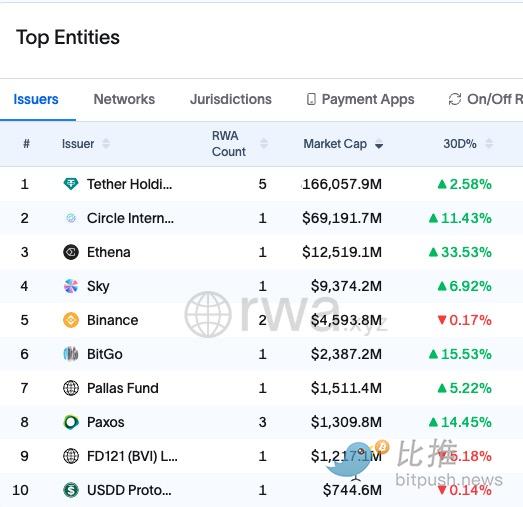

In the stablecoin market, which has long been dominated by two giants, USDT and USDC, USDe launched by Ethena is gaining momentum rapidly.

With the "strong support" of former BitMEX CEO Arthur Hayes, USDe's circulating market value has exceeded US$12.5 billion, an increase of nearly 35% in one month, far exceeding USDT and USDC, and is the world's third largest dollar-anchored stablecoin after Tether and Circle.

Mechanism: Hedging between spot and perpetual contracts

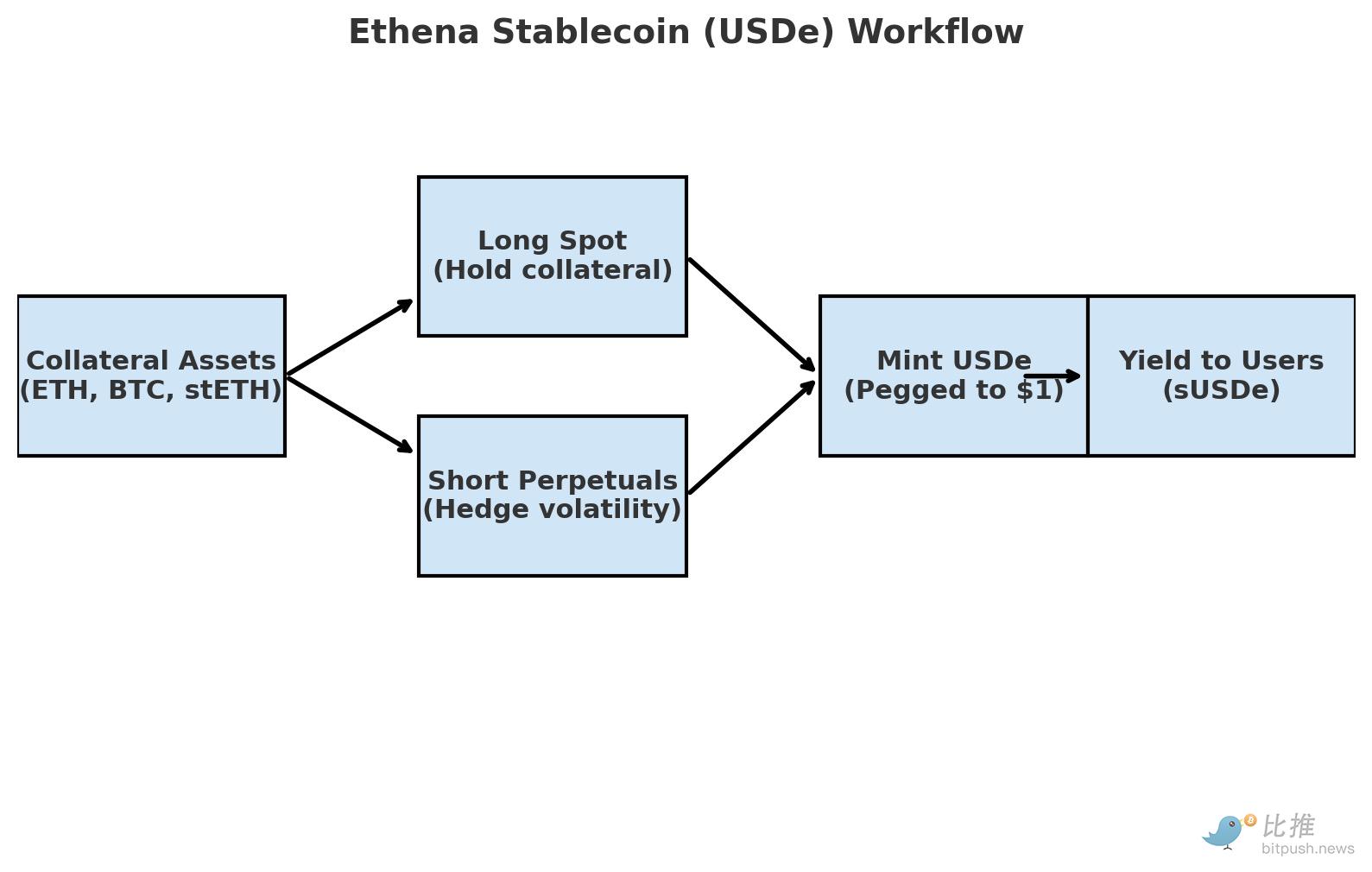

Unlike USDT and USDC, which rely on US dollar or treasury bond reserves, USDe adopts a "crypto-native" stabilization mechanism.

Users deposit ETH, BTC, or stETH into the protocol, and Ethena simultaneously goes long on these spot assets and establishes an equal amount of short positions on centralized exchanges. This way, regardless of market price fluctuations, the gains and losses from the spot and short positions essentially offset each other, maintaining the USDe stable anchor near $1.

On this basis, Ethena launched sUSDe. Since the perpetual contract funding rate has been positive for a long time, the protocol will distribute the profits to users who staked USDe.

The core advantages of this mechanism are:

- High yield: USDe provides users with high returns by staking ETH and utilizing the funding rate of perpetual contracts. The current annualized yield is much higher than traditional stablecoins.

- Decentralization: USDe does not rely on the traditional banking system and is considered a "crypto-native" solution.

- Market demand: With new regulations such as the US GENIUS Act prohibiting regulated stablecoins from providing returns, USDe’s non-bank design has attracted a large amount of capital seeking returns.

Currently, the annualized yield of sUSDe reaches 9%, which is much higher than the 4.2% of USDC on Aave. This is the important reason driving the continued influx of funds.

Data: Explosive Growth

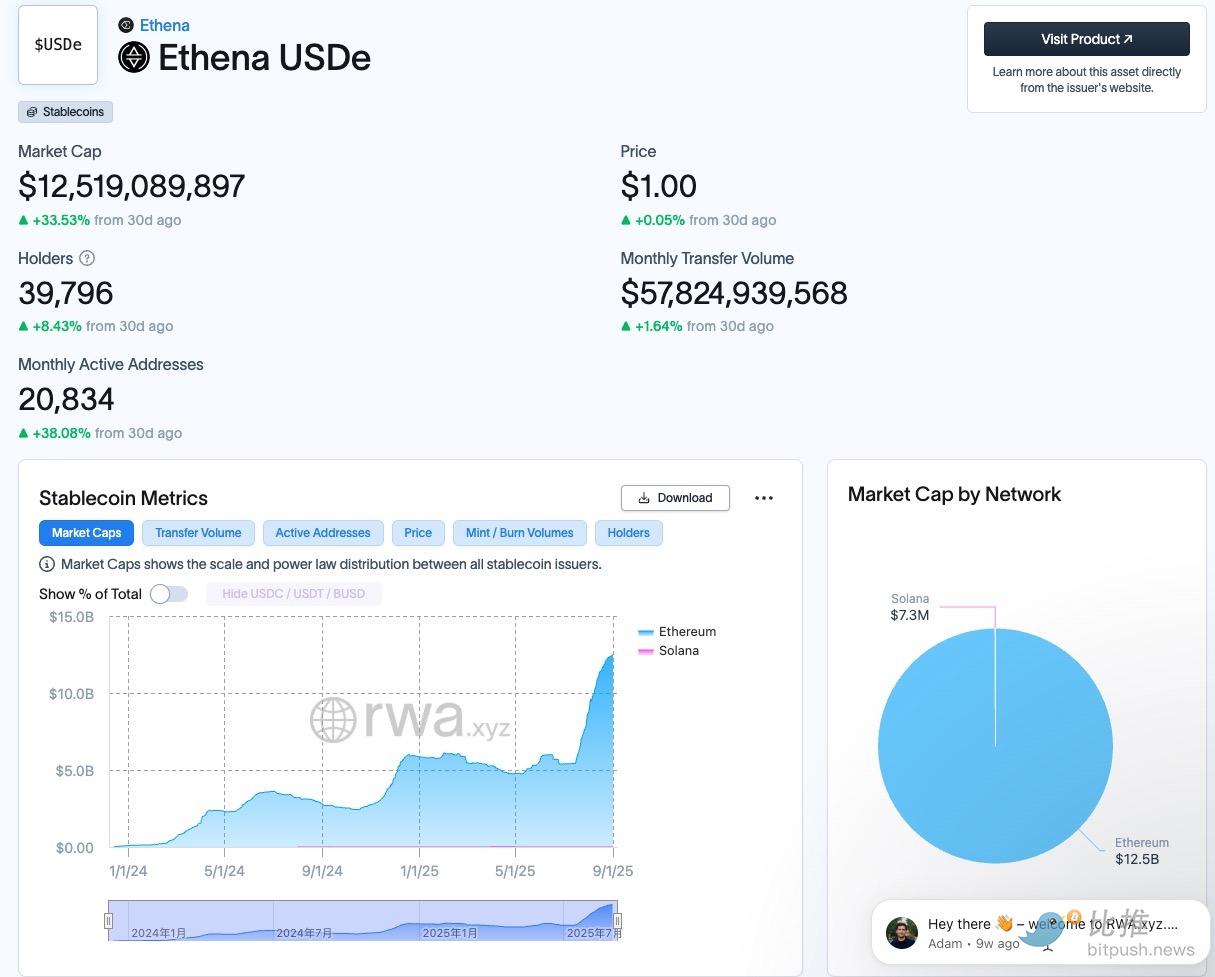

Data from RWA.xyz shows that USDe has experienced significant growth in recent months. Its market capitalization has risen to $12.52 billion, representing a growth of over 30% compared to 30 days ago. The number of addresses holding the token is approaching 40,000, with monthly active addresses exceeding 20,000, representing a nearly 40% increase. Monthly on-chain transfer volume has reached $57.8 billion, demonstrating its widespread adoption in settlement and payment applications.

Since July, the USDe market capitalization curve has become significantly steeper, indicating that it has benefited from favorable stablecoin legislation and the appeal of high returns.

It’s worth noting that USDe is almost entirely deployed on the Ethereum mainnet, with only $7.3 million on Solana. This means that USDe’s liquidity is highly concentrated, and its stability could be tested if the Ethereum ecosystem experiences fluctuations.

Fee Switch: A “dividend moment” for governance

Beyond the surge in scale, the market is also paying more attention to Ethena's ongoing fee switch, a governance milestone: once activated, a portion of the protocol's revenue will be distributed to ENA holders or injected into the treasury, transforming ENA from a "governance ticket" into an "asset with predictable cash flow."

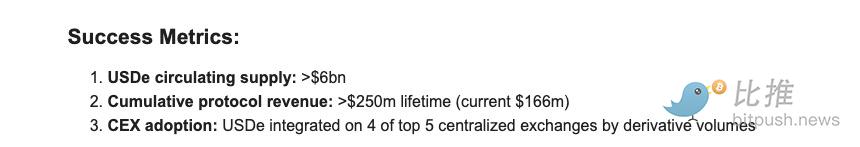

To implement this mechanism, Ethena has set three conditions: USDDe circulation exceeding $6 billion, cumulative revenue reaching $250 million, and integration with at least four of the top five global derivatives exchanges. The first two have already been completed, leaving only the final one still under development.

The potential impact of the fee switch is twofold. For ENA holders, it means that the token value is linked to protocol revenue, further increasing market attention. However, for sUSDe holders, if their profit sharing comes from the same revenue pool, their returns may be diluted. Finding a balance between token value repatriation, user benefits, and risk mitigation will be a key test for Ethena going forward.

Risk: Instability behind high returns

USDe’s rapid rise is not without its hidden challenges. USDe’s core challenges lie in the volatility of funding rates, counterparty risk on centralized exchanges, and liquidity management in extreme market conditions.

First of all, its returns depend on the funding rate. If the market turns into a bear market and the funding rate turns negative, sUSDe’s high returns may disappear in an instant.

Secondly, its hedging mechanism is highly dependent on centralized exchanges. Once the exchange encounters a black swan event, the risk exposure of the protocol will be difficult to control.

Furthermore, Chaos Labs has warned that Ethena's asset re-pledging could trigger a liquidity crisis on DeFi lending platforms, while S&P Global has even assigned USDDe a 1250% risk weight in its credit rating, significantly higher than USDT and USDC. These concerns highlight the potential fragility of the USDDe model.

Despite these potential risks, however, since its launch in 2023, the USDe has not faced any liquidity crises or experienced significant deviations from its dollar peg. This suggests that the future of the USDe will be a balancing act between its design risks and its operational capabilities. Whether it can maintain high yields while continuing to effectively navigate market challenges will be crucial in determining its continued success in the cryptocurrency ecosystem.