In early September, the personnel and power landscape surrounding the Federal Reserve continued to evolve at an accelerated pace.

On September 3, it was reported that the White House had made it clear that it would finalize the next Federal Reserve Chairman as soon as possible. Treasury Secretary Scott Besant has initiated the interview process with 11 candidates, which will begin this Friday and last for a week.

Meanwhile, personnel and power dynamics surrounding a "smooth transition" are increasing. On the one hand, Trump's previous dismissal of the Director of the Bureau of Labor Statistics (BLS) has sparked market concerns about the independence of official data. On the other hand, Federal Reserve Governor Adrienne Kugler officially submitted her resignation in early August, leaving the seat open for a new governor. The new Fed governor, Stephen Miran, former Chair of the White House Council of Economic Advisers (CEA), was nominated by Trump and will testify before the Senate Banking Committee on September 4th. Miran emphasized "monetary policy independence" in her written testimony, and she will focus on "maintaining independence" during the confirmation process. Expectations are that her confirmation will proceed swiftly.

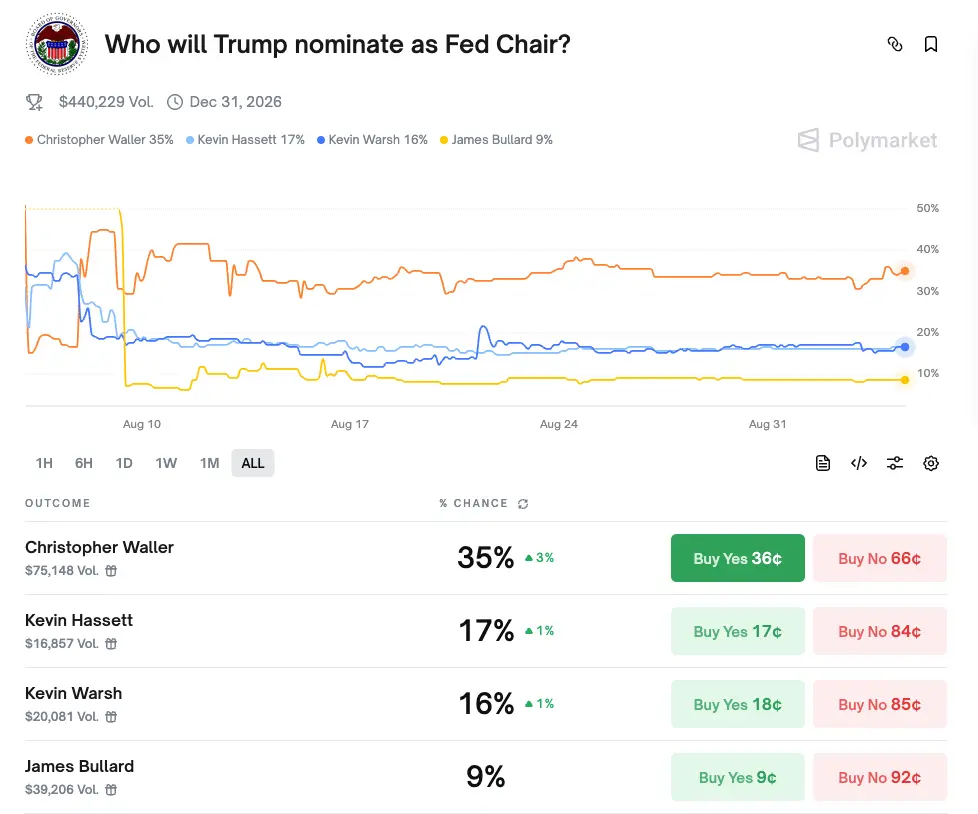

With more and more actions taking place, the market is shrouded in confusion about the future. Who will be the next chairman of the Federal Reserve has become the focus of market attention?

Who are the 11 candidates for Federal Reserve Chairman?

According to Fed appointment rules, the Fed Chair must be a current member of the Board of Governors. Current Chair Powell's term as Chair expires in May 2026, while his term as a Governor runs until January 2028. If he chooses to remain a Governor after leaving office, Trump's pool of candidates for a future Chair would be limited. The current list of 11 core candidates includes elite leaders from across the political and business sectors, including those from the Fed establishment, former officials, and Wall Street veterans.

Christopher Waller

Christopher Waller, the former director of research at the Federal Reserve Bank of St. Louis, possesses both extensive academic background and practical policy experience. He is considered by stakeholders and prediction markets to be the leading candidate. Known for his "data-driven yet relatively flexible" approach, he has recently publicly supported a swift interest rate cut, preferring to shift interest rates even sooner after inflationary pressures ease. His speeches on stablecoins have been clear and coherent, advocating for private-sector-led innovation within a framework of legislation and reserve regulation.

He was personally nominated by Trump during his first term. This current director, who is "familiar with the rules and has a dovish stance," may be Trump's most reassured successor.

Michelle Bowman

Vice Chairman of Supervision Michelle Bowman is considered a representative figure of "hawkish regulators." As one of the youngest members of the Federal Reserve Board of Governors, she is the most hawkish female representative.

In August this year, she proposed that Federal Reserve staff should be allowed to hold a small amount of crypto assets to improve supervisory understanding, sending a more "technology-neutral" signal in regulatory tone than before, but emphasizing the priority of price stability in monetary policy.

Philip Jefferson

Philip Jefferson, the 63-year-old current Vice Chairman of the Federal Reserve, is also one of the popular candidates. He has a deep academic and organizational coordination background and is familiar with the daily operations of the Federal Reserve. He is a representative of the "conservatives" and is relatively cautious in balancing employment and inflation. He is seen as one of the candidates to ensure the continuity of the existing framework.

It is worth noting that if he is elected, he will be the first African-American Federal Reserve Chairman in history.

Lorie Logan

Lori Logan, former president of the Dallas Fed, previously led open market operations at the New York Fed. His 23 years of experience at the New York Fed have made him highly skilled in market tactics and crisis management. He led the successful handling of both the 2008 financial crisis and the 2020 pandemic. He is considered a central banker known for his expertise in trading.

Kevin Warsh

Former Federal Reserve Governor Kevin Walsh is a candidate with both crisis cycle experience and a strong reform agenda. His father-in-law is the heir to the Estée Lauder family. At just 35, he became the youngest governor in Federal Reserve history. After leaving the Fed, he researched monetary policy reform at the Hoover Institution at Stanford.

His deep connections in Washington and Wall Street were also seen as a plus, making him considered a popular candidate as early as the last round of draft in 2017.

James Bullard

James Bullard, former president of the Federal Reserve Bank of St. Louis, is known for his ability to identify early signs of inflationary turning points and his ability to connect academics with the market. He began warning the market of inflationary risks as early as 2021, but due to his personality and independent views, he has long maintained a relatively unconventional voting record on the FOMC.

Kevin Hassett

Kevin Hassett, director of the White House National Economic Council, has a deep connection with President Trump. Due to his position, he analyzes economic data for Trump almost every day and is even called his "economics professor" by Trump.

The two sides share similar policy philosophies, making him a candidate with high political trustworthiness. His weakness lies in his lack of experience working within a central bank.

Marc Sumerlin

Marco Summerlin, a former member of the George W. Bush economic team, served as Deputy Director of the National Economic Council. However, he proposed the most radical Federal Reserve reform plan, advocating for a "process reshaping" of the FOMC at the communication and institutional levels, making him a "reformist within the establishment."

Larry Lindsey

Larry Lindsay has a bipartisan background, having served as Chief Economic Advisor to President George W. Bush and as a Federal Reserve Governor during the Clinton administration. He is highly skilled at coordinating policy between the White House, the central bank, and the market, and accurately predicted the collapse of the dot-com bubble. However, at 70 years old, he faces market scrutiny for his understanding of modern monetary policy tools.

David Zervos

Jefferies chief market strategist David Zervos is a market frontline expert, known for his blunt style, sharp comments, and unique strategic perspective. However, he has a keen sense of the market and maintains close communication with the Federal Reserve, having worked at the New York Fed in the 1990s.

Rick Rieder

Rick Reid, BlackRock's Chief Investment Officer of Global Fixed Income, may be the candidate with the most experience in managing the largest assets in practice. He manages more than $4 trillion in assets at BlackRock, and the assets he manages have gone through multiple economic crisis cycles.

In recent months, the media has clearly favored easing and a resurgence in risk appetite. A transition to a policymaking role would put the transferability of their market experience and policymaking expertise to the test, as well as potential conflicts of interest. The market is also concerned about potential conflicts of interest arising from their transition from fund management to policymaking.

Three crypto-friendly candidates?

Among them, Christopher Waller, the most popular candidate, also has the most systematic stance on the use scenarios of "crypto assets-stablecoins-payment innovation".

From the outset, Waller's scrutiny of crypto assets has been sober, almost harsh. He once compared most cryptocurrencies to "baseball cards"—without intrinsic value, their prices determined by a fragile balance of sentiment and confidence. Regarding such highly volatile speculative assets, he insisted that "the market bears its own profits and losses," and taxpayers should not be left footing the bill for failed investments.

Waller presents a different perspective on the topic of stablecoins. As early as 2021, when stablecoins were still merely an adjunct to crypto assets, he saw their potential. He repeatedly emphasized that "stablecoins can improve payment efficiency, introduce international competition, and increase speed," but this presupposes Congress to improve legislation and establish adequate and transparent reserve and custody rules. In subsequent speeches in 2024 and 2025, he repeatedly urged Congress to pass legislation to prevent bank runs and payment system disruptions, ensuring that stablecoins can truly become secure "synthetic dollars."

Waller has consistently insisted that innovation should be led by the private sector, with the government's role being to "build the highway"—clearing infrastructure like FedNow being the lanes, and the vehicles driven by market competition. However, he also warned that the lack of regulation of non-bank payment institutions and decentralized platforms could lead to the accumulation of leverage, the creation of bubbles, and ultimately, a threat to financial stability.

Unlike Waller, Rick Reed and David Zervos have significant involvement with the crypto industry, beyond their theoretical and policy contributions. Rick Reed's involvement is more evident in the funds he manages and industry activities. As BlackRock's Chief Investment Officer for Global Fixed Income, he not only participated in activities related to projects like Circle and Bullish, but also, through BlackRock's channels, engaged with and supported certain investments in stablecoins and crypto credit. Public documents indicate that he has also participated in numerous public and primary market events involving crypto trading platforms, stablecoin issuers, and crypto lenders.

David Zervos has actively participated in and supported numerous crypto-related projects. He has invested in or supported eToro (trading platform), Circle Internet Group (issuer of USDC), Bullish (crypto exchange backed by Peter Thiel and Alan Howard), and Figure Technology Solutions (crypto-mortgage lending platform). Furthermore, he supported MicroStrategy's early Bitcoin purchase plan, indirectly promoting the adoption of Bitcoin by businesses.

Overall, Waller represents the "institutional friendliness" of the Federal Reserve system, while Zervos and Reed represent the "capital friendliness" of Wall Street. If one of them becomes chairman in the future, the Fed's policy direction may be driven by the dual forces of "monetary easing and crypto institutionalization," leaving a clearer growth path for the compliant crypto market.

Summarize

Looking at this list of candidates spanning academia, politics, and business, we can see that the succession of the Federal Reserve Chairman is not just a matter of the pace of monetary policy, but also directly affects the institutional direction of global financial markets and the crypto industry. For the market, the identities and paths of the candidates with different profiles express different future market directions.

At the same time, observers warn that Trump's frequent nominations and personnel arrangements have fueled growing market concerns about the Federal Reserve's independence. If the new chair is viewed as an extension of excessive "politicization," it could accelerate easing and risk appetite in the short term, but also increase medium- to long-term volatility in US dollar assets and the institution's credibility.

For the crypto industry, regardless of who ultimately takes office, the real benefit lies not in a "friendly label" but in whether institutionalization can be implemented. The boundaries between stablecoin legislation, bank integration, and decentralized payments will be crucial in determining whether the industry can reap the long-term benefits of these policies.

In other words, the arrival of the new chairman may just be the beginning. What the market needs to pay more attention to is whether the system is truly moving towards compliance and transparency.