Source: Grayscale; Compiled by: Golden Finance

Quick takeaways

- Regulatory clarity for digital assets in the United States has been a long time in the making — and while the path forward is still unfolding, policymakers have made meaningful progress this year.

- Market concerns about favorable regulations may have contributed to ETH's outperformance. Ethereum is a leader in the blockchain finance market and could therefore benefit if regulatory clarity boosts the adoption of stablecoins, tokenized assets, and/or decentralized finance applications.

- Digital asset treasuries (DATs)—publicly listed companies that hold cryptocurrencies on their balance sheets—have proliferated in recent months, but investor demand may be reaching a saturation point. Valuation premiums for large-scale projects are compressing.

- Bitcoin prices briefly hit an all-time high of around $125,000, but closed August lower. While Bitcoin's price performance in August was less impressive than other cryptocurrencies, the pressure on the Federal Reserve's independence served as a stark reminder of why investor demand for Bitcoin is so strong.

In August 2025, the total cryptocurrency market capitalization stabilized at around $4 trillion, but with significant volatility under the hood. The crypto asset class encompasses a wide range of software technologies with distinct fundamental drivers, so token valuations don’t always move in sync.

While Bitcoin's price fell in August, Ether (ETH) gained 16%. The second-largest public blockchain by market capitalization appears to be benefiting from investor attention to regulatory changes, which could support the adoption of stablecoins, tokenized assets, and decentralized finance (DeFi) applications—areas in which Ethereum currently leads the industry.

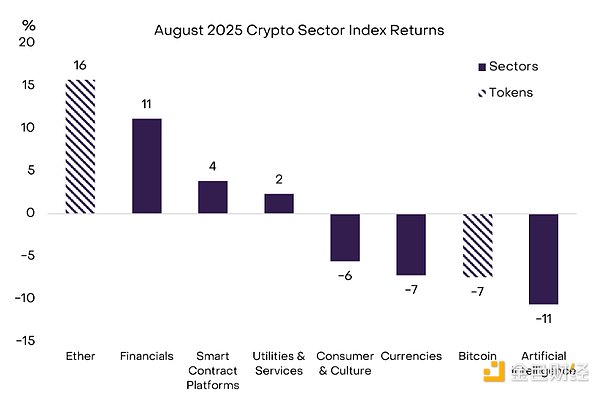

Figure 1 illustrates the changes in various sectors in August using Grayscale's "Cryptocurrency" framework (a rigorous digital asset taxonomy and index portfolio developed in partnership with FTSE Russell). The Currency, Consumer & Culture, and Artificial Intelligence (AI) crypto sector indices all saw slight month-over-month declines. The weakness in the AI sector reflects the underperformance of AI-related stocks in the public equity markets. Meanwhile, the Finance, Smart Contract Platform, and Utilities & Services crypto sector indices all saw gains during the month. Despite a month-over-month decline, Bitcoin prices reached a new all-time high of approximately $125,000 in mid-August; ETH prices also reached a new all-time high of just under $5,000.

Chart 1: Cryptocurrency track returns in August

The GENIUS Act and the Future

We believe Ethereum's recent outperformance is closely tied to fundamentals: most importantly, increased regulatory clarity surrounding digital assets and blockchain technology in the United States. We believe the most significant policy change this year was undoubtedly the passage of the GENIUS Act in July. This bill provides a comprehensive regulatory framework for stablecoins in the US market (see "Stablecoins and the Future of Payments"). Ethereum is the leading stablecoin blockchain today (in terms of transaction volume and balances), and the passage of the GENIUS Act drove ETH's nearly 50% gain in July. The same factors appear to have driven Ether's gains in August.

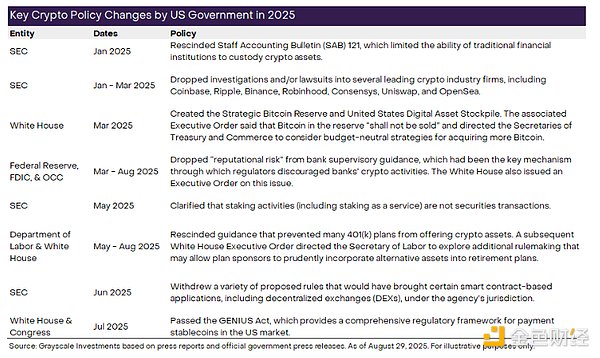

However, US policy changes this year extend far beyond stablecoins, encompassing a range of issues from crypto asset custody to banking regulatory guidance. Exhibit 2 summarizes what we believe to be the most significant specific policy actions by the Trump administration and federal agencies regarding digital assets this year. These policy changes—and more to come—have spurred a wave of institutional investment across the crypto industry (see "The Institutional Chain Reaction" for more details).

Figure 2: Policy changes bring greater regulatory clarity to the crypto industry

In August, Federal Reserve Board Governors Waller and Bowman both attended a blockchain conference in Jackson Hole, Wyoming, something that would have been unthinkable just a few years ago. The event took place immediately prior to the Fed's annual Jackson Hole Economic Policy Conference. In their speeches, they emphasized that blockchain should be viewed as a fintech innovation and that regulators should strike a balance between maintaining financial stability and creating space for the development of new technologies.

In August, Federal Reserve Board Governors Waller and Bowman both attended a blockchain conference in Jackson Hole, Wyoming, something that would have been unthinkable just a few years ago. The event took place immediately prior to the Fed's annual Jackson Hole Economic Policy Conference. In their speeches, they emphasized that blockchain should be viewed as a fintech innovation and that regulators should strike a balance between maintaining financial stability and creating space for the development of new technologies.

In September, the Senate Banking Committee plans to consider cryptocurrency market structure legislation—regulations that would cover areas of the cryptocurrency market beyond stablecoins. This Senate effort builds on the CLARITY Act, which passed the House of Representatives with bipartisan support in July. Senate Banking Committee Chairman Scott has stated that he expects the market structure legislation to also receive bipartisan support in the Senate. However, significant issues remain to be resolved. Industry groups are particularly focused on ensuring that the market structure legislation includes protections for open-source software developers and non-custodial service providers. Lawmakers are likely to continue debating this issue in the coming months (notably, Grayscale was a signatory to a recent industry comment letter to members of the Senate Banking and Agriculture Committees).

DAT surplus?

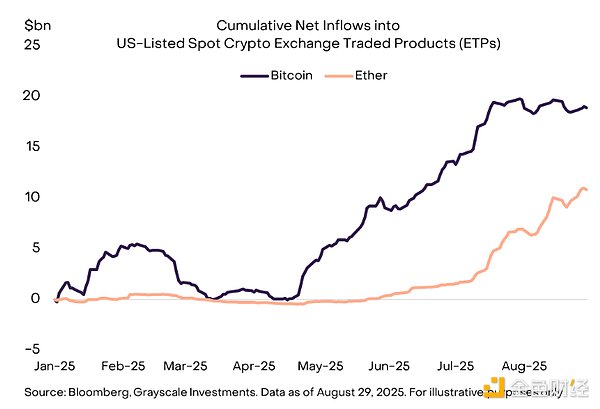

BTC underperformed in August, while ETH outperformed, which was clearly reflected in fund flows across a range of venues and products.

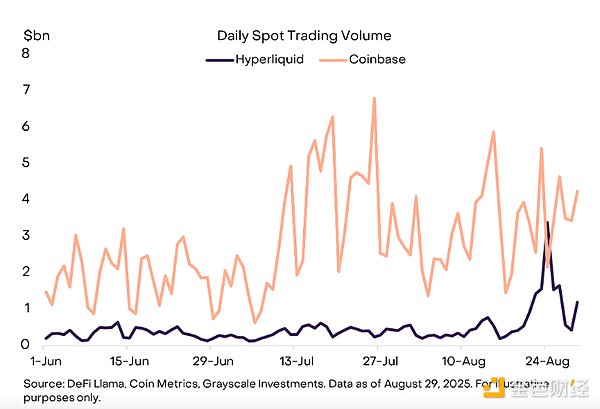

Part of this drama unfolded on Hyperliquid, a decentralized exchange (DEX) offering spot trading and perpetual contracts (see "The Rise of DEXs" at https://www.jinse.cn/blockchain/3716302.html). Starting on August 20th, a single Bitcoin "whale" (a large holder) sold approximately $3.5 billion in BTC and immediately bought approximately $3.4 billion in ETH. While it's impossible to determine the investor's motivations, it's encouraging to see such a large-scale risk transfer occurring on a DEX rather than a centralized exchange (CEX). In fact, on its highest trading day of the month, Hyperliquid's spot trading volume briefly surpassed Coinbase's (Chart 3).

Figure 3: High-liquidity spot trading volume surges

Net inflows into cryptocurrency exchange-traded products (ETPs) in August also reflected a similar preference for ETH. US-listed spot BTC ETPs saw a net outflow of $755 million, the first net outflow since March. In contrast, US-listed spot ETH ETPs saw a net inflow of $3.9 billion this month, following a net inflow of $5.4 billion in July (Chart 4). Following the surge in ETH net inflows over the past two months, both BTC and ETH ETPs hold over 5% of their respective tokens' circulating supply.

Figure 4: ETP net inflows shifted to ETH

Bitcoin, Ether, and many other crypto assets were also supported by purchases by digital asset treasuries (DATs). DATs are publicly traded companies that hold cryptocurrencies on their balance sheets and serve as an on-ramp for equity investors. Strategy (formerly MicroStrategy), the largest Bitcoin DAT, purchased an additional 3,666 BTC (approximately $400 million) in August. Meanwhile, the two largest Ethereum DATs purchased a combined 1.7 million ETH (approximately $7.2 billion).

According to media reports, at least three new Solana DATs are in the works, including an investment vehicle valued at over $1 billion sponsored by Pantera Capital and a consortium including Galaxy Digital, Jump Crypto, and Multicoin Capital. Additionally, Trump Media & Technology Group announced plans to launch a DAT based on the CRO token, which is associated with Crypto.com and its Cronos blockchain. Other recent DAT announcements have focused on Ethena's ENA token, Story Protocol's IP token, and Binance Smart Chain's BNB token.

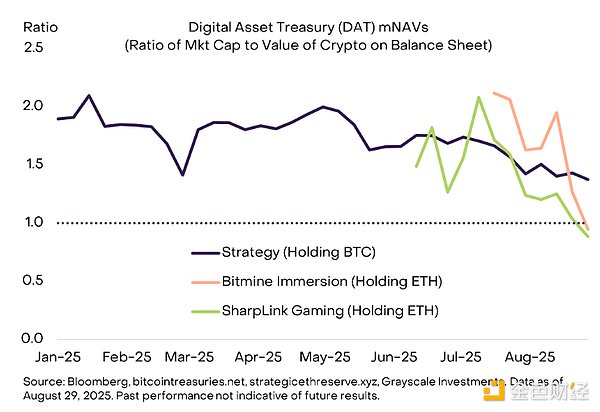

Despite sponsors' continued offering of these investment vehicles, price performance suggests that investor demand may be reaching saturation. To gauge the supply-demand imbalance for DATs, analysts typically monitor their "mNAV," the ratio of a company's market capitalization to the value of its cryptoassets on its balance sheet. If there is excess demand for cryptoassets in the form of public equity instruments (i.e., a shortage of DATs), mNAV may trade above 1.0; if there is an excess supply of cryptoassets in the form of public equity instruments (i.e., a surplus of DATs), mNAV may trade below 1.0. Currently, the mNAV of some large DATs appears to be converging toward 1.0, suggesting that DAT supply and demand are approaching equilibrium (Exhibit 5).

Figure 5: DAT valuation premium is declining

Back to Basics: Reasons to Be Bullish on Bitcoin

As with all asset classes, much of the public discussion about the cryptocurrency market focuses on short-term issues, such as regulatory changes, ETF flows, and DATs. However, it may be helpful to step back and consider the core investment philosophy. While the cryptocurrency space encompasses many different assets, Bitcoin's raison d'être is to provide a monetary asset and peer-to-peer payment system based on clear and transparent rules, independent of any specific individual or institution. Recent threats to the independence of the Federal Reserve are another reminder of why many investors are so drawn to these assets.

For background, most modern economies utilize a "fiat" monetary system. This means the currency has no explicit backing (i.e., it's not pegged to any commodity or other currency) and its value is based entirely on trust. Throughout history, governments have repeatedly exploited this characteristic to achieve short-term goals (such as reelection). This can lead to inflation and erode trust in the fiat monetary system.

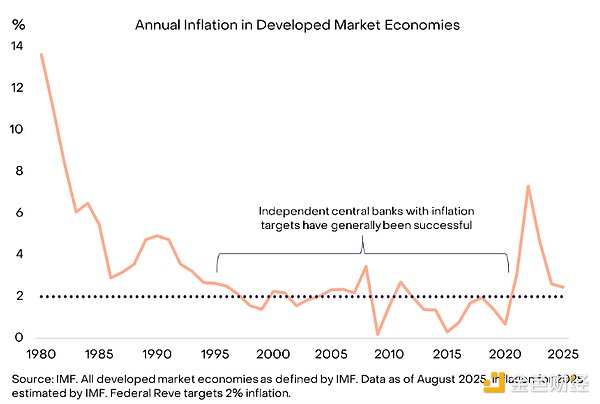

For fiat currencies to be effective, therefore, there needs to be a way to ensure that governments live up to their promises not to exploit the system. The approach taken by the United States and most developed market economies is to give central banks a clear objective (usually in the form of an inflation target) and operational independence. Elected officials typically exercise some oversight over central banks to ensure democratic accountability. With the exception of a temporary spike in inflation following the COVID-19 pandemic, this system of clear objectives, operational independence, and democratic accountability has achieved low and stable inflation in major economies since the mid-1990s (Chart 6).

Figure 6: Independent Central Banks Achieve Low and Stable Inflation

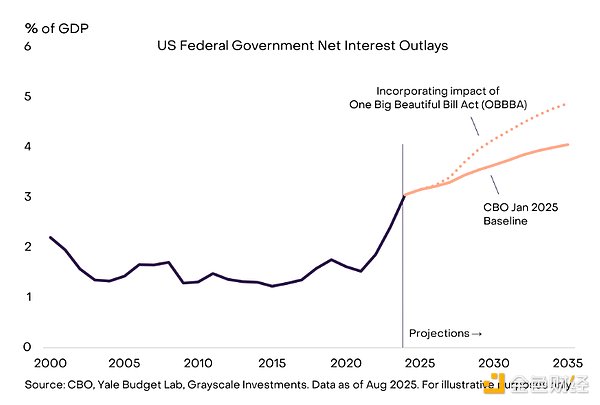

In the United States, this system is now under strain. The fundamental drivers are not primarily inflation, but deficits and interest payments. The US federal government's total debt currently stands at approximately $30 trillion, equivalent to 100% of GDP. Despite a peacetime economy and low unemployment, this is still the highest level since World War II. As the Treasury refinances this debt at interest rates around 4%, interest payments continue to rise, diverting resources that could be used for other purposes (Exhibit 7).

Figure 7: Interest Payments Eat Up More of the Federal Budget

The Big Beautiful Bill (OBBBA), passed in July, will lock in high deficits for the next decade. Unless interest rates fall, this will mean higher interest payments and further squeeze other uses of government revenue. Consequently, the White House has repeatedly pressured the Federal Reserve to lower interest rates and called for the resignation of Fed Chairman Powell. These threats to the Fed's independence escalated further in August with the ouster of Lisa Cook, one of the six current members of the Fed's seven-member board of governors. While this may help elected officials in the short term, weakening the Fed's independence increases the risk of long-term high inflation and monetary weakness.

Bitcoin is a monetary system based on transparent rules and predictable supply growth. When investors lose confidence in the institutions that protect the fiat monetary system, they turn to trusted alternatives. Unless policymakers take steps to strengthen the institutions that back fiat currencies—so that investors can trust their commitment to low and stable inflation over the long term—demand for BTC is likely to continue to rise.