Article written by Prathik Desai

Article compiled by: Block unicorn

As we move through the three quarters of 2025, I thought it would be a good time to take a look back at how money is flowing into the crypto ecosystem.

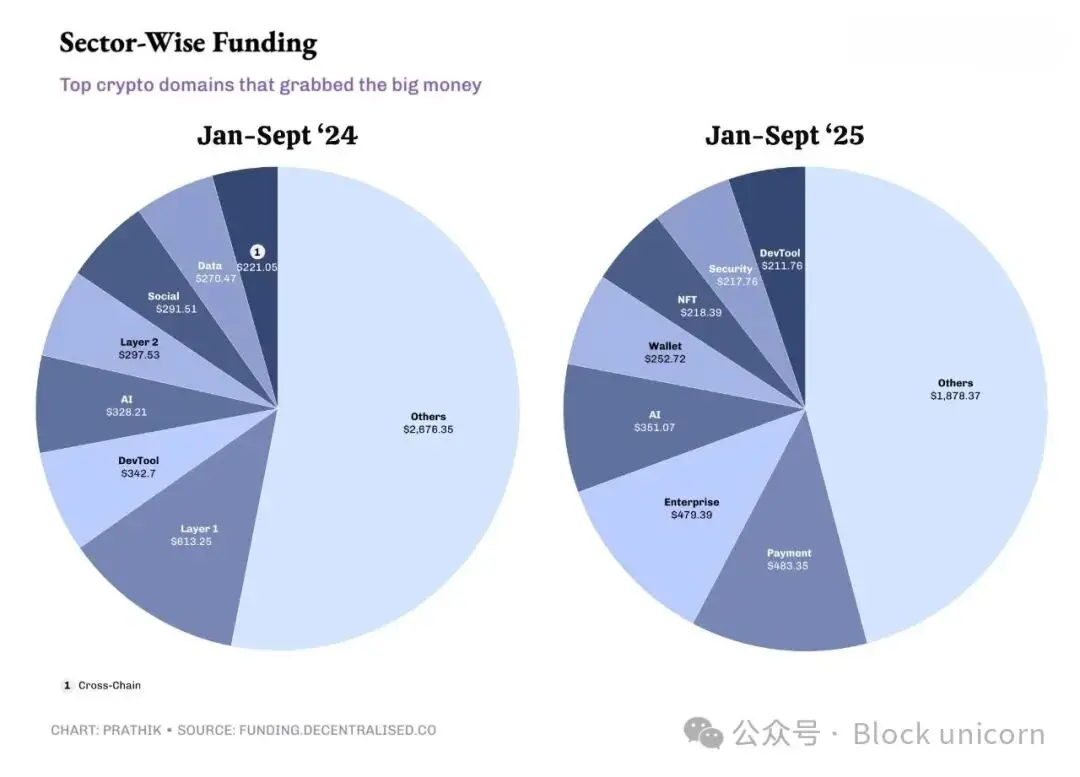

While 2024 will see a surge in funding for Layer 1 and 2 projects, developer tools, and AI products, this year’s funding will primarily support payments and enterprise-grade infrastructure.

Funds that chased every hot idea last year are now becoming more selective, focusing on a few specific areas. The result is fewer deals but more money, and the venture capital market seems to see the value of cryptocurrencies more clearly.

While overall funding is down year-on-year in the nine months to September, the data tells us this may not be a bad sign for projects building in this space.

Okay, now let’s get to the point.

From January 1st to September 30th, crypto venture capital investment totaled $4.09 billion across 463 funding rounds, of which 392 disclosed check amounts. This represents a 19% decrease from the same period last year, according to funding tracker data from Decentralised.co. During the same period in 2024, total funding was $5.04 billion across 980 deals, of which 725 disclosed funding amounts.

Despite the decline in total funding, the average deal size of disclosed rounds surged 50% to $10.4 million, while the median check size rose from $3 million to $4 million in 2025. Thus, the market appears calmer than the previous year, yet capital intensity is higher.

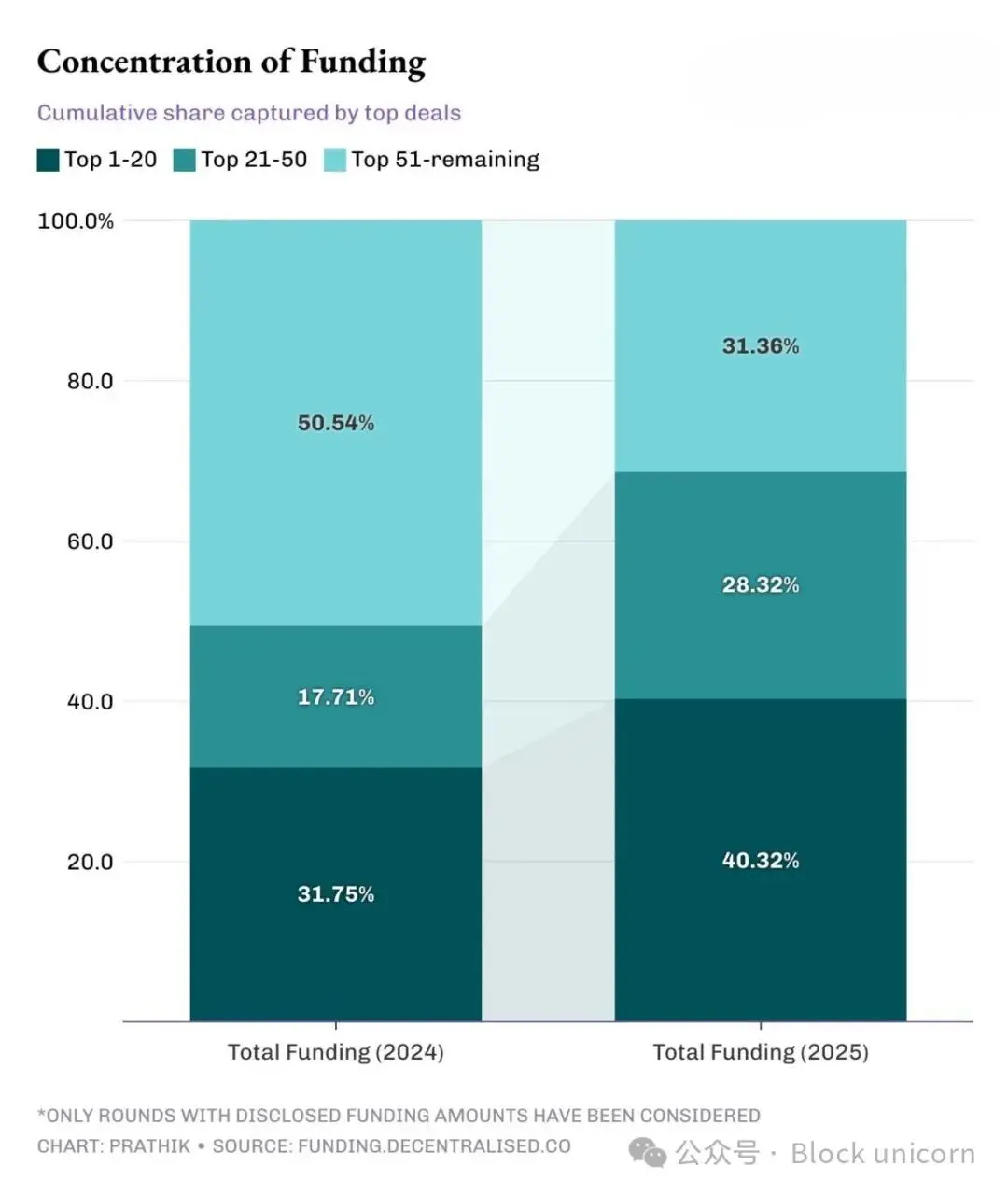

The top 20 rounds accounted for 40% of all funding in 2025, compared to 32% in 2024. Zooming in to the top 50 rounds, that share swells from 49% in 2024 to 69% this year.

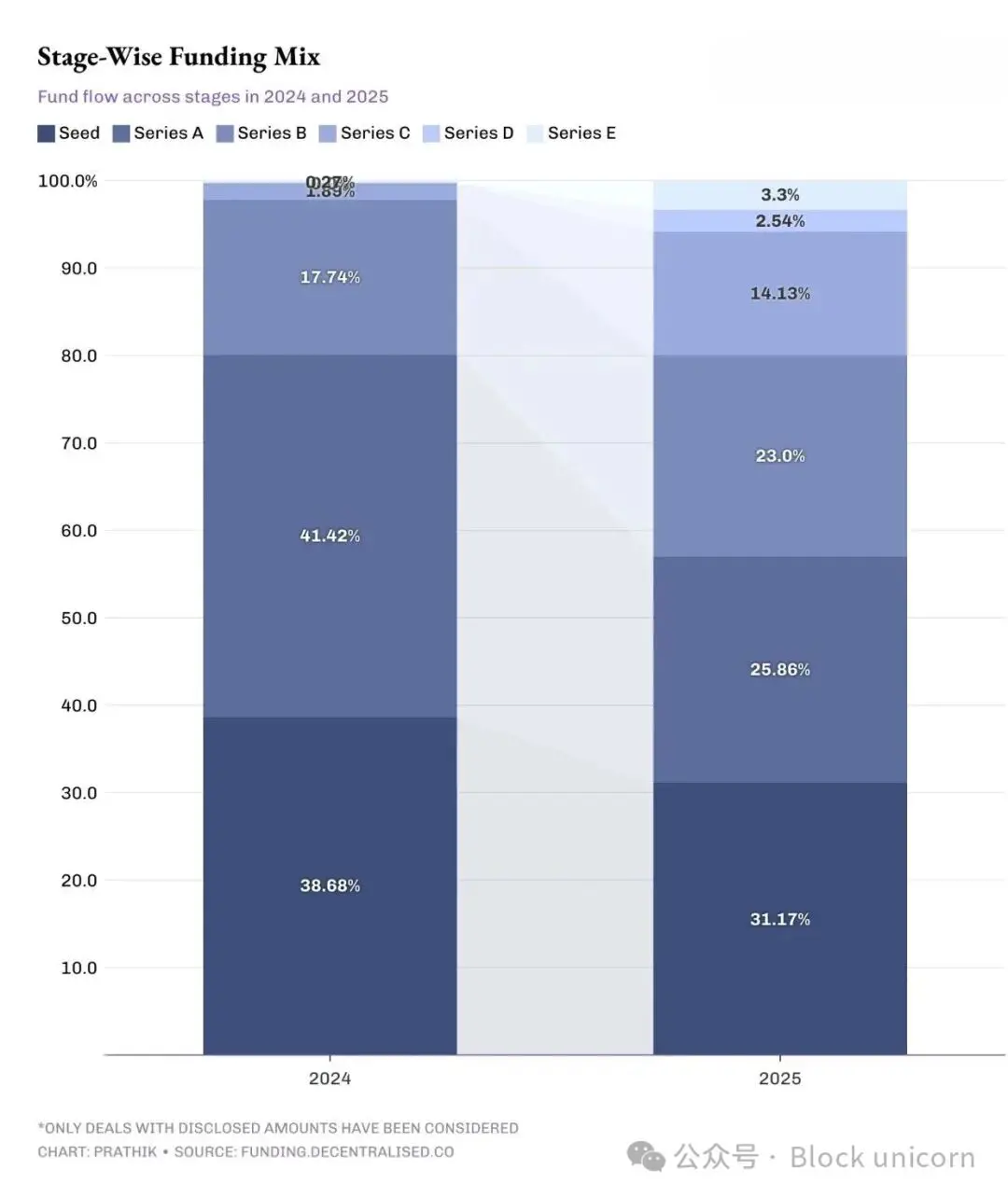

This year's capital flows show that the financing stage is also upgrading.

The share of seed and Series A funding has decreased, while the share of later-stage funding has increased. Approximately 57% of funding went to early-stage crypto projects (seed and Series A), compared to 80% in the first nine months of 2024.

This suggests that investors are shifting risk from the idea stage to the execution stage.

Today, venture capitalists demand evidence before investing in a project. They double down on projects with established distribution systems and a clear regulatory status, rather than new entrants.

Investing more money in later stages means fewer failures and fewer opportunities for quick riches. Returns are flattening, relying more on cash flow. On the other hand, this could lead to a narrowing of the pipeline of ideas by 2026. If Series A and Seed rounds don't recover soon, venture capital interest in emerging sectors could wane.

The concentration of funding flows suggests a shift in venture capitalists’ expectations about where value will come from.

Industry data shows that the only sector that remains a consistent investor favorite in both 2024 and 2025 is AI. The top five funding-absorbing sectors in 2024 failed to attract the same level of investor interest in 2025.

For founders, this means that if you're building a business in AI, payments, enterprise infrastructure, and real-world asset tokenization (RWA), funding is there. Outside of these areas, funding has dried up in areas like layer-1 and layer-2 infrastructure, developer tools, and social, which will constitute the cream of the crop in 2024.

All of this conveys several key messages.

First, the capital structure is shifting toward fewer but deeper dominant investors. This is often seen in mature industries. As an industry accumulates experience and experimentation over its lifecycle, more cautious and calculated investments emerge. This adds structure to the ecosystem, favoring later-stage projects but leaving little room for new entrants with smaller funds.

Second, price discovery has shifted from hype cycles to indicator-based fluctuations. Investors now bet when they see profits, rather than chasing hype.

Third, the pace is slowing. Fewer new experiments are being funded, which means less innovation in new areas to test market demand. New products will still emerge, but they are more likely to come from established companies or bootstrapped projects, such as Aster (BNB Chain) and Hyperliquid (non-VC-backed).

This new approach rewards meaningful metrics like revenue generation and company-level storytelling. It also exposes optimism bias by highlighting the fragility of ideas. Overall, a smaller venture capital market will become more stable.

We may hope to restore some aspects of 2024, such as a more even distribution of investment across the stages and a thicker middle, but until then, we must accept the status quo of less investment and larger funds.

That’s all for this discussion, see you in the next article.