Author: capradavis

Compiled by Tim, PANews

Bio Protocol V2 introduces new features that strengthen the incentive model while removing the complex and costly multi-step funding application process from V1.

Of greater interest, however, is how these upgrades make capital allocation in the DeSci space more attractive.

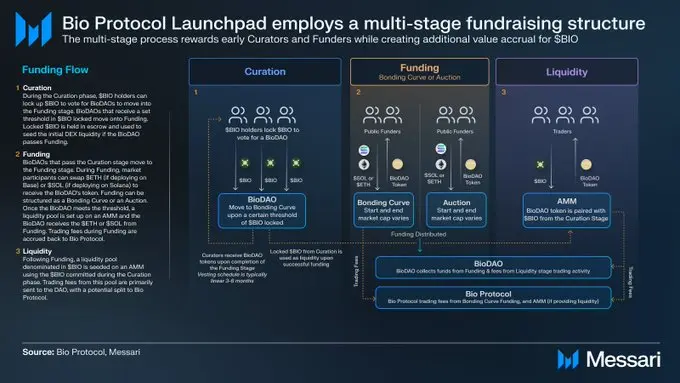

Bio V1 is reportedly launching a multi-stage community-governed launch platform in March 2025, utilizing an updated token economics model. Under this model, project funding is conducted in two phases, culminating in the launch of the BioDAO token and BIO as a trading pair on the DEX.

The Bio Launchpad consists of three main steps: 1) Curation 2) Fundraising 3) Creating Liquidity and Trading

1) Curation: BIO token holders stake BIO tokens to vote. The winning project will receive the corresponding BioDAO tokens, which will be released linearly over 3-6 months.

2) Fundraising: Using the Bonding Curve or auction model, new users can participate in the fundraising with ETH or SOL tokens and obtain corresponding BioDAO tokens according to the fundraising rules.

3) Create liquidity and transactions: BioDAO tokens will form an AMM trading pair with BIO, and users can provide liquidity and participate in transactions

In addition to the launchpad upgrade, V2 also marks Bio Protocol’s first foray into artificial intelligence, introducing BioAgents, an intelligent agent designed to accelerate scientific research for BioDAOs and assist with daily operational tasks.

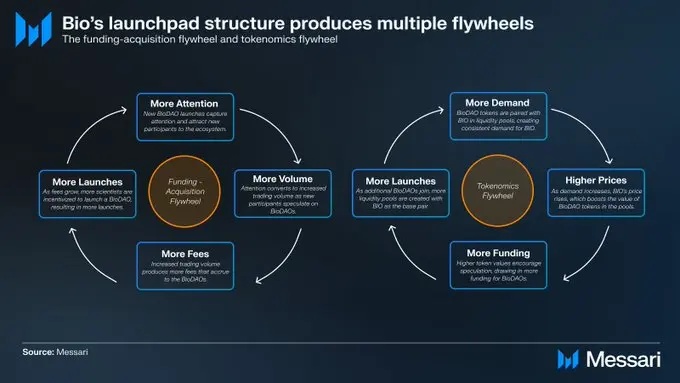

Bio's V1 launchpad mechanism established a dual flywheel architecture, which was continued in V2. The first is a transaction fee-based capital recycling mechanism (similar to the Believe platform), and the second is a token economics flywheel mechanism (similar to the Virtuals platform).

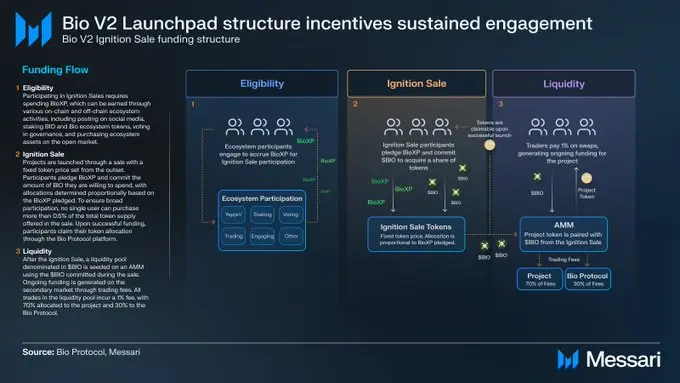

Bio Protocol's V2 upgrade changes the fundraising model from large single-time fundraising to a small-time, high-frequency model, and incentivizes positive behavior through mechanisms such as BioXP.

The Bio V2 incentive system consists of three parts: 1) Participation 2) Ignition Sales 3) Liquidity Providers

1) Participation Eligibility

Participating in Ignition Sales requires BioXP points. Ways to earn BioXP include:

Social Media Posting (Yappin')

Stake BIO and ecological tokens

Governance Voting

Trading ecological assets

2) Ignition Sales

The project launches a sale with a preset fixed token price:

Participants pledge BioXP and commit to invest a certain amount of BIO

Token distribution is determined based on the proportion of BioXP pledged

Maximum subscription limit for a single person: 0.5% of the total tokens sold

After successful financing, claim tokens through the Bio platform

3) Liquidity

After the sale is completed, the $BIO raised from the sale will be used to establish a liquidity pool in the AMM

Secondary market transactions continue to generate capital flows:

a) A 1% handling fee is charged for all transactions in the liquidity pool

b) 70% allocated to the project owner

c) 30% allocated to Bio Protocol

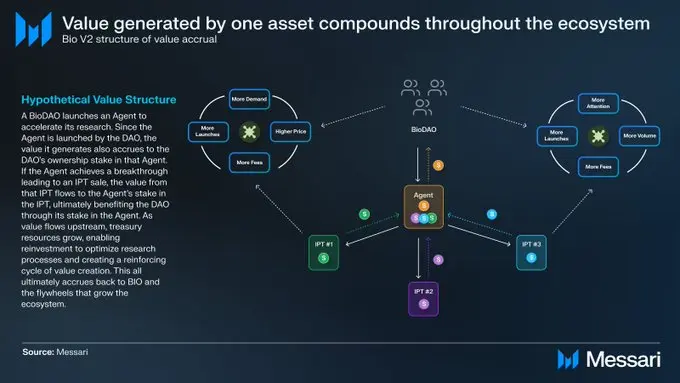

V2 also unifies the Bio ecosystem. In the new version, BioAgents are tokenized, and IPTs (previously issued through the Molecule platform) will be issued uniformly through the V2 platform, with all three types of digital assets adopting a standardized issuance model.

This is powerful in itself, as all assets contribute to and benefit from the dual flywheel system. But what is truly impactful is the pattern that forms when the value created by one asset compounds across multiple assets.

The interconnected relationships between BioDAOs, Agents, and IPTs create several sub-ecosystems within the larger Bio Protocol network. This structure provides more avenues for balancing risk exposure and effectively mitigates the risk of capital fragmentation, as each asset class can contribute to upstream assets.

With greater flexibility, richer creative expression vehicles, and more convenient asset circulation, Bio V2:

1) Establish Bio Protocol as the ultimate platform for DeSci;

2) Promote the DeSci field to become a more viable narrative and accommodate a larger pool of funding.