1. Market Observation

The United States and the European Union reached an agreement on trade issues and decided to impose a 15% tariff on most goods exported to Europe. Although this move avoided a full-scale trade war, there were differences in the details of the agreement in the statements of the leaders of both sides, and the unequal terms caused concerns in some European industries, bringing new uncertainties to the global economy. At the same time, the market focus is turning to the United States. The Federal Reserve is expected to keep interest rates unchanged at this week's policy meeting, but Chairman Powell is facing huge pressure from Trump to cut interest rates, and there may be dissenting voices supporting rate cuts within the Fed. Analysts generally believe that the Fed may open a window for a rate cut in September. This week is also regarded by Wall Street as a "moment of truth". In addition to the interest rate decision, key data such as the financial reports of the four major technology giants, GDP and non-farm employment will be released intensively, jointly testing the resilience of the US economy.

Against this background, the crypto industry giants have also seen new changes in their views on the macro cycle. Bitwise Chief Information Officer Matt Hougan and LD Capital founder Yi Lihua both believe that driven by long-term positive factors such as ETF fund inflows, regulatory improvements and institutional adoption, the traditional four-year cycle is no longer applicable, and the market is entering a stage of "sustained and stable prosperity". However, this optimism contrasts with the general public perception. Gallup polls show that only 14% of American adults hold cryptocurrencies, and most investors still regard them as high-risk assets.

Specific to the recent performance of Bitcoin, HashKey Chief Analyst Jeffrey Ding pointed out that after hitting a record high of $123,000 on July 14, Bitcoin is currently experiencing a volatile downward trend, once falling below the key support level of $116,000. He believes that the pullback is due to both macro and micro pressures: macro, the uncertainty of the US credit rating, debt problems and tariff policies has suppressed risk appetite; micro, there are signs that institutional funds have flowed out of Bitcoin ETFs and turned to Ethereum, coupled with the deterioration of market sentiment and bearish technical indicators, which have jointly exacerbated price fluctuations. Jeffrey Ding judged that Bitcoin may continue to be under pressure in the short term, but the long-term trend still depends on the evolution of the global economy and regulatory environment.

In addition, several analysts have given detailed forecasts for Bitcoin's short-term trend. After the recent rebound from a two-week low of $114,700, Bitcoin prices are trying to break through $120,000. Analyst Ted Pillows said that Bitcoin needs to break through and stabilize at $119,500 to start a new round of gains, otherwise it may continue to consolidate. CrypNuevo warned that Bitcoin is currently between two key liquidation zones, $121,000 to $120,000 and $114,500 to $113,600. Based on previous similar situations, he expects Bitcoin to first hit the upper liquidation zone and then reverse to the lower area. In addition, the unfilled CME gap is at $114,300, which further supports the view that Bitcoin may test the liquidation zone of $114,500 to $113,600 in the next 1-2 weeks. Analyst Ak47 pointed out that once the price hits the historical high of $123,000, it will lead to the liquidation of more than $9.5 billion in short positions. Analyst IncomeSharks gave two scenarios: the worst case is a pullback to $112,000, but this is still a bullish signal; the best case is to hit $125,000 in August. In terms of Ethereum, analyst BitBull said that thanks to multiple positive factors such as the growth of network activity, continued ETF buying and destruction mechanism, Ethereum is about to break through its four-year long-term resistance level, and it is expected that breaking through $4,000 this week is almost inevitable.

In addition to the two major mainstream assets of Bitcoin and Ethereum, BNB prices have also performed quite actively, rising 7.5% in 24 hours to a record high of $855. Nano Labs, a listed company, announced last Tuesday that it had purchased 120,000 BNBs, which currently exceeds $100 million, and plans to continue to increase its holdings by $1 billion; Windtree, a listed company, announced last Friday that it had obtained $520 million in new financing to expand its BNB funding strategy. In addition, 10X Capital has actively deployed with the support of YZi Labs. These capital inflows may have driven BNB's recent strong performance. Last week, due to Musk's tweet mentioning that Vine would be restarted in the form of AI, the related concept coin VINE continued to rise, and has now exceeded $0.15, a 24-hour increase of 110%. In the Base ecosystem, the ZORA token continued to lead the rise, breaking through $0.1 last night, continuing to set a new record high. In addition, the blue-chip NFT sector also generally rose. In the past 7 days, the sales on the Ethereum chain exceeded $157 million. CryptoPunks led the blue-chip sector with $35.14 million. NodeMonkes rose 96.5% this week, rektguy soared 108.9%, and MoonCats soared 179%.

2. Key data (as of 12:00 HKT on July 28)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $119,465 (+27.77% year-to-date), daily spot trading volume of $33.978 billion

-

Ethereum: $3,933.53 (+17.76% year-to-date), daily spot trading volume of $33.419 billion

-

Fear of Greed Index: 75 (Greed)

-

Average GAS: BTC: 1 sat/vB, ETH: 0.33 Gwei

-

Market share: BTC 60%, ETH 11.9%

-

Upbit 24-hour trading volume ranking: XRP, ETH, GLM, KNC, ALT

-

24-hour BTC long-short ratio: 51.15%/48.85%

-

Sector ups and downs: CeFi rose 5.37%; L2 sector rose 4.5%

-

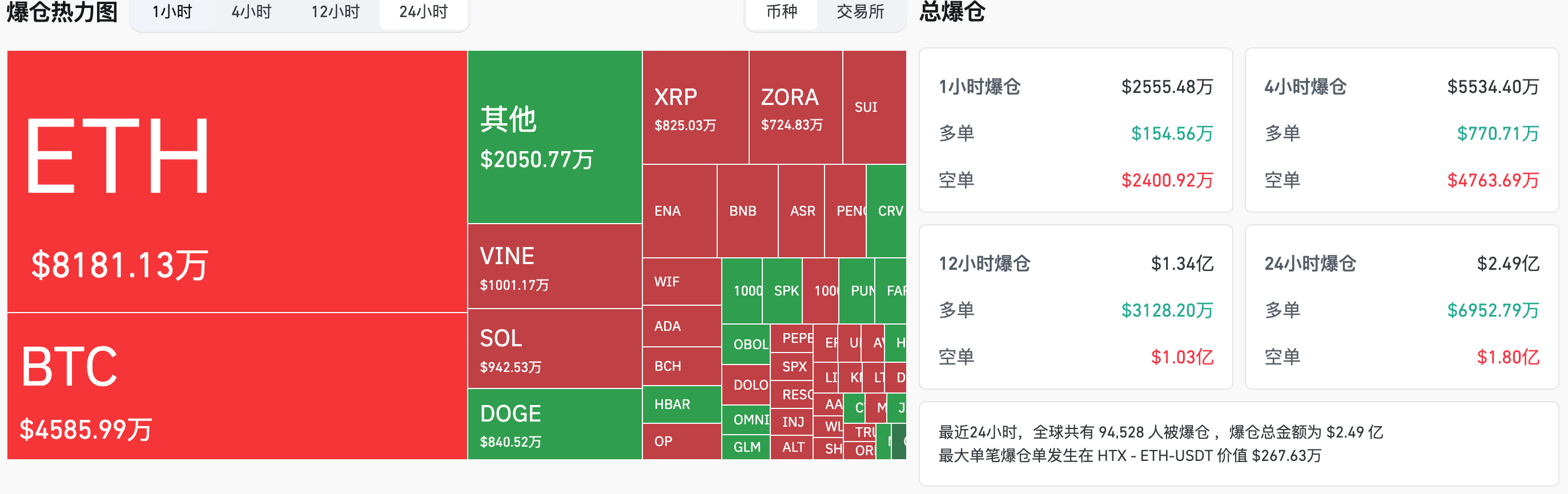

24-hour liquidation data: A total of 94,528 people were liquidated worldwide, with a total liquidation amount of US$249 million, including BTC liquidation of US$45.86 million, ETH liquidation of US$81.81 million, and VINE liquidation of US$10.01 million

-

BTC medium- and long-term trend channel: channel upper line (US$118,999.24), lower line (US$116,642.82)

-

ETH medium- and long-term trend channel: channel upper line (US$3,584.39), lower line (US$3,513.42)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, otherwise it is a bearish trend. When the price is within the range or repeatedly passes through the cost range in the short term, it is a bottoming or topping state.

3.ETF Flow (as of July 25)

-

Bitcoin ETF: +$130 million

-

Ethereum ETF: +$453 million, continued 17 Daily Net Inflow

4. Today's Outlook

-

Binance Wallet will launch the 32nd exclusive TGE on July 28: Delabs Games (DELABS)

-

Sui Ecosystem Parallel Multi-Party Computing Network Ika will be launched on the mainnet on July 29

-

Jupiter (JUP) unlocks approximately 53.47 million tokens, which is 1.78% of the current circulation, worth approximately US$31.7 million

-

Sign (SIGN) unlocked about 150 million tokens, accounting for 12.5% of the current circulation, with a value of about 11.7 million US dollars

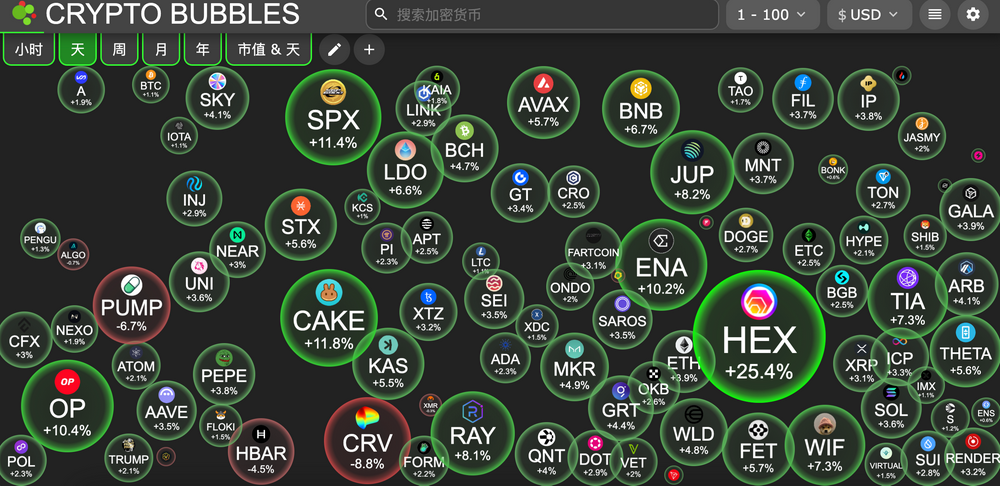

Today's top 100 largest market capitalization gains: HEX up 25.4%, PancakeSwap up 11.8%, SPX6900 up 11.4%, Optimism up 10.4%, Ethena up 10.2%.

5. Hot News

-

This week's macro outlook: Fed decision + non-farm "super week" is coming

-

Ethena Foundation subsidiary repurchases 83 million ENA through third-party market makers

This article is supported by HashKey, HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. It is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security and platform security.