The story of "Joan Sucks", the first episode of the final season of "Black Mirror": the heroine casually clicked "Agree", but the platform, based on the user agreement that no one read carefully, "legally" turned her daily life into a live-action drama broadcast globally.

In fact, every industry has its own user agreement. The same is true for Perp. The liquidation rules are the "user agreement" of this track.

It’s not sexy or conspicuous, but it’s incredibly important. For the same token, each trading platform has different depths, different K-line trends, and different liquidation mechanisms, leading to completely different position outcomes.

Today’s two perp dex examples are good teaching materials: at the same time, while Binance’s pre-market contract quotes did not fluctuate by the same amount, the XPL price on Hyperliquid was pulled up to nearly +200% in about 5 minutes; and the ETH price on Lighter plunged to US$5,100.

Under extreme market conditions, some people are happy while others are sad.

In just one hour, several Hyperliquid whales liquidated their counterparts' short positions by driving up prices, earning a combined profit of nearly $38 million to $46.1 million. The widely-watched address 0xb9c…6801e, which had been accumulating long positions since August 24th, saw a one-minute profit of approximately $16 million following a "book sweep" at 5:35 AM. HLP netted approximately $47,000 in this significant move. However, short sellers were not so lucky. XPL shorts at 0x64a4 were liquidated within minutes, resulting in a loss of approximately $2 million. Shorts at 0xC2Cb were fully liquidated, resulting in a loss of approximately $4.59 million.

Rather than saying that this is a "manipulation by bad guys", it is better to say that it is the result of the combined effect of the liquidation system and market structure. It is also a new lesson for all crypto players: always pay attention to the depth and liquidation mechanism.

How does liquidation occur?

On any perpetual contract platform, the first thing you need to understand is: Initial Margin (IM) and Maintenance Margin (MM): IM determines the maximum leverage you can open; MM is the liquidation line. When the account equity (collateral plus unrealized profit and loss) falls below it, the system will take over the position and enter the liquidation process.

Next, consider the price. The price used to determine liquidation isn't the last traded price, but the mark price. This price is often determined by a combination of external indices, language oracles, and the platform's own order book, and is smoothed and processed for anti-manipulation measures. The index price is closer to a weighted spot reference based on pure external markets. The last price is the most recent traded price on the platform, which is susceptible to price manipulation by instantaneous order sweeps.

Therefore, when "account equity < maintenance margin," liquidation is initiated. However, the details of liquidation still depend on the platform's own liquidation execution mechanism.

Hyperliquid: Let the Market Eat the Liquidation Order

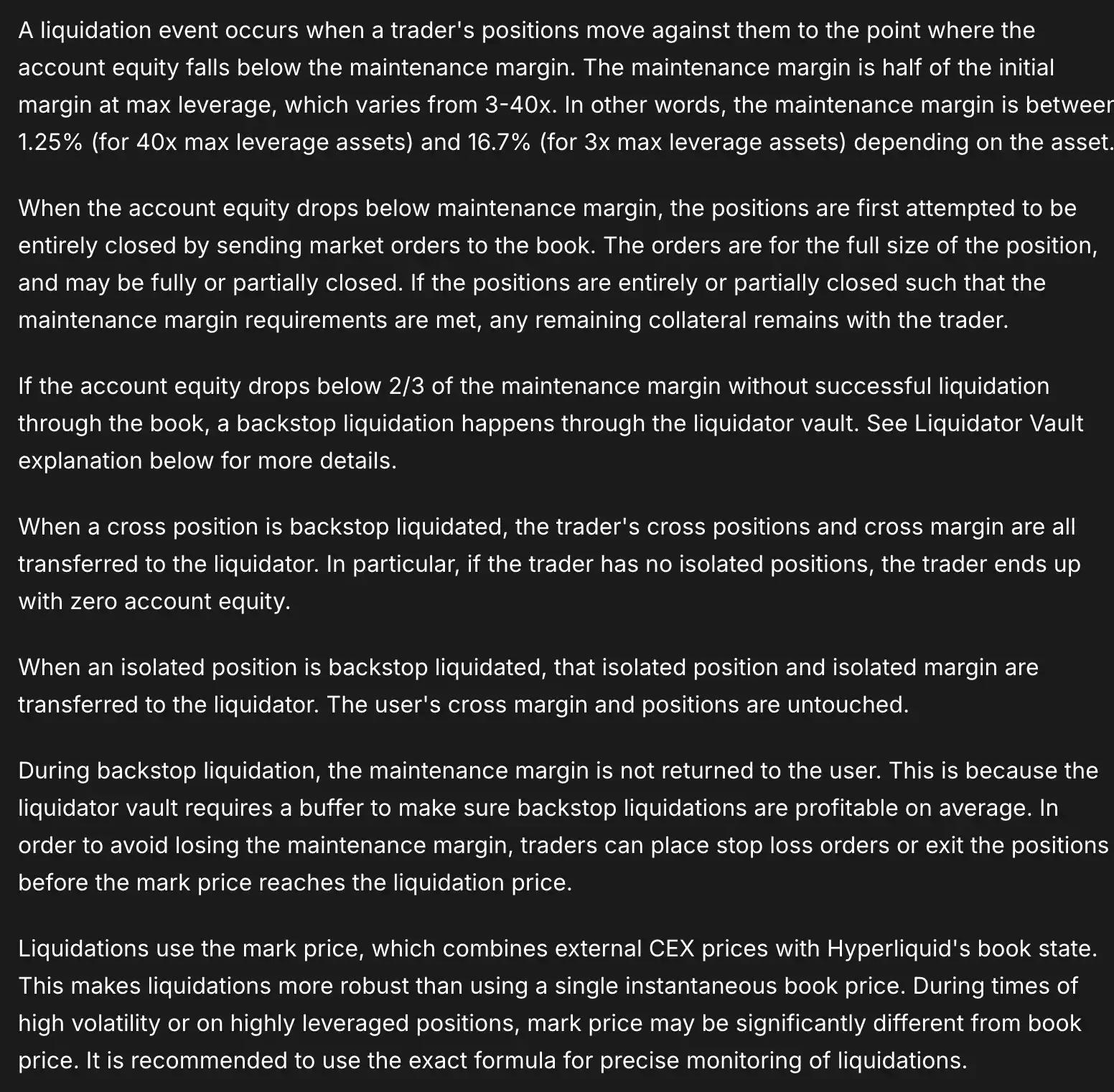

Let's first look at Hyperliquid. Hyperliquid's liquidation mechanism works as follows: when an account's equity falls below the maintenance margin (MM), the system prioritizes placing a liquidation order directly into the order book, mitigating the risk in a market-based manner.

For large positions (e.g., >100,000 USDC), a 20% liquidation is typically performed first, followed by a cooldown period of approximately 30 seconds. If this is not fully liquidated and the situation deteriorates to a higher threshold (e.g., equity falls below 2/3 × MM), a backup liquidation is triggered, with the community-based Liquidator Vault (HLP component) taking over. To ensure the continuity of this guarantee, maintenance margin is often not refunded during this phase.

There is no "liquidation fee" for the entire process, but in pre-market periods and other situations where the external anchor is weak and the depth is relatively poor, the liquidation action itself will further push the price in the same direction for a while, causing a short-term upward spiral.

Hyperliquid's mark price is determined by a combination of external CEX quotes and its own book value. If fluctuations are dominated by internal trading, this can accelerate the triggering rhythm. Furthermore, isolated and cross margin trading differ in their backup phases: when a cross position is taken over, the full position and margin may be transferred along with it; with isolated positions, only the position and its isolated margin are affected.

So, let's rewind to this morning and take a brief look at the Hyperliquid XPL incident. Starting at 5:35 AM, buying orders for Hyperliquid's XPL rapidly surged through the order book, with the mark price driven by intra-platform matching, and the magnitude of the increase far exceeding normal trading hours.

For the heavily crowded short positions, this upward move instantly depresses the ratio of account equity to maintenance margin. When equity falls below the minimum margin (MM), the system takes over the position according to established procedures. Next, the system buys from the order book to cover the short position (larger orders may be partially liquidated first and enter a cool-down period). This series of short-covering buy orders further pushes up the price and the mark price, triggering more short positions to fall below the MM. Over a period of seconds to tens of seconds, a positive feedback loop of "sweep the order book → trigger liquidation → liquidation and then sweep the order book again" is formed—this is the mechanistic explanation for the price increase of nearly 200% in just a few minutes.

If the balance still cannot be cleared on paper and the equity of the account being liquidated falls further to a deeper threshold (such as 2/3×MM), the backup liquidation mechanism will take over and continue to take over the bottom-line buy order to ensure that the risk is "eaten" within the system.

Once the order book depth is restored and the liquidation queue is fully digested, addresses that actively went long begin to take profits, and the price quickly falls from its high like a roller coaster. This is the entire process of "Hyperliquid's XPL nearly +200% in a few minutes → serial short liquidation → rapid decline".

This is actually the inevitable result of the coupling of pre-market liquidity depth + position congestion + liquidation mechanism.

Will Lighter really go bankrupt sooner?

Let's take a look at Lighter. This morning, the ETH price on Lighter spiked to $5,100, also attracting considerable attention. As a perp dex highly favored by the foreign CT community, currently second only to Hyperliquid in trading volume, Lighter's price fluctuations have sparked numerous discussions.

Lighter has three thresholds: IM (Initial Margin) > MM (Maintenance Margin) > CO (Cut-Out Margin). If the IM falls below, it triggers "Pre-Liquidation," where only reductions are allowed, not additions. If the MM falls below, it triggers "Partial Liquidation," where the system issues IOC limit orders at a pre-calculated "Zero Price" to reduce your position. The Zero Price design ensures that even if a trade is executed at the Zero Price, your account health will not deteriorate further. If a trade is executed at a better price, the system deducts a liquidation fee of up to 1% and deposits it into the LLP (Insurance Fund). Further down the line, if the equity falls below the CO, it triggers a "Full Liquidation," which wipes out all positions and transfers the remaining collateral to the LLP. If the LLP is insufficient to cover the margin, ADL (Automatic Position Deleveraging) is activated, eliminating a portion of the counterparty's highly leveraged/largely profitable positions at their respective Zero Prices, striving to achieve deleveraging without harming innocent parties at the system level. Overall, Lighter sacrifices some liquidation speed in exchange for manageable impact on account health and book value.

So does this mean that Lighter’s liquidation price is much higher than other DEXs, and it will be liquidated earlier?

A more accurate answer is: yes, and not entirely.

To put it in simpler terms, Lighter's "earlier liquidation" is a phased "reduction of positions to put out fires": it issues IOC limit orders at "zero price" to reduce positions. The goal is to not worsen the health of the account. In many cases, it is to reduce the position to a safe level, which does not mean "exploding" you; it will only be cleared if it deteriorates to the CO level.

Therefore, we cannot simply say that "Lighter stocks are more likely to explode." Instead, we should liquidate and reduce positions more gently to "spread out" the risks and reduce the price impact caused by a one-time book sweep. The price to pay is that if the transaction is completed at a price better than "zero", a liquidation fee of ≤1% will be charged to the insurance fund (LLP).

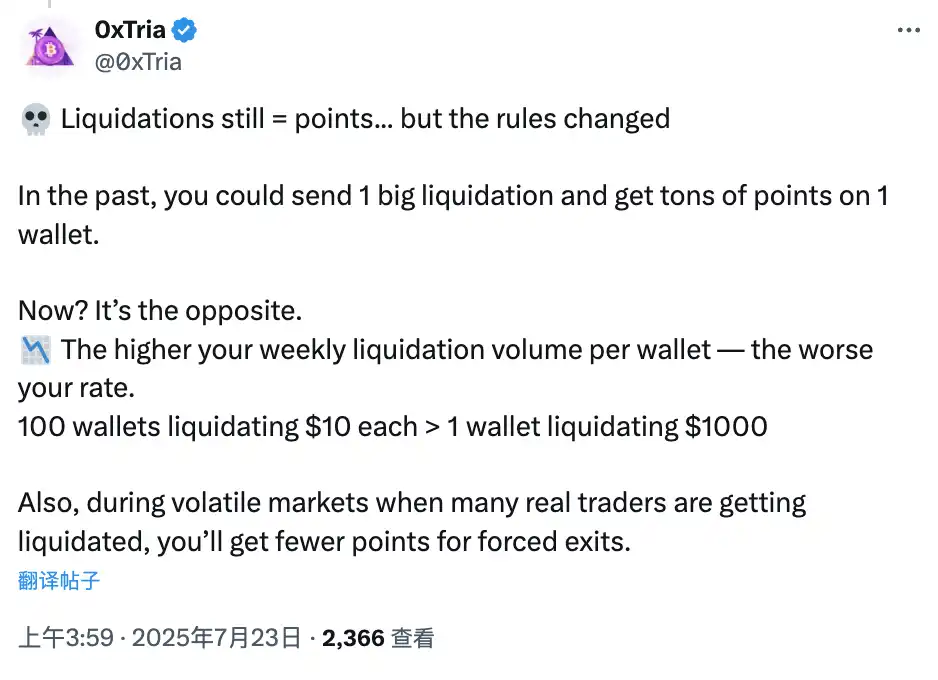

Interestingly, in the early days, Lighter's points weighting was heavily weighted towards liquidation amounts. According to analysis by Lighter community member 0xTria, the initial liquidation of an account at the time was worth "1 point per $1 liquidation," while the community valued points at $15-30. This directly encouraged many users to exploit liquidations and new accounts to arbitrage points. However, in versions released a few weeks later, this weighting was significantly reduced.

How to avoid being manipulated by bad actors

The cryptocurrency world is a jungle of the weak. For ordinary people, the focus isn't on making multiples of profit, but rather minimizing the chances of being liquidated or manipulated by large investors. So how can we minimize this possibility?

Look at the chip structure

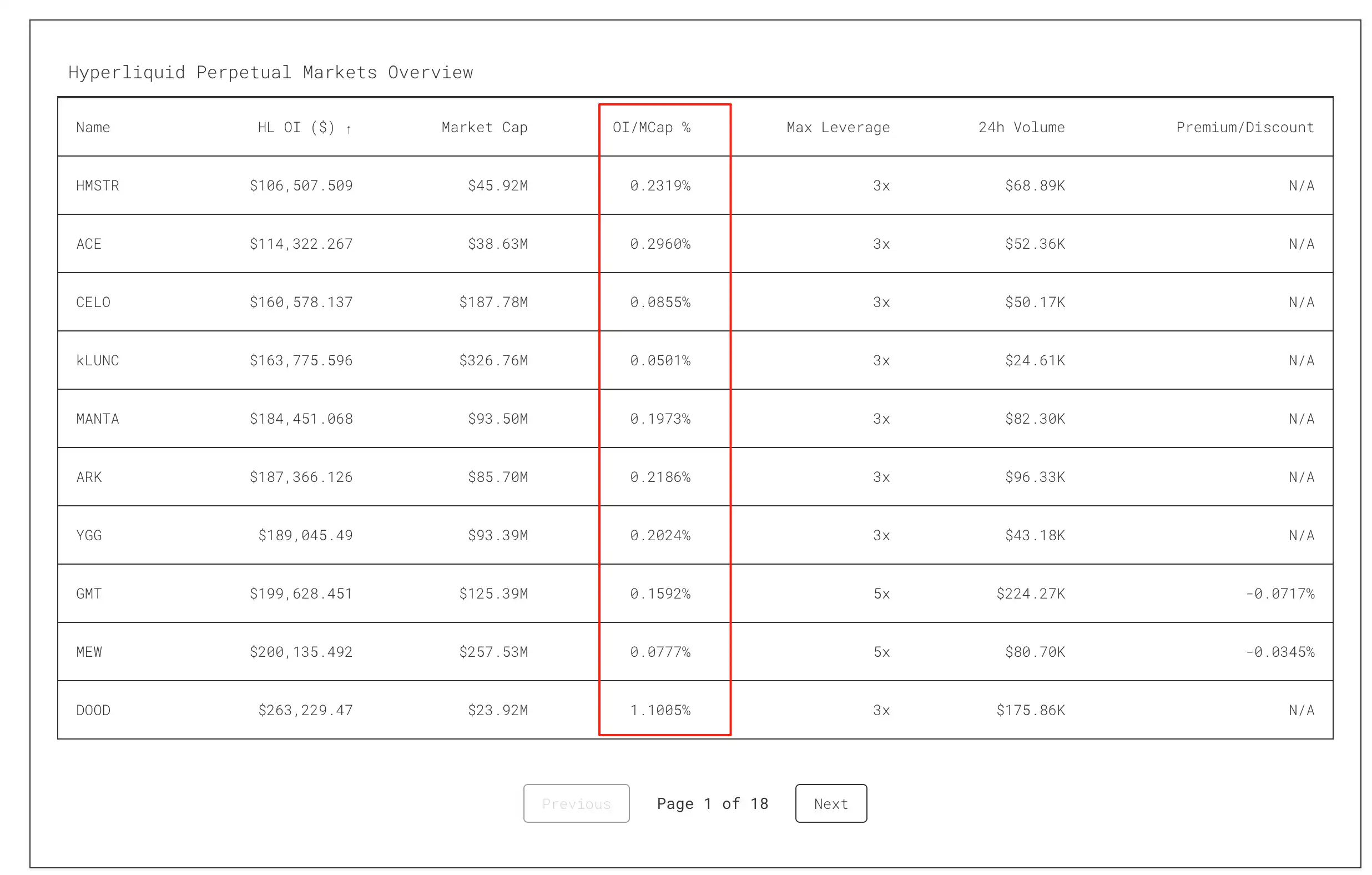

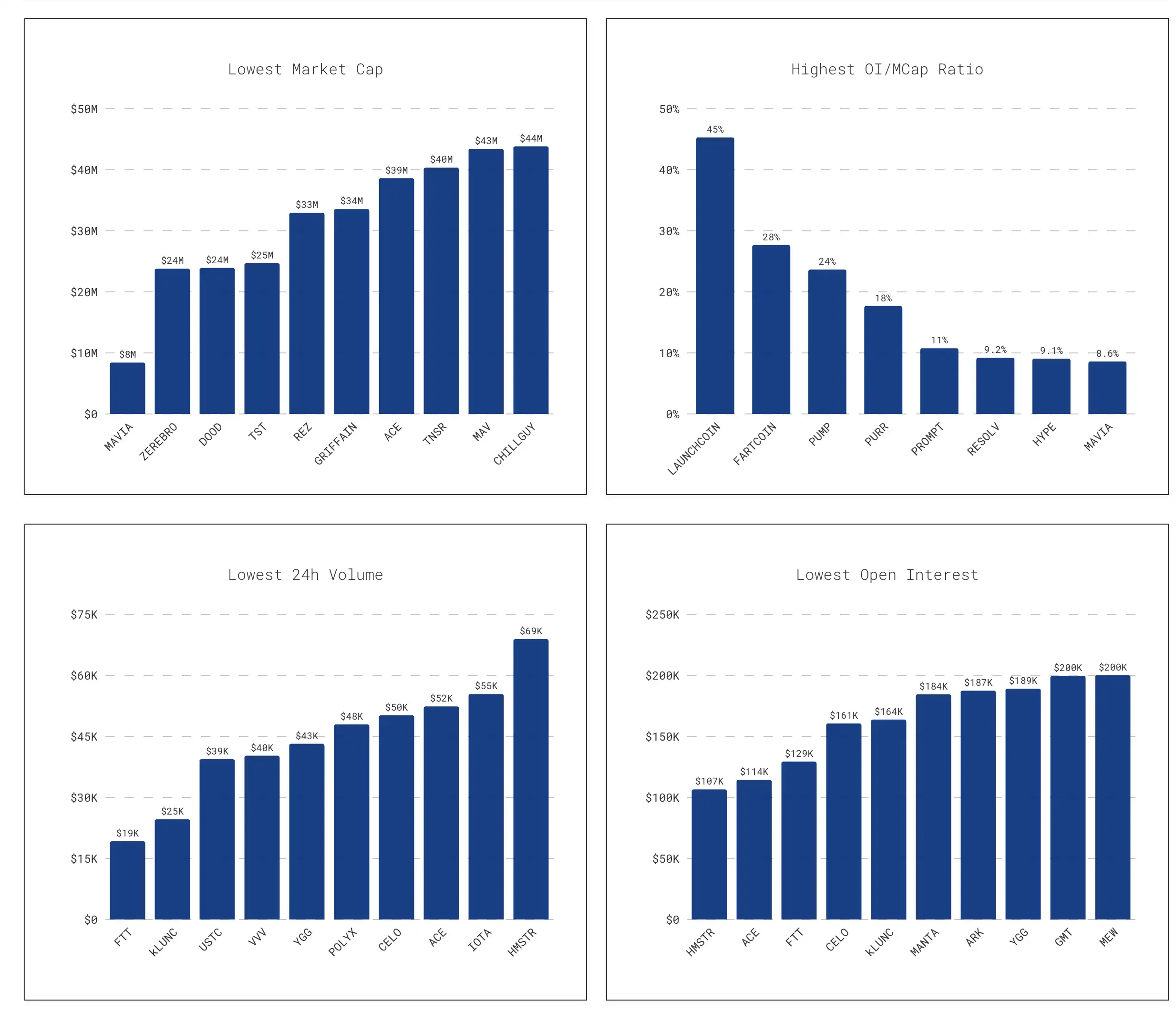

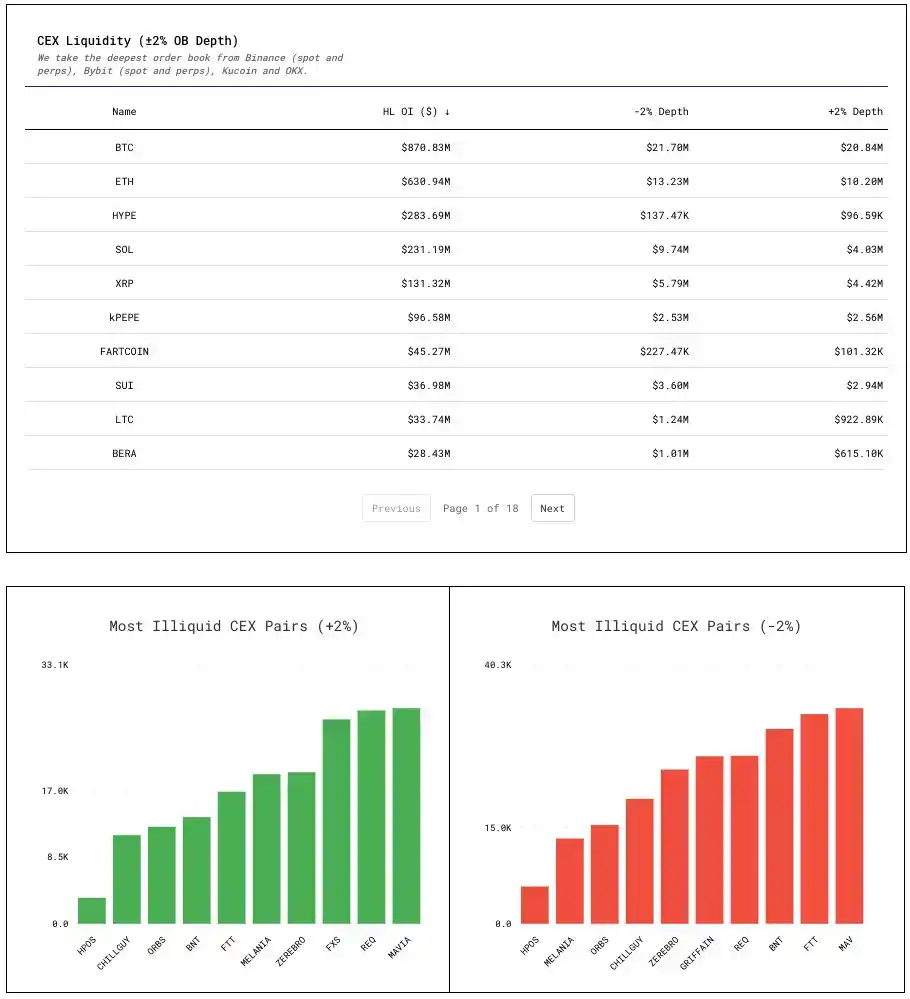

The following Hyperliquid data compiled by ASXN's data platform is very instructive:

Take, for example, the OI/Market Capitalization ratio. This is Open Interest (OI) divided by Market Capitalization, expressed as a percentage. A higher ratio indicates a greater proportion of derivatives positions in the token's total value, making it more susceptible to capital influx. A typical example is the position inherited by the HLP liquidation vault, which at one point exceeded 40% of JELLY's circulating supply. This caused the price of the token to fall like a domino, with one push causing it to topple.

Similarly, DEX liquidity tables can quickly view a token’s on-chain liquidity and its risk of manipulation, and identify signs of holder hoarding.

Funding rates and comparisons to major centralized exchanges allow us to identify assets that may be subject to manipulation. When large positions enter thin open interest, funding rates may appear abnormal compared to other exchanges.

Measuring depth

How to measure depth? You can test how much it costs to move the price up or down 2%: how much buy orders are needed to push the price up 2%? How much sell orders are needed to push the price down 2%?

This is the true order book thickness outside the optimal buy/sell range, and thus the cost of attack for large traders. Assets with a deep gap mean lower costs to manipulate prices, resulting in lower barriers to manipulation and higher risks.

This also means that we should trade the most liquid tokens as much as possible on the most liquid platform.

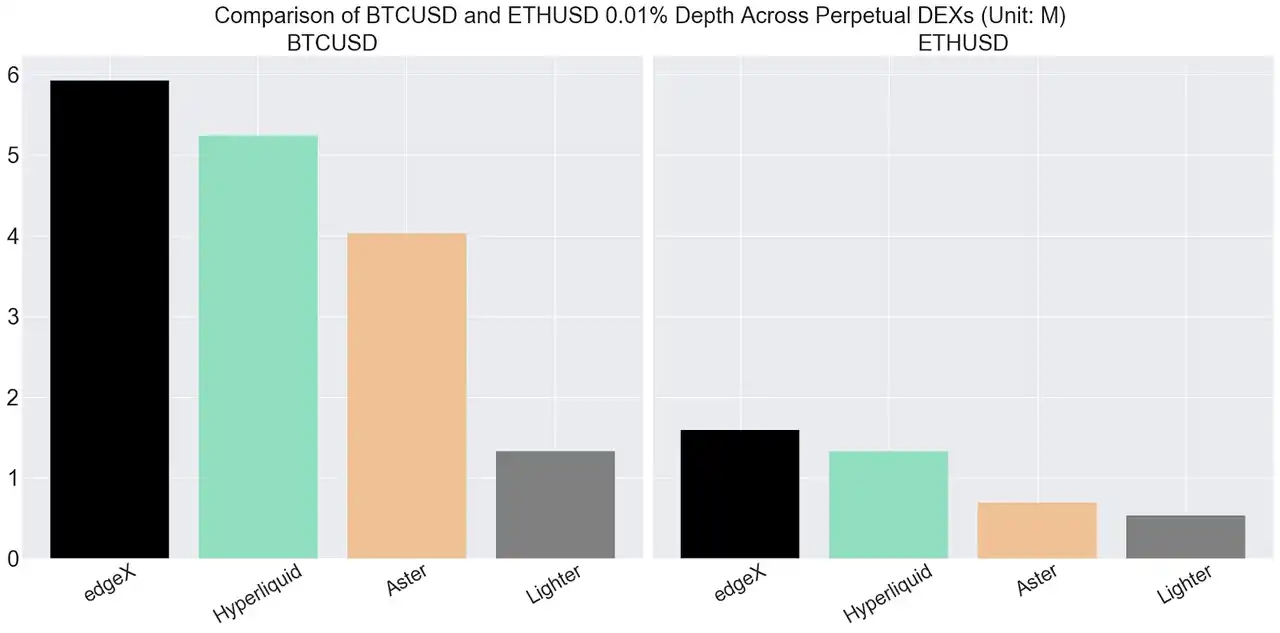

Taking the core BTC/USDT as an example, within the price difference range of 0.01%, the depths of several current mainstream perp dexes are: edgeX $6M, hyperliquid $5M, Aster $4M, and Lighter $1M.

This also means that the liquidity of other altcoins will be far lower than this level and depth, and the risk of manipulation will be greatly increased, not to mention pre-market trading tokens such as XPL.

Be sure to read the liquidation agreement

People who can see the rules clearly are usually more likely to see the risks they can take.

Before officially trading, be sure to read all clearing rules: How is the Mark Price calculated? Does the platform primarily rely on external index prices, or does it heavily weight its own order book? Especially for pre-market and unpopular products, be wary of whether the Mark Price is easily influenced by internal trading. Monitor the Mark/Index/Last values during both normal and volatile trading hours to see if there are significant deviations.

Is there a tiered margin system? If so, larger positions require higher maintenance margin, which means the break-even point is shifted earlier. Will liquidations be conducted by sweeping the order book at market prices or by building positions in batches? What is the liquidation ratio? What triggers fallback liquidation? Is there a liquidation fee? Do liquidation fees go to team revenue, the vault, or foundation buybacks?

Furthermore, even if two trading platforms hedge against each other, ignoring the depth and liquidation mechanisms, there are still significant risks. Cross-platform hedging does not equal margin on the same platform; these two things should be considered separately. If you can set a stop-loss, do so. If you can manage positions individually, do so. A single position only affects the position and its margin. For a full position, only place the liquidity you can afford.

Finally, it should be noted that the risks of contract mechanisms are greater than most people imagine.