At 3 a.m., you're lying in bed trading Apple stock on your phone.

Pledge Tesla shares into DeFi protocols to borrow stablecoins;

Even using crypto wallets to buy a fraction of SpaceX shares...

These "impossible tasks" in the traditional financial market are becoming the new trend in the investment market in 2025.

Digital stock tokens are blurring the lines between cryptocurrencies and traditional investments. Crypto exchanges like Kraken and Bybit, along with traditional platforms like Robinhood, are vying for a foothold in this new era of "stock tokenization."

What is it exactly?

Tokenized shares are digital representations of real company stock that exist on a blockchain network rather than a traditional exchange. You can think of them as crypto twins of real stocks—each token typically represents one share (or fraction) of a company and is fully backed by real shares held in escrow.

When you buy a tokenized Apple share, a licensed custodian holds the actual Apple shares in reserve, and you receive a blockchain token whose price moves in sync with the stock price. These digital stock tokens can be traded on cryptocurrency exchanges, integrated with DeFi protocols, and transferred between wallets—functions that are impossible with a traditional brokerage account.

Who are the pioneers?

In 2025, the tokenized equity space is exploding, with cryptocurrency exchanges and traditional brokerages vying for market share.

- Kraken and Bybit launched simultaneously in June 2025, offering over 60 US stock tokens under the brand name "xStocks." They partnered with Swiss firm Backed Finance to tokenize blue-chip stocks like Apple, Tesla, and Nvidia, as well as the S&P 500 ETF, on the Solana blockchain. KuCoin followed suit, integrating xStocks to offer USDT trading pairs, while Bitget also joined the fray, enabling seamless wallet transfers and DeFi compatibility.

- Robinhood has launched over 200 tokenized stocks for its European customers, including shares in private companies like OpenAI and SpaceX. The tokens, based on the Arbitrum blockchain, saw their release send Robinhood’s stock price to a record high.

- eToro has expanded its 24/5 stock trading service and announced plans to launch ERC-20-based tokenized stocks on Ethereum, with the goal of achieving a true 24/7 market by the end of the year.

- Gemini entered the space through a partnership with FINRA-approved startup Dinari, while CMC Markets has also hinted at launching tokenized assets through CMC CapX.

Why did it break out?

The maturity of infrastructure is a key factor, and blockchain technology has finally ushered in its golden moment for financial applications.

Today, high-performance networks like Solana and Ethereum's Layer-2, with their lightning-fast transaction speeds and near-zero fees, provide an ideal infrastructure for financial innovation. More importantly, this is no longer a period of unchecked growth. A group of licensed institutions in crypto-friendly regions like Switzerland and the EU are injecting expertise and trust into this emerging market.

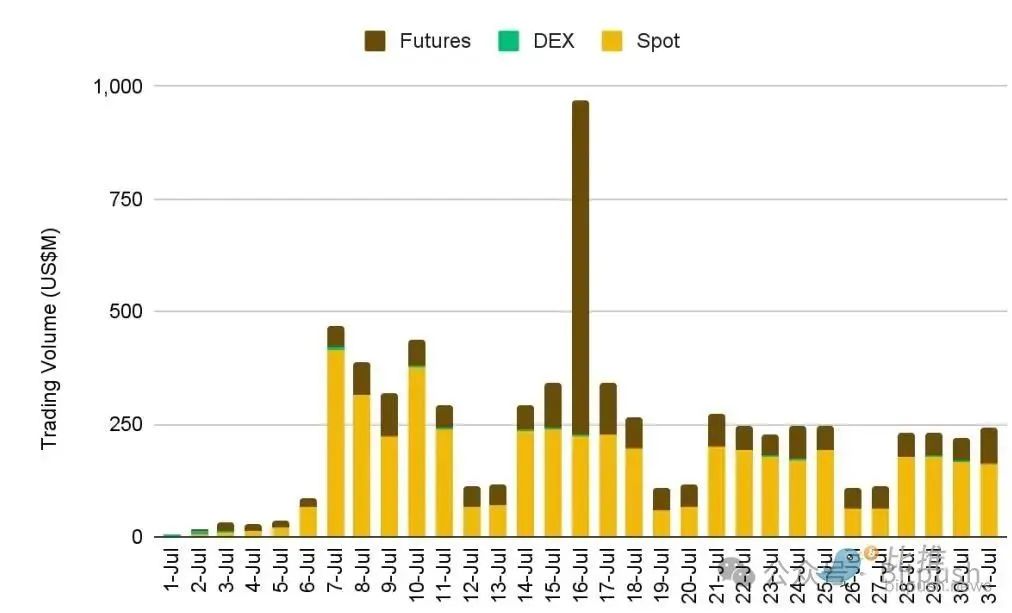

Behind this revolution lies the global investor's strong desire for a "never-closing market" trading experience. This investment freedom, which transcends the constraints of time and space, enabled Backed Finance's xStocks platform to achieve a trading volume of US$300 million in just one month, confirming the market's strong demand for on-chain stock trading.

According to a report from Binance Research, the tokenized equity market saw explosive growth in July, reaching a total market capitalization of $370 million. While $260 million of this was attributed to the Exodus Movement (EXOD) stock issuance via Securitize, excluding this issuance, the remaining market capitalization increased from $16.7 million in June to $53.6 million, a 220% monthly increase.

The growth in investor demand is also reflected in the number of addresses: the number of blockchain addresses holding tokenized shares surged to over 90,000 in July, compared to just 1,600 in June.

This pace is reminiscent of the early DeFi Summer boom of 2020-2021, when total locked value in DeFi grew from $1 billion to $100 billion in less than two years. This suggests that tokenized equities may be approaching a major inflection point that will accelerate the transition to hybrid finance.

Advantages: Combination of 24/7 market and DeFi

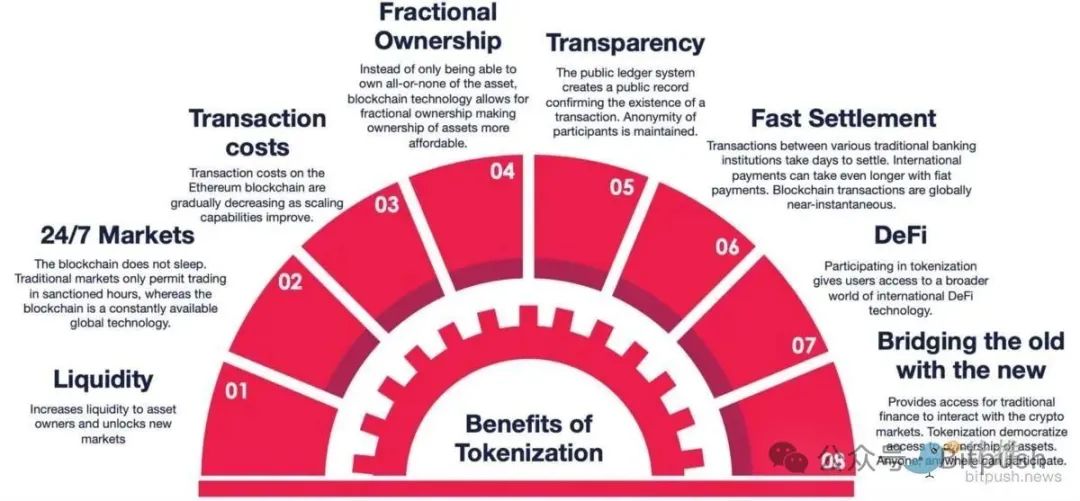

Tokenized stock promises offer several advantages over traditional stock trading:

- Longer Trading Hours: They offer 24/5 trading, covering both Asian and European time zones, and can even trade when US markets are closed.

- Instant Settlement: Traditional stocks require T+2 (two business days) settlement, while blockchain transactions can be settled in seconds without the need for intermediaries.

- Fractional Ownership: Seamless fractional ownership is achieved through the divisibility of the blockchain.

- Lower fees: Through the efficiency of blockchain, Bitget advertises that its users only need to pay gas fees and do not need to pay broker commissions.

Tokenized stocks also enable new investment methods that are not possible with traditional portfolios:

- DeFi Integration: Equity tokens can be used as collateral for DeFi lending, generating new income streams.

- 24/7 Trading: Allows instant position management across global time zones.

- Portfolio diversification: You can hold both Bitcoin and tokenized stocks on a single platform.

Mark Greenberg, global head of Kraken’s consumer business, said the ultimate goal of tokenization is not just to create “Wall Street on the blockchain,” but to enable a 24/7, autonomous, and globally accessible experience, much like the internet, thereby unlocking new accessibility for investors.

"Packaged" products and hidden risks

Despite the positive market outlook, tokenized stocks also face controversy.

The "Not Real Stock" Controversy: Some argue that these tokens are essentially "Contracts for Difference" (CFDs) for the crypto era. As experts put it, "It's just a wrapper... not real stocks." Token holders are completely dependent on the promises of the issuer and custodial arrangements—if the chain of trust breaks, they have no direct recourse to the underlying shares.

Liquidity Risk: During non-trading hours, liquidity may be insufficient. Market makers may find it difficult to hedge stock risk when the underlying market is closed, which may lead to artificially high prices and wide spreads during non-trading hours.

Europe leads, US lags

Europe is leading this revolution thanks to its more inclusive regulatory framework. The EU has no accredited investor requirements, while regulatory clarity in places like Switzerland makes it an ideal choice for issuers.

Kraken, Bybit, and KuCoin have all restricted their tokenized stock services to non-U.S. users. The U.S. market remains closed to retail tokenized stock trading, and the SEC may deem these tokens securities requiring registration or restrictions on accredited investors.

Market forecast: Reaching a trillion US dollars in 2033

While still in its early stages, the adoption of tokenized stocks is showing positive signs. Market enthusiasm was also reflected in the surge in Robinhood’s stock price following the announcement of its tokenized stock offering.

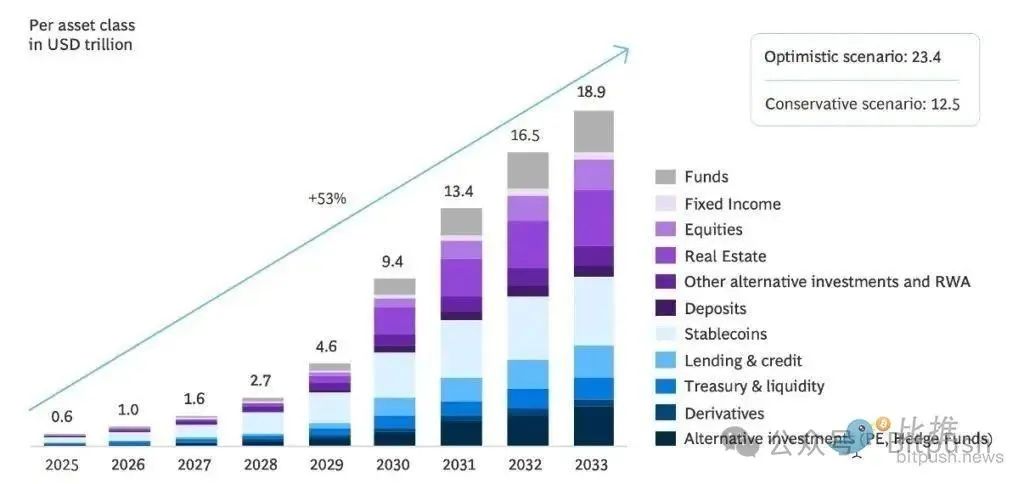

Binance Research predicts that if just 1% of the global stock market were tokenized, the market capitalization of tokenized stocks could exceed $1.3 trillion, eight times the DeFi market's peak. This, in turn, would drive demand for more sophisticated DeFi infrastructure, and the two would reinforce each other and drive blockchain adoption.

BCG data shows that RWA will grow from $600 billion in 2025 to $18.9 trillion in 2033. Even if global stock trading only accounts for a small portion, it can bring huge trading volume to tokenized platforms.

Which chain ecosystem is dominant?

Solana has become the blockchain of choice for tokenized stocks due to its high throughput and low transaction costs. Kraken, Bybit, and Backed Finance have all chosen Solana. Ethereum also maintains its importance through Layer-2 solutions (such as Arbitrum, which powers the Robinhood platform) and its vast ecosystem.

platform | Issuer | state | Number of stocks/ETFs | technology | user |

Kraken | xStocks | Online | 60+ | ERC-20 Bridging to Solana | Non-U.S. users |

Bybit | xStocks | Online | 60+ | ERC-20 Bridging to Solana | Non-U.S. users |

Robinhood | Stock tokens | Pilot projects | 200+ | Arbitrum L2 | EU residents |

Gemini | via Dinari | Online | Rolling online | ERC-20 on Base & Arbitrum | EU residents |

Dinari | dShares | Online | 40+ | ERC-20 on Base & Arbitrum | Non-U.S. users |

Backed Finance | xStocks | Online | 60+ | ERC-20 Bridging to Solana | Any platform that integrates this technology |

In summary, tokenized stocks are opening a Pandora's box, blurring the lines between traditional finance and the crypto world. The only question now is: how long will it take Wall Street to catch up with this new era of trading in a city that never sleeps?