Written by: 1912212.eth, Foresight News

On the evening of August 22nd, Federal Reserve Chairman Jerome Powell's speech finally gave the precarious crypto market a shot in the arm. At the Jackson Hole annual symposium, Powell stated that a shift in the balance of risks may require policy adjustments, as the situation suggests that downside risks to employment are rising. The market interprets Powell as preparing for a September rate cut.

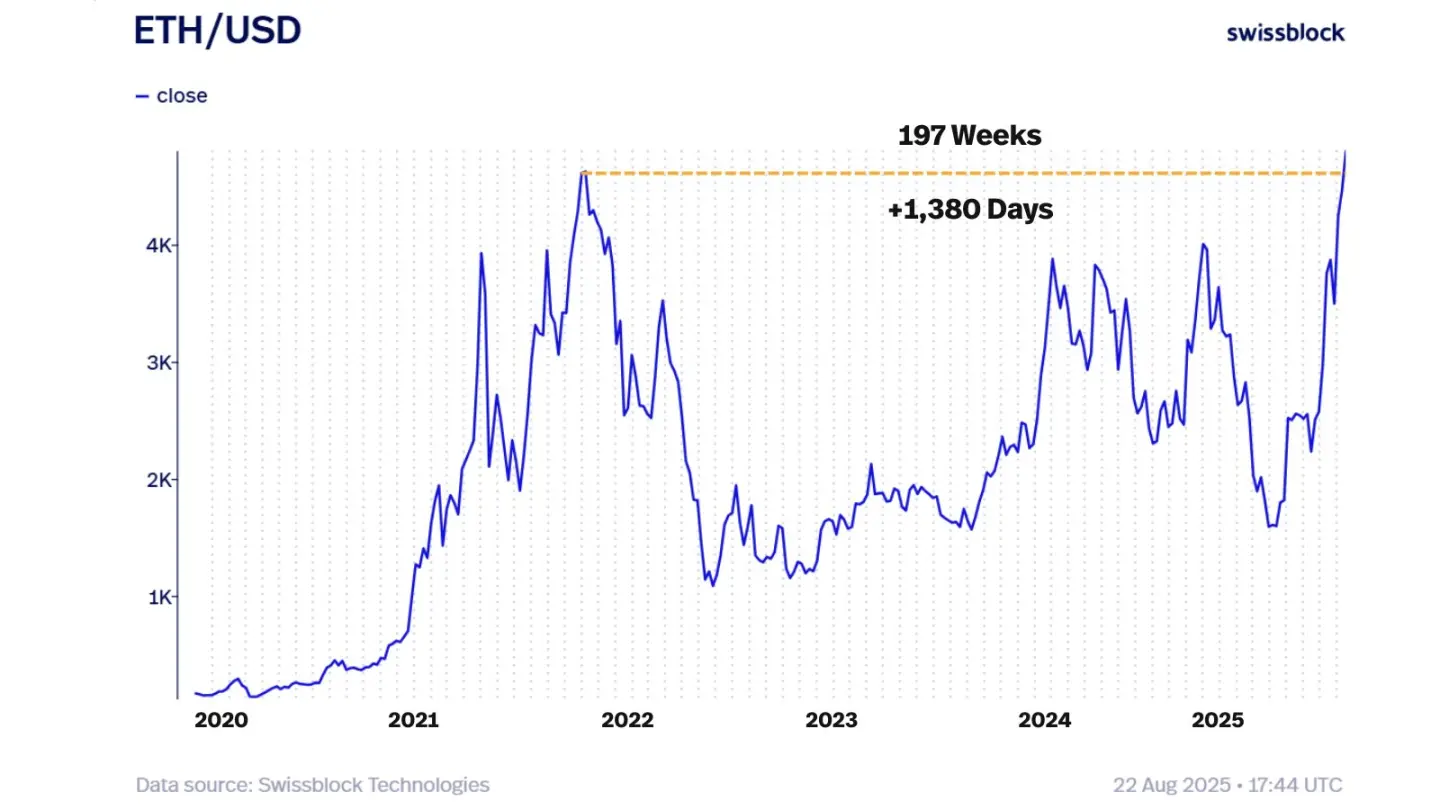

Influenced by this positive news, BTC quickly reclaimed the $112,000 mark, rising 2.95% in an hour, briefly climbing above $117,000. Ethereum's performance was even more impressive, rising steadily from around $4,200 to reach a new all-time high of $4,887.59 at around 5:00 AM on August 23. The ETH/BTC exchange rate rose to 0.0418, a new high since October 2024. Many altcoins benefited from the broader market rally and experienced a strong rebound.

In terms of contract data, Coinglass shows that in the past 24 hours, the total open interest of the entire network exceeded US$694 million, and the short position exceeded US$468 million.

Powell's stance softens, market expects two rate cuts this year

Before Powell's speech, the market was pessimistic and expected a hawkish outlook, and some traders chose to leave the market and wait and see. As a result, the crypto market saw a significant decline before the conference.

Unexpectedly, Powell's speech in this blockbuster speech believes that the current situation means that the downside risks facing employment have increased. This shift in the balance of risks may mean that interest rates need to be cut.

Powell mentioned that the stability of labor market indicators such as the unemployment rate allows the Fed to carefully consider adjusting its monetary policy stance, which opens the door to a rate cut in September.

According to CME's "Fed Watch" data, after Powell's speech, the probability of the Fed cutting interest rates in September increased to 91.2%.

Nick Timiraos, a renowned Wall Street Journal reporter known as the "Federal Reserve's mouthpiece," reported that Federal Reserve Chairman Jerome Powell on Friday opened the door to a rate cut as early as next month's meeting, suggesting the prospect of a sharper slowdown in the job market could ease concerns about tariff-induced cost increases driving inflation. However, Powell's comments tempered market expectations of continued aggressive rate cuts by emphasizing concerns about inflation. Inflation has been above the Fed's 2% target for more than four consecutive years.

Deutsche Bank expects the Fed to cut interest rates by 25 basis points in September and December, respectively, while the bank previously predicted that the Fed would only cut interest rates in December 2025.

Kathy Bostjancic, chief economist at Nationwide, predicts the Fed will have cut interest rates by a cumulative 75 basis points by the end of the year. She noted, "Powell struck a decidedly more dovish tone and left the door wide open for a September rate cut, arguing that downside risks to employment are rising significantly. This supports our call for a 25 basis point rate cut next month, and we continue to expect the Fed to have cut interest rates by a cumulative 75 basis points by the end of the year, given further weakening in the labor market and a modest and temporary rise in inflation."

The Kobeissi Letter analyzed the significance of Fed Chairman Powell's speech today: "Today's speech shows that their (the Fed's) priority has shifted to supporting the labor market. The changing balance of risks may require adjustments to policy, and he was explicitly referring to the labor market. Therefore, the employment report will determine future interest rate cuts.

The Federal Reserve's next interest rate decision will be announced at 2:00 a.m. Beijing time on September 18.

Ethereum spot ETF and stablecoin data show optimism

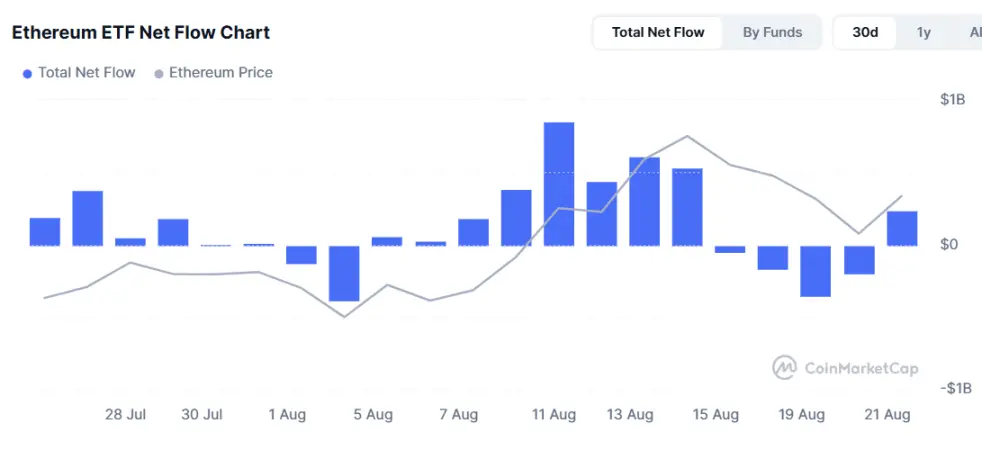

As one of the important indicators for monitoring market capital flows, the data for Bitcoin spot ETF is not optimistic. Large net outflows have occurred in recent days, reflecting the strong risk aversion in the market.

However, after four consecutive days of net outflows, the Ethereum spot ETF saw a net inflow of $287.61 million on August 21st. The total net inflow now stands at $12.09 billion. It's easy to see that the market may be betting on Ethereum for higher returns.

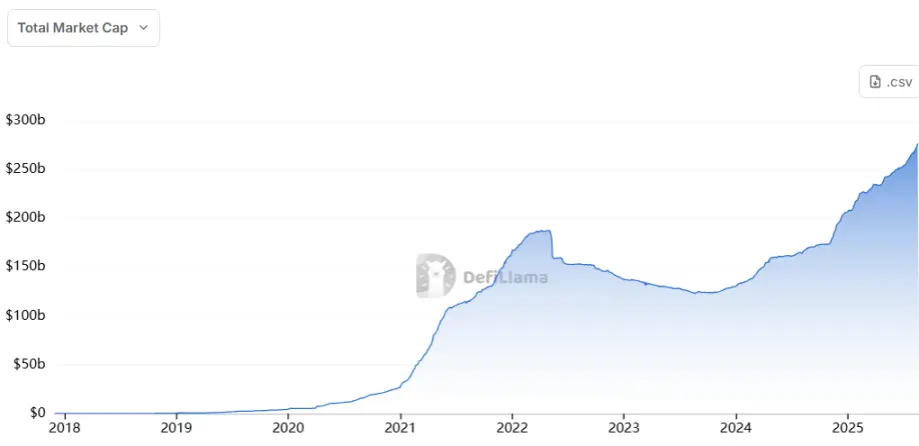

Stablecoin data continues to pour in.

According to defiLlama data, the total market capitalization of stablecoins is currently $277.74 billion, with a 7-day total increase of 0.96% to $2.645 billion. Among them, USDT has a monthly increase of 2.6%, USDC has a monthly increase of 4.63%, and USDe has a monthly increase of 80.87%.

Furthermore, the popular project WLFI token will open for trading and initial claims at 8:00 PM on September 1st. Early supporters will be eligible to claim a 20% share of the token, and it will be listed on DeFi DEXs and major CEXs. As a DeFi project backed by the Trump family, WLFI carries a political aura. The launch of its token trading is likely to attract a significant number of politically inclined cryptocurrency investors, particularly those in the United States, contributing to a short-term market boost and an injection of liquidity.

Market View

Raoul Pal, a former Goldman Sachs executive and founder of macro research firm Real Vision, released a technical analysis suggesting that Total3 (altcoins other than BTC and ETH) is about to reach a turning point.

Data analysis agency Altcoin Vector analyzed that as ETH provides upward momentum and driving effects for other tokens, once ETH stabilizes above its historical high price, altcoins may explode.

Weiss crypto analyst Juan said that the altcoin frenzy will only come after ETH breaks through $5,000, and the peak of this round of growth may be between September 13 and 20, with the latter being more likely. Before then, the market will generally rise.