Author: Aylo

Compiled by Tim, PANews

First of all, you can't possibly escape the top. You can't do it, I can't do it, and I won't even try.

Cycle tops occur quickly over short periods of time but are usually not apparent until a significant period has passed before they are confirmed.

Day traders who focus on short-term trends may seize opportunities, but they have already called cycle tops so many times that these misjudgments have long since lost their meaning. They never look at the broader perspective.

I'm just a student learning about market trading, still accumulating knowledge and experience. I haven't experienced enough market cycles yet to consider myself an expert, so I'm just being candid here.

I make decisions independently and bear all my own profits and losses. I never consider myself a prophet, and it is common for new things to overturn old ideas.

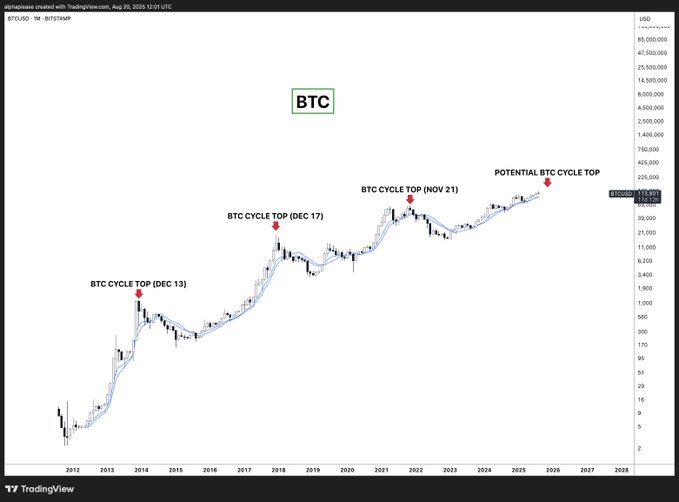

The evidence for the "four-year cycle theory"

Looking back at the historical BTC price chart, there is an unmistakable pattern: December 2013, December 2017, and November 2021. This four-year cycle remains remarkably regular, and market patterns tend to persist until fundamental changes occur.

Reasons why the four-year cycle pattern may continue to hold:

- Mental set: The four-year cycle of the crypto market has become deeply rooted in people's minds

- Self-fulfilling prophecy: Market perception could trigger a sell-off, coupled with leverage hidden in the system (e.g., the current round of digital asset treasury DAT?).

- Bitcoin Halving Correlation: Supply shortages caused by Bitcoin halving events have historically triggered price peaks 12-18 months in advance (although in the current cycle, this appears to be more narrative-driven)

- Occam's razor principle: The simplest explanation is usually the most correct. If it works three times, why make it complicated?

(Note: Occam's razor principle means that among different theories or models to explain the same phenomenon, one should give priority to the one that makes the fewest assumptions, requires the fewest entities, or is the simplest form. In other words, try to avoid unnecessary complexity.)

We are certainly not early in this cycle, Bitcoin has already risen significantly from the bottom. The four-year cycle pattern suggests that we are approaching a bull market top.

Refuting the Four-Year Cycle Theory (i.e., the 2026 Bull Market Theory)

I have a simple question: Will the institutional-driven cycle really look exactly like the two previous retail-driven cycles?

I generally agree with the market cycle theory, so the discussion here does not include super cycles, but I believe that market cycles can be under- or over-extended due to the influence of other factors.

Why do we say this time might really be different?

1. Differences in behavioral patterns between institutional and retail investors

- Spot ETF capital flows and traditional exchange capital flows have created a new liquidity model.

- Systematic profit-taking by institutions is smoother than that by retail investors and causes less panic.

2. Traditional indicators may have failed

- We have a large number of cycle analysis tools (such as NVT, MVRV, etc.), but their historical applicability is mainly based on retail-dominated markets.

- Institutional participation has fundamentally changed the situation of "excessive bubble".

- Calculated based on the price of gold, the current price of Bitcoin has not even exceeded the high point of the previous cycle, and it is not a bubble at all.

3. Changes in the regulatory environment

- The regulatory environment in this cycle is completely different. Currently, cryptocurrencies have been accepted by the United States and the SEC, and the institutional framework is gradually becoming clearer.

- Previous bull cycles ended in part due to regulatory storms (such as the regulatory crackdown on ICOs in 2018).

- The possibility of this sudden systemic risk leading to the end of the cycle has been basically eliminated.

4. The Federal Reserve and Macroeconomic Dynamics

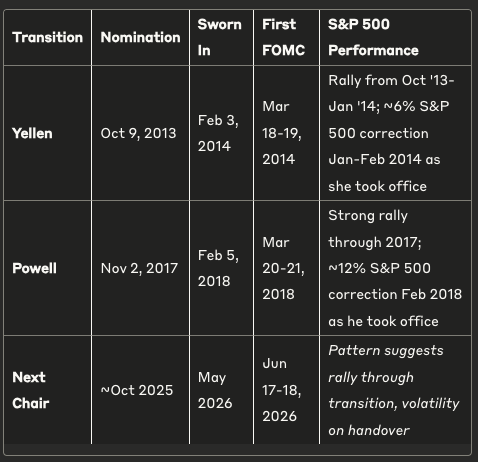

- Federal Reserve Chairman Powell's term will end in May 2026, and Trump may announce his successor in late 2025.

- The "shadow Fed chairman" effect not only weakens the effectiveness of current monetary policy, but also triggers pre-emptive buying due to market expectations that Trump will nominate a dovish chairman.

- The new Fed Chair's first FOMC meeting will take place on June 17-18, 2026, a potential catalyst event.

- A prolonged “Goldilocks environment” persists throughout the economic transition period.

(Note: Goldilocks environment is an economic term referring to the ideal state of "high growth and low inflation", which comes from the metaphor of "not too hot, not too cold" in the fairy tale "Goldilocks and the Three Bears".)

Historical patterns show that the change of Federal Reserve chairman usually attracts market attention.

A consistent pattern: Both presidential transitions have followed a similar pattern: the stock market rises on news of the nomination, and the rally continues throughout the transition period, but once the new president is officially inaugurated, the S&P 500 always pulls back.

During the Yellen transition (January-February 2014), the S&P 500 fell by approximately 6%, while the Powell transition (February 2018) triggered a correction of approximately 12%. This suggests that Trump's announcement of his nominee for president at the end of 2025 could extend the bull market into the transition period. However, there is a high probability of market volatility during the power transition in May-June 2026, which could coincide with the top of the cycle.

5. Market structure changes

- Concerns about currency devaluation are giving rise to new drivers beyond risk appetite

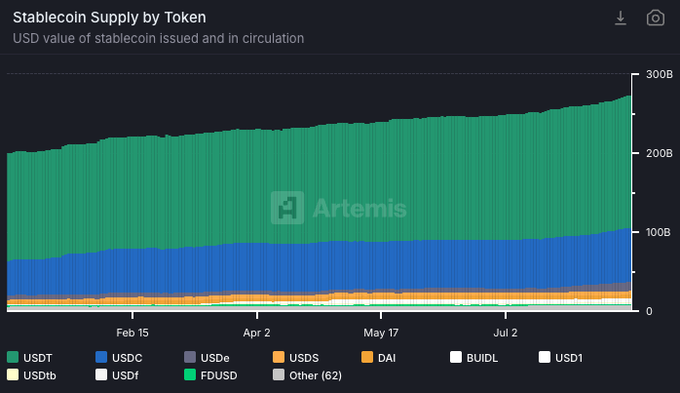

- Stablecoin market capitalization, a leading indicator, is currently continuing to grow (our "reserves" indicator).

The current sources of demand for Bitcoin are more diversified than in previous cycles: ETFs, digital asset treasuries, and pension funds.

What factors may end the 2026 bull market theory early and cause the four-year cycle to reappear?

- Cryptocurrency Treasury Leverage Risk: The most significant bearish factor I've observed is the possibility that cryptocurrencies treasury firms could liquidate leveraged positions at a faster-than-expected rate. A massive forced sell-off could overwhelm buyers and alter market structure. However, it's important to distinguish between a loss of buying demand (in which case the net asset value remains at 1) and forced sellers, triggering a "cascading sell-off." If major treasuries weaken their buying power, the market impact will clearly be significant. There are already numerous signs that this is happening, with both Strategy and major ETH treasury institutions experiencing significant declines in net asset value. I'm not blind to this, and neither should you be, so it's crucial to monitor this closely.

- Macro risk: The real macro risk is a resurgence of inflation, but I haven't seen any evidence of that yet. Cryptocurrencies are highly correlated with the macro environment, and we are still in a Goldilocks economy.

Top features that have not yet appeared

The frenzy has not yet arrived

The concerns remain: every 5% drop triggers calls for a market top (as has been the case for 18 months).

There is no ongoing enthusiasm or consensus in the market for a continued upward trend.

No top selling occurs (optional)

If the crypto market sees a sharp rise by the end of this year and significantly outperforms the stock market, this signal of a peak surge may indicate that the crypto market will peak before the business cycle peaks, and this business cycle will most likely continue until 2026.

Stablecoin Leading Indicators

A particularly useful indicator: stablecoin market capitalization growth

In traditional finance, the growth of the M2 money supply is often a precursor to asset bubbles. In the crypto market, the total market capitalization of stablecoins plays a similar role, representing the total "dollar" liquidity available in the crypto market.

Historical data shows that major crypto market cycle tops often occur 3-6 months after stablecoin supply growth stagnates. As long as stablecoin supply continues to grow significantly, it means that the market still has ample room to rise.

My current opinion

I have to say this with a gun pointed at my chest: based on current observations, I don’t see the top of the major cycle arriving before 2026 (this view can be changed quickly, so don’t be too serious about it).

We only have three data points covering a four-year cycle to validate this, and institutional participation represents a fundamental shift in market structure. The news of a Fed chairman transition alone could extend the Goldilocks environment into 2026, which I believe is particularly relevant given that cryptocurrencies are more correlated with the macroeconomy than ever before.

This time around, market participants have a deeper understanding of the four-year cycle, which makes me think the outcome will be different. When has anyone ever made the right call? Is everyone preparing to sell out en masse, following the four-year cycle?

However, I admit that this four-year cycle has been surprisingly stable, and market laws tend to persist until they are broken. When the public begins to realize this cycle, it may become a self-fulfilling prophecy that ends the law.

I will continue to take profits on over-performing altcoins when Bitcoin Dominance (BTC.D) pulls back, but I will hold onto Bitcoin, as I predict it will reach a new all-time high in 2026. It's important to note that regardless of how the current market cycle evolves, your altcoin holdings could peak at any time.

Conclusion

The four-year cycle is the strongest argument supporting the 2025 peak prediction. This pattern has been proven three times, and simple rules often work. However, factors such as market structural changes brought about by institutional investors, the unique nature of the Federal Reserve's policy transition period, and the lack of market enthusiasm suggest that this cycle may continue until 2026.

The coming months will be full of uncertainty, so it is not advisable to stick to the old ways.

In any case, once you face the reality and feel that you cannot escape the top, you can start to develop a systematic exit strategy.

The right position is one that allows you to sleep soundly at night. It doesn't matter if you sell too early, as long as you've made enough money.

I'm absolutely open to all opinions, including opposing ones. I wrote this article to help me make a decision and to "learn openly."