 Sales Tax, Customs, and Excise Duty Act regulated the collection of indirect taxes. Currently, Bhutan's tax system primarily consists of personal income tax, corporate income tax, sales tax, and customs and excise duties. New legislation, including the Income Tax Bill of Bhutan 2025 (hereinafter referred to as the "Income Tax Act") and the Goods and Services Tax Bill of Bhutan 2025 (hereinafter referred to as the "GST Act"), has been passed to further modernize the system. Currently, sales tax, customs, and excise duties are administered under the 2000 Sales Tax, Customs, and Excise Duty Act, with specific rates announced by the Ministry of Finance (the sales tax is currently 7%). However, Bhutan plans to implement a 5% Goods and Services Tax (GST) to replace the existing sales tax starting in January 2026. Since the new law will take effect on January 1, 2026, this article will focus on the new law.

2.2.2 Personal Income Tax

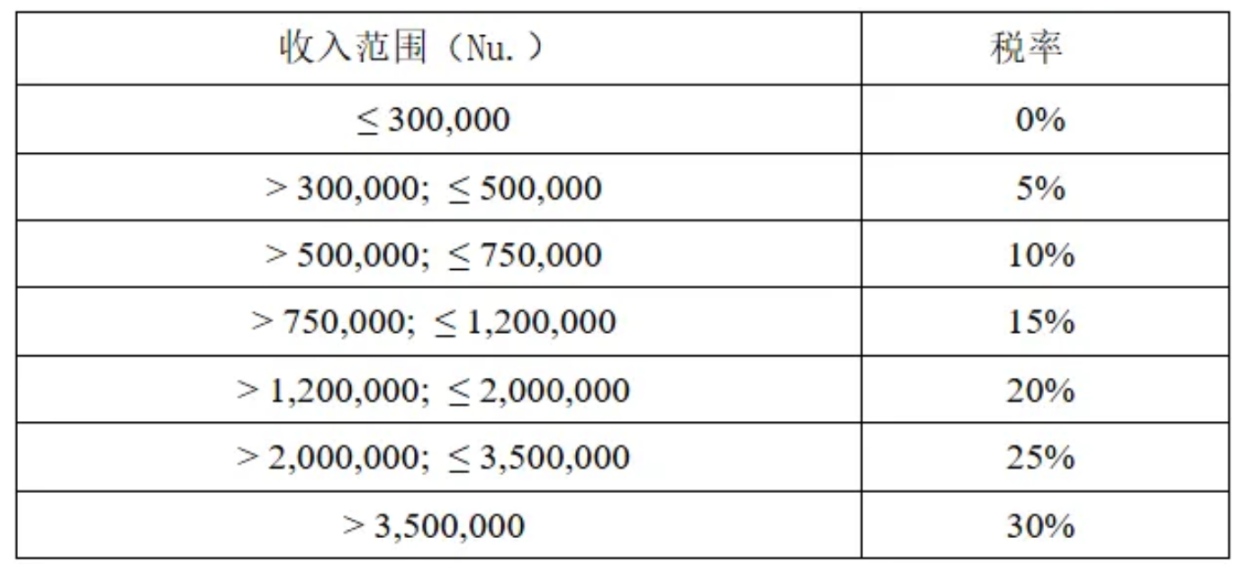

Bhutan's personal income tax is based on a progressive tax system, with rates increasing from 0% to 30%. It applies to citizens, residents, and other individuals with income in Bhutan exceeding 300,000 Ngulthams per year. The 2025 Income Tax Act merged the previous Personal Income Tax (PIT) and Business Income Tax (BIT) into the Personal Income Tax to simplify the tax structure. Under the new law, the specific individual income tax rates for each tier are as follows:

2.2.3 Corporate Income Tax

Bhutan's corporate income tax applies to companies, groups, and entities with a significant economic presence (SEP). Under the new Income Tax Act, the tax rate is 22%, down from the previous 30%, aimed at attracting investment and supporting business development.

2.2.4 Sales Tax and the upcoming Goods and Services Tax (GST)

Currently, Bhutan has a 7% sales tax on most goods and services. However, Bhutan plans to implement a 5% goods and services tax (GST) in 2026 to replace the existing sales tax, thereby unifying the tax system, streamlining tax compliance, and aligning it with international standards.

2.3 Cryptocurrency Tax Policies and Latest Developments

Bhutan does not have specific tax provisions specifically targeting Bitcoin or other cryptocurrencies. While the country participates in cryptocurrency mining and supports digital infrastructure, it does not consider cryptocurrencies legal tender and does not provide specific tax exemptions. Under Bhutan's current tax legislation, any potential taxable event related to cryptocurrency—such as generating income from cryptocurrency mining, investment, or trading (sale or exchange), receiving cryptocurrency as payment for goods or services, or even simply holding digital assets—may trigger the application of existing taxes.

When the Income Tax Law was revised in 2024, Bhutan’s mainstream media reported that according to relevant officials from the Department of Revenue and Customs, the revision of the Income Tax Law will consider digital assets such as cryptocurrencies as a source of income for personal income tax. However, the new Income Tax Law does not explicitly define cryptocurrency as taxable income for personal income tax purposes. Instead, it defines four types of taxable income: income from employment, income from business, income from investment, and income from other sources. It only considers cryptocurrency as a form of "supplies of digital assets," thus constituting "digital services." This suggests that Bhutan remains cautious regarding cryptocurrency taxation, with the specific regulations remaining vague. However, it is certain that businesses providing cryptocurrency-related services will be subject to a 22% income tax rate. Furthermore, it is worth noting that capital gains tax is generally levied when cryptocurrency is considered property for tax purposes. By interpreting the existing income tax law, Bhutan may still tax related gains as "investment income" or "income from other sources," depending on the duration of holding the cryptocurrency and the nature of the transaction. Regarding the Goods and Services Tax, the new law does not explicitly stipulate whether cryptocurrency transactions are taxable.

3 Bhutan’s regulatory framework for cryptocurrencies

3.1 Basic Framework of Cryptocurrency Regulatory System

Bhutan's regulatory system has undergone a transition from pilot programs to full-scale implementation. Cryptocurrency regulation in Bhutan is primarily the responsibility of the Royal Monetary Authority (RMA) and is implemented through the "Cryptocurrency Mining Regulatory Sandbox Framework," issued by the RMA in 2019. This framework emphasizes strict compliance oversight of crypto-related businesses. The framework aims to ensure that mining activities comply with national laws, protect investors and consumers, and support innovative technological applications. More specifically, the framework requires cryptocurrency mining companies to adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations and obtain various forms of approval from the RMA to prevent the misuse of cryptocurrencies for illicit activities and ensure financial risks are avoided. In 2024, Bhutan further refined its regulations, requiring crypto businesses operating in the country to obtain a license and provide comprehensive risk disclosure to protect cryptocurrency investors. This framework, with its emphasis on anti-money laundering and investor protection, aligns not only with FATF standards but also with global concerns about the security and integrity of financial transactions in the cryptocurrency sector.

3.2 Latest Developments in Cryptocurrency Regulatory Regime

Bhutan has a positive and open attitude towards cryptocurrencies. It not only accepts cryptocurrencies but also integrates them into its national development strategy. In particular, it has established a sovereign Bitcoin reserve, utilized its hydropower resources for green mining, and used it as a tool for economic diversification. In this process, Bhutan has continuously updated its cryptocurrency regulatory system.

According to the Royal Monetary Authority of Bhutan's latest notice, "RMA's Regulatory Stance on Cryptocurrency," published on May 30, 2025, the RMA will adopt a phased, focused regulatory strategy for cryptocurrencies, supporting responsible innovation while safeguarding citizens' rights and financial stability. Based on this approach, while continuously monitoring developments in the sector and strengthening national cryptocurrency capacity building, the RMA has officially announced the following position:

Cryptocurrency mining and trading operations are limited to entities registered with the Gelupu Mindfulness City and its partner companies and must comply with the GMC regulatory framework;

Crypto trading through domestic banks regulated by the RMA will continue to be restricted.

The latest regulations suggest that Bhutan's future policies may continue to support the development of cryptocurrencies, albeit with some limitations. However, given Bhutan's renowned commitment to "Gross National Happiness," its cryptocurrency policy is likely to remain cautious, emphasizing investor protection, sustainability, and social benefits to balance economic innovation with financial stability.

4 International Comparison and Future Outlook

4.1 International Comparison

A brief comparison of Bhutan with other countries focused on cryptocurrency development reveals the following key differences: First, in terms of monetary systems, El Salvador has adopted Bitcoin as legal tender for its entire economy, promoting cryptocurrency with greater legal force. Bhutan, on the other hand, has not yet declared any cryptocurrency legal tender, thus avoiding subverting its existing fiat currency system. Second, in terms of driving forces, unlike Switzerland, which promotes blockchain through private innovation and market forces, Bhutan, through the involvement of state-owned entities such as Druk Holding & Investments and DK Bank, has integrated cryptocurrency into its national development plans. This parallels the United States' ongoing legislative push for crypto assets. Third, in terms of global positioning, while countries like the United Arab Emirates and the United States are striving to establish themselves as global crypto hubs, Bhutan's approach is distinct. Rather than pursuing global centrality, its crypto strategy focuses on enabling local development goals—increasing regional connectivity, openness, and financial inclusion through the widespread adoption of crypto payment systems, thereby supporting tourism.

Bhutan's tax system is also quite unique in its specifics. Bhutan's tax policy is relatively relaxed, allowing for cost deductions and employing a progressive tax rate, reflecting its friendliness towards small and medium-sized investors. India, also in South Asia, imposes a flat 30% tax on cryptocurrency income and disallows losses from being deducted from other income, resulting in a more stringent tax environment. However, unlike European countries like Portugal, which use tax incentives to attract cryptocurrency users, Bhutan does not offer widespread tax incentives. Instead, it focuses on promoting cryptocurrency through merchant payments and digital tools for everyday use. Furthermore, in contrast to the United States, another major holder of Bitcoin, which has a more detailed and transparent approach to cryptocurrency taxation and regulation, and a clear focus on maintaining its leading position, Bhutan does not have a dedicated cryptocurrency tax. Instead, it distributes cryptocurrency income across existing tax categories and items, resulting in a relatively simple regulatory framework and a cautious approach.

4.2 Future Outlook

In terms of regulation, Bhutan's cryptocurrency regulatory system reflects a philosophy that combines prudence with openness and innovation. In particular, its focus on anti-money laundering and investor protection is aligned with international standards. However, transparency and regulatory details still need to be improved, leaving some uncertainty. In particular, according to the latest announcement from the competent authorities, geographical restrictions and controls on related businesses will continue. In the future, Bhutan may become a global model for the green development of cryptocurrencies. Its policies will continue to support the development of cryptocurrencies, focusing on capacity building, risk isolation, and sovereign control. Regulatory details will also be further refined.

Bhutan's tax system is undergoing a period of transition. Recent adjustments to individual and corporate income taxes reflect the government's commitment to balancing economic development and social equity, and the implementation of the Goods and Services Tax (GST) will further simplify the tax structure. Nevertheless, due to the lack of specific laws, regulations, or guidelines, Bhutan's stance on cryptocurrency taxation remains somewhat ambiguous, and related tax matters remain in a gray area. While Bhutan's tax policy is likely to continue evolving towards greater transparency and efficiency, its cryptocurrency taxation policy is likely to remain as is for some time. This, while providing flexibility in addressing cryptocurrency-related tax issues, also introduces uncertainty and risk. We believe that Bhutan's positive attitude towards cryptocurrencies will spur the rapid development of a tax framework conducive to the development of the industry.