Written by Luoluo

Recently, a number of users who contributed to Binance Alpha's trading volume and received airdrops have declared they are "quitting." The reason is that the points required to qualify for two new Alpha asset airdrops at the end of August reached new highs, raising the points required to claim the "priority" and "first-come, first-served" airdrops to 260 and 230 points, respectively.

The situation of high points and users calling for withdrawal was very similar to the Alpha market atmosphere in May and June of this year. Later, after the "points consumption" and "points tiering" rules were implemented, Alpha enthusiastic users were able to get through July smoothly, and Binance Alpha's trading volume was pushed to the level of US$10 billion.

Today, with the reappearance of high transaction volume and high threshold for receiving rewards, Alpha is increasingly becoming a platform that tests user loyalty. When people with low scores consider giving up, where will Alpha go?

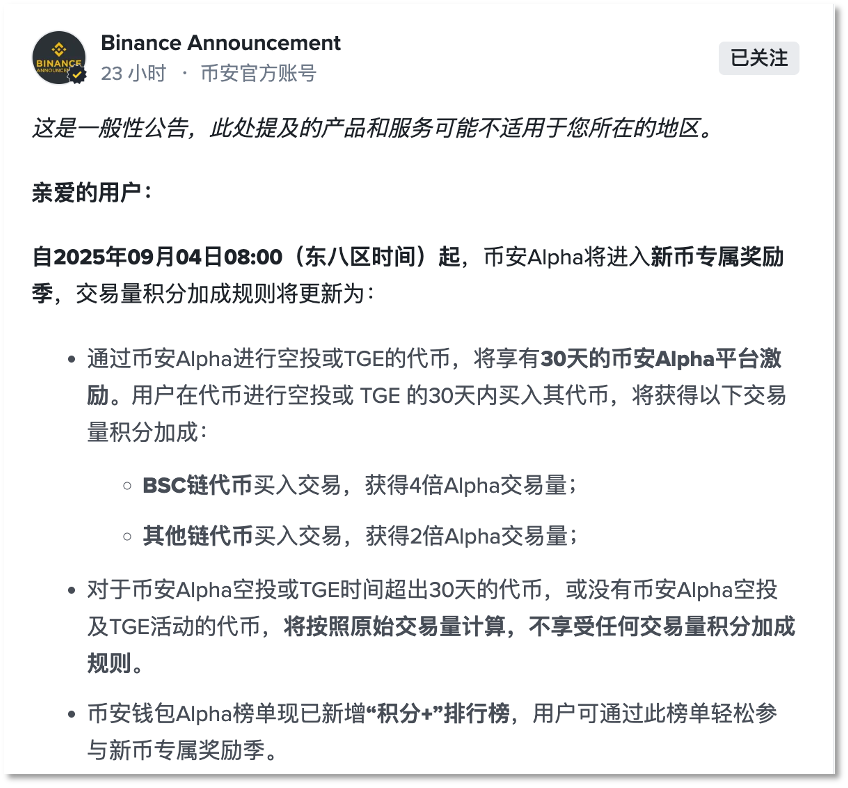

On September 4th, the Alpha Points rules were upgraded. New airdrop/TGE projects will receive a 30-day "Newbie Support Period." During this period, users who purchase these new tokens will receive a "super-doubled" trading volume bonus: 4x the trading volume bonus for BSC tokens and 2x for other chains. This rule will increase users' trading volume point rewards, but users should also be aware of the volatility risks of new tokens.

The "differential treatment" of the BSC chain and other chains in this rule also once again released Binance's intention to support the Alpha Web3 market.

In more than half a year, Binance Alpha has launched over 100 airdrop activities. The increase in trading volume and liquidity brought about by incentives and stimulation has made the platform seem more attractive than the Binance main site, like a small copycat market.

As a frontier for Binance's new offerings, Alpha conducts research on various Web3 projects for Binance in the real-money trading market. Over the past three months, the performance of Alpha's airdropped tokens has shown that three to four projects have become blockbuster hits each month after listing on Binance, reversing the trend of project tokens peaking as soon as they were listed on Binance earlier this year.

Binance’s recently launched Alpha2.0 market maker program reveals that this section, which was born out of Web3 Wallet, is trying to make Alpha into a bigger "cake".

Why are Alpha points increased?

On August 28, two projects that raised the threshold for Alpha airdrop points were DOLO and BLUM.

DOLO first adopted a phased point-based redemption system. The points exposure in the "priority redemption" stage was 260 points, which was the highest score since the launch of the Alpha airdrop. The "first come, first served" threshold in the second stage also increased, from 200 points, which had remained unchanged for 11 consecutive periods, to 30 points.

Users who were waiting for high-scoring players to claim the next BLUM airdrop after receiving the DOLO score reduction did not expect that the "first come, first served" threshold for this round of airdrops would also be forced to 230 points.

While some people were shouting on social media that "I can't play anymore" and "I'm quitting", others were pocketing the DOLO and BLUM airdrops for $48 and $28 respectively.

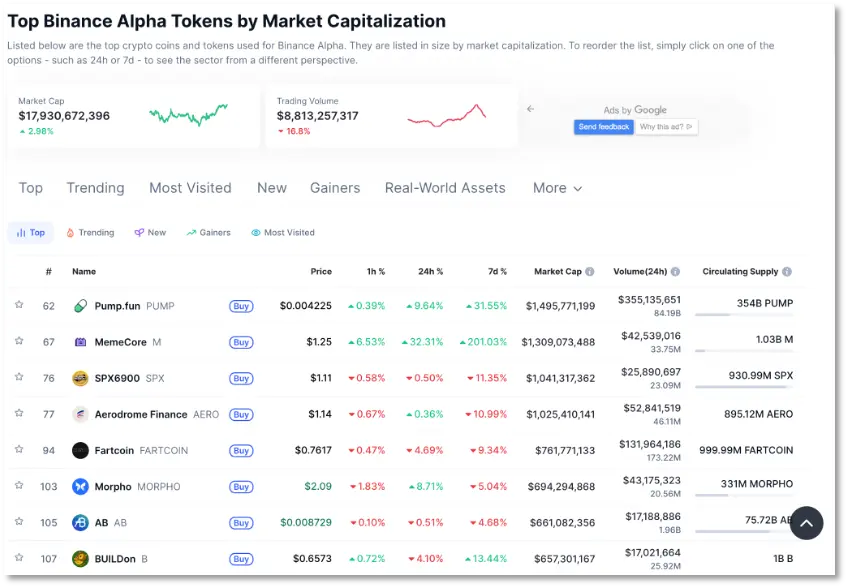

The high airdrop threshold suggests continued growth in Alpha trading activity. According to CoinMarketCap data, two weeks ago, Binance Alpha's overall market capitalization was $17.4 billion, with a trading volume of $8.83 billion. Following the listing of the new token, trading volume in the sector rose to $10.015 billion the following week, maintaining a market capitalization of $17.1 billion. As of September 4th, its trading volume reached $8.813 billion, with a market capitalization of $17.93 billion.

As of September 4, Binance Alpha’s trading volume was $8.813 billion

Points are high, but traders and score-boosting people are still there. This is a situation that happened as early as May and June when Alpha was running. Binance has been dynamically adjusting measures for two consecutive months.

Essentially, Alpha Points is an initiative designed to reward users for their active participation in the Binance ecosystem. Officially launched on April 25th of this year, users accumulate points based on their balance and trading volume. Once they reach a certain point, they can claim new airdropped tokens. Prior to this, some users had keenly seized the opportunity and, with minimal trading, secured a significant portion of the token airdrop. Within a month, they quietly amassed profits exceeding 10,000 yuan, earning nearly 1,000 yuan a day.

On the day the points system was launched alone, the number of active users of Binance Wallet soared by more than 58% - from 44,967 to 71,228, and trading volume doubled in 24 hours - jumping from US$48.46 million to US$118 million.

The internal competition has begun. Binance has also been iterating the points system to dynamically balance the distribution of rewards to participants, while also strengthening risk control and anti-cheating measures to maintain the fairness of the event.

In May, when the points requirement for claiming the Alpha airdrop was about to rise from double digits in April to triple digits, approaching 200 points, Binance Alpha’s points system was upgraded on May 13th, adding a “consumption mechanism” that required users to actually consume 15 points when confirming their participation in Alpha or TGE.

By reducing points and lowering the threshold, Binance attempted to adjust its rules to benefit contributors, curb excessively high points, and attract newcomers. However, it took about two weeks for the "points consumption" process to truly lower the threshold to around 200 points, roughly equivalent to the 15-day accumulation period for points.

User @Mingo shared his earnings on social media. The 24th Alpha and TGE airdrop earned him $1,795 that month. After deducting $133.50 in transaction costs, his monthly salary exceeded 10,000 yuan. The lowest single-period profit on his account was $70. The popular project NXPC (MapleStory), which offered a 187-point threshold, boosted many users' earnings to $600 or even over a thousand dollars. This set a record for Alpha airdrop earnings and undoubtedly became @Mingo's highest daily income that month.

The picture comes from Binance user @MingoMingge’s social media post

Undoubtedly, the high returns in the early days of the Alpha airdrop were a key factor in attracting continued user participation. However, the team-based studios were often viewed by ordinary users as undermining the fairness of the Alpha airdrop. Photos of multiple phones vying for Alphas, and recruitment posts from studios seeking dedicated airdrop handlers, were widely circulated on social networks.

To this end, Binance launched a rectification campaign. In early June, Binance detected the use of bots by certain teams in Alpha activities. The company clarified that any use of bots (including but not limited to scripts, automated tools, or other non-manual methods) will be considered a violation. The company has upgraded its risk control system to enhance its ability to detect and address violations. Accounts that trigger risk control measures will be disqualified from participating in Alpha points.

On Binance's social media platform, many people reported receiving pop-up notifications regarding violations. Some appealed successfully, while others failed.

However, the weekly active users of more than 100,000 still pushed the threshold for receiving airdrops directly based on points to between 210 and 251 in June.

Starting from June 19, Binance has once again iterated the points rules. The Alpha airdrop began to adopt a two-stage distribution mechanism. In the first stage, a high-points priority threshold was set within a limited time. In the second stage, the points were lowered to a certain level and distributed to qualified users on a first-come, first-served basis.

After the introduction of the segmented points rule, many users discovered that they needed to pass a "machine test" when claiming/grabbing airdrops. In addition to facial recognition, a slider was added to prove that you are a human.

Binance has further strengthened its ability to detect bots, resulting in relatively stable Alpha scores in July. In the 31st Alpha airdrop (excluding the TGE), the highest score for "priority claiming" was 234, occurring only in the first PEAQ airdrop, with a single number earning around $45. The lowest score was 210, occurring in BGSC at the beginning of the month and RCADE on July 10th, both yielding around $40. The threshold for "first-come, first-served" claiming, after fluctuating between 120 and 190 points, has now stabilized at 200.

According to one user, after diligently accumulating the high threshold of 240 points, he received five airdrops in July. After deducting costs, he earned around $240, with an average of around $48 per period. "This is obviously much lower than the previous two months."

In August, the "first come, first served" threshold of almost 200 points was being broken by 230 points at the end of the month. The internal circulation of the Alpha airdrop was still continuing, and data from Dune showed that the weekly active users of Binance Wallet transactions had climbed from more than 120,000 at the beginning of the month to more than 180,000 at the end of the month.

On September 4, Alpha Points updated its trading volume rules.

Finally, on September 4, Alpha adjusted the points rules again and added a new "Points Plus" gameplay, which "super-doubled" the trading volume points to achieve a trading volume bonus for the new airdrop/TGE tokens within 30 days. At the same time, it also opened an "accelerator" for users who are keen on accumulating points and taking airdrops to increase the points return.

In the view of KOL @BitHappyX, the "30-day trading volume doubling period" rule is "a redistribution of resources and benefits": it restricts the studio's arbitrage model while allocating resources and traffic to truly participating users and new projects.

He explained that since the old currencies only retain 1x transaction volume points, this will cut off the studio's channels for obtaining points through large-scale sweeps of the sideways old currencies, thus compressing their arbitrage space; and although the new currencies enjoy point bonuses, the price fluctuations in the first month (within 30 days) are often large. Although ordinary users will also face risks, studios that pursue high points and heavily invest will obviously bear higher financial risks.

He predicts that as the advantages of old currency points are insufficient and the risks of new currency increase significantly, some studios will be forced to give up "fake activity" or even withdraw from Alpha directly.

As Winson Liu, Global Head of Binance Wallet, emphasized, “Through reward participation, we provide a fairer path for truly loyal Alpha users to participate, while also enabling Binance Alpha to support more high-quality Web3 projects.”

Does the “Selection Pool” work for Binance listings?

After more than eight months of operation, Binance Alpha has distributed over 100 airdrops. When the trading volume of this sector exceeded US$10 billion, the continued surge in trading volume showed that this ecosystem has strongly stimulated user interest, allowing Alpha to form a momentum cycle independent of the traditional altcoin market. Using trading as a hard-core indicator, Binance continues to verify market projects.

In fact, as early as December last year when Binance announced the launch of Alpha, it intended to cultivate this on-chain DEX in the Binance wallet as a new token selection pool for the main site. Although there is no guarantee that Alpha tokens will be listed on the main site, the cases of individual projects that conducted exclusive TGE (token generation events) in the Binance wallet and were listed on the main site at the beginning of the year have enhanced the outside world's impression of Alpha as a "candidate area for listing."

At the time, Binance was plagued by public outcry over its "poor listing quality" and "girlfriend coins." Co-founder He Yi had to repeatedly address the criticism, repeatedly disclosing listing criteria and emphasizing "rigorous selection." Binance also implemented a "voting for listing and delisting" system.

Although Binance later deliberately slowed down the pace of new product launches, the downward trend of most new assets, which peaked upon launch, has not been effectively improved.

It was in this context that Binance Alpha officially began testing. The results proved that no matter how good the promises were, they were not as good as transforming user demands into effective products and experiences, which is what Binance excels at.

On March 18, Binance Alpha 2.0 was launched by integrating into the main site, breaking the boundaries between centralized exchanges (CEX) and Web3 wallets, allowing CEX users to directly purchase various new early-stage project tokens on the chain with assets such as USDT and USDC on the site.

Winson Liu clarified, "Binance Alpha serves as a pre-listing token selection pool, aiming to enhance transparency in Binance's listing process. By publicly recommending selected early-stage projects, the Alpha platform strengthens community trust and provides users with insights into promising tokens within the Binance ecosystem."

As the number of Alpha tokens increases and the number of projects in the selection pool grows, will Binance's listings on the main site surge due to the surge in new tokens? Have these Alpha-selected projects improved Binance's listings?

As of September 4th, CoinmarketCap reported a total of 274 token projects listed and trading on Binance Alpha. According to Binance's official data from August 18th and subsequent updates, 177 of the Alpha-listed projects, or 64.6%, have conducted TGEs, airdrops, or booster campaigns. Of these, 26, or 14.6%, have entered the Binance spot market, and 77, or 43.5%, have listed on the contract market.

The conversion rate of Alpha airdrop tokens listed on the spot market was 14.6%

According to DWF Labs data from June, of the over 190 tokens listed on Binance Alpha, 18 were listed on the Binance main site's spot market, with a conversion rate of 9.5%. Two months later, only 26 of the 274 Alpha tokens were listed on the spot market, with a conversion rate still at 9.48%.

It can be seen that even with Alpha as a pre-selection pool, Binance still maintains an almost unchanged conversion rate under the "strict selection" standard.

Looking at the Alpha tokens listed on Binance’s main website, the vast majority have launched TGE/airdrop/Booster activities, and airdrops are the most frequent channel for tokens to be listed on Binance’s spot or contract markets.

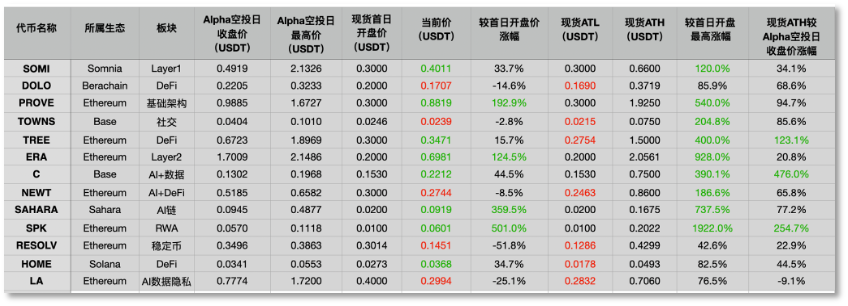

Hive Tech counted 107 airdropped tokens launched by Binance Alpha in the three months from June to September. A total of 13 tokens were listed on the spot market + contract market of the Binance main site, and 19 tokens were listed on the contract market alone.

Alpha airdrop token performance on Binance spot trading

Judging from the trends of these 13 Alpha tokens listed on the Binance spot market, as of September 4, eight tokens have fluctuated with the market correction amid the overall decline in the current crypto asset market. However, the current prices of PROVE, ERA, SAHARA, and SPK remain strong, still up 1-5 times from their opening prices, with SPK having the highest increase of 501%. Only three tokens have significantly fallen below their first-day opening prices (with a drop of more than 10%). RESOLV, launched in June, performed the worst, down 51.8% from its issue price.

Among the 13 projects, the ATH (historical high) of 9 tokens increased by more than 100% compared with the opening price on the first day, and the lowest increase was more than 40%. The ATH of PROVE, SAHARA, ERA, and SPK increased by 540%, 737%, 928%, and 1922% respectively compared with their opening prices on Binance spot.

If we use the closing price of Alpha on the day of the airdrop as a coordinate, except for LA (-9.1%), which was the first to be listed, the ATHs of the remaining tokens after being airdropped and listed on the Binance spot market can still create a minimum increase of 20%. The spot ATHs of TREE, SPK, and C increased by as much as 123%, 476%, and 245% respectively compared to the closing price on the day of the Alpha airdrop, which shows the support ability of the Binance ecosystem for project tokens.

This new coin's performance significantly surpassed the projects launched on Binance at the end of last year, breaking the cycle of new projects frequently breaking their IPO prices. This demonstrates that Alpha's strategy of listing through airdrops is indeed achieving a selective effect.

Accelerating towards the core market of Web3

As more and more projects are launched, the "launch-at-the-peak" phenomenon is now appearing in the Alpha trading area. This is consistent with the market characteristics of Alpha, an emerging Web3 blockchain: early-stage projects and poor on-chain liquidity.

But Binance plans to change that.

First, the new Alpha points rules on September 4th will focus more on newly launched projects, which is expected to bring them real trading volume from the market, and at the same time will once again help Binance achieve the effect of "killing two birds with one stone".

Judging from the rules, BSC, which occupies the mainstream issuance chain among Alpha tokens, remains the ecosystem that Binance focuses on supporting. The incentive of "4 times the trading volume" will be used to guide and support BNBChain (previously it was 2 times with no time limit). On-chain activity and transaction fee income are expected to increase as a result. The trading efficiency and price performance of new project tokens in the Alpha trading area will also have the opportunity to improve as user trading participation increases.

In addition to improving the trading performance of new tokens from the traffic level, on August 28, Binance officially announced the launch of the Alpha 2.0 limit order market maker program, inviting users with extensive DEX trading experience to join and grant them the right to zero transaction fees for limit buy/sell and access to the Alpha exclusive API.

Binance is leveraging its strategic advantages gained from years of development in CEX to fill the "liquidity" gap for Alpha as a core market of Web3. Its long-term advantages have become increasingly apparent over the past six months.

Because Alpha has attracted a large number of users through airdrops and trading competition rewards, Binance Wallet has already ranked among the top major Web3 wallets globally in terms of active users compared to other wallets. Furthermore, the majority of tokens listed on the Binance Alpha platform are from the BNBChain chain. Of the airdropped tokens from June to August alone, 77% came from the BNBChain chain.

Messari's latest BNBChain Q2 2025 report shows that BNBChain maintained strong growth in the second quarter, with user activity and on-chain transactions reaching all-time highs. Daily active addresses and transaction volume increased significantly, with robust DeFi activity. BNBChain ranked first in DEX trading volume, stablecoin transactions, and active users, solidifying its leading position in the Web3 ecosystem.

In terms of market capitalization and investor confidence, BNB's market capitalization increased by 7.5% quarter-over-quarter to US$92.6 billion. In terms of on-chain transactions and activity, with transaction fees falling by 90% to 0.1 gwei, BNB Chain's average daily transaction volume increased by 101.9% quarter-over-quarter to 9.9 million transactions, and the average daily active addresses increased by 33.2% to 1.6 million. The number of new addresses increased by 17 million in May. In terms of DEX performance, it ranked first in the entire chain, with an average daily transaction volume of US$3.3 billion in Q2. PancakeSwap, which undertakes a large amount of Alpha transaction matching capabilities, has a market share of 85.1%.

Active users, surging traffic, and DEX trading volume are attracting projects to build on BNBChain. One crypto community insider bluntly suggested that innovative projects deploy directly on BNBChain, stating, "Low transaction fees and high traffic are what early-stage projects desire most. BNBChain now offers nearly all of these, and project tokens have the opportunity to enter Alpha and even receive support from Binance. Why not?"

Winson Liu, global head of Binance Wallet, believes that the surge in transaction volume represents a change in how users interact with Web3. “Binance Alpha is redefining how users discover early-stage projects and earn real rewards – we are setting a new standard for prioritized participation for Web3 users.”

From the DEX function in the Binance Web3 wallet gradually becoming an important part of the main site, Alpha is developing towards the core product direction of Web3, which can be seen from the richness of the interface.

Initially, Alpha was displayed on mobile devices alongside Binance's spot and futures trading areas. Later, with the introduction of a points system, a separate airdrop interface similar to Launchpool emerged. Further on, this interface not only offered airdrops but also allowed users to access trading competitions, financial management, TGE, Bootser tasks, and other interfaces with one click. This was a thorough and refined integration of user-favorite features from the Binance Web3 wallet into a single interface.

Now, users no longer need to enter their wallet address on a third-party website to count transaction volume and calculate accumulated points. Alpha directly provides an estimated value for users' points reference.

Today, projects listing on Alpha are achieving similar results to listing on Binance's main website: optimal exposure, significant traffic from top platforms, and effective market liquidity. Binance Alpha is also increasingly taking shape as a core Web3 marketplace. The new rule of doubling user points for every increase in trading volume also suggests that Alpha will continue to add new projects. As this market grows, airdrops will have the potential to become a continuous source of user benefits.