Author: Nom

Compiled by: TechFlow

TL;DR

-SOL’s Digital Asset Treasury (DAT) will be more efficient at accumulating current trading supply than ETH or BTC’s DAT.

- The recently announced $2.5 billion SOL DAT, equivalent to $30 billion in funding for ETH or $91 billion in funding for BTC.

-SOL in FTX Legacy is about to exit the market, but its narrative impact still needs to be further digested.

-SOL’s inflation problem remains an obstacle to price increases, with its size being approximately three times the unlocked amount, and needs to be resolved as soon as possible.

Do you really want to read the full content? Let’s take a look at a few key points:

I won't get into the question of whether inflation is good or bad because I've spent enough time on that and I look forward to the changes that are coming.

I am a holder of spot SOL, staked SOL, and locked SOL (thanks to SPV on Estate SOL), so my perspective may be biased. I hope the tokens I hold appreciate in value, and price stagnation is a negative for me.

Headwinds: FTX Legacy and Market Pressure

Like many familiar blockchains, Solana sold tokens to investors through multiple funding rounds. A significant portion of these tokens went to FTX. According to @CoinDesk's @realDannyNelson, FTX held 41 million Sol at the time of its bankruptcy, most of which were sold through several funding rounds. The main buyers included Galaxy and Pantera, with exercise prices of approximately $64 and $102 (plus fees). At the current Sol price of approximately $190, these investments have already yielded significant profits.

Through analysis of pledged accounts, there are currently approximately 5 million units of "FTX Legacy SOL" to be unlocked, with a total value of approximately US$1 billion.

Why mention this?

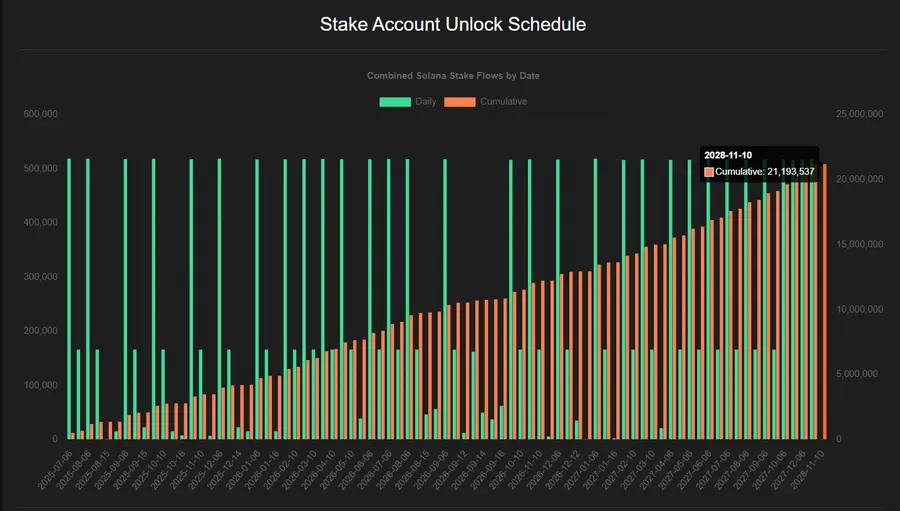

Galaxy and Pantera recently announced $1.25 billion and $1 billion SOL DAT programs, respectively. Together with Sol Markets' $400 million, this totals approximately $2.5 billion (net of fees). The problem is that this likely won't have a material impact on Solana's price, as the SOL currently locked in the market can be purchased or distributed by these entities. According to @4shpool (gelato.sh), approximately 21 million units of SOL remain to be unlocked until 2028, with a total value of approximately $4 billion. A rough calculation (more detailed modeling can be provided by professional financial analysts) suggests that "FTX Legacy SOL" accounts for approximately a quarter of the remaining unlocked supply.

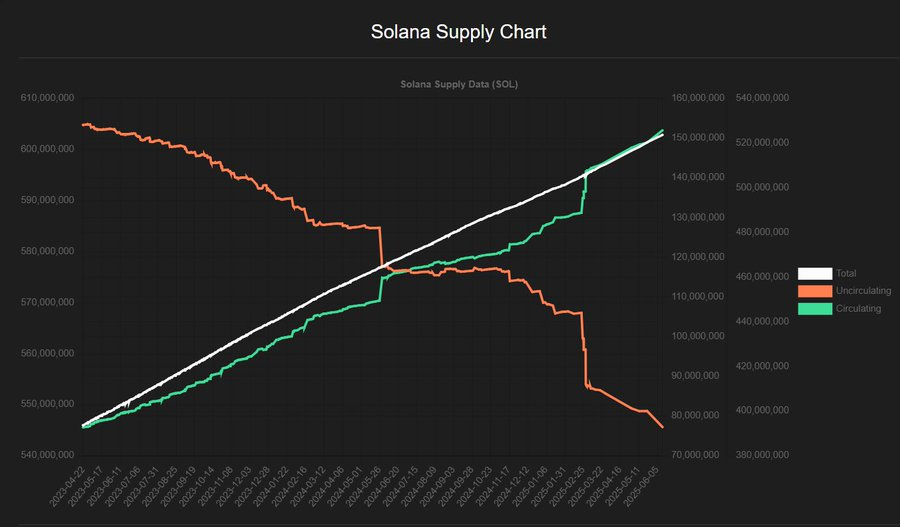

On the other hand, Solana's inflation is also a concern. While the current inflation rate is generally considered to be 7-8%, the actual inflation rate is approximately 4.5% of the circulating supply. This means that, based on the supply of approximately 608 million SOL in epoch 839, the supply will have increased by approximately 27.5 million (inflation) and 10 million (unlocking) a year later, bringing the total circulating supply to approximately 645.5 million, with an inflation rate of approximately 6.2%. Again, this is just theoretical calculation; I'll let a more experienced analyst review it and provide you with a more accurate chart.

As can be seen from the sharp increase in circulating supply, a "static" inflation rate is not accurate, with large increases at some points and smaller increases at others. We have completed the remaining large unlock points.

We need to keep an eye on one key number: the amount of SOL entering the market daily. If someone receives tokens for free (e.g., through staking inflation or unlocking) or at a discount (e.g., FTX Legacy SOL), we can expect some of them to be sold. I'm assuming that all of the 37.5 million SOL inflation over the next year will be sold. This is bad news for me if I'm hoping for price appreciation—see point 2. Therefore, we need an inflow of funds, which can be achieved through DATs or ETFs like $SSK (thanks to the @REXShares team for creating and submitting the BONK ETF, which I unabashedly recommend). Ideally, every dollar spent on SOL purchases should enter the market, driving the price up. However, this approach is less efficient when SOL can be purchased at a locked or discounted price. Therefore, we assume that greedy DAT participants will buy these tokens before they unlock.

Is that bad?

The short answer: Not bad. To offset the annual supply of 37.5 million SOL (assuming an ideal price of $200 per SOL), the market would need an inflow of approximately $7.5 billion, or about $20.5 million per day (this is a simplification, excluding Monday-Friday trading days and bank holidays). If DATs could purchase tokens at a discount from FTX Legacy SOL or other locked SOL zones, this would increase the efficiency of this inflow.

For example, raising $400 million to buy SOL at a 5% discount equates to a $420 million inflow, which is clearly better than injecting $400 million directly into the market. The only question is how to assess the time value between buying SOL from the market today and reducing sales in the future.

The SOL inflation rate for the next three years will be higher than the unlocked supply (until the lockup ends in 2028), and FTX Legacy SOL only accounts for a quarter of the remaining unlocked supply. Therefore, DATs prioritizing the purchase of Legacy SOL over existing SOL will not significantly impact the overall market. Either Galaxy or Pantera could clear the remaining supply (assuming all Legacy SOL is available for sale), and this does not include existing DATs like @defidevcorp, @solstrategies_, or @UpexiTreasury (as well as existing ETPs).

Good News: Trading Supply vs. Circulating Supply

Funds spent on SOL are more efficient than funds spent on ETH or BTC for two main reasons.

Trading Supply

First, circulating supply does not equal tradable supply, especially for staked assets. Staked SOL cannot be purchased directly, but it can be used to purchase staked token derivatives (LSTs). According to the @solscanofficial team, Solana currently has 608 million SOL, of which 384 million SOL are staked, representing 63.1%. LSTs account for 33.5 million SOL, so the actual tradable supply in the market is approximately 57.5% (approximately 350 million SOL cannot be traded, with at least a two-day delay). In comparison, ETH's stake ratio is 29.6%, and LSTs account for 11.9%. A higher supply in the market makes price fluctuations more difficult to achieve, while SOL's lower tradable supply contributes to price increases.

Relative capital efficiency

Solana's market capitalization is significantly lower than both ETH and BTC, with a circulating market capitalization of approximately $104 billion, compared to ETH's $540 billion and BTC's $2.19 trillion. Therefore, every dollar invested in Solana DAT is 5x more efficient than investing in ETH DAT and 22x more efficient than investing in BTC DAT. When considering the staked supply, these efficiencies increase to 11x and 36x, respectively.

The benefit of these DATs is that they remove supply from the market, earn tokens through staking returns (already factored into inflation above), and enable subsequent instruments like ETFs to drive the market more efficiently. SSK has seen approximately $2 million in daily inflows since launch, but an inflationary plan would require 10x that inflow—possibly achievable with the approval of more ETFs.

Why read this?

I've never signed up for Elon bucks, so this is a mystery to all of us.

Summarize

- Compared to ETH or BTC DAT, SOL DAT will be more efficient in accumulating current trading supply (rather than circulating supply). Currently, less than 1% of the supply is managed by SOL DAT, and it is expected that with the launch of the new plan, this proportion will increase to 3%, and may reach 5% in the future.

- The recently announced $2.5 billion SOL DAT raise is equivalent to ETH’s $30 billion or BTC’s $91 billion. SOL DAT needs a leading figure like Michael Saylor or Tom Lee to drive the narrative.

-SOL in FTX Legacy is about to exit the market, but its narrative impact still needs to be further digested.

-SOL's inflation problem still needs to be solved, and its scale is about three times the unlocked amount.

-Currently, ETF inflows are insufficient, but as larger-scale financial instruments are approved, SOL is expected to become a focus of institutional attention starting in Q4.

-Buy $BONK (not investment advice, please do your own research).

-If you just want to get investment advice from posts like this, I suggest you find a more professional quantitative analyst to manage your assets