Author: @agintender

The full text is as follows:

Navigating the crypto derivatives landscape: Why can Hyperliquid facilitate huge transactions while centralized exchanges impose stricter restrictions? The conflict between freedom and order has never been a problem of regulation and technology, but a problem of the value return of the trading system.

Overview

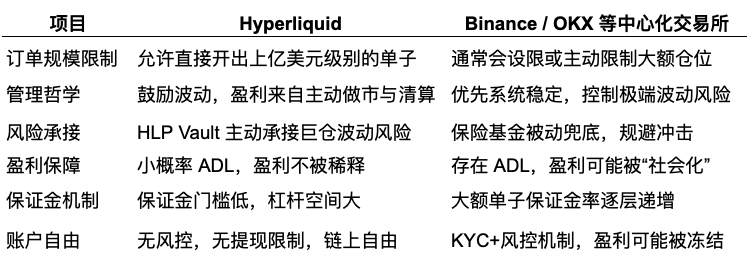

It is no coincidence that extreme trading (i.e. "ultra-high leverage + ultra-large positions") frequently appears on the decentralized platform Hyperliquid. This is because its underlying design philosophy and mechanism are naturally more suitable for high-risk, high-elasticity trading styles. Especially for strategic traders who "risk big with small", Hyperliquid provides six key advantages:

Hyperliquid is more like an "arena" for extreme traders, creating an ecosystem that allows extreme risk exposure, supports high-frequency trading strategies, and protects user rights with a non-custodial funding structure. Binance and OKX are more like "financial system gatekeepers", which, while pursuing stability and compliance, limit the space for individual extreme strategies.

There is no absolute superiority or inferiority between the two, only different choices of risk preferences and strategy styles.

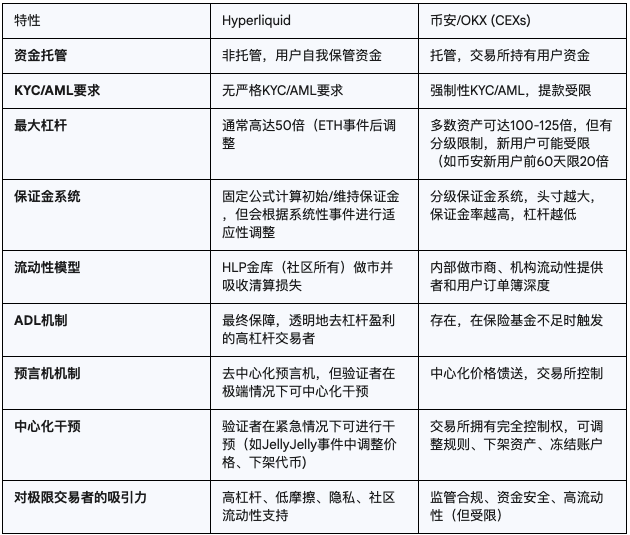

Function and feature comparison overview

This article will start with the HLP vault - starting with this "core mechanism" to discuss Hyperliquid's "Innate Giant Whale Body".

1. Liquidity Model: Hyperliquid HLP Vault Operation Mechanism

Hyperliquid's HLP (Hyperliquid Liquidity Provider) vault is a core component that enables the platform to operate efficiently as a market maker and liquidator. The HLP vault is not only a passive liquidity pool, it also actively participates in market making and liquidation. Its rapid growth to over $500 million in TVL shows its success in attracting capital, which directly translates into the deep liquidity required for large transactions. In addition, its risk-adjusted performance is strong, with a Sharpe ratio of 2.89 (compared to Bitcoin's 1.80) and a negative correlation with Bitcoin of -9.6%

The role of HLP in “absorbing losses” in the event of a major liquidation is a key feature that supports extreme traders in taking large positions, as it provides insurance against potential losses that could spread through the market. The “democratizing” nature of HLP means a broader and potentially more resilient base of liquidity providers, in contrast to relying on only a few large institutional market makers.

Market Maker and Liquidator Roles vs Insurance Funds

The HLP Vault acts as the default market maker on the platform. This means that it continuously provides buy and sell quotes, providing liquidity for all trading pairs. When users trade, a large portion of their orders are matched with the HLP Vault.

In addition to market making, HLP Treasury also plays a key role in the liquidation process. When traders’ margin is insufficient to maintain their positions, HLP Treasury intervenes to liquidate these positions, thereby preventing the accumulation of bad debts and ensuring the stability of the platform.

CEXs rely on centralized insurance funds to cover bad debt losses caused by insufficient liquidation. Although these insurance funds are usually large, their capacity is limited. When the market is extremely volatile and large-scale liquidations cause losses that exceed the capacity of the insurance fund, CEXs may need to initiate ADL or other mandatory measures.

The capacity of the insurance fund limits the single or multiple large liquidations that the exchange can withstand. If the loss caused by a large position liquidation is too large, even with the insurance fund, it may not be enough to cover it.

Once the extreme traders’ huge positions are liquidated, it may put tremendous pressure on CEX’s insurance fund, thereby triggering ADL, causing their profitable positions to be forced to close, and even causing distrust from other traders.

Community ownership and profit sharing

A unique feature of the HLP Vault is its community ownership. Users can become owners of the vault by staking USDC to mint HLP tokens. This means that the profits of the vault are directly distributed to HLP token holders.

Profits mainly come from the following aspects:

- Transaction Fees: The HLP Vault collects transaction fees from the trades it matches.

- Funding rate: As a market maker, HLP Treasury will charge or pay funding rate, depending on market conditions. When the market is in a premium (perpetual contract price is higher than the spot price), HLP Treasury will charge funding rate; otherwise, it will pay funding rate.

- Liquidation Profit: When the HLP Vault liquidates a position, it will charge a certain liquidation fee.

These profits are distributed to HLP token holders periodically (usually weekly) or used to buy back Hyperliquid tokens (performed every 10 minutes)

Diversify risk to support large positions.

The HLP vault supports the absorption and liquidation of large positions by spreading risk through the following mechanisms:

- Diverse liquidity providers: HLP vaults are made up of many independent stakers, rather than a single entity. This decentralized liquidity means that risk is spread across a large number of participants, reducing the risk of failure of a single entity.

- Automatic hedging and rebalancing: The HLP vault’s algorithm continuously monitors the market and automatically adjusts its hedging strategy to manage its risk exposure. For example, when the vault holds a large number of positions in one direction, it may reduce risk by hedging in the external market or adjusting its quotes.

- Smart Risk Management: The HLP Vault is designed to absorb large orders and effectively manage the risks posed by these positions through its internal hedging and liquidation mechanisms. This allows Hyperliquid to support larger individual positions than many centralized exchanges (CEX).

HLP is one of the core mechanisms of Hyperliquid. It can be said that its Oracle price design (3-second update, funding rate algorithm, and even leverage restrictions are all operated around HLP. They are not a separate link, but a whole, one link after another. The funding rate algorithm gives HLP a certain market maker advantage, and the Oracle price gives HLP participants confidence, so the size of HLP can continue to grow, and then it can absorb larger positions and withstand higher volatility.

2. Market Maker Advantage: Hyperliquid Funding Rate Algorithm

Hyperliquid’s funding rate algorithm is designed to closely anchor the price of perpetual contracts to the spot price of the underlying asset. In addition to providing traders with a funding fee with controllable costs and risks, it also provides HLP with a corresponding “market maker advantage”.

Components

The funding rate consists of two parts:

Average Premium Index: This reflects the deviation between the perpetual contract market price and the oracle spot price. When the perpetual contract price is higher than the oracle price, the premium index is positive; otherwise, it is negative.

Interest Rate: This is a fixed base rate, usually set to cover the financing costs of holding the contract. Hyperliquid’s interest rate is usually set at 0.3% (higher than Binance)

Based on the characteristics of oracle prices

Hyperliquid's funding rate is calculated based on the oracle price, not the spot price inside Hyperliquid. This ensures that the funding rate accurately reflects the fair price of the external market, thereby avoiding distortion of the funding rate caused by internal market manipulation. This feature gives confidence to "HLP participants" to a large extent, which in turn makes the HLP pool bigger and bigger. (Because Hyperliquid itself "can't" manipulate the price)

High frequency charges and extreme rates

High-frequency collection: Hyperliquid's funding rate is collected 1/8th of the time per hour. This means that the funding rate is calculated and collected once every 8 hours. This high-frequency collection mechanism enables the funding rate to respond to market changes more quickly and causes the perpetual contract price to return to the spot price more effectively.

Extreme rates: Hyperliquid allows extreme funding rates, up to 4%/hour. This high cap means that in extreme market conditions, funding rates can quickly become very high, quickly correcting the deviation between the perpetual contract and the spot price.

Risk cost expectations for large positions and market price regression mechanisms

Together, these features provide a risk cost expectation and market price reversion mechanism for large positions:

Predictable Risk Cost: Although funding rates fluctuate, their algorithm is transparent and based on observable oracle prices. This allows traders to predict the potential funding costs of holding large positions with relative accuracy. For extreme traders, they can manage their risk by factoring in high funding rates before entering a position.

Fast market price return: The combination of high frequency charging and extreme rates means that when the perpetual contract price deviates significantly from the oracle price, the funding rate will rise (or fall) rapidly, creating a strong incentive for traders to align their positions with the market consensus. This helps pull the perpetual contract price back to a level consistent with the spot price, effectively preventing price decoupling. This is especially important for large positions because it means that the market will have a strong self-correction mechanism even in the event of huge deviations.

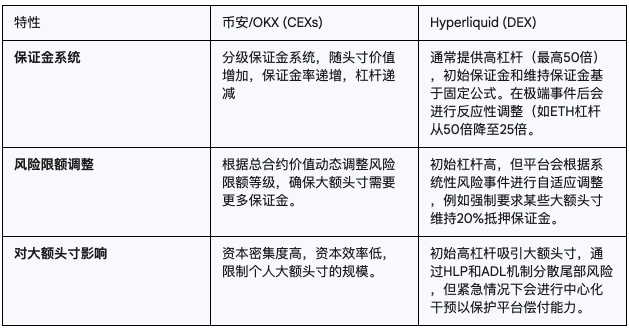

3. Capital cost advantage: Hyperliquid contract margin requirements comparison

Hyperliquid’s tiered margin system differs significantly from Binance and OKX’s initial and maintenance margin requirements for large Bitcoin perpetual contracts. This is mainly because the existence of HLP makes the platform more “inclined” to accept volatility.

Hyperliquid Margin Requirements

Hyperliquid uses fixed and relatively flat margin requirements, typically applying the same margin rate to all position sizes (e.g. 1% initial margin, 0.5% maintenance margin). This means that even the largest positions will have the same low margin rate applied.

Binance and OKX’s Tiered Margin System

Both Binance and OKX use a Tiered Margin System, which means that as the size of a position increases, the required initial margin and maintenance margin ratio will gradually increase. The core idea is that larger positions bring greater risks, so higher margins are required to cover potential losses. For example, if you hold a $10 million Bitcoin contract, you may only be able to use 20x leverage; while if you hold a $100 million contract, the leverage may be limited to 5x or even lower.

This mechanism is designed to protect the exchange itself. If a large position is liquidated, the losses may exceed the ability of its insurance fund to bear, thus threatening the stability of the entire platform. By limiting the leverage of large positions, CEXs reduce single-point risk. This directly limits the ability of extreme traders to establish super-large positions on CEXs. They need to invest more of their own funds as margin, or are forced to spread their positions across multiple accounts or multiple platforms, increasing operational complexity.

Take the Bitcoin perpetual contract as an example:

Binance: For smaller positions, leverage up to 125x may be provided (initial margin 0.8%). However, as the notional value increases, the available leverage will gradually decrease, which means that the margin rate will increase accordingly. For example, for positions exceeding a certain amount, the leverage may be limited to 50x (initial margin 2%), or even lower.

OKX: Similar to Binance, OKX also has detailed tiered risk limits. For example, the leverage of Bitcoin perpetual contracts is tiered according to the notional value of the position, gradually decreasing from a maximum of 100 times. This means that the greater the value of the Bitcoin contract you hold, the higher the margin ratio you need.

Evaluate whether Hyperliquid offers a lower margin threshold

Hyperliquid provides relatively low margin thresholds for large positions under specific leverage.

For small positions: Hyperliquid’s margin rates may be comparable to CEX’s highest leverage tier (i.e., lowest margin rate).

For large positions: Binance and OKX’s tiered margin system means that once a position exceeds a certain threshold, the required margin rate increases significantly. Hyperliquid maintains a low and fixed margin rate, which allows extreme traders to establish extremely large positions with relatively low funding costs.

For example:

Let's say you wish to establish a long perpetual swap position in Bitcoin worth $100 million.

On Binance or OKX, you may not be able to use 100x or even 50x leverage due to the tiered margin system. For example, you may only be able to use 10x or 20x leverage, which means you need an initial margin of $10 million or $5 million.

On Hyperliquid, if its flat margin rate is 1%, you only need an initial margin of $1 million.

Therefore, for traders seeking to enter large positions, the low and consistent margin requirements offered by Hyperliquid do constitute a significant advantage.

4. Profit withdrawal: Hyperliquid withdrawal policy investigation

Non-custodial platform features

Hyperliquid is a non-custodial platform. This means that users have relatively more control over their funds, which are stored directly in the user's EVM-compatible wallet. The platform itself does not directly custody the user's crypto assets.

Withdrawal restrictions and profit withdrawal blocks

Due to its non-custodial nature, Hyperliquid does not have daily withdrawal limits or barriers to profit withdrawals like centralized exchanges (CEXs).

- No daily withdrawal limit: Users can withdraw all or part of their funds on Hyperliquid at any time and anywhere, as long as the on-chain network allows it. There are no daily or per-transaction withdrawal limits set by CEXs for compliance, risk management, or internal liquidity management.

- No profit withdrawal blockage: Hyperliquid will not restrict users from withdrawing money because of their profits. Whether it is profit or loss, users have absolute control over their funds.

- For reasons such as compliance (AML/KYC), risk control, and internal liquidity management, CEXs usually have daily or per-transaction withdrawal limits. In some cases, when users have huge profits, withdrawals may be subject to stricter scrutiny or delays. Withdrawal limits are a reflection of CEX's custody power over user funds. They need to ensure that their reserves are adequate and comply with regulatory requirements to prevent illegal fund flows.

For traders like James Wynn who want to withdraw funds quickly after making huge profits or need to flexibly mobilize huge amounts of funds, CEX withdrawal restrictions are a serious obstacle. They cannot freely control their funds like on Hyperliquid. Hyperliquid's non-custodial model avoids these problems and provides users with greater freedom of funds. (At least on the surface)

5. Profit Guarantee: Hyperliquid Liquidation Mechanism and Automatic Deleveraging (ADL)

Hyperliquid Liquidation Mechanism

Hyperliquid's liquidation mechanism is based on margin rates. When a trader's maintenance margin rate falls below a certain threshold (usually 0.5%), their positions will be triggered for liquidation. Hyperliquid's HLP vault will act as a liquidator, taking over and closing these positions to prevent bad debts. Therefore, the more sufficient the funds in the HLP vault, the lower the probability of ADL being triggered.

Both Binance and OKX include an automatic deleveraging (ADL) feature. When the insurance fund is not sufficient to cover liquidation losses, ADL will force profitable traders to close their positions based on profit size and leverage level. ADL is the last line of defense for CEX to protect itself and maintain market order under extreme market conditions. It distributes a portion of liquidation losses to profitable traders to avoid liquidation or systemic risks.

For extreme traders who hold huge profitable positions, ADL is a huge uncertainty factor. Even if they successfully predict the market direction and gain huge floating profits, they may be forced to close their profitable positions due to the losses of others, thus losing some of their potential gains. This kind of profit uncertainty is something extreme traders do not want to see.

Hyperliquid’s differences in handling profitable positions

The main difference between Hyperliquid and CEX in handling profitable positions is that it does not include the ADL function. This means:

Profitable positions are not threatened: Even in the event of extreme market volatility leading to large-scale liquidations, profitable traders do not need to worry about their positions being automatically reduced by the system. This provides greater certainty and security for extreme traders because their profits will not be used to cover the losses of other traders.

HLP Treasury bears losses: If bad debts are generated during the liquidation process, these losses will be borne by the HLP Treasury instead of being distributed to profitable traders through ADL. This is due to the HLP Treasury's sufficient liquidity and risk management capabilities.

This difference makes Hyperliquid more friendly to profitable positions in extreme market conditions, and also allows extreme traders to hold large profitable positions with more confidence.

6. How HLP Vaults and Funding Rate Algorithms Work Together to Attract Extreme Traders

The unique design synergy of the HLP vault and funding rate algorithm enables Hyperliquid to attract and support extreme traders such as James Wynn to make huge transactions, which is reflected in the following aspects:

1. (Nearly) unlimited liquidity and depth (HLP vault):

Large order absorption capacity: As the main market maker of the platform, HLP Vault's huge capital pool and automatic market making algorithm can provide great depth to absorb super large orders. This is a basic requirement for traders like James Wynn who hope to establish tens of millions or even hundreds of millions of dollars in positions in one transaction. When facing a single order of this size, traditional CEX is likely to have too much slippage, or even the order cannot be fully executed.

Low slippage trading: Because the HLP vault provides continuous liquidity, traders can enjoy lower slippage even when trading large amounts, ensuring that their trades can be executed at close to the best market price, which is critical for high-frequency and extreme trading.

2. Predictable risk costs and market calibration (funding rate):

Tilted market maker advantage: more investors are willing to put their money into the HLP vault to provide more liquidity, earn more fees, and form a flywheel effect.

Clear expectations of funding costs: The transparency and high frequency of the funding rate algorithm allow traders to predict the funding costs of holding large positions with relative accuracy. Although the funding rate may be high, it is transparent and calculable, and traders can factor it into their risk models. For extreme traders, this means they will not take risks at unknown costs.

Price Anchoring and Arbitrage Opportunities: The existence of funding rates and high caps ensure that perpetual contract prices can quickly return to spot prices. This means that even in the event of huge price deviations, the market will have a strong self-correction mechanism. This provides arbitrage opportunities for extreme traders, who can take advantage of the price difference with the spot market and earn income by bearing the funding rate, or quickly open a position when the price deviates and expect the price to return.

3. Fund security and freedom (non-custodial & no ADL):

Free control of funds: Hyperliquid's non-custodial nature ensures that traders like James have full control over their huge funds and can withdraw them at any time without worrying about platform restrictions or potential fund freezes. This provides a great sense of psychological security in the context of frequent withdrawal issues or fund freezes on centralized platforms.

Profits are not threatened (no ADL): Hyperliquid does not use the ADL mechanism, which means that even when the market fluctuates violently and causes a large number of liquidations, James's profitable positions will not be automatically reduced by the system. This allows extreme traders to hold profitable positions with more confidence, without having to worry that their profits will be used to cover the losses of other traders, thereby maximizing their potential profits.

In summary, the HLP vault provides unparalleled liquidity and trading depth, while the funding rate algorithm provides a transparent and effective risk cost management and market price calibration mechanism. Coupled with the freedom of non-custodial and ADL-free funds, these together create a unique trading environment that enables Hyperliquid to meet the needs of extreme traders like James Wynn who pursue high leverage, large positions, and value the safety of funds and uneroded profits.

Write at the back

The rise of Hyperliquid shows that the market is evolving and that high-performing (real yield) decentralized exchanges, despite some centralized elements in practice, are carving out an important niche by providing features that traditional CEXs cannot meet or are limited to (such as high leverage, low friction, community liquidity).

This indicates that derivatives trading may become more fragmented and specialized in the future, and different platforms will provide different services based on traders' different needs, risk preferences, and acceptance of decentralization.

There is no right or wrong, better or worse, between the two, only different choices of risk preferences and strategy styles.

Leverage is the way out and the contract is the destination.

Who is taming desire? Who is releasing fluctuations? Who is returning to human nature?

May we always maintain a sense of awe for the market.