Original title: The Aster Counterstrike

Author: Token Dispatch

Compiled and edited by LenaXin and ChainCatcher

Background

On September 18, 2025, Changpeng Zhao released a price chart that was neither Bitcoin nor BNB.

The chart shows the native token of the decentralized perpetual exchange ASTER, which just launched the day before.

"Well done! A good start. Keep it up!" he said.

Within hours, the ASTER token surged 400% from its IPO price, sending a clear signal to the market: the former Binance CEO wasn’t just expressing congratulations; he was declaring war on Hyperliquid.

As HYPE token holders watched their Hyperliquid assets soar to an all-time high of nearly $60, Changpeng Zhao’s carefully calculated tweet landed like a pinpoint strike. Banned from running Binance, but clearly not from shaking up the market, Zhao is throwing his weight behind Hyperliquid’s fiercest competitor.

However, the war machine has already begun. YZi Labs (formerly Binance Labs) has been quietly funding the development of ASTER. The BNB Chain partnership network is activating. The world's largest crypto empire is launching a full-scale crackdown on this decentralized upstart that dares to seize market share in derivatives.

This is the opening salvo in the perpetual contract decentralized exchange war, and Binance has no intention of admitting defeat.

1. What is ASTER?

ASTER was born from the December 2024 merger of two major DeFi protocols, Astherus and APX Finance. This integration created a unified trading infrastructure designed to directly compete with Hyperliquid's growing market share.

The platform is a multi-chain decentralized exchange supporting BNB Chain, Ethereum, Solana, and Arbitrum Networks. By aggregating multi-chain liquidity, it enables seamless trading without manual cross-chain transactions. Since its launch in March 2025, ASTER has processed over $514 billion in trading volume for 2 million users. Following the token issuance, the platform's total locked value briefly peaked at $2 billion, but had fallen back to $655 million by September 2025.

Unlike decentralized exchanges that focus solely on spot trading, ASTER is positioned as a comprehensive trading platform offering both spot and perpetual futures markets. While perpetual derivatives are its core business, the platform also offers spot trading capabilities, with the first trading pair to be launched being its native token, ASTER/USDT.

(2) How does ASTER solve the problem of front-running and liquidation manipulation?

ASTER's core architecture is dedicated to solving the liquidity fragmentation problem plaguing multi-chain DeFi. The platform builds "unified liquidity" by aggregating cross-chain order books, rather than forcing users to transfer assets across chains.

Its "hidden order" system is particularly prominent, which conceals the size and direction of orders until execution. This dark pool-like design effectively solves key pain points of on-chain trading: front-running and liquidation manipulation.

Changpeng Zhao previously commented on this feature, noting that it solves “the problem of liquidation manipulation that exists on other on-chain DEXs.”

The platform's margin system supports both segregated and cross-collateralized trading, allowing users to use liquid collateral tokens like BNB or ecosystem stablecoins as margin. This capital-efficient innovation allows traders to earn passive income on their collateralized assets while maintaining active positions.

At the core of the ASTER ecosystem is USDF, an ecosystem-wide stablecoin backed by a delta-neutral position. Users can mint USDF by depositing supported assets and use the stablecoin as collateral for transactions while earning returns. This creates a self-circulating liquidity system where stablecoin holders naturally become liquidity providers.

ASTER's roadmap includes the integration of zero-knowledge proofs for enhanced privacy and the development of Aster Chain, a custom Layer 1 blockchain optimized for transactions. This functionality will be available in beta to a limited number of traders in June 2025, enabling the platform to eventually compete with Hyperliquid's custom Layer 1 architecture.

(3) The peak showdown between ASTER and Hyperliquid

ASTER and Hyperliquid offer two distinct approaches to decentralized perpetual swap trading. Hyperliquid built its own dedicated Layer 1 blockchain from the ground up, utilizing a fully on-chain order book, achieving performance comparable to centralized exchanges. This vertical integration has made Hyperliquid an industry benchmark for transaction execution efficiency and user experience, but it also limits it to a single ecosystem.

ASTER takes the opposite approach, maximizing coverage and liquidity access through multi-chain deployment. Although this increases technical complexity, it enables it to leverage existing DeFi ecosystem resources and serve user groups that prefer specific chains.

Hyperliquid dominates the DeFi perpetual contract market with approximately 70% of the market share, with open interest reaching $15 billion and average daily trading volume consistently remaining above $800 million.

However, ASTER's multi-chain strategy offers advantages that Hyperliquid struggles to replicate. The platform's integration with yield protocols like Pendle and Venus creates capital efficiency opportunities that Hyperliquid's isolated L1 architecture simply can't match.

ASTER users can simultaneously obtain BNB staking income, USDT deposit interest and transaction fees.

Leverage configurations also differ significantly. Hyperliquid caps leverage at 40x, while ASTER supports 100x leverage for most trading pairs, with up to 1001x for certain assets. ASTER's US stock perpetual contracts offer 24/7 exposure to traditional stock market risks, expanding its service reach beyond crypto-native traders.

(IV) Token flows reveal the competitive landscape

ASTER's token economics model prioritizes community incentives and long-term sustainability. The total supply of 8 billion tokens will be allocated according to specific proportions: 53.5% for airdrops and community rewards, 30% for ecosystem development, 7% for a treasury, 5% for the team, and 4.5% for liquidity and exchange listing.

The community allocation ratio is among the highest in the DeFi field, exceeding 50% of the total supply. The unlocking mechanism uses a 25% token release immediately upon the generation event, and the remaining portion is set to a three-month lock-up period and then released linearly over nine months.

The token has multiple functions within the ecosystem, including governance rights, fee discounts, staking rewards, and access to advanced features. Revenue sharing is achieved through fee buybacks, with a portion of transaction fees used to purchase and potentially destroy ASTER tokens, creating deflationary pressure as trading volume grows.

Users can stake their ASTER tokens and use their ecosystem derivatives as trading collateral, thus creating multiple value streams from a single position.

(V) Token Showdown: A Comprehensive Analysis of ASTER and HYPE

The ASTER and HYPE token economic models demonstrate different concepts of value capture and distribution mechanisms.

Hyperliquid's HYPE token uses a more traditional cryptoeconomic model, with aggressive buybacks through protocol revenue. The platform generates over $1 billion in annualized revenue, and uses the majority of its proceeds for HYPE buybacks, creating strong deflationary pressure.

HYPE's core advantage lies in its proven "revenue-buyback" flywheel effect. Currently, 43.4% of the total supply is staked, and this, combined with substantial protocol revenue, enables the token to maintain a strict circulation limit. This powerful price support mechanism is currently unmatched by ASTER.

Hyperliquid will initiate a large-scale token unlock for core contributors in November 2025. These unlocks will generate significant selling pressure, potentially overwhelming even aggressive buyback programs. Hyperliquid is preparing to launch the USDH stablecoin to generate additional buyback pressure, but the timing of this launch presents uncertainty.

ASTER's strategy prioritizes community ownership over immediate value capture. While this means weaker short-term buybacks, it creates stronger network effects and decentralized governance. The 53.5% community allocation ensures that value truly flows to actual users, not early investors or team members.

(6) Binance’s Strategy

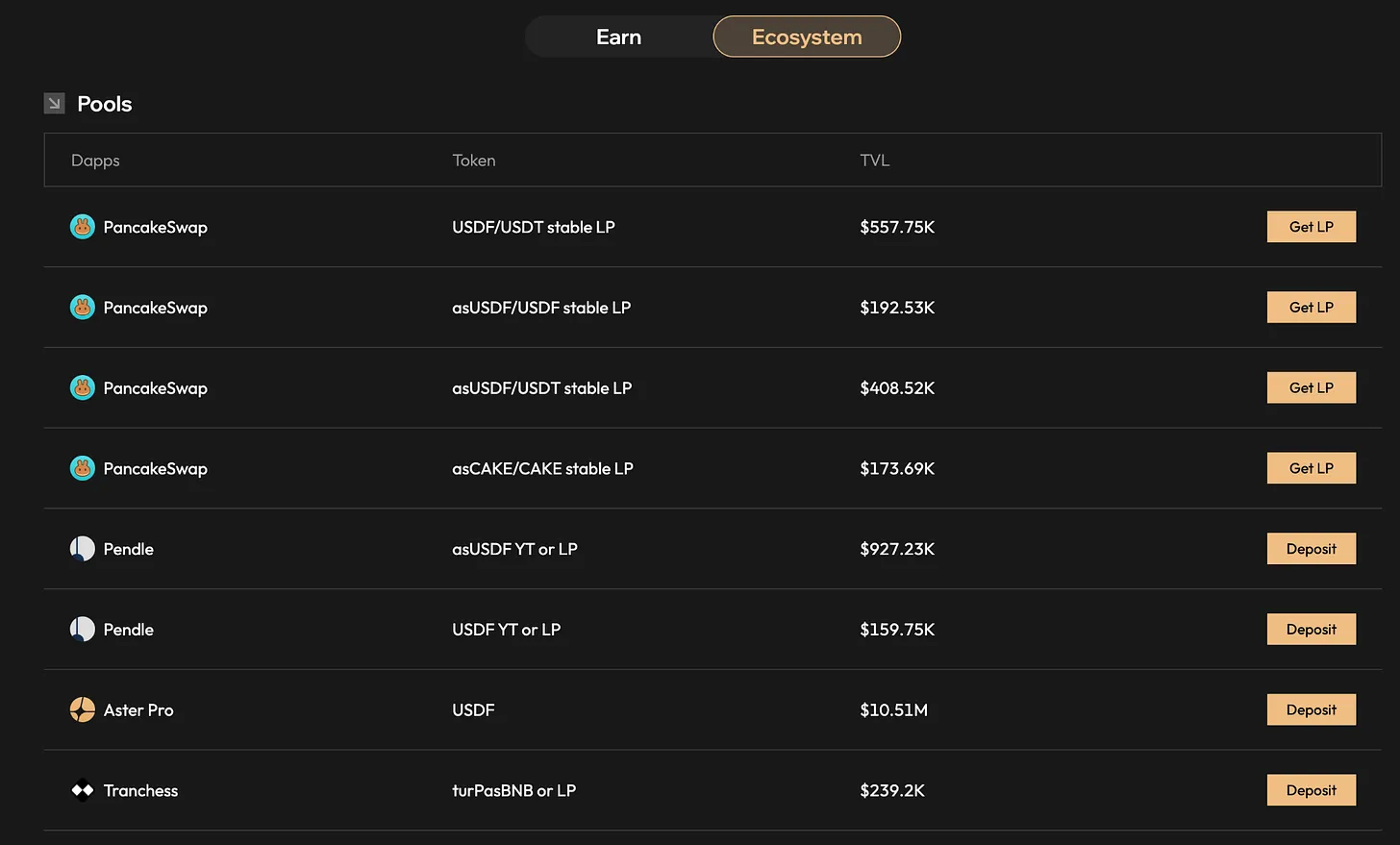

Analyzing ASTER's liquidity provision system reveals the strategic depth behind its launch. Professional market makers provide core order book depth, while the platform's cross-chain architecture aggregates liquidity from multiple blockchains. Strategic partnerships with protocols such as Pendle, ListaDAO, Kernel, Venus, YieldNest, and PancakeSwap create additional sources of liquidity and user incentives.

Pendle tokenizes returns, ListaDAO provides BNB liquidity staking (generating asBNB), Venus offers lending services, and PancakeSwap directs arbitrage trading from the largest DEX on the BNB chain. These collaborations make ASTER a core hub where users can trade derivatives and participate in multiple DeFi strategies.

The ecosystem collateral system solves the opportunity cost problem by allowing users to earn returns from trading margin. Users do not need to hold idle USDT and can mint USDF as collateral while earning delta-neutral returns.

Similarly, asBNB can still earn staking returns (approximately 5-7% annualized) when used as margin for leveraged positions. This allows a single deposit to generate multiple income streams: staking income, trading profits, and token rewards, incentivizing users to retain more funds on the platform long-term, naturally deepening the liquidity pool.

YZi Lab's investment timeline provides a key footnote to Binance's strategic layout. The investment institution completed its investment in Astherus (the predecessor of ASTER) in November 2024, just as Hyperliquid posed a substantial competitive threat to Binance's derivatives dominance.

According to a representative of the BNB chain, ASTER, as a key project of the YZi Lab incubation program, has received mentor guidance, ecological exposure, and technical marketing resource support, thereby establishing its position as the largest perpetual contract DEX on the BNB chain.

Hyperliquid's trading volume continues to grow steadily between 2024 and 2025. While Binance maintains a significant lead in absolute trading volume, Hyperliquid's growth trajectory from near-zero to significant market share demonstrates its success in carving out a separate market rather than directly stealing Binance's traders.

Combined with its investments in other projects like MYXFinance, YZi Labs' investment strategy is becoming increasingly clear. These investments demonstrate a collaborative approach to building the DeFi infrastructure for the BNB chain and creating alternatives to successful protocols on other chains.

Binance's overall strategy focuses on ecosystem defense rather than direct competition. Rather than simply copying Hyperliquid's customized L1 solution, it leverages the strengths of its existing ecosystem: regulatory relationships, fiat currency access, institutional partnerships, and a deep liquidity pool. ASTER capitalizes on these network effects while providing a decentralized trading experience increasingly favored by sophisticated traders.

Rather than viewing decentralized protocols as a threat to be ignored or marginalized, Binance actively invests in and promotes DeFi alternatives that remain within its ecosystem’s sphere of influence.

(7) What is the conclusion?

The rise of ASTER will either mark a turning point in decentralized derivatives trading or become the most expensive “I can do it too” that Zhao Changpeng has ever said to his competitors.

On the surface, the platform appears to have all the ingredients for success: multi-chain liquidity, ecosystem collateral, perpetual contracts for US stocks, and strong backing. While the idea of trading derivatives while earning income sounds appealing, it's important to note that innovations in the cryptocurrency world that seem too good to be true often are.

The fact that the total locked value plummeted from a peak of $2 billion to $655 million should serve as a cautionary tale: there's a fundamental difference between initial excitement and sustained adoption. When TVL plummets 67% in a single day, we might question whether these figures represent real users or just those eager to make a quick buck.

Its token economics model prioritizes long-term community building over short-term value capture, a strategy that can be considered either visionary or naive, depending on one's perspective. Unlike Hyperliquid's proven "revenue-buyback" model, ASTER's value proposition requires users to believe in the sustainability of a business model that earns a 3% margin return on a 100x leveraged position.

The real test will be whether the platform can convince traders to abandon Hyperliquid’s proven infrastructure for a multi-chain experiment supported by the ecosystem that gave birth to the 2022 FTX crash.

When the world’s largest exchange feels compelled to support a DeFi competitor, it suggests that the centralized model isn’t as unshakable as once believed. Whether this move will make ASTER a winner or simply an expensive hedge remains to be seen.