Author: cptn3mox , Hashed

Key takeaways

- Mantle (MNT) has strategically transitioned from a general-purpose L2 to a Bybit core utility token, creating structural demand through integration with the exchange.

- Key catalysts for Bybit’s integration include enhanced collateral usage, VIP fee tiers, and potential buyback and burn mechanisms, most of which will be rolled out by the end of September 2025.

- Currently, MNT is priced at $1.15, significantly undervalued compared to its competitors, and its MCAP/Vol (0.12) and MCAP/OI (0.15) are the lowest compared to major exchange tokens.

- Price targets based on competitor benchmarks suggest 3x to 6x upside potential ($3.45-$6.90) over a 6-12 month timeframe.

- Mantle’s nascent but rapidly growing L2 ecosystem provides additional utility with deep Bybit exchange integration, providing security for long-term investments.

Background

Mantle (MNT) passed governance approval in May 2023, and the MNT token was separated from BitDAO at a 1:1 migration, and launched its modular Ethereum L2 mainnet in July 2023.

As the network's gas, governance, and incentive token, MNT is the core vehicle for driving most activities and governance within the network. The Mantle L2 network is primarily backed by the Mantle Treasury, which holds $4 billion in assets and a $200 million ecosystem fund to support the development of RWA and DeFi within the ecosystem.

In July 2025, Mantle decided to deeply integrate with Bybit, positioning MNT as its core utility token for fee discounts and collateral usage (similar to Binance's BNB), with other potential catalysts.

This was further reinforced in August 2025, when Mantle appointed Bybit Co-CEO (Helen Liu) and Bybit Head of Spot Trading (Emily Bao) as key advisors to work alongside Mantle’s core team.

Catalyst: Why now?

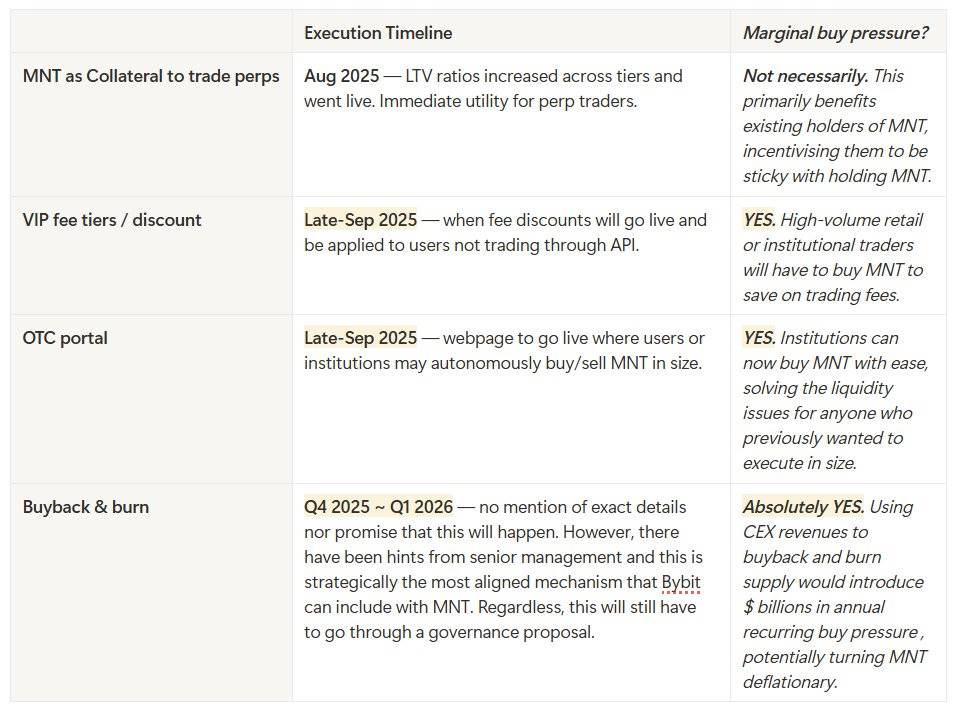

As Bybit's core utility token, MNT is poised for significant growth. Below are some announced catalysts, while others are hinted at or remain speculative.

Bybit Integration Roadmap

Collateral Usage: Traders can use MNT as collateral for perpetual contract trading ( link )

Already online, but the collateral value ratio has increased significantly recently

For example, if you previously held 1 million MNT tokens, you could only trade them at a maximum LTV of 90%, but now you can trade them at 100% LTV;

If you are a large institution holding 8 million MNT tokens, you could previously only trade them at a 10% LTV, but now you can trade them at a 60% LTV.

VIP Fee Tier: Hold MNT to Get Trading Discounts ( Link )

Enjoy 25% discount on spot trading

10% discount on linear contracts (USDT perpetual contracts/futures, USDC perpetual contracts)

This naturally creates structural buying demand, especially from institutional traders who have to save on trading fees.

Potential buyback and destruction: Use CEX income for buyback and destruction

If approved, this could be the biggest catalyst for MNT.

Must pass a governance proposal and be approved by token holders (but we know supply is concentrated in shareholders)

Reduces circulating supply and potentially makes MNT deflationary ( see AMA recap )

OKX/OKB Example ( link )

OTC Portal: Enables large buyers to purchase MNT in bulk (currently liquidity is scarce)

Under development, targeting whales/funds

The web version will be launched at the end of September and will be able to conduct batch OTC/RFQ transactions independently.

Other MNT Utilities:

MNT Launchpool: Stake MNT to receive Launchpool tokens that will be exchanged at the Bybit TGE.

Increased spot trading pairs: Available spot trading pairs will expand from 4 to over 20, scheduled to begin in September 2025.

Crypto Card Usage: By the end of September, MNT can be used for crypto card payments with zero conversion fees. Consumer users will receive additional acceleration, allowing them to upgrade to VIP faster and receive more cash back through Bybit Card & Pay.

Bonus: In addition to ongoing events like the MNT Puzzle Hunt, we also plan to offer options trading and access to VIP events and merchandise.

Timeline

Comparison with other exchanges

MNT reference price = $1.15

MNT is the most undervalued exchange token in terms of MCAP/Vol and MCAP/OI

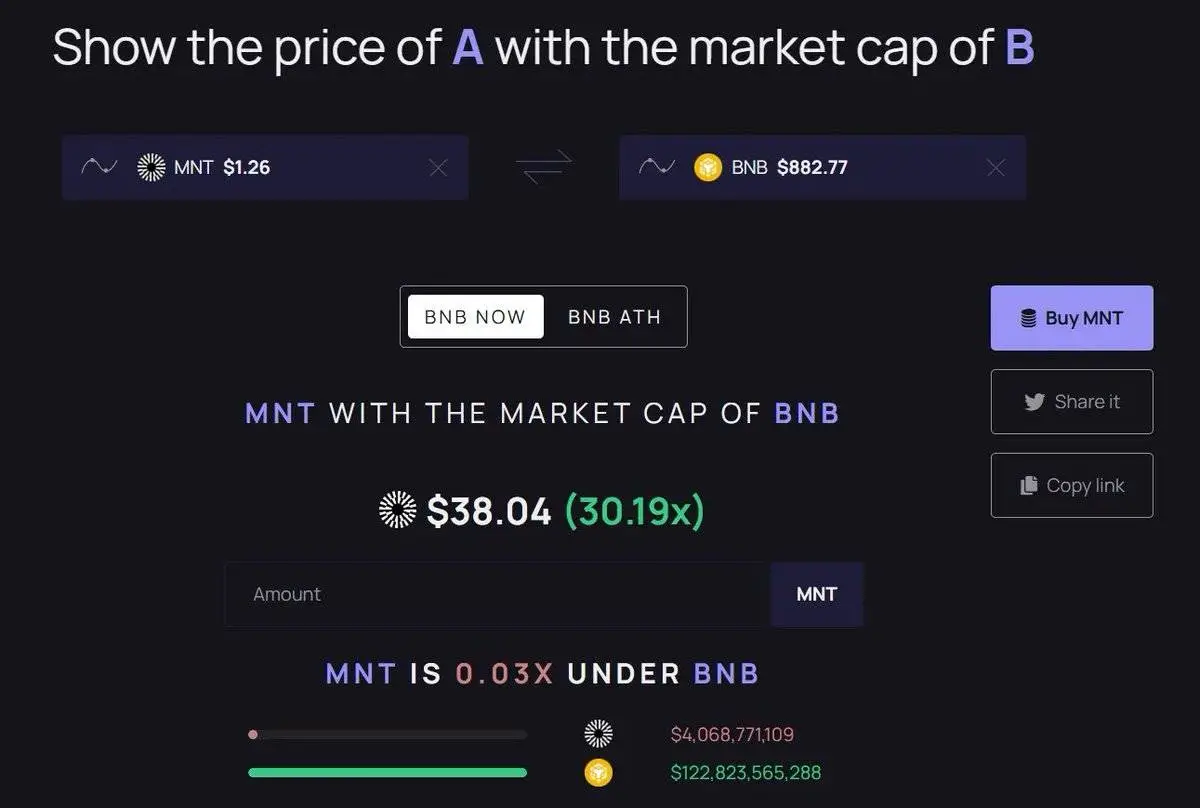

- Bybit's trading volume is 1/3 of Binance's, but MNT's market capitalization is only 1/30 of BNB's.

- Bybit's trading volume is 5 times that of Crypto(dot)com, but MNT's market capitalization is only half of CRO's.

- Bybit's trading volume is twice that of Hyperliquid, but MNT's market capitalization is only one-third of HYPE's.

Price Target

Current MNT Price: $1.15 / Market Cap: $3.7 Billion

1. Using MCAP/Vol

- Assuming the same MCAP/volume as Binance (1.05): $1.15 → $10.10 (~8.7x ROI)

- Assuming average MCAP/volume compared to competitors (~0.71): $1.15 → $6.88 (~6x ROI)

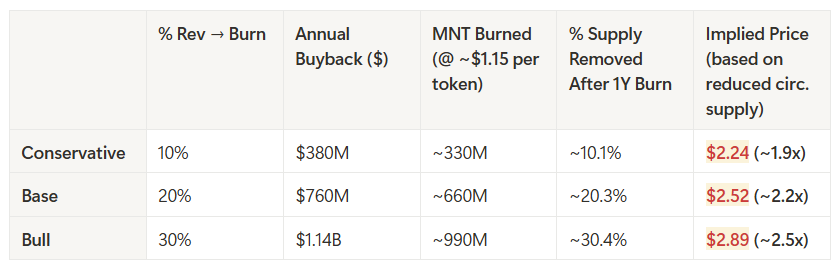

2. Quantified Flows (based only on the impact of buybacks and burns)

Assumptions

- Daily trading volume: approximately $32.7 billion (85% perpetual contracts + 15% spot)

- Fee structure (broad assumptions): ~0.02% commission for perpetual contracts + ~0.1% for spot trading

Potential annual income:

- Perpetual Contracts: 85% × $32.7 billion × 0.02% × 365 ≈ $2.03 billion in perpetual contract fees

- Spot: 15% × $32.7 billion × 0.1% × 365 ≈ $1.8 billion in spot trading fees

- Total: Perpetual Contracts + Spot = $3.8 billion in total fee income

If governance allocates 20% of CEX revenue to MNT repurchase and destruction:

- About $760 million in buy-ins per year.

- At a token price of $1.15, this equates to purchasing 660 million MNT tokens per year (approximately 20% of the circulating supply).

Impact: This flow will significantly reduce the effective float and could drive price appreciation similar to BNB/OKB.

3. On-chain TVL indicator

- Assuming the same MCAP/Bridge TVL as BNB Chain (5.1x): $1.15 → $2.68 (~2.3x ROI)

- Assuming the same MCAP/stablecoin as BNB Chain (10.5x): $1.15 → $1.54 (~1.4x ROI)

4. Continue to imagine: Bybit grows to the same scale as Binance, and the market value of MNT equals the market value of BNB

- There's a 30x upside potential from here.

Summarize

Multiple valuation methods highlight that MNT is significantly undervalued relative to its peers.

- Comparing this to BNB’s MCAP/trading volume data implies a potential price target of $10.10 for MNT, representing approximately an 8.7x appreciation as the Bybit and MNT integration matures.

- Comparing this to the average MCAP/trading volume data among exchange competitors implies a potential price target of $6.88 for MNT, representing approximately 6x growth potential.

- Based on other separate valuation metrics, MNT is poised for 2x to 3x growth.

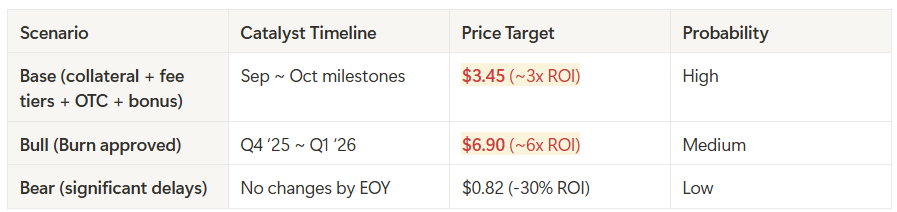

If all of these catalysts play out over the next 1 year, MNT could achieve its target price of $3.45 to $6.90.

risk

Execution risk: Buybacks and burns have not yet been approved. Without this, MNT remains just a collateral/fee token.

Dependence on Bybit: This thesis relies heavily on Bybit being an adoption catalyst. If trading volumes stagnate or Bybit loses market share to other centralized exchanges, MNT’s upside will be limited.

Ecosystem stickiness: Although Mantle L2 has $170 million TVL, it is still small compared to BNB’s $7.5 billion, and stronger on-chain product adoption is needed to support the exchange token theory.

Competition: Other L2s (Base, Arbitrum) and exchanges (BNB, OKB, HYPE) may surpass Bybit in innovation, reducing Bybit’s market attention and marginal buyers of MNT.

Invalid signal

Fundamentals

MNT buyback and destruction proposal failed

Bybit is reducing its emphasis on MNT integration or signaling a slowdown in MNT promotion.

Less allocations to buybacks than initially anticipated, or stalling of buybacks once initiated

Massive dilution of the treasury increases circulating supply

Any broader macro risk aversion could add to supply pressures

price

If the price falls below $0.82, the

This is a key level that will bring MNT back to where it was before all the Bybit announcements and will be a difficult resistance level for MNT to break through during 2025.

This indicates that the market does not care about/does not value the deep integration between Bybit and MNT.

Conclusion

Mantle (MNT) is at a critical turning point in its token journey, seamlessly transitioning from its previous Layer 2 token functionality to Bybit's core utility token. Factors such as an increased collateralization ratio, the upcoming Q4 MNT fee discounts, the upcoming OTC platform launch, and potential buyback and burn indicate significant structural demand and a potential deflationary mechanism.

While risks such as execution delays, dependence on Bybit, and L2 competition remain, MNT's valuation metrics significantly lag behind peer competitors such as BNB, OKB, CRO, and HYPE.

With no upcoming token unlocks and the CeDeFi flywheel starting, MNT is an undervalued gem that is expected to rise 3-6 times in the next 6-12 months.

Disclaimer: The content of this article is for informational purposes only and should not be construed as legal, business, investment, or tax advice. Hashed currently holds or plans to invest in the aforementioned assets. The information provided herein does not contain any material, non-public information.