Overview:

Scott Bessant says dollar-pegged stablecoins could grow to $2 trillion and stimulate global demand for U.S. debt.

Congress is moving forward with a bipartisan stablecoin bill backed by Trump and the cryptocurrency industry.

Retailers hope the bill will reduce credit card fees, but banks are divided over its impact.

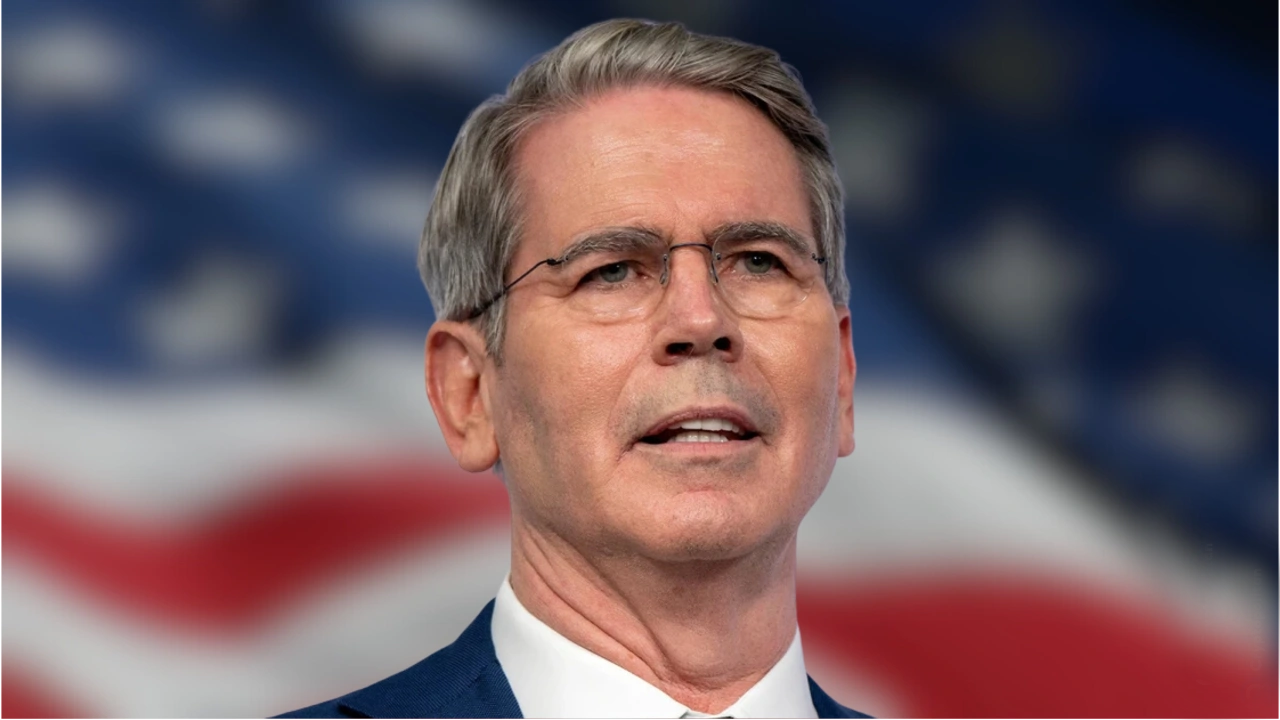

U.S. Treasury Secretary Scott Bessant said at a Senate Appropriations Committee hearing on Wednesday that the market value of stablecoins pegged to the U.S. dollar could surge to $2 trillion within a few years.

Scott told lawmakers that the U.S. government is taking steps to bolster the dollar’s reserve currency status by supporting legislation that would embed stablecoins more deeply into the financial system and establish strict rules to ensure they are fully backed by Treasury bills and other short-term government debt.

Scott said that concerns about the future of the U.S. dollar have repeatedly emerged throughout history. He added that each time the dollar has returned in strength — and now, he believes that cryptocurrencies are part of the next phase.

“This administration is committed to preserving and strengthening the dollar’s reserve currency status,” Scott said during questioning . He also noted that legislation pending in Congress would set clear rules for dollar-pegged stablecoins, which would have to be backed 1-to-1 by high-quality assets such as U.S. Treasury bonds.

Scott pushes Congress to pass Treasury-backed stablecoin rules

Scott said the $2 trillion figure is not wishful thinking. "I think $2 trillion is a very reasonable number, and I expect the actual number will probably be significantly higher than that," he told the committee. His position is that stablecoins backed by U.S. debt will expand the dollar's influence around the world as more people begin to use stablecoins for daily transactions. He also believes that stablecoins pegged to the dollar will boost global demand for U.S. government bonds - which is consistent with broader fiscal goals.

See also Deutsche Bank Evaluates Issuing Stablecoins and Tokenized Deposits

Meanwhile, Congress is working to push through new stablecoin legislation. The Senate passed a key procedural vote on Wednesday by a vote of 68-30, and is expected to pass the final bill as early as next week. The bill has the support of President Donald Trump, major cryptocurrency lobbying groups, and a handful of influential lawmakers from both parties.

The Senate vote came a day after the House Financial Services and Agriculture committees passed a broader crypto bill after Republicans blocked amendments that would have prevented Trump from profiting from his cryptocurrency holdings.

Cryptocurrency giants, led by Fairshake PAC and its affiliated entities, spent huge sums of money to support pro-crypto candidates and policies in the last election. Now, these groups are backing the bill to ensure that stablecoins can be more widely used in the payments sector.

Retailers are also backing the technology, hoping the currency will offer them an alternative to Visa and Mastercard, whose credit card processing fees have long been a problem for large merchants.

Retailers and banks clash over bill as vote nears

Retailers not only support the stablecoin bill, but are also actively lobbying for a separate provision to be included in the bill that would force large banks to offer more credit card processing network options besides Visa and Mastercard. But Senate leaders are expected to block that effort, while Democrats are also pushing to ban Trump from profiting from cryptocurrency projects while in office.

As for banks, their opinions are also divided. Smaller banks have been warning that stablecoins will draw deposits out of the traditional banking system, thereby reducing lending and everyday credit access. On the other hand, larger banks are exploring the creation of their own stablecoins so that they can control customer funds and earn interest on the reserves backed by these stablecoins.

Scott didn’t talk about these struggles. He focused on the U.S. dollar and the role that cryptocurrencies play in underpinning it. He stressed that as long as these stablecoins are fully backed by U.S. government debt, demand for the dollar will be stronger both domestically and internationally.

He also mentioned that while Citigroup analysts predict that the U.S. Treasury will add $1 trillion in stablecoin purchases by 2030, the Treasury sees greater potential. “This is not just a possibility, this is something we are actively working towards,” he said.

The bill is a top priority for Scott and the White House. Senate Banking Committee Chairman Tim Scott confirmed that he will hold hearings on the broader cryptocurrency regulation bill in July, but the bill may not pass until the fall. Senate Majority Leader John Thune said on Wednesday that the Senate will strive to pass the stablecoin bill in the coming days and urged the House to move quickly to send it to Trump.