Author: Darshan Gandhi, Polaris Fund

Compiled by: TechFlow

A deep dive into centralized exchanges (CEXs) and their token burns: mechanics, frequency, and other aspects.

Buybacks and burns on exchanges are nothing new.

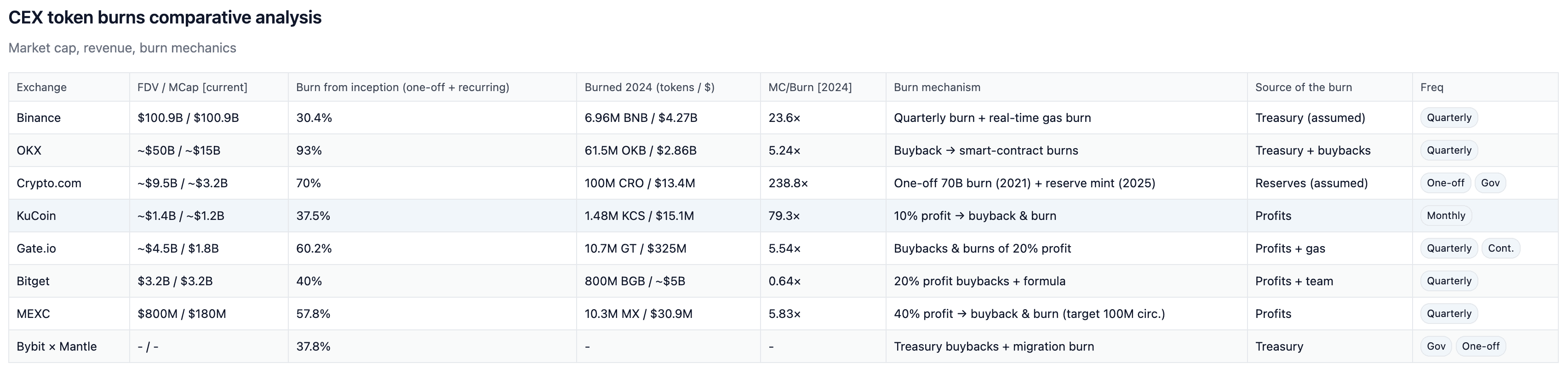

These operations have been quietly underway for years, quietly shaping supply and demand long before they attracted mainstream attention. Nearly every major centralized exchange (CEX), including Binance ($BNB), OKX ($OKB), Gate ($GT), KuCoin ($KCS), and MEXC ($MX), has implemented some form of burn program for over five years.

Today, the way these token burns are presented has changed.

Hyperliquid ($HYPE) has placed token buybacks at the heart of its token strategy, rather than hiding them in the fine print. It has transformed the burn mechanism from a background function to a prominent feature, and more importantly, by running the burn continuously and publicly as part of its treasury management, setting a new standard for transparency.

This positioning makes the burn mechanism seem refreshing, even though established exchanges like Binance, OKX, Gate, KuCoin, and MEXC have been doing similar things for years. The difference is that established exchanges have never been so aggressive in marketing it, nor have they integrated the burn mechanism so tightly into their financial operations (we’ll explore the reasons in more detail later).

The destruction mechanism is essentially a means of value transfer, demonstrating the following:

- How exchanges tie token supply to their business models

- Which levers drive scarcity (profit, formula, or governance)

- How credibility is built or lost over time

Additionally, the burn mechanism acts as an inflation control tool, stabilizing supply by offsetting token unlocking or issuance.

The question now is no longer whether the burn will happen, but whether the burn will be executed consistently enough and whether the model can provide transparency to token holders.

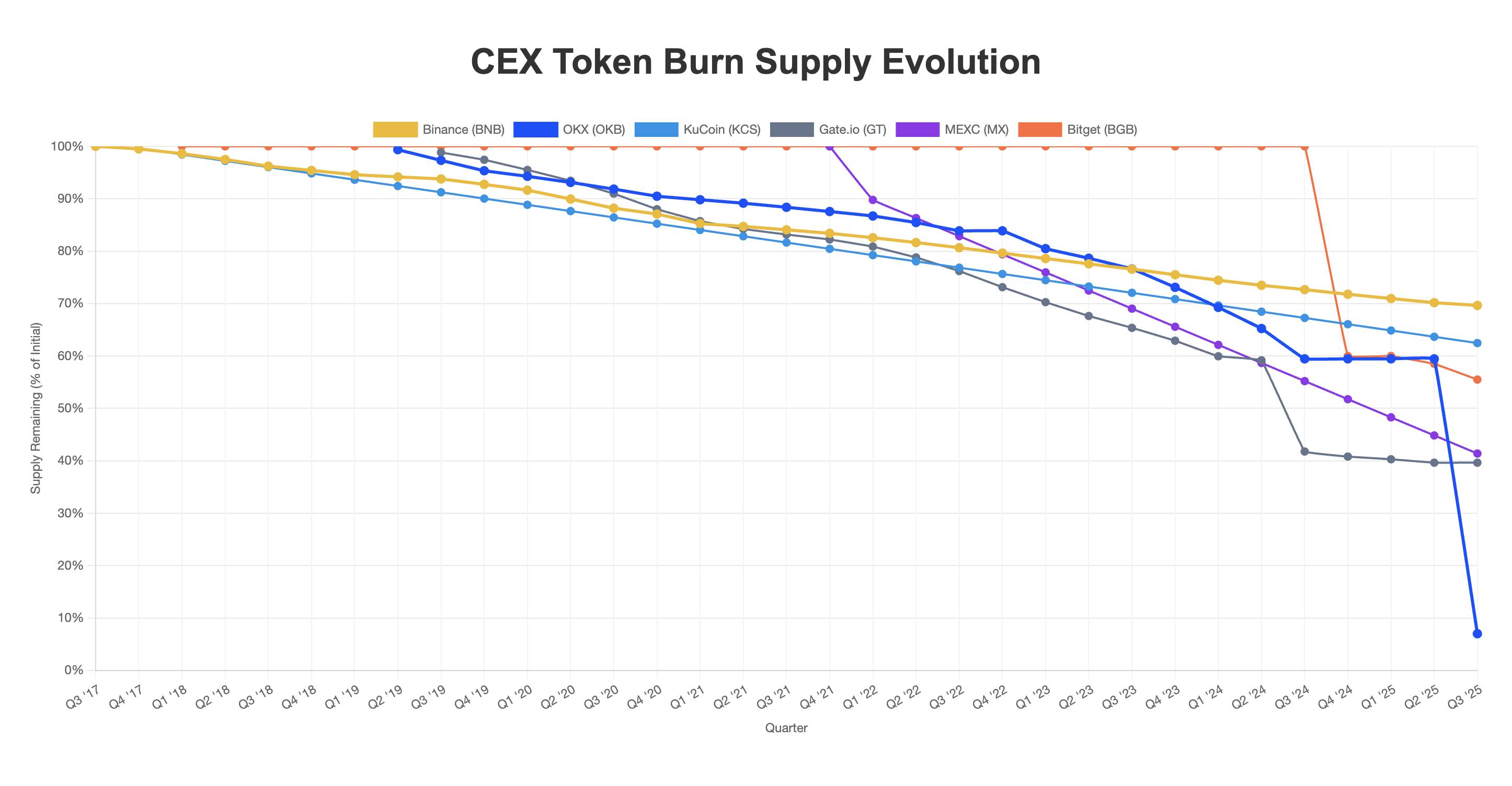

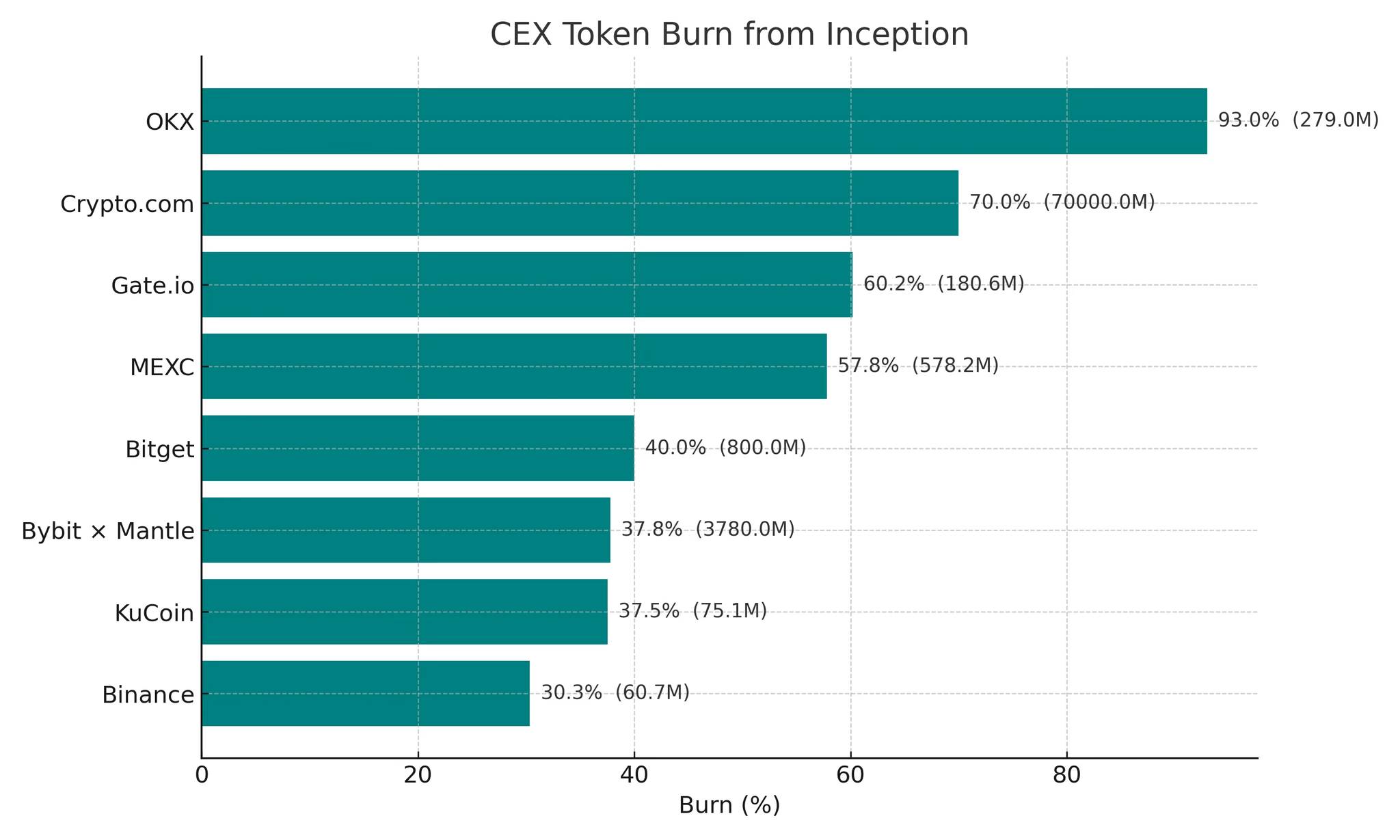

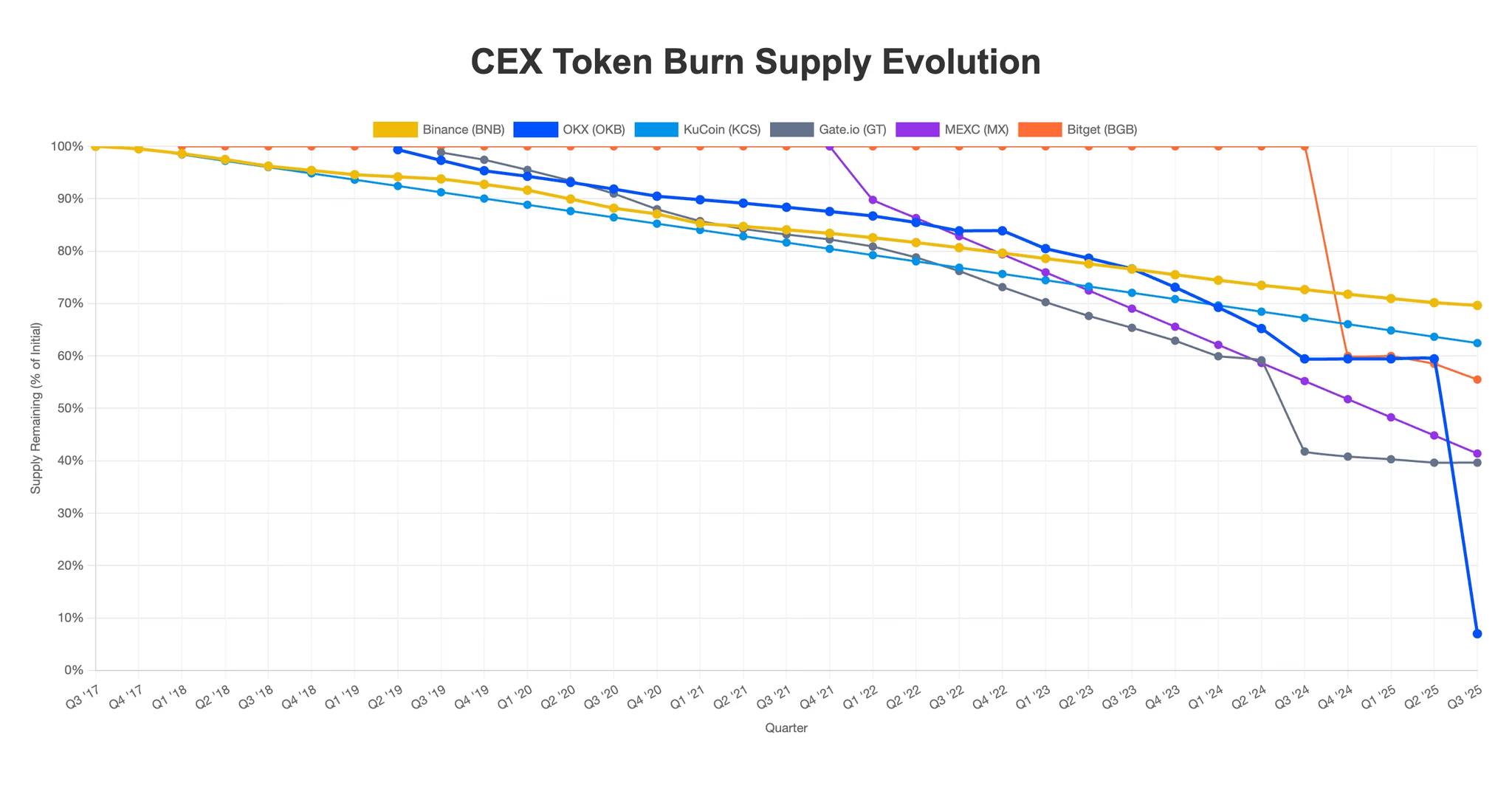

To clearly visualize this shift, here’s a breakdown of how exchange token supply dynamics are changing.

Key Takeaway: When analyzing exchange tokens, the burn model is crucial. Designs based on profit, formula-driven, or governance-controlled can have vastly different impacts on scarcity, predictability, and trust.

Destruction Model: The Exchange’s Operating Model

The exchanges’ destruction plans are mainly divided into three categories:

- Profit or revenue-linked (Gate, KuCoin, MEXC): A fixed percentage of revenue is used to purchase and burn tokens. Cadence is predictable and auditable.

- Formula or Funding Driven (Binance, OKX, Bitget): Supply cuts are determined by a formula or fund allocation. Larger in scale, but less correlated with business health.

- Governance-driven (Bybit, HTX): The destruction cadence is determined by voting among token holders. This model decentralizes control but introduces political and execution risks.

Burning schedules are also constantly evolving. For example, Binance transitioned from a profit-linked burn mechanism to one based on price and block count, and later added a BEP-95 gas fee burn mechanism. Binance even abruptly changed its burn rate to demonstrate that BNB was not a securitization. From a regulatory perspective, this de-profiting burn reduced the risk of securities classification, but the constantly changing mechanism created market uncertainty.

In addition, other CEXs have also updated their dynamics, such as:

KuCoin has adjusted the destruction rhythm to once a month for the sake of transparency.

Gate has maintained a stable 20% profit distribution since 2019.

Since the maximum supply of tokens is fixed, burns are infrequent. When they occur, they are valuable because they reduce the circulating supply and accelerate the process of a full supply compression.

Key Points: The burning model determines durability. Profit-linked = stable and auditable. Formula-driven = scalable but less transparent. Governance-driven = decentralized but less trustworthy. Sudden model shifts (e.g., Binance) create structural risks, while increased transparency (e.g., KuCoin) builds trust.

Regulatory perspective

The destruction model is not only about economics, but also about regulatory positioning.

In the traditional stock market, corporate buybacks have been controversial, with the U.S. Securities and Exchange Commission (SEC) raising questions about them, including:

- Market manipulation

- Internal interests

- Weak information disclosure standards

Token burning is equivalent to a buyback of cryptocurrency, but without the legal protections that come with it. This gap changes the way the model is designed.

- Profit-linked burns look most like buybacks and, because they directly link token value to profits, attract closer regulatory scrutiny.

- Formula-driven burn mechanisms (e.g., Binance’s auto-burn, OKX’s supply cap) are easier to defend. They can be described as mechanical, revenue-neutral, and less likely to trigger securities classification.

- Governance-driven burns add a political dimension. Regulators may deem community voting insufficient to prevent manipulation.

Key Point: Burn design is both part of token economics and part of legal defense. Decoupling burn from profits reduces regulatory risk but also reduces transparency for token holders.

Exchange model trends

The following three model trends are particularly prominent:

1. Scale and opacity

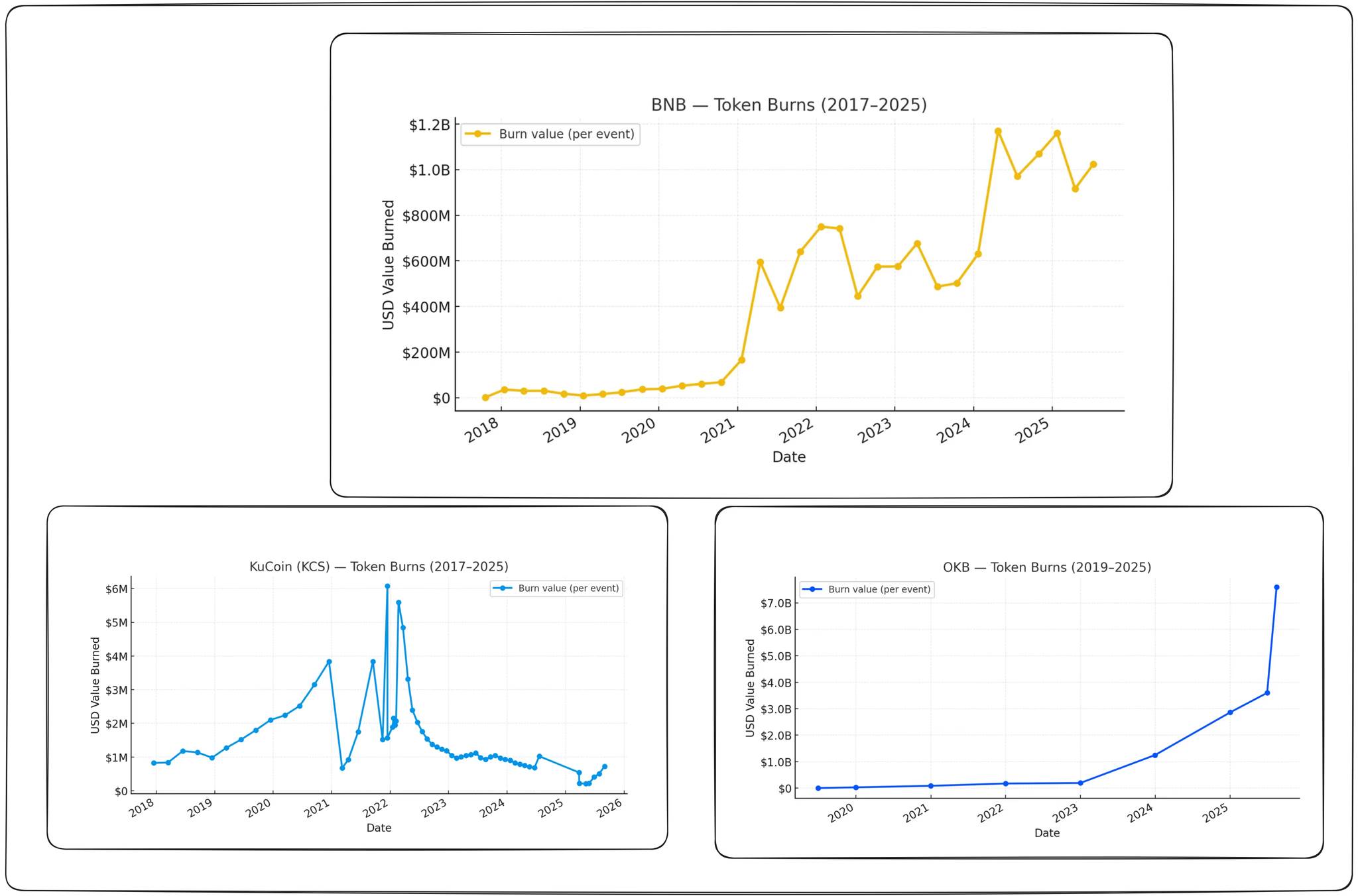

- Binance has the largest destruction (approximately $1 billion per quarter), but the rules are constantly changing.

- OKX finally set the supply cap at 21 million after years of pacing.

Key point: Size attracts attention, but rule changes and delays in setting caps undermine transparency.

2. Stable profit-linked rhythm

- Gate: Fixed 20% profit distribution since 2019, and has destroyed about 60% of the supply.

- MEXC: 40% profit distribution, approximately 57% destroyed.

- KuCoin: Token destruction will be changed to monthly in 2022, but the scale of destruction will be reduced as profitability increases (10% of profits)

Key Point: Profit-linked models are the easiest to predict. The less cash burn, the worse the business health.

3. New Entrants and Governance Risks

- Bitget: $5 billion will be destroyed in December 2024. Currently, about 30 million tokens are destroyed every quarter, with the goal of destroying 95%.

- Mantle: destroyed 98.6% of BIT during migration; now relies on the DAO.

Key Point: Marketing helps, but only a proven cadence can enhance longevity.

The pace, scale, and quality of destruction

Supply reductions have ranged from around 30% on Binance to around 93% on OKX. However, the market is pricing in more than just percentages; it’s also focused on the sustainability of the destruction and the predictability of its cadence.

- Gate, KuCoin, and MEXC: Stable Profit-Linked Destruction → Building Trust

- Binance: Largest scale → Blurred by constant adjustments to the formula

- OKX: Strengthening confidence through a massive $7.6 billion destruction → Multi-year consistency support

- Bitget: $5 billion destroyed → The first incident has not been verified and subsequent developments need to be observed

- Crypto.com: Revocation in 2025, destruction in 2021 → Leading to reduced trust

Note: The large burn in August 2025 coincided with a significant surge in OKB, demonstrating that one-time supply events can sometimes drive near-term price action.

Key Point: Don't just track the number of tokens burned. Ask: Is the scale repeatable? Is the cadence aligned with profitability? Is governance stable? Focus on the dollar volume burned quarterly/yearly. Large burns = credibility indicator, not guarantee.

Our overall view

- Consistency is more important than scale: the market tends to reward repeatability rather than simply generating headlines.

- The profit-pegged model is best: it ties the token value to the health of the exchange and is easy to assess (transparent).

- Massive destruction is just a marker: without follow-up action, it will gradually become a token act.

At present, buybacks remain an important marketing cost.

Interestingly, centralized exchanges actually choose to reinvest profits into their own tokens rather than retaining them in cash or USDC. This practice concentrates treasury value in the tokens themselves, amplifying both returns and risks.

Ultimately, as we've tried to demonstrate throughout this report, the true innovation lies not in burning itself, but in its consistency and transparency. Hyperliquid has undoubtedly redefined burning as a visible, recurring fund management function. This effectively reshapes industry expectations: scarcity alone is no longer enough. Scarcity that is regular, clear, and consistent with exchange economics is the true path forward for all exchanges. This shift may present significant challenges for CEXs that have been slow to implement it.