Author: @eyeonchains

Compiled by angelilu, Foresight News

Yesterday, a black swan event struck the market, marking the largest margin call in crypto history. However, someone managed to short the market in advance, establishing over $1.1 billion in short positions and generating profits exceeding $80 million in 24 hours. Was this a prediction or an inside job? The true identity of this whale has drawn market attention.

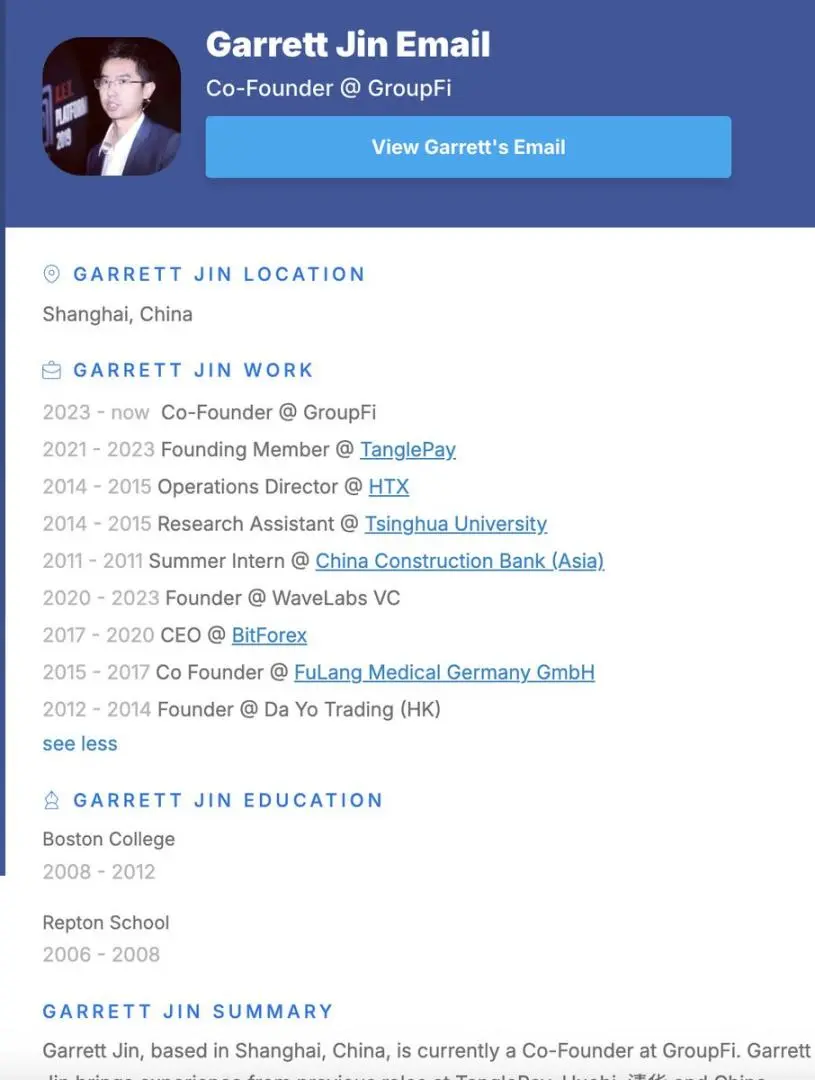

A thread on the online detective, Eye, revealed the identity of this whale. First, the findings reveal that the whale is a Chinese individual named Garrett Bullish, who has a diverse background in crypto, including stints as Director of Operations at Huobi (HTX), CEO of BitForex, which was embroiled in a trading scandal, and founder of several crypto projects. Furthermore, the source of his massive funds appears to be suspicious.

Regarding this incident, Zhao Changpeng retweeted the tweet, hoping someone could cross-verify it. Lookonchain suggests that Liquid Capital founder Jack Yi may have known that the wallet 0x52d3, which sent ETH to obtain gas, also transferred 1.31 million USDC to Trend Research's Binance deposit address.

ZachXBT, a credible on-chain investigator, only expressed doubts about the investigation at the time of posting, stating, "You clearly stated in your post that the Bitcoin whale was Garrett Jin, and now you are replying to me saying that these BTC must have come from multiple entities."

The authenticity of the investigation cannot be confirmed at this time. The following is the full text of Eye's analysis (slightly edited during compilation). Foresight News will continue to monitor subsequent developments:

Huge capital flows draw attention

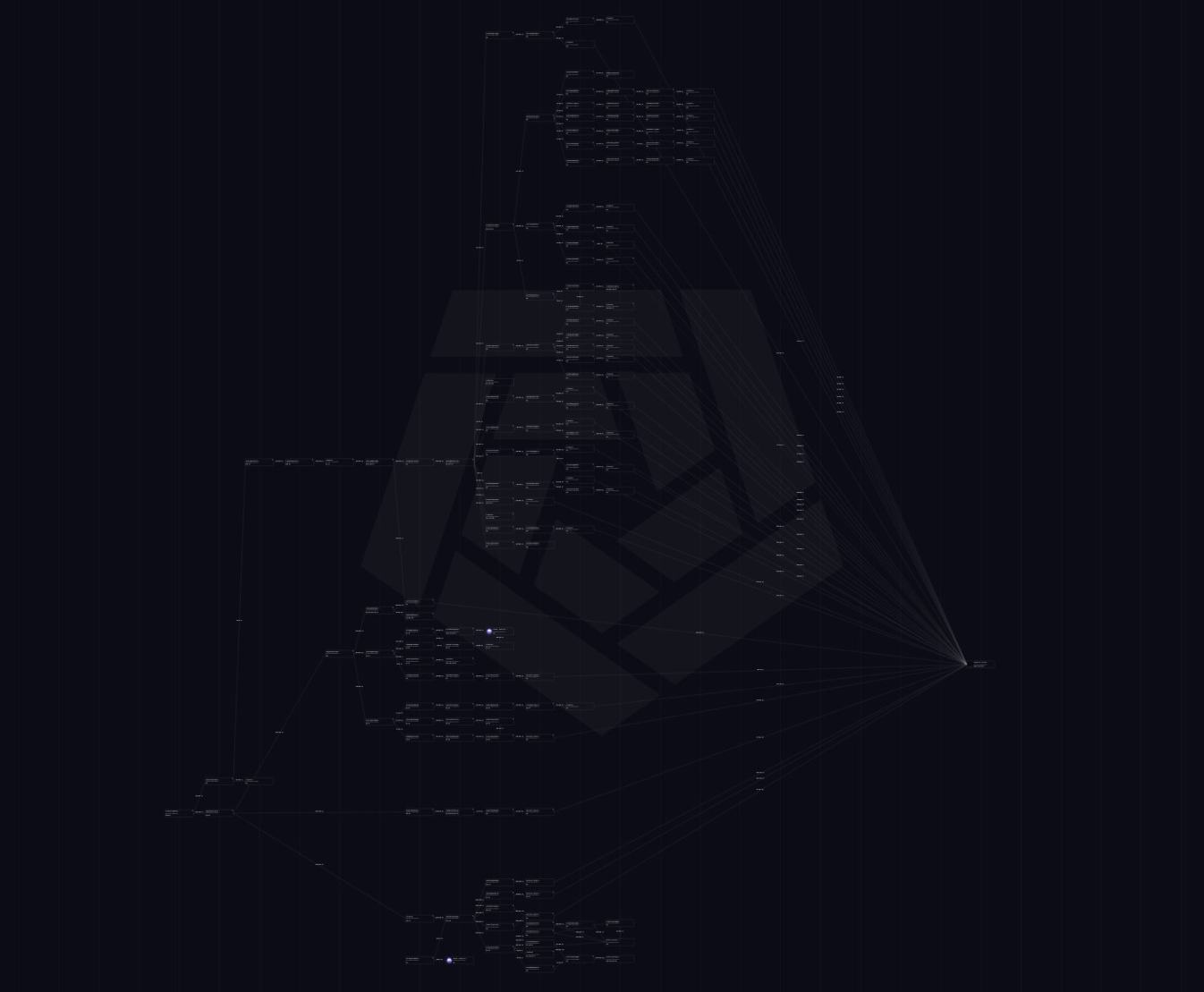

An investigation into the mysterious Hyperliquid/Hyperunit whale revealed that it holds over 100,000 Bitcoins. Recently, it sold over $4.23 billion worth of Bitcoin to purchase Ethereum, and also placed $735 million in short Bitcoin orders on the same platform.

Between August and September, the whale sold over 35,000 Bitcoin (BTC) for Ethereum (ETH) via Hyperliquid/Hyperunit spot and perpetual contracts, using a series of Bitcoin wallets. Meanwhile, multiple Ethereum addresses received over 570,000 ETH, all of which was subsequently deposited into the same Beacon deposit contract for staking.

Identity clues gradually emerge

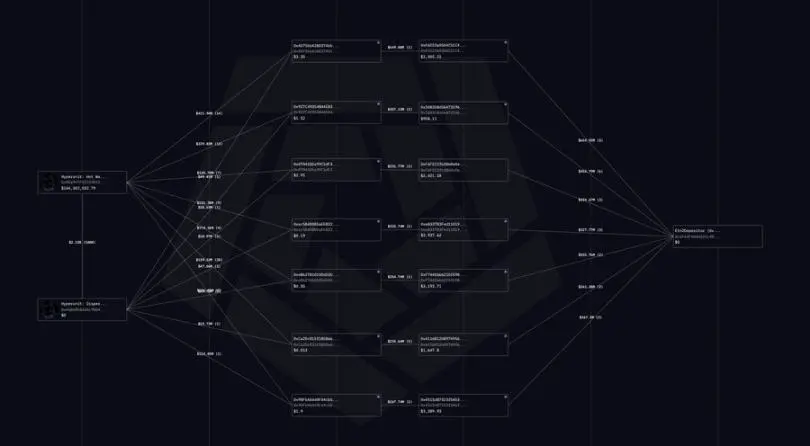

By analyzing the address of a whale that opened a $735 million Bitcoin short position, on-chain sleuth Eye noticed that it received transaction fees from a specific wallet. Tracing these transactions, the flow of funds was linked to an address called "ereignis.eth."

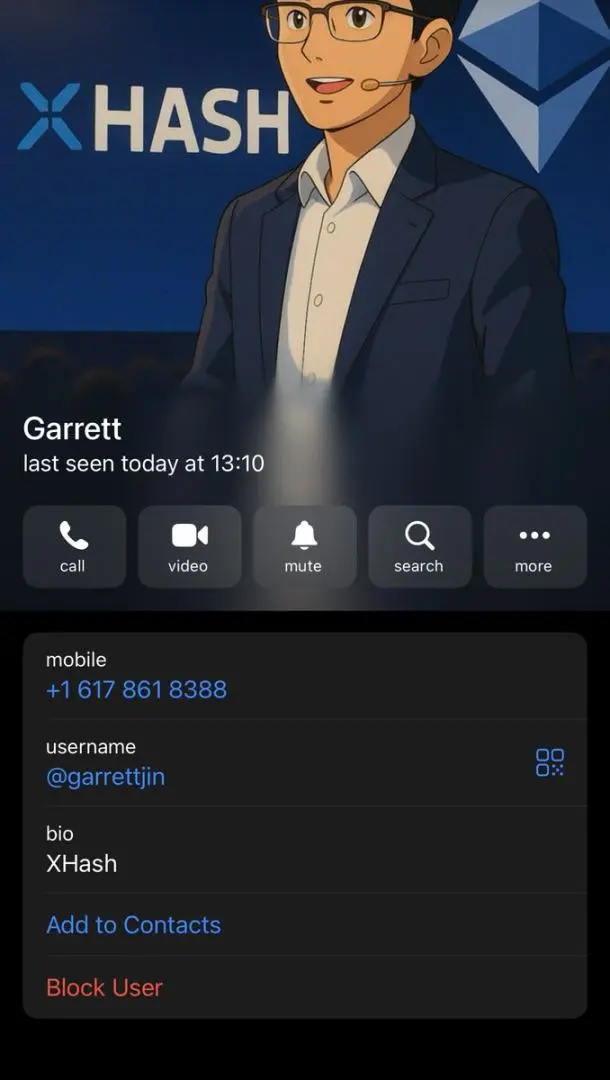

Further investigation revealed that “ereignis.eth” also has another ENS name: “garrettjin.eth”, which points to the X (Twitter) user @GarrettBullish.

Garrett Jin's Background

Garrett Jin graduated with a degree in economics from Boston University in 2008 and began his career at China Construction Bank. He founded Da Yo Trading (HK) in 2012 and later served as Director of Operations at Huobi (HTX) until 2015. He then moved to Frankfurt to co-found a healthcare platform, leaving that position in 2017.

From 2017 to 2020, he served as CEO of @bitforex.com. The exchange was later embroiled in scandal, accused of faking trading volume, and experienced a private key breach in early 2024, resulting in the withdrawal of approximately $57 million. The exchange was subsequently issued a fraud warning by the Hong Kong Securities and Futures Commission and ultimately shut down, leaving many users with lost funds.

Project History and Funding

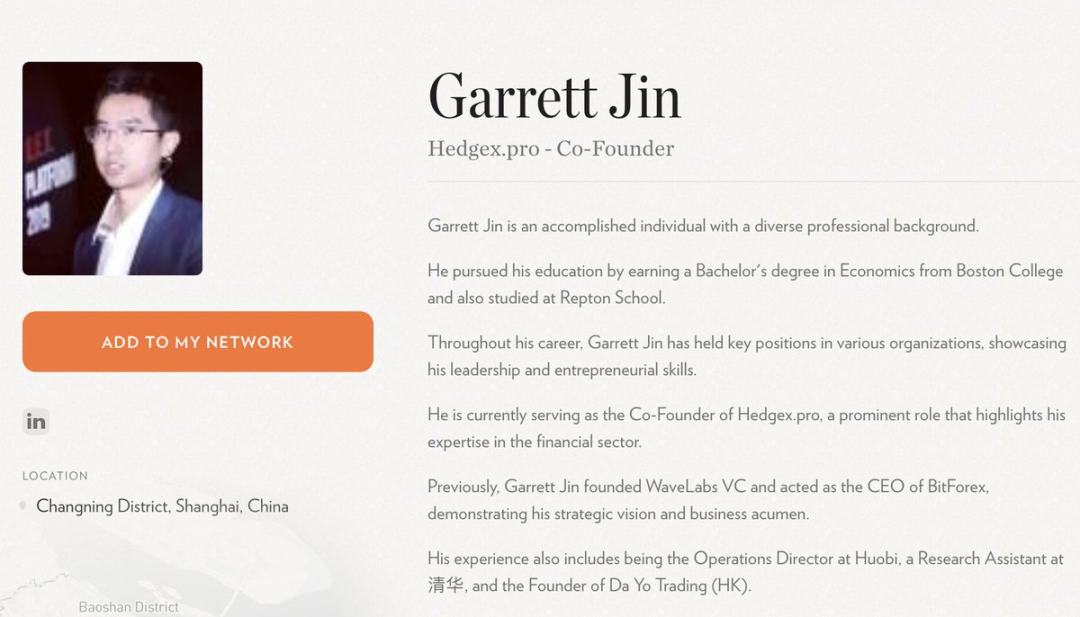

Garrett founded WaveLabs VC in 2020 during the Bitforex crash and launched several projects, including TanglePay, IotaBee, and GroupFi. The ENS name “ereignis.eth” (meaning “event” in German) further confirms his connection to these large-scale operations.

Investigations show that the funds of this Hyperliquid/Hyperunit whale mainly came from Bitcoin withdrawn from exchanges such as HTX and OKX a few years ago. This pattern forms a suspicious connection with his work experience at Huobi and the funds that disappeared in the Bitforex scam.

Current situation

Garrett currently holds 46,295 Bitcoins (worth approximately $5.19 billion) and is the founder of @XHash_com, a non-custodial Ethereum staking platform that may have been used to introduce suspicious funds.

Notably, after the investigation was released, Garrett immediately removed @XHash_com from his X profile and changed his profile picture. He also modified his Telegram privacy settings, hiding his previously public photos and phone number. Chain Detective Eye stated, "It seems he's hiding something."