Ethena once again leveraged the capital markets, successfully creating a two-way flywheel for $ENA and $USDe in both the on-chain and stock markets.

Dual Currency System Battle Royale

USDT created a stablecoin, USDC captured users' awareness of compliance, and USDe acted as a capital capturer.

Image Caption: Ethena's Path to Capitalization. Image Source: @zuoyeweb3

When the $ENA Treasury Strategy was launched, I subconsciously thought it was a simple imitation of the current strategy trend. However, after careful review, I realized that Ethena is actually trying to break the curse of the "dual currency" system.

The curse is that on-chain stablecoin issuers must choose between the price of their protocol token and their stablecoin market share.

• Aave chose to empower $AAVE. $AAVE's price rose 83.4% in three months, but $GHO's issuance was only $300 million.

• Sky, a derivative of MakerDAO, saw its price rise 43.2% in three months, with $USDS issuance reaching $7.5 billion.

• Ethena's ENA token saw a 94.2% price increase in three months, with $USDe issuance reaching $7.6 billion.

Add to that the collapse of the Luna-UST dual-token system, and maintaining a balance between the two becomes incredibly difficult. The fundamental reason is that protocol revenue is limited. If this revenue is diverted to market share, the token price becomes unstable, and vice versa.

In the entire stablecoin market, this is a barrier to entry for latecomers created by USDT. USDT invented the stablecoin sector, so naturally, there's no need for Circle to share profits with its partners, but it still won't share with USDC holders.

Ethena uses a bribery mechanism to share ENA as profit "options" with CEX partners, temporarily appeasing large traders, investors, and CEXs while prioritizing the dividend rights of USDe holders.

According to A1 Research, since its inception, Ethena has shared approximately $400 million in profits with USDe holders in the form of sUSDe, breaking the entry barrier set by USDT/USDC.

Not only has Ethena surpassed Sky in stablecoin market share (excluding its residual share of DAI) but it has also surpassed Aave in terms of performance as a primary token project. This is no accident.

While the price increase of Ethena's ENA token is certainly due to the aforementioned Upbit stimulus, Ethena is deeply transforming the value transfer method of its dual-currency system by introducing a stock market treasury strategy.

Returning to the previous question, while prioritizing protecting USDe's market share, ENA's dividend rights still need to be redeemed. Ethena's choice is to launch StablecoinX, imitating the treasury strategy, but with a modified one.

• The BTC treasury strategy, taking Strategy as an example, bets on the long-term upward trend of BTC's price. Holding 600,000 BTC is both a catalyst for growth and a source of trouble during declines.

• The ETH treasury strategy, taking Bitmine (BMNR) as an example, bets on eventually acquiring 5% of the circulating supply, becoming a new market maker and following the path of Sun Ge and Yi Lihua in the stock market, profiting from volatile trends.

• The BNB/SOL/HYPE treasury strategy involves project foundations or single entities inflating stock prices to stimulate native currency growth. This is the most common strategy, as these assets have yet to achieve market valuations similar to BTC/ETH.

ENA's treasury, StablecoinX, differs from the above. On the surface, it appears to be an on-chain entity injecting and raising funds, spending $260 million to purchase 8% of ENA's circulating supply, thereby stimulating ENA's price.

The market responded positively, with Ethena's TVL, USDe supply, and sUSDe APY rising accordingly. However, it should be noted that sUSDe is essentially a liability of the protocol, while ENA sales revenue represents profit.

StablecoinX reduces ENA circulation and stimulates secondary market sales. The communication costs involved are manageable and can be negotiated between Ethena and its investors, Pantera, Dragonfly, and Wintermute.

Dragonfly led Ethena's seed round, and Wintermute participated. This is more like accounting than new investment.

Ethena's successful escape from the dual-currency system, driven by capital manipulation, is arguably the greatest stablecoin innovation since Luna-UST.

Real adoption has yet to occur.

When the false prosperity is shattered, long-held principles will be exposed.

ENA's new upward trend is one source of profit for the project, and USDe/sUSDe holdings will also increase accordingly. At the very least, USDe now has the potential to become a truly application-focused stablecoin.

ENA's treasury strategy mimics BNB, SOL, and HYPE, increasing yields to stimulate stablecoin adoption. This not only capitalizes on volatile trends, but also mitigates selling pressure during declines through the high-control mechanism.

Capital operations can only stimulate coin prices. After stabilizing the growth flywheel of USDe and ENA, long-term development still requires real-world adoption of USDe to cover market-making costs.

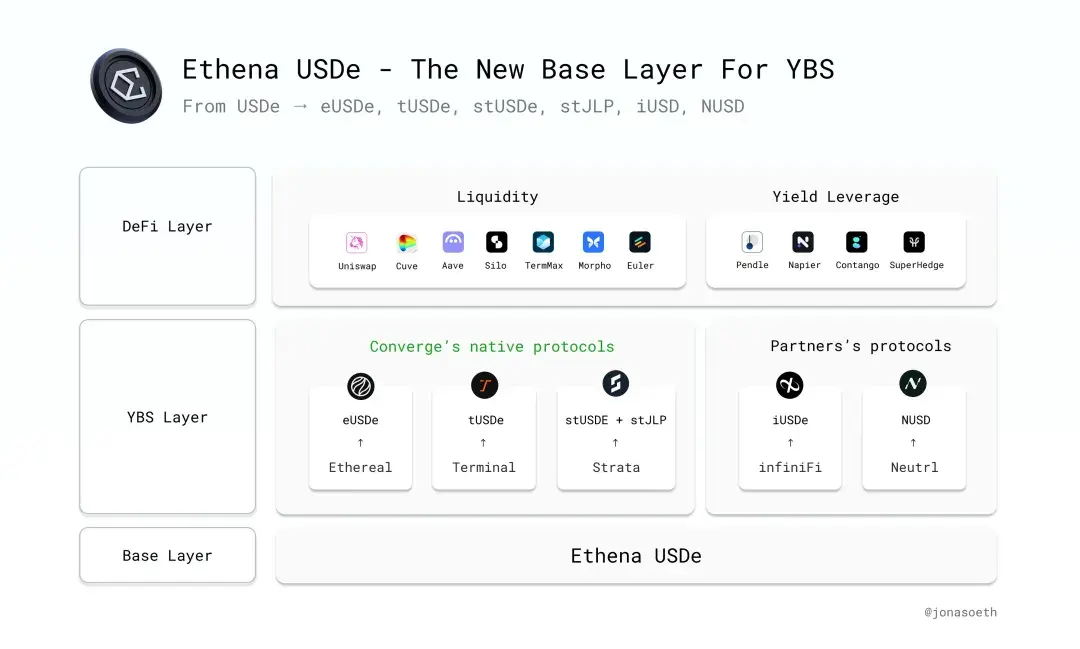

Image Caption: Ethena Ecosystem Expansion

Image Source: @Jonasoeth

In this regard, Ethena has always walked a two-pronged approach:

• On-chain: Ethena has long collaborated with Pendle to revitalize the on-chain interest rate market, and has gradually partnered with Hyperliquid. Ethena is also internally supporting Ethreal as an alternative to Perp DEX

• Off-chain: Collaborating with BlackRock's partner Securitize to launch the Converge EVM Chain, targeting institutional adoption. Following the recent Genius Act, the company is increasing the issuance of its compliant stablecoin, USDtb, with Anchorage Digital.

In addition, Anchorage Digital and Galaxy Digital are both recent institutional investors. In a sense, they represent the third wave of market makers after Jump Trading/Alameda Research. The second wave included market makers like DWF/Wintermute, a topic discussed later.

Beyond Ethena's on- and off-chain capital landscape, real-world adoption remains lackluster.

Compared to USDT and USDC, USDe/USDtb has only scratched the surface in cross-border payments, tokenized funds, and DEX/CEX pricing. Their only notable feature is their partnership with TON. DeFi protocol collaborations are unlikely to reach widespread adoption.

If Ethena's goal is on-chain DeFi, then it's already very successful. However, if it enters off-chain institutional and retail adoption, then we've only just taken the first step in a long journey.

In addition, concerns about ENA have emerged, and a fee switch is on the horizon. Remember that Ethena currently only distributes profits to USDe holders? The fee switch will require ENA holders to share profits through sENA.

Ethena uses ENA to stabilize the CEX exchange in exchange for USDe's survival, and uses a treasury strategy to stabilize the interests of large ENA holders and investors. However, the inevitable is inevitable. Once ENA begins sharing in protocol revenue, ENA will become a liability for Ethena, not revenue.

Only by becoming a true USDT/USDC analog can ENA enter a true revenue-generating cycle. Currently, it's still struggling, and the pressure will never truly subside.

Conclusion

Ethena's capital manipulation has inspired more stablecoin and YBS (interest-bearing stablecoin) projects. Even Genius Act-compliant payment stablecoins don't prohibit on-chain interest accrual using RWA.

Following Ethena, Resolv also announced the activation of its fee switch protocol, but will not yet distribute actual profits to token holders. Ultimately, the prerequisite for protocol revenue distribution is protocol revenue.

Uniswap has been cautious about fee switches for many years. The core goal is to maximize protocol revenue between LPs and UNI holders. However, most YBS/stablecoin projects currently lack the ability to generate sustained returns.

Capital stimulus is the pacemaker; actual adoption is the hematopoietic protein.