Software is eating the world, and stablecoins are eating blockchain.

This time it is no longer Coinbase's Base or Robinhood L2. Circle and Stripe almost simultaneously chose to build their own stablecoin Layer 1, completely breaking away from the constraints of existing public chains, and completely reconstructing them around stablecoins from the underlying mechanism to the Gas token.

When banks lose their dominance, stablecoins will follow suit.

On the surface, Circle's Arc and Stripe's Tempo are direct competitors to Tron and Ethereum, but in reality they are targeting the global clearing power of the "post-central bank-bank system." The Visa and SWIFT systems that support fiat currencies can no longer meet the global liquidity needs of stablecoins.

Cross-border crisis: Card organizations give way to stablecoin public chains

The Wintel Alliance monopolized the personal PC market for nearly 30 years, until the rise of the ARM system on the mobile side, and Intel gradually declined without making any mistakes.

Bank cards and card organizations were not synchronized. In 1950, the first card organization, Diners Club, established a credit accounting system for restaurants and their loyal fans. Loyalty became the predecessor of the credit and points system. It was not until the 1960s that it was integrated with the banking industry. Starting with credit cards, local banks in the United States broke through state and national borders and swept the world.

Compared with banks that need to cyclically swing around leverage under the command of the Federal Reserve, card organizations operated by Visa/MasterCard can be said to be cash flow businesses that are guaranteed to make money regardless of drought or flood. To give just one example, in 2024, Capital One acquired Discover for US$35.3 billion, transforming itself into a giant organization that combines a card issuer and a card organization.

The integration of traditional banks is the forerunner of the issuance of stablecoins and the establishment of a stablecoin public chain. Only through integration can we control all issuance, distribution and repayment channels.

After the Genius Act, the operating logic of the US dollar has been completely changed. Traditional commercial banks assume the responsibilities of credit creation and currency issuance (M0/M1/M2), but Tether and Circle's US debt positions have exceeded those of multiple countries.

Stablecoins are directly connected to government bonds, and the banking industry can still issue stablecoins to save itself, but card organizations and cross-border payment channels will face a survival crisis.

• Banking industry -> Stablecoin issuers USDT, USDC

• Card schemes/SWIFT/PSP -> Stablecoin L1

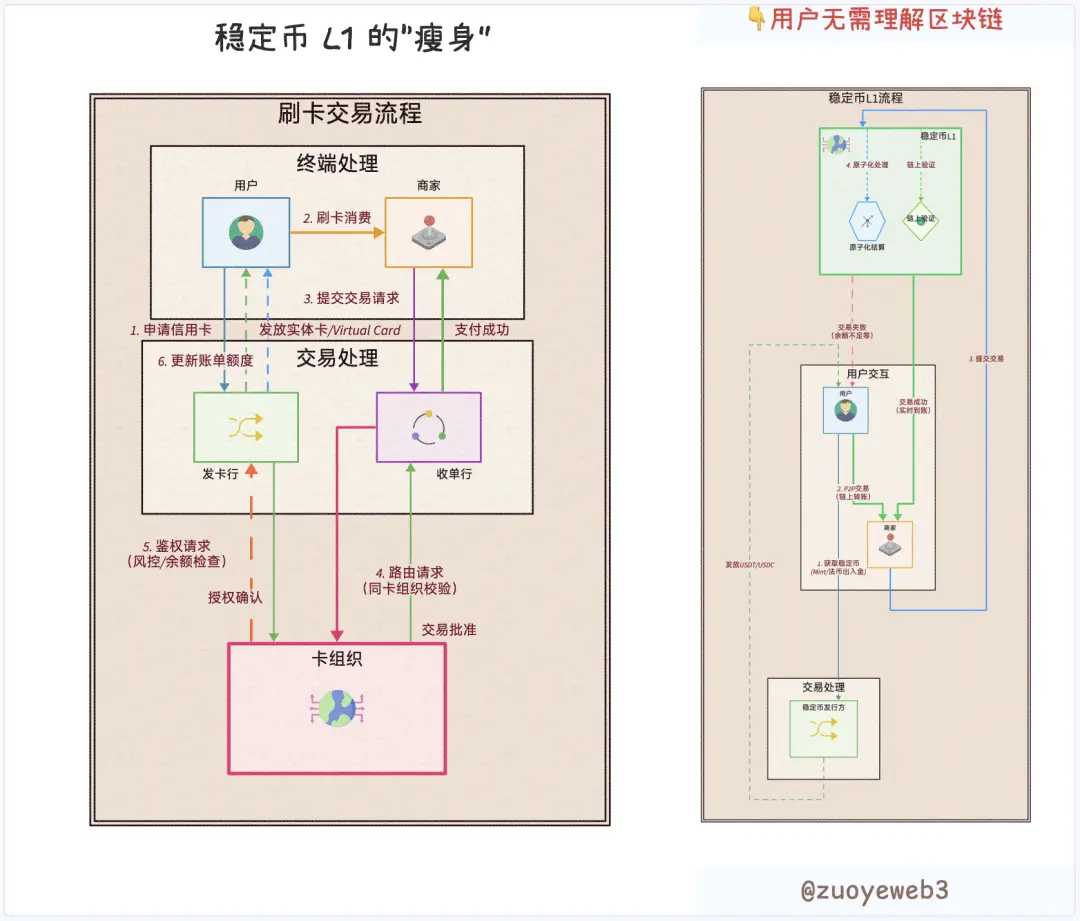

In traditional transaction flows, users, merchants, issuers, acquirers, and card organizations are completely different roles, but the programmability of blockchain completely changes all of this. Any role can be reduced to a "user," whether it's the privacy vault and confidential transfers required by an institution or the convenience needed by an individual, it's just a distinction made by different codes.

Stablecoin L1 directly eliminates the necessity of any non-user institutions. Only users, stablecoins and L1 are needed to complete the interchange and stacking of any roles and functions, even the compliance review of regulatory authorities.

Image description: Image of transaction process innovation

Source: @zuoyeweb3

Of course, this does not mean that professional issuance and technical service agencies will disappear, but that from the perspective of coupled code, suppliers can be reviewed and selected. Taking U cards as an example, the profits of virtual cards are taken away by upstream, and the U card issuer itself can only make a loss and gain publicity.

Technological innovation is the forerunner of changes in organizational relationships.

Now all we have to do is build a Visa from scratch, save the profits and distribute them to users.

Just like Capital One, before acquiring Discover, it had to pay a 1.5% handling fee to Visa/MasterCard, and USDT/USDC also had to pay gas fees to Tron and Ethereum.

Just as Circle was promoting Arc, Coinbase Commerce directly connected with Shopify, and Circle also chose Binance as its partner for its own income-generating stablecoin USYC.

Tether once claimed that 40% of the public chain transaction fees were generated by it, and Circle even had to "subsidize" Coinbase an additional $300 million in a single quarter. Therefore, it is reasonable to remove existing channel dealers and establish its own distribution channels and terminal networks.

However, Circle chose to build its own, while Tether chose external horse racing with Plasma and Stable.

The only exception is Stripe. Stripe itself lacks a stablecoin, but it has a network of end users and has completed a closed-loop technology after acquiring Bridge and Privy. It is a bold prediction that Stripe will sooner or later issue or "support" its own stablecoin.

To summarize, stablecoin issuance, distribution channels, and terminal networks are all building their own closed loops:

• Stablecoin issuers: Circle’s Arc, Tether’s Plasma and Stable, and USDe’s Converge

• Distribution channels: Exchanges such as Coinbase and Binance, existing public chains such as Ethereum and Tron

• Terminal network: Stripe’s own Tempo

The freedom of the French is not the freedom of the British, and USDT's L1 is not the habitat of USDC. When everyone no longer wants to make do with their lives, the competitors of the existing public chains and card organizations will rush out like the Yangtze River, and it will be unstoppable.

Technology Diffusion: Public chains are easy to build, but institutional clients are difficult to expand

Defending freedom to the extreme is not evil, and pursuing justice to the restrained is not a virtue.

Privacy is no longer a concern for ordinary users, just as QUBIC's swallowing of Monero cannot compare to the popularity of the treasury strategy. From a liberal perspective, private transactions are just a "paid privilege" for institutional users. What ordinary users really care about is the transaction fees.

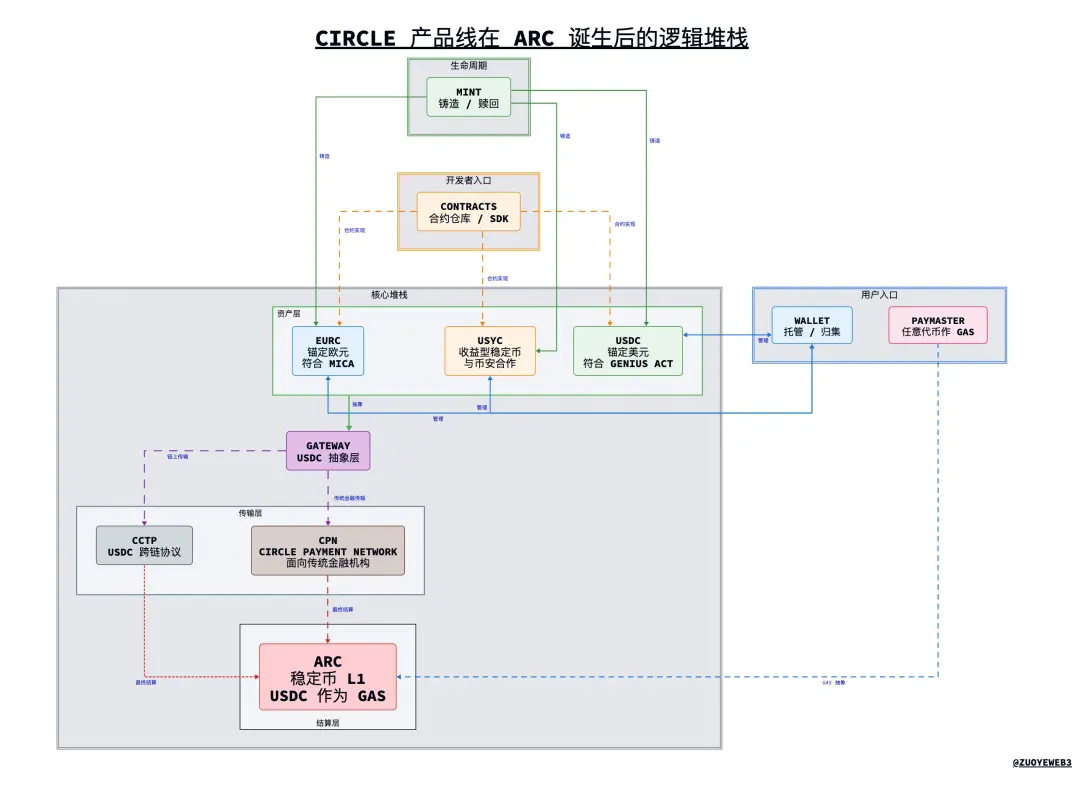

Before the release of Arc, Circle's product lines had already blossomed into multiple lines and even became a bit complicated. Only under the unified regulation of Arc could synergy be achieved, allowing USDC to escape the embarrassing situation of being a subsidiary of Coinbase.

Image caption: Circle product line logic stack after the birth of Arc

Image source: @zuoyeweb3

Taking Arc as an example, we can get a glimpse of the technical architecture of the future stablecoin public chain. It should be noted that the above is only my personal understanding of the logical architecture and does not necessarily mean it is the case (cosmic disclaimer).

1. Product Description

• USDC/EURC/USYC: Circle’s three main stablecoin product lines, USDC is anchored to the US dollar and complies with the Genius Act, EURC is anchored to the euro and complies with MiCA regulations, USYC is a yield-based stablecoin, and USYC cooperates with Binance

• CPN (Circle Payment Network): A cross-border clearing network initiated by Circle with USDC as the underlying layer, similar to SWIFT

• Mint: Users can mint stablecoins such as USDC

• Circle Wallet: Individual and institutional users can manage all types of Circle stablecoins here

• Contracts: USDC and other stablecoin contracts written by Circle

• CCTP: USDC cross-chain technology standard

• GateWay: USDC abstraction layer, users do not need to know the underlying public chain and technical details, and can directly interact with USDC

• Paymaster allows any token to be used as a Gas token

• Arc: Circle’s stablecoin Layer 1, with USDC as the native Gas Token

2. Logical Stack

• The main part: From top to bottom, it is divided into: USDC/EURC/USYC -> Gateway -> CCTP/CPN. CCTP is mainly used on the chain, and CPN is mainly promoted in traditional financial institutions -> Arc

• Consider the most important parts as a whole. Mint is the recharge entrance, Wallet is the fund collection entrance, Contracts is the programming entrance, and Paymaster is the accompanying function. Any token can be used as Gas Token.

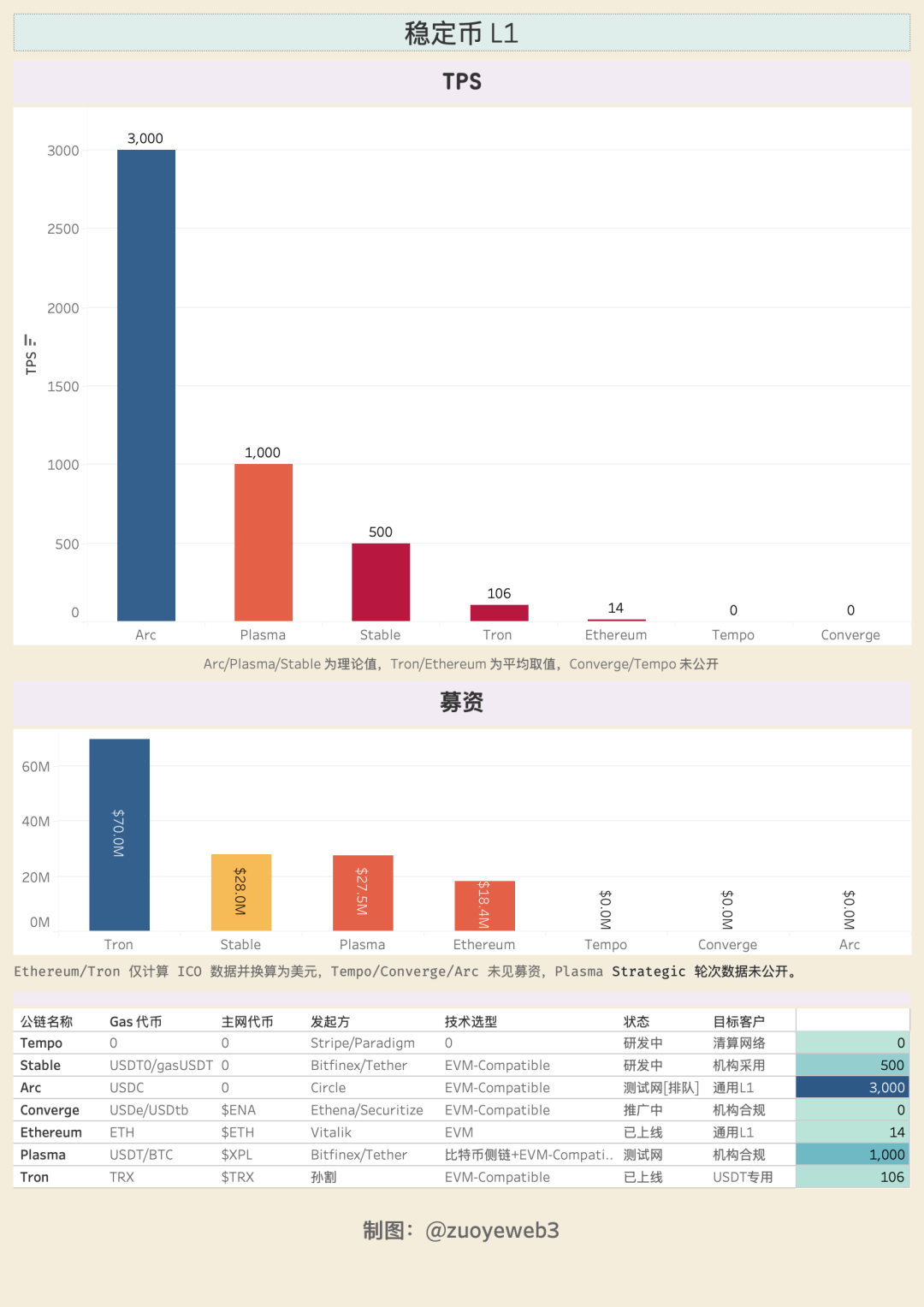

Under the so-called PoS, but actually DPOS mechanism, Arc with up to 20 nodes can theoretically have 3,000 TPS and sub-second transaction confirmation time, and the Gas Fee can even be as low as 1U. It also considerately prepares privacy transfer and vault modes for institutions, and is ready to undertake large-scale corporate funds on-chain storage. This may also be an important reason why Circle built its own L1. In addition to stablecoin transactions and transfers, enterprise-level asset management is also a focus of competition.

In addition, the universal L1 architecture reserves interfaces and full-function architecture for the on-chain addition of more assets such as RWA. Malachite, which is based on the CometBFT developed by the acquired Informal Systems, has a theoretical potential of 50,000 TPS.

Then comes the familiar EVM compatibility, MEV protection, FX (foreign exchange) engine and transaction optimization. It can be said that with the support of Cosmos, there are no technical bottlenecks in launching Hyperliquid-level products. If it is L2, the difficulty will not exceed deploying a Docker instance.

In Arc's plan, cryptographic technologies such as TEE/ZK/FHE/MPC will be integrated. It can be said that the current diffusion of technology has made the startup cost of the public chain extremely close to a constant. The difficulty lies in ecological expansion. To build distribution channels and terminal networks, Visa took 50 years, the USDT/Tron Alliance took 8 years, and Tether has created USDT for 11 years.

Time is the biggest enemy of stablecoin L1, so stablecoins choose a strategy of separating words from deeds:

• Do: Retail use -> Distribution channels -> Institutional adoption

• Say: Institutional compliance -> Popularization

Both Tempo and Converge are targeting institutional adoption, and Arc is promoting global compliance. Compliance + institutions is the GTM strategy given by stablecoin L1, but this is not the whole story. Stablecoin L1 will use a more "Crypto" approach to promote it.

Plasma and Converge are both collaborating with Pendle, Circle is secretly promoting 24/7 exchange of yield-generating stablecoins USYC and USDC, and Tempo, led by Paradigm founder Matt Huang, is its CEO. Its core goal is to be more blockchain-focused rather than Fintech-focused.

Institutional adoption has always been a means of compliance, just as Meta claims to protect user privacy. However, in real business, users must first be present to promote institutional adoption. Don’t forget that USDT’s earliest and largest user group has always been ordinary people in Asia, Africa, and Latin America. Now, it has also entered the field of vision of institutions.

Distribution channels have never been an area that institutions excel in, and the army of ground salesmen is the foundation of the Internet.

Image caption: Stablecoin L1 comparison

Image source: @zuoyeweb3

Emerging stablecoins L1 either raise a lot of funds or rely on powerful backers. Under the supervision of the Genius Act and MiCA, they are basically unable to pay interest to users, let alone use this to acquire customers. However, USDe relied on the issuance of revolving loans to reach the $10 billion mark within a month.

The gap between on-chain revenue distribution and user conversion leaves market space for interest-bearing stablecoins. With USDe managing the chain, USDtb, with the cooperation of Anchorage, becomes a compliant stablecoin under the Genius Act.

Profits can greatly promote user adoption, which is a fatal temptation. Beyond the boundaries defined by the rules is a good arena for each company to show its skills.

Conclusion

Before the stablecoin L1, TRC-20 USDT was the de facto global USDT clearing network. USDT was also the only stablecoin with real users, so Tether did not need to share profits with exchanges. USDC was just its compliant substitute, just like Coinbase is Binance's mapping on Nasdaq.

Stablecoin L1 is challenging Visa and Ethereum. The global currency circulation system is being fundamentally reshaped, and the global dollar adoption rate is declining. However, stablecoin L1 has already set its sights on foreign exchange trading. The market is always right, and stablecoins are eager to do more.

More than 10 years after the birth of blockchain, we can still see innovations in the public chain field, which is already gratifying enough. Perhaps, the most fortunate thing is that Web3 is not Fintech 2.0, DeFi is also changing CeFi|TradiFi, and stablecoins are changing banks (deposits/cross-border payments).

It is hoped that the stablecoin L1 will still be the successor to the core concept of blockchain.