Author: Duo Nine

Compiled by Tim, PANews

Altcoins have had a rather disappointing year, with most performing poorly, but there is one big exception: HYPE.

What makes Hyperliquid different and what are its future prospects?

I will answer that question later. Meanwhile, in the past 24 hours, HYPE has surpassed its all-time high of $50 and is on track to reach new highs this year.

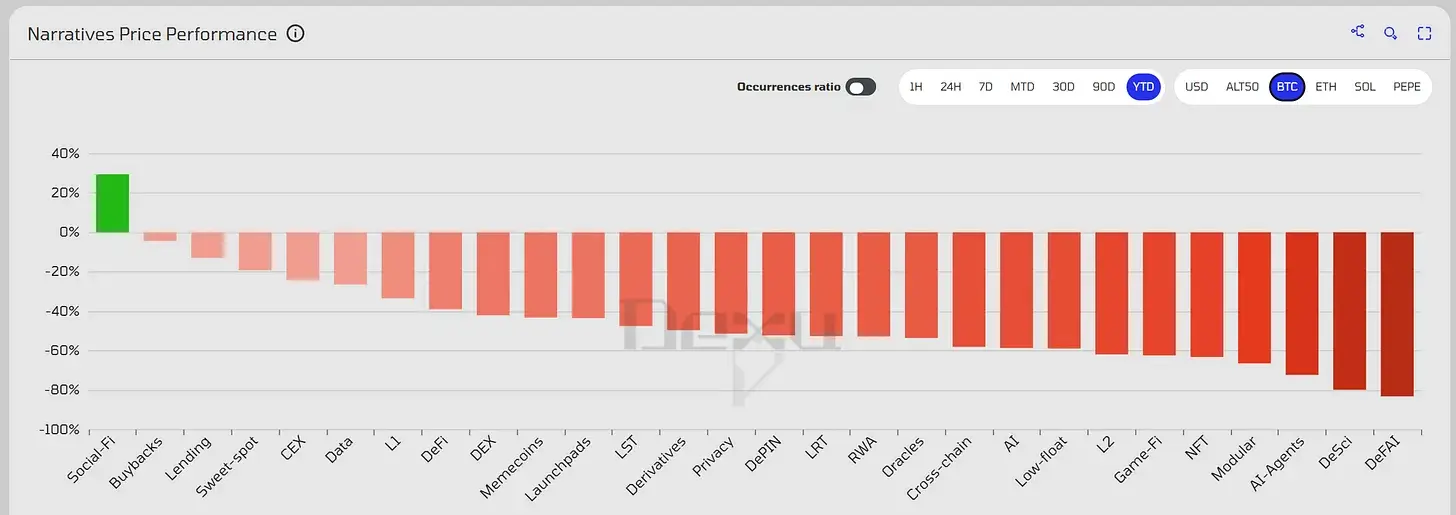

First, let's take a quick look at the year-to-date performance of most altcoins relative to Bitcoin. Notice something in the chart below? With the exception of SocialFi, all other sectors are down.

In other words, it would be a wiser choice to hold only Bitcoin in 2025. Exceptions include SocialFi projects such as Cookie, Kaito, and Zora tokens, the latter of which recently rose 15 times, which I reported in the previous Alpha Post.

Image from dexu.ai

Once you compare altcoins to Bitcoin and identify the winners, the options become quite limited. One of these coins is HYPE, Hyperliquid’s governance token. Let’s start at the very beginning and explore the first part.

Why is Hyperliquid different?

TLDR: Crypto is mostly about extracting value from users, but Hyperliquid is doing something different.

Before we discuss some examples, it's important to define the term "extractive." It refers to a situation where a protocol or chain extracts funds from users and never gives them back to the ecosystem. These funds ultimately disappear into the project team's bank accounts.

This practice reappears every once in a while with new brands and narratives, and the operators behind it are usually the same group of people who keep repeating their routines to defraud users of money in a legal way.

Let’s take a few recent examples to illustrate this:

- The Pump.Fun platform earned billions of dollars in fees by issuing massive amounts of Meme tokens on the Solana blockchain. They then raised a significant amount of capital from investors in a pre-launch pre-sale. However, the PUMP token plummeted 67% upon listing. They exploited users for a significant amount while providing little in return.

- Cronos: Crypto.com created the CRO token in 2018 with an initial supply of 100 billion. In 2021, the project destroyed 70 billion tokens to support the price. However, in March 2025, an insider-led vote resulted in the issuance of an additional 70 billion tokens. This operation sacrificed user interests rather than creating value for them.

- TRUMP/MELANIA/YZY: These celebrity tokens are the epitome of extractive practices. Once a celebrity agrees to collaborate, tokens are privately created and allocated to insiders. Once the tokens are listed, the tokens, acquired at zero cost, are sold for hard currency. The entire process involves pocketing the profits without any return.

Now let's look at Hyperliquid.

They launched a decentralized exchange, initially starting by paying rebates to anyone providing liquidity to the order book (called market makers). Market makers earned revenue by creating limit orders, and their profit came from splitting the fees paid by takers between the Hyperliquid platform and the market makers (this model is still available on the Grvt platform).

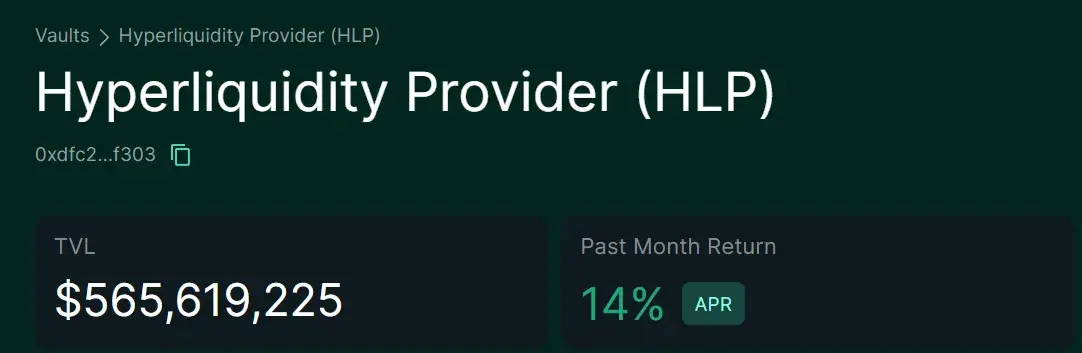

To further enhance exchange liquidity, Hyperliquid has created an HLP staking vault. Users who deposit USDC into this vault receive dividends on liquidation fees, while also receiving other trading fee income. Centralized exchanges like Binance and Coinbase, on the other hand, pocket all liquidation fees.

Prior to this, the HYPE token did not exist. However, all users who traded on Hyperliquid accumulated points. These points were then converted into HYPE tokens and airdropped to all users who traded on the exchange.

The first airdrop (with more likely to follow) distributed 31% of Hyperliquid's total supply, or 310 million HYPE tokens, to users. This airdrop coincided with the launch of its spot market. Unsurprisingly, the price of HYPE soared from $2 to its current price of $51. Recipients received these tokens "for free" based on their trading metrics.

They (the users who received the airdrop) were insiders, and this move fundamentally changed the trajectory of Hyperliquid's development.

Furthermore, Hyperliquid currently uses 97% of its revenue to buy back its own tokens and plans to increase this ratio to 99%. This means that the transaction fees paid by users when trading on Hyperliquid will be used to buy back HYPE tokens and drive up their price.

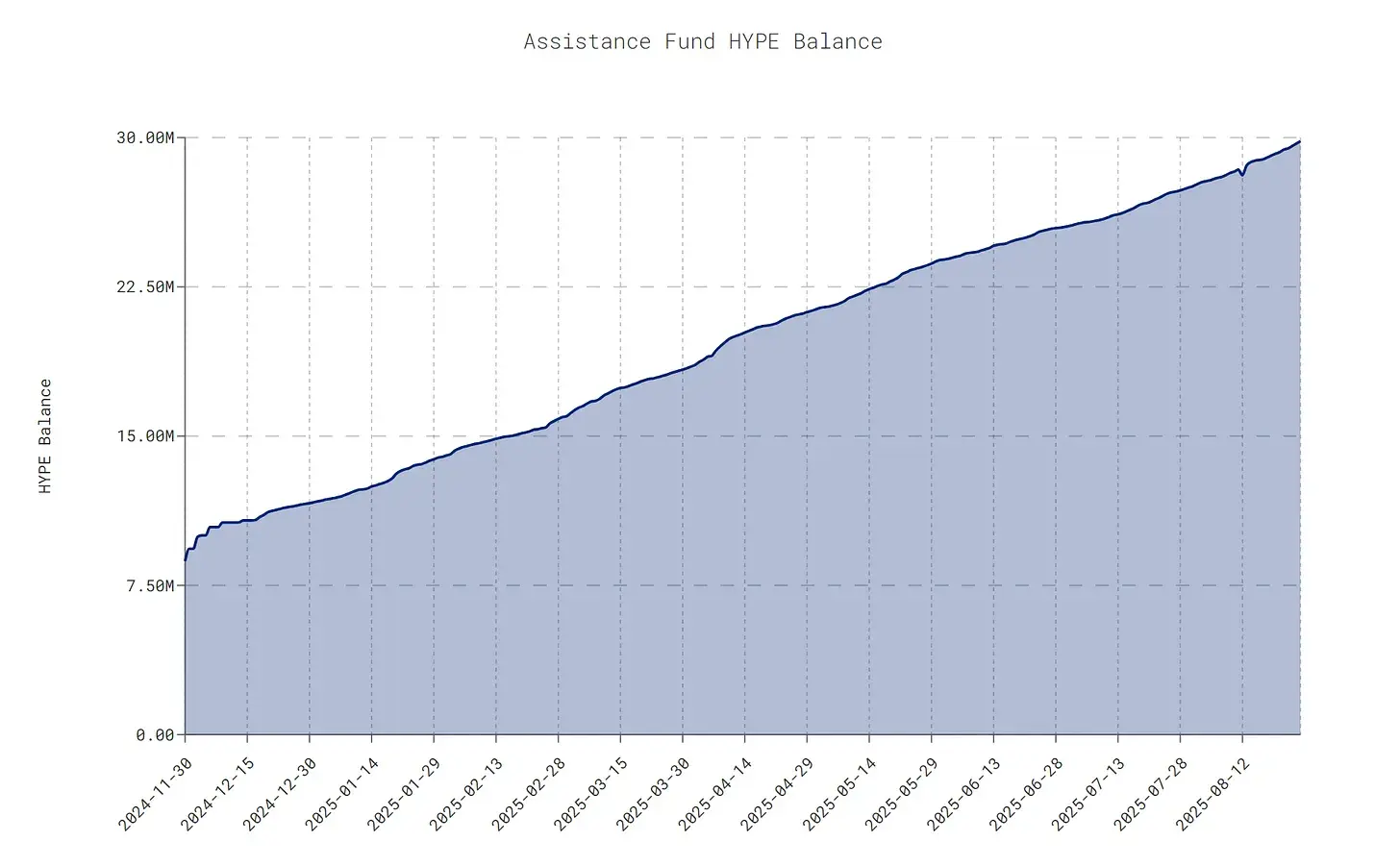

If you happen to stake a large amount of HYPE to get a discount on trading fees, you are actually paying for your own fees by trading on the platform. To date, the Hyperliquid Assistance Fund has purchased nearly 30 million HYPE tokens worth approximately $1.5 billion.

Icons from data.asxn.xyz

While other platforms charge significant fees from users and may return a portion, Hyperliquid returns 97% and soon to be 99% of the funds invested. Users notice this difference, which is why HYPE has become an industry outlier and will continue to capture market share from centralized exchanges that primarily charge fees to users.

These competitors also happen to be the same ones who claim that the Hyperliquid team will eventually sell the 30 million HYPE from the aid fund.

This is impossible!

I think it is more likely that the Hyperliquid team will destroy these tokens, which will cause the price of HYPE to skyrocket 2-5 times overnight.

Why are they destroying the tokens in the aid fund?

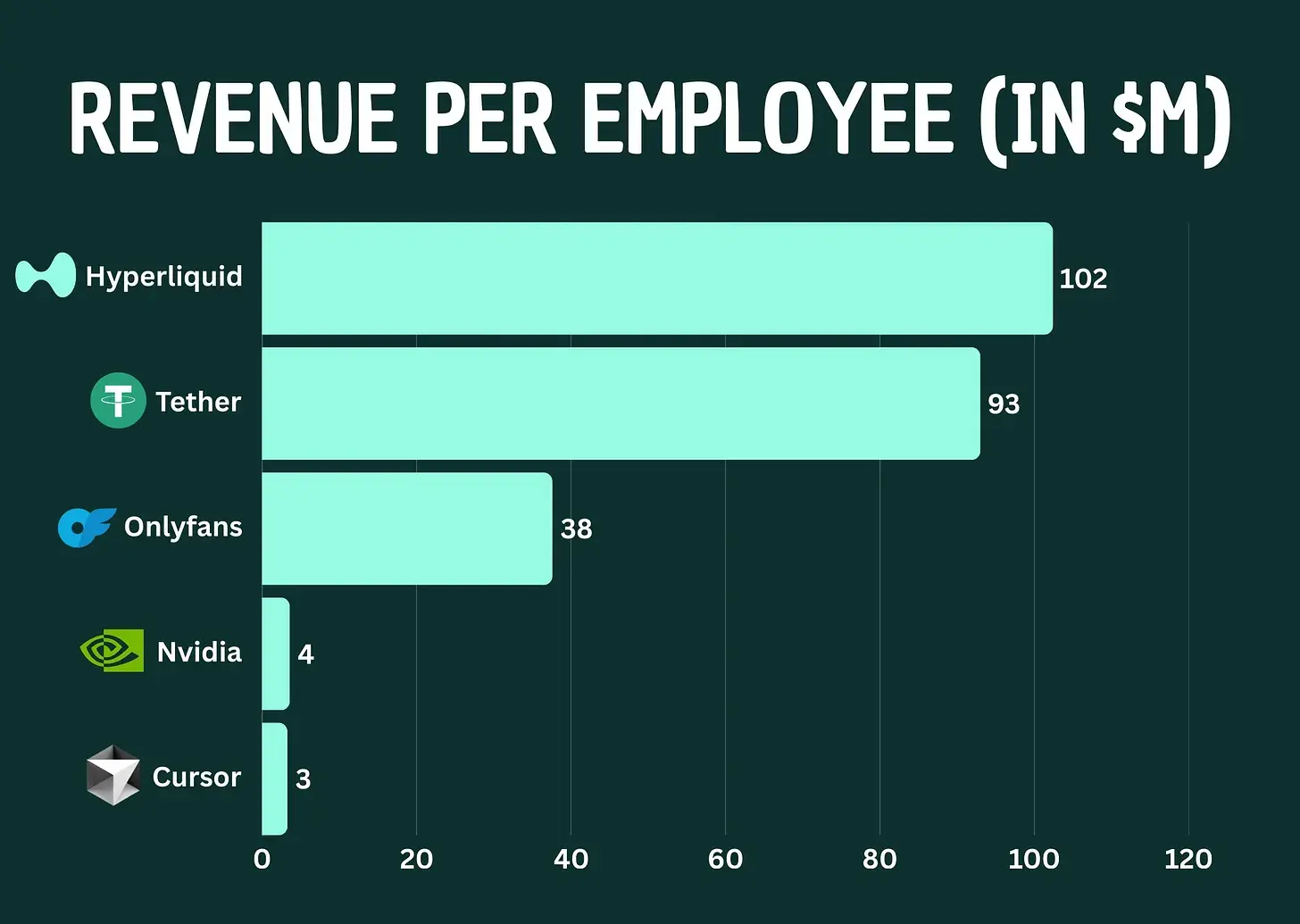

Because it is good for their users and the ecosystem. Perhaps it is worth pointing out here that Hyperliquid is managed by 11 people and their average revenue per person is $102 million, which is the highest in the world!

I repeat, eleven people! The Hyperliquid team also happens to derive the majority of its revenue from market making. They don't need to sell HYPE tokens to be profitable; they just need to run a successful exchange, which they've already achieved.

That being said, let’s take a look at HYPE’s price action.

Where will the HYPE price peak?

As shown in the chart, the price is currently in an ascending channel, ranging from $40 to $60. If the price breaks through $63 (the upper limit of the channel), its significance will far exceed the current breakthrough of $50.

I think a price target around $109 or $100 will have a magnet effect on the price and market heat will eventually hit that level, most likely after a breakout above $63.

It’s worth noting that the current price action has weakened compared to the rally from April to June. While millions of dollars are being repurchased daily, HYPE’s market capitalization has reached a significant size, making the impact of these buybacks, while still significant, less pronounced than before.

If we ignore stablecoins, HYPE’s market capitalization has already ranked among the top ten cryptocurrencies, which is a huge achievement in itself. If HYPE rises to $100 in the future, its market capitalization will double, ranking close to Dogecoin and second only to Solana.

I believe this is a peak in this cycle. HYPE's price could rise further, but this depends on the growth of its HyperEVM protocol ecosystem and user base. If all goes well, this will explode in the next cycle.

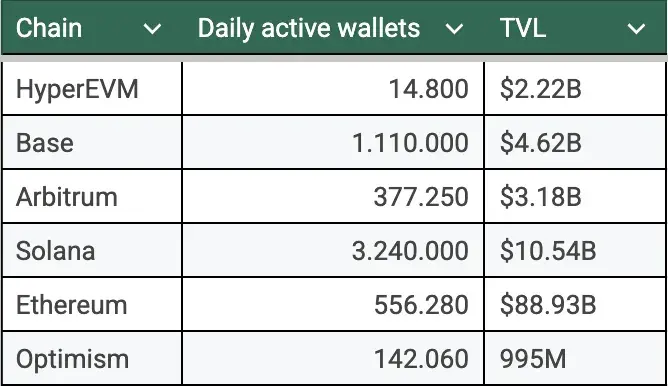

As of now, HyperEVM has approximately 15,000 users, the majority of whom are traders on the Hyperliquid DEX itself. This number is minuscule compared to Solana or other chains like Ethereum or Arbitrum. Unless this changes, HYPE's upside potential will be limited to the performance of its exchange.

Onboarding new users to the Hyperliquid DEX is now straightforward, but the same cannot be said for the HyperEVM, where the user experience remains problematic, though this is improving with recent integrations like native USDC functionality.

Furthermore, major exchanges like Coinbase and Binance have yet to list the HYPE token, limiting the HyperEVM's ability to attract new users. Hyperliquid's success has sparked envy among its peers, while its rapid growth has also unnerved established exchanges.

In a market dominated by takers, Hyperliquid's emergence has completely transformed the landscape. This has made them stand out and become a user favorite. If they can maintain this momentum and avoid any black swan events (as Hyperliquid is still very centralized), HYPE can only go one way: up.