Today, well-known rapper and internet celebrity Kanye West announced the launch of YZY MONEY and token YZY on social media.

https://bbzx2018.feishu.cn/sync/D4BRdgDigs01HObtJJzcpZRDns5

After Kayne West’s official Twitter account released the contract address of $YZY, $YZY’s market value exceeded $3 billion within half an hour, and then began to fall back. Its current market value is approximately $1.7 billion.

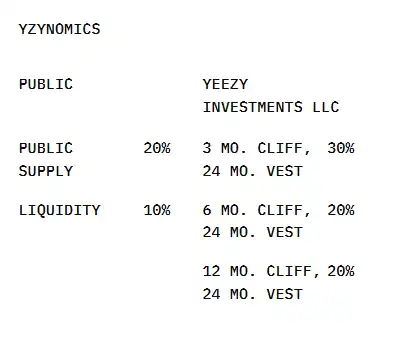

Token Economics

According to the official website of YZY MONEY launched by Kanye West, the economics of YZY tokens are as follows:

Public offering: 20%

Liquidity pool: 10%

Yeezy Investments LLC (issuer): 30% (locked for 3 months, released linearly over 24 months)

Team: 20% (locked for 6 months, released linearly over 24 months)

Ecological Development Fund: 20% (locked for 12 months, linearly released over 24 months)

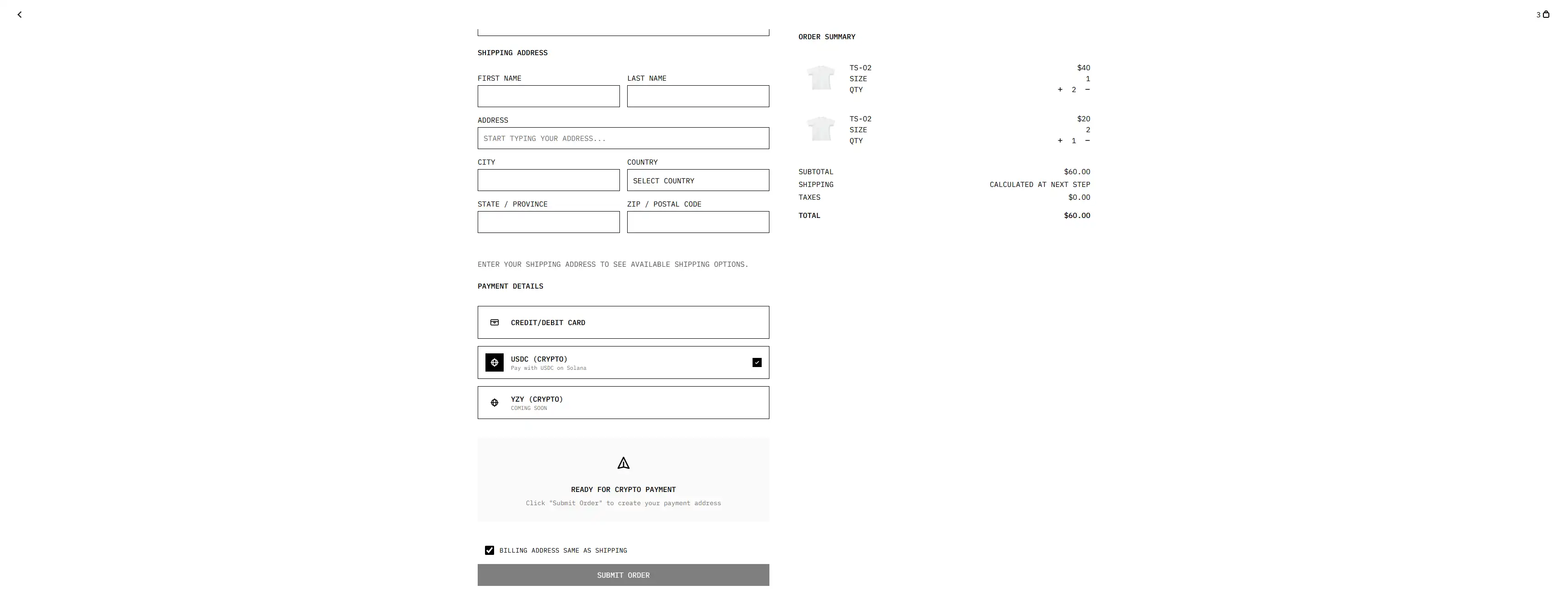

Ye Pay and YZY Card

Along with the YZY token, Ye Pay and YZY Card were also launched. According to the YZY MONEY website, Ye Pay is a cryptocurrency payment processor that allows merchants to accept credit cards and cryptocurrency payments, with a lower processing fee than the 3.5% typically charged by traditional platforms. Merchants can seamlessly integrate Ye Pay into their websites or apps, providing consumers with a simple and fast checkout experience.

Currently, yeezy.com already supports cryptocurrency payments, and the option to pay directly with $YZY also displays "COMING SOON".

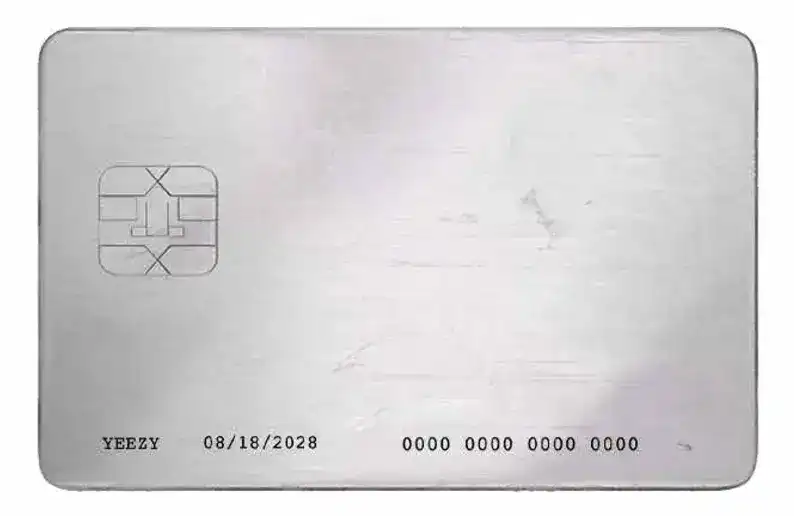

The YZY Card is a debit card that allows users to spend YZY and USDC at millions of merchants worldwide. It is a non-custodial card that allows users to spend cryptocurrencies directly without manually converting fiat or relying on middlemen. Currently, users can submit their email address on the YZY MONEY website to get on the waiting list.

Insider suspicions and chip concentration risks

Lookonchain posted on social media that although Kanye West officially announced the launch of YZY, only YZY has been added to the liquidity pool, not USDC. Developers can sell YZY by adding/removing liquidity, similar to LIBRA.

Multiple insider wallets prepared funds in advance and immediately bought YZY after the announcement. Insider wallet 6MNWV8 knew the contract address in advance and even attempted to buy yesterday.

6MNWV8 spent 450,611 USDC today to buy 1.29 million YZY at $0.35, and sold 1.04 million YZY at $1.39 million, leaving 249,907 YZY (about $600,000), with a profit of more than $1.5 million.

Two days ago, market speculation about Kanye West's coin issuance began after his official Twitter account followed @YZY_MNY. The $YzY token, launched in February of this year, saw its market capitalization soar from over $5 million to nearly $15 million on August 19th, with a single, large purchase of 4,207.9 SOL (approximately $767,000).

However, according to the YZY Money website, to prevent sniping, they deployed 25 YZY contract addresses and randomly selected one as the final official address. They claim, "This move reduces the probability of selecting the correct CA to 1/25, thereby preventing sniper attacks and returning power to genuine traders."

Coinbase director Conor Grogan posted on social media, "According to my estimates, at least 94% of YZY tokens are held by insiders; 87% of the tokens are held by a single multi-signature wallet (now dispersed across multiple wallets); over 3% of the tokens were purchased in a single large transaction by multiple (pre-prepared) wallets at market open; and over 7% of the tokens are in liquidity pools."