Today, American Bitcoin Corp. (ABTC) officially listed on the Nasdaq. Co-founder and Chief Strategy Officer Eric Trump, who holds close ties to the Trump family, staged a thrilling "capital roller coaster" on its first day of trading.

ABTC Pump & Dump

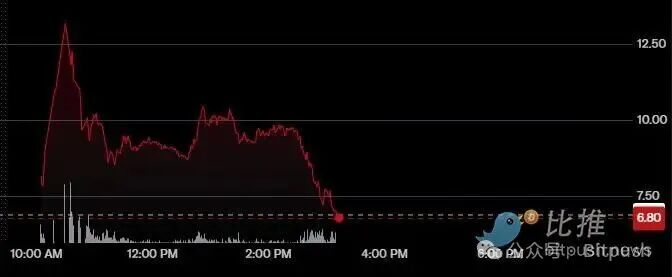

Market data showed that ABTC surged by more than 110% at its opening, but ultimately closed up about 17%.

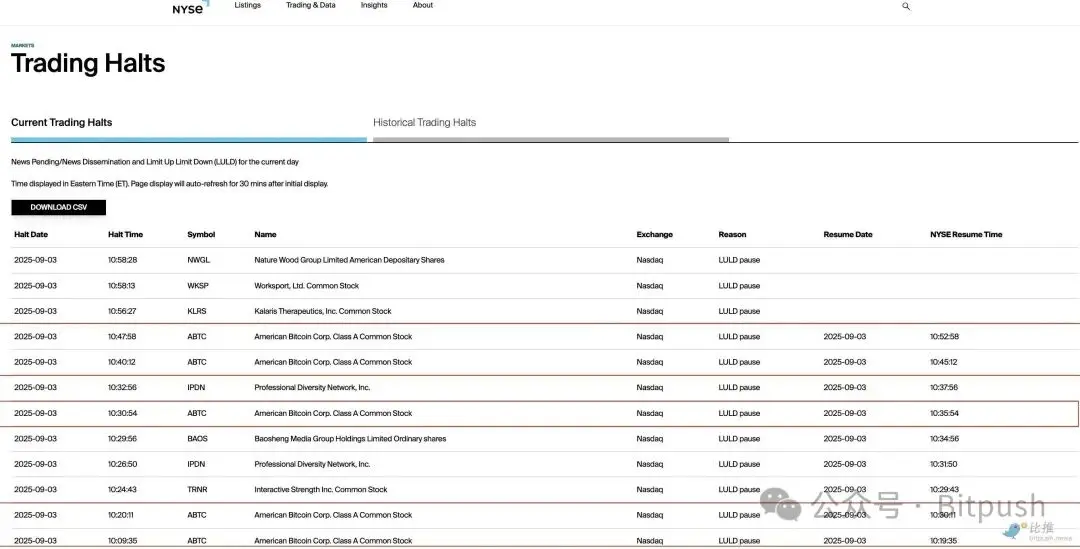

On that day, the stock was suspended five times by Nasdaq within an hour after opening due to violent fluctuations. It rose to $14 several times and then fell back to around $9.50, retracing more than half of the gains.

This trend is a typical example of the "Pump and Dump" model: first, use political exposure and capital market enthusiasm to raise stock prices, and then take the opportunity to cash in profits, leaving ordinary investors to take over and suffer losses.

A mysterious transaction: from mining machine "donation" to IPO

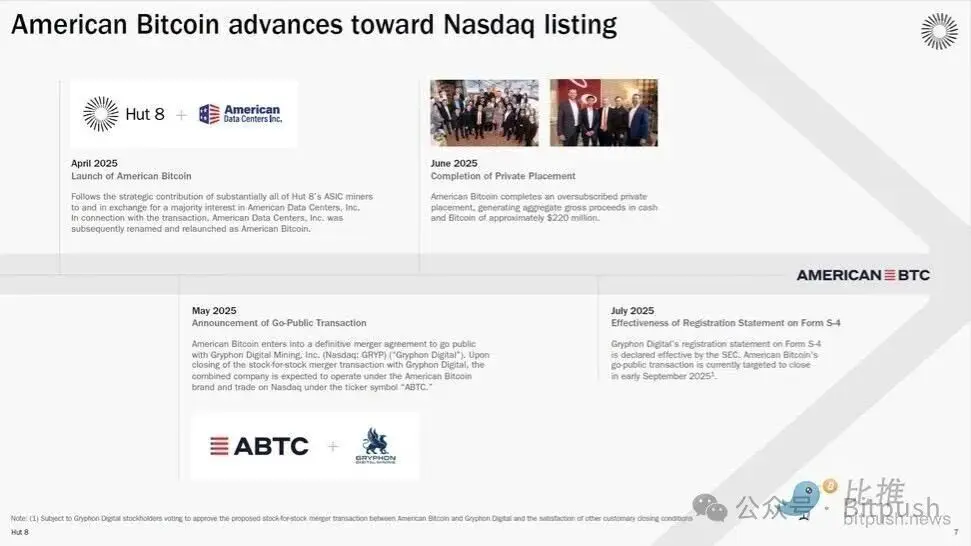

In late March, Eric Trump and Donald Trump Jr. struck a deal with Hut 8, one of the largest publicly traded bitcoin mining companies in the U.S., to create a new entity called American Bitcoin.

Under the agreement, Hut 8 donated all of its 61,000 mining machines to American Bitcoin. In return, Hut 8 acquired an 80% stake in American Bitcoin.

The most puzzling aspect of the deal is that the mining company gave up its 100%-owned equipment in exchange for a smaller stake by partnering with Trump's sons.

In response, Matthew Sigel, head of digital asset research at VanEck, said on social media: "I completely don't understand why Hut 8 would use 61,000 mining machines in exchange for 80% of the shares of a subsidiary that it already wholly owns?"

Eric Trump serves as chief strategy officer at the new company, which the company says brings "business acumen" and a "commitment to a decentralized financial system." Donald Trump Jr. is not listed in any executive position.

In the IPO, Gryphon Digital Mining served as a "public shell company," providing American Bitcoin with a springboard into the core US capital markets. This merger provided the Trump family entity with a direct path to a Nasdaq listing, perfectly aligning with its $210 million capital raising plan. Furthermore, the company also held 2,443 Bitcoins as a corporate treasury reserve, adding weight to its financial narrative.

In his first public statement, Eric Trump said: "Our Nasdaq listing marks a historic milestone for Bitcoin's entry into the core U.S. capital market. Our mission is to make the United States the undisputed leader of the global Bitcoin economy." Donald Trump Jr. emphasized that the company "symbolizes the core values of freedom, transparency and independence."

However, the reality is that the core of all narratives is ultimately a cash-out tool - disguised as a belief in Bitcoin, but underlying it is capital arbitrage.

WLFI: Another script for wealth harvesting

Just days before ABTC's listing, World Liberty Financial (WLFI), another crypto bet of the Trump family, went online for trading. Its WLFI token briefly surged to $0.46, but then plummeted by approximately 50%, closing at around $0.22.

On its initial public offering, WLFI boosted the Trump family's paper wealth by approximately $5 billion. Trading volume reached $1 billion in the first hour, bringing the token's market capitalization to nearly $7 billion. Reuters also reported that the project has generated approximately $500 million in actual profits for the family to date.

WLFI's listing is not a simple issuance, but through a voting mechanism, early investors agreed in July to unlock their tokens for trading. The governance attributes of WLFI are more intriguing than its economic value - the official has not even stated whether it includes equity or dividend distribution.

Political halo + retail investor enthusiasm = arbitrage artifact

The following table intuitively shows the difference in returns for investors of different identities on the first day of WLFI:

Identity/Group | Cost price | Listing price (approx.) | Revenue |

|---|---|---|---|

Retail investors (secondary market buyers) | $0.30–0.46 | $0.22 | Losses of 20%–50% |

Ordinary early-stage investors | $0.05 | $0.22 | About 4 times the profit |

Core Insiders/Privileged Investors | $0.015–0.05 | $0.22 | Nearly 4–14 times the return |

It is not difficult to see from this:

- Retail investors, as "high-level buyers", become the main losers;

- Although ordinary early investors made money, they were not the biggest winners;

- The privileged camp obtains overwhelming returns at extremely low costs and cashes out easily.

The core logic of this wave of hype is:

- Narrative packaging: From "America's Bitcoin Economic Leader" to "Freedom and Transparency", each project is given a grand meaning;

- Identity Revealed: The endorsement of Eric Trump and Donald Trump Jr. will undoubtedly increase the project's attention and buying;

- Building hype: Social media and mainstream media collaborate to create hype, stimulating retail investors’ FOMO (fear of missing out);

- Cashing in: The sales are completed under a wave of high heat, but retail investors are left at high levels and continue to bear pressure.

The Trump family's path to encryption is not accidental, but rather a way to use their political capital to establish a cross-cycle wealth map for themselves. For example, in addition to tokens, WLFI also has supporting assets such as the stablecoin USD1. At the same time, the project's internal holdings account for as much as 60-75%, and the interests are seriously tied.

Coupled with billions of dollars in cooperation with allies such as Abu Dhabi and Justin Sun, this capital deployment across political cycles and asset classes is not just arbitrage but also an "institutional ATM."

When the carnival is over, the only ones left are ordinary investors who hold on to their remaining chips and look up at the K-line - they become the only "paying audience" of this show.