The more I study oracles, the closer I feel to their essence.

Everyone is familiar with MEV, but not many know about OEV.

MEV, as previously known, stands for Miner Extractable Value; OEV, on the other hand, stands for Oracle Extractable Value.

There are two rules: those with additional information always receive additional benefits; but the more people who know additional information, the more these benefits are diluted.

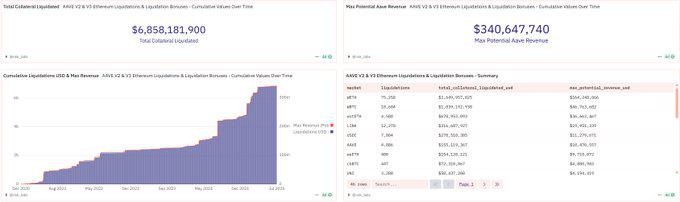

For example, in the case of AAVE margin calls, the protocol incentivizes third parties to liquidate by offering a liquidation reward, such as 10% of the margin call amount.

This is essentially a guaranteed win, and the payer is the margin call holder who runs out of money or forgets to replenish their margin.

So, can you imagine how things would play out with a public, lucrative opportunity? Initially, it would take hours, waiting for real people to manually liquidate. Then, it would take minutes, with scripts competing for orders with fast internet speeds. Finally, it would take seconds, with bots having to burn gas to secure priority on-chain access.

The result of the Gas War is that these bots must pay over 90% of the total to the miners in order to win the competition and even take a small share.

Of course, the miners (nodes) are the happiest. They don't have to do anything, and don't even have to bear the stigma of being a "liquidation vulture." They can just sit back and relax and pocket 90% of the revenue.

However, as some people get more competitive, others get even more. Even at the second level, it's still not enough, so the war spreads to the oracle level.

After much deliberation, it's generally believed that the first to see the liquidation information is actually the oracle. After all, only when the oracle announces a liquidation does it actually happen. If the oracle doesn't announce a liquidation, you might not even get liquidated.

For example, suppose Alice's Ethereum price is 2999 and she's about to be liquidated. If the oracle's price were to rise just a bit, forcing the price to 3000, and Ethereum were to reverse at the integer level, Alice's position might have been saved.

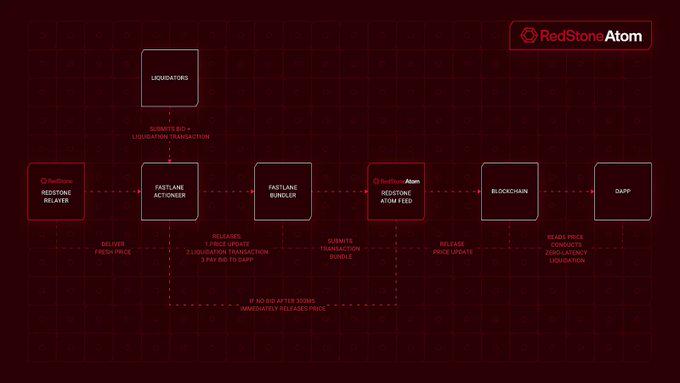

So, how does this race move from seconds to milliseconds? Take RedStone's new Atom feature as an example.

In the same bankruptcy liquidation scenario, the oracle data can be sent off-chain and a small off-chain auction can be conducted.

The liquidator, on the other hand, handles the transaction directly off-chain, eliminating the need for a gas war. The highest bidder wins, taking about 300 milliseconds.

After each auction, atoms are submitted directly to the smart contract based on the highest bid (bypassing public channels).

This smart contract is quite interesting. It bundles three operations into a single atomic transaction:

1. Update the signed oracle price;

2. Execute liquidation;

3. Transfer the winning bid amount to the designated recipient.

Because all three operations are settled within the same block, the oracle update and liquidation are inextricably linked, eliminating the possibility of another liquidator observing the on-chain information and immediately copying it to preemptively liquidate.

This bundling of three transactions onto the chain is indeed quite impressive, but upon closer inspection, this is standard blockchain thinking—time in the blockchain world isn't linear, but rather measured in blocks, such as 12 seconds in Ethereum.

These three transactions theoretically occur simultaneously, so no one can insert another transaction between them. It's already exhausted.

So, after RedStone Atom, the OEV war has escalated from seconds to milliseconds, reaching the finish line in one fell swoop. Once you start racing at the finish line, it's pointless for others to try to jump ahead.

And because settlements are handled off-chain, the protocol may be even faster than before.

This way, the profits captured by OEV can be fed back to the protocol, the oracle itself, and the liquidator, benefiting all three parties. I believe this will minimize friction and is a fantastic design.