1. Market observation

The U.S. House of Representatives passed the GENIUS Act, which establishes a regulatory framework for stablecoins, and the CLARITY Act, which clarifies the regulatory ownership of crypto assets. Both bills have received significant bipartisan support, indicating that the regulatory clarity long sought by the digital asset industry will gradually be implemented. At the same time, Trump is preparing to sign an executive order to open the $9 trillion 401(k) retirement fund market to investments in alternative assets such as cryptocurrencies, gold and private equity. This move could completely change the way Americans save and accelerate the mainstreaming of cryptocurrencies.

In terms of monetary policy, Federal Reserve Board member Christopher Waller and Vice Chairman Michelle Bowman became the only two officials who publicly supported the July rate cut. In his speech to the New York Association of Money Market Practitioners, Waller emphasized that although the Trump administration's tariff policy has pushed up the prices of some commodities, core inflation has been lower than expected for five consecutive months and wage growth has not accelerated. He advocated ignoring the temporary impact of tariffs and focusing on the underlying inflation that is close to the 2% target. He warned that the labor market is on the "edge of danger" and expected the economy to "remain weak" in the second half of the year. He suggested a 25 basis point rate cut at the July 29-30 FOMC meeting. However, most officials, including Board member Adrienne Kugler and the president of the New York Fed, are concerned about the long-term impact of tariffs and advocate maintaining interest rates. The futures market shows that the probability of unchanged interest rates this month is high, and the expectation of a rate cut in September is only slightly over 50%.

Jeffrey Ding, chief analyst at HashKey, pointed out that the recent significant rise in Bitcoin prices and record highs are due to the dual resonance effect of active on-site funds and large inflows of off-site funds. The key to this rise is that it broke through the "Trump bottom" oscillation range of $90,000 to $110,000 formed since November last year. Jeffrey Ding believes that breaking through this range marks the official start of the fourth wave of Bitcoin's bull market, and predicts that the market may complete a round of rapid pull-ups in the next two to three months. In addition, Bitcoin's breakthrough of the "Trump bottom" has also stimulated the willingness of other crypto assets such as Ethereum to go long, prompting the market to show a general rise.

Bitcoin is facing a critical technical level, and analyst Rakesh Upadhyay believes that Bitcoin is facing resistance at $120,000 and may fluctuate between $115,000 and $123,218 in the short term. Despite buyers' attempts to push prices higher, bears have successfully defended the level, indicating that Bitcoin may remain range-bound in the short term. If Bitcoin falls below $115,000, it may further fall to the key support level of $110,530; conversely, if the price breaks through the resistance range of $120,000 to $123,218, it is expected to hit $135,729 or even $150,000. Analyst Man of Bitcoin also emphasized that breaking through $120,126 is an initial upward signal, and staying above $123,195 will further confirm the trend. Darkfost, an analyst from CryptoQuant, provided an optimistic perspective based on on-chain data, pointing out that the MVRV indicator, which measures the unrealized profits of short-term holders, is currently only 1.15, far below the 1.35 that usually triggers profit-taking, indicating that prices may have room to rise by 20% to 25% before entering the next round of correction.

As for Ethereum, analysts Ted and Poseidon believe that its current trend is similar to the 2016-17 cycle, and breaking through the key resistance level of $4,000 may trigger a larger rise. Analyst CryptoCondom even predicted that the $10,000 target may be achieved against the backdrop of a continued decline in liquidity caused by digital asset finance companies pushing a large amount of ETH into pledge pools, ETFs and private reserves. In addition, institutional buying enthusiasm continues to rise, with SharpLink Gaming increasing its holdings by 144,501 ETH in nine days, BitMine Immersion disclosing that its ETH holdings exceed $1 billion, and GameSquare planning to raise $70 million to increase its ETH holdings.

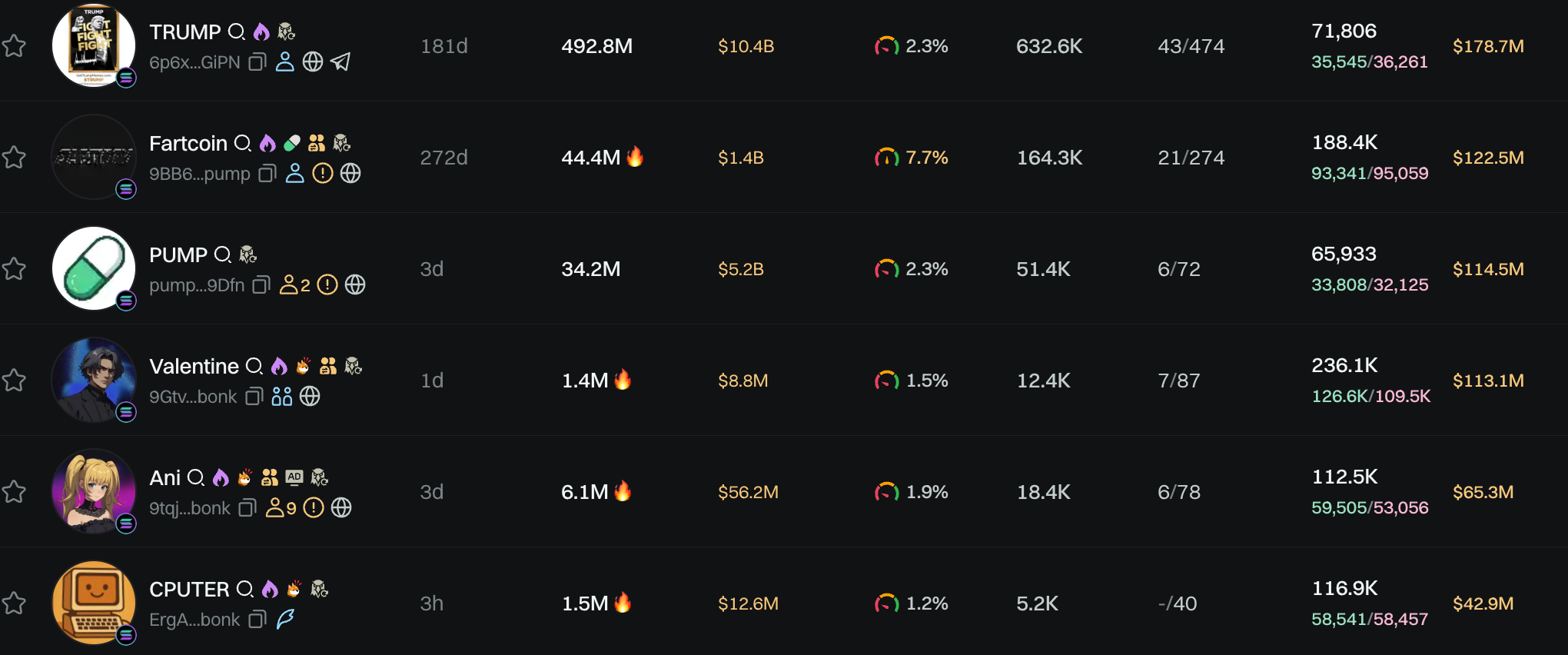

In the altcoin market, the concept coins related to Grok AI companions continue to cause market fluctuations. Yesterday, after Musk announced that the male AI companion of Grok was named "Valentine", the market value of the meme coin of the same name soared to 20 million US dollars, but related currencies such as TAKI, CHAD, and ANDREJ also plummeted. The market value of the previously popular Grok female AI companion Ani also dropped from a high of 88 million US dollars to 55 million US dollars. In addition, an AI self-running experiment conducted by AI developer @mckaywrigley gave birth to the meme coin $CPUTER. Although the developer himself did not recognize the token, its market value quickly exceeded 16 million US dollars and has now dropped to 13 million US dollars.

2. Key data (as of 12:00 HKT on July 18)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $120,495 (+28.59% YTD), daily spot volume $51.841 billion

Ethereum: $3,647.28 (+9.03% YTD), with daily spot volume of $67.357 billion

Fear of Greed Index: 71 (greed)

Average GAS: BTC: 0.72 sat/vB, ETH: 3.9 Gwei

Market share: BTC 60.9%, ETH 11.1%

Upbit 24-hour trading volume ranking: XRP, ERA, ETH, DOGE, BTC

24-hour BTC long-short ratio: 50.58%/49.42%

Sector gains and losses: PayFi sector rose 15.95%; L2 sector rose 11.52%

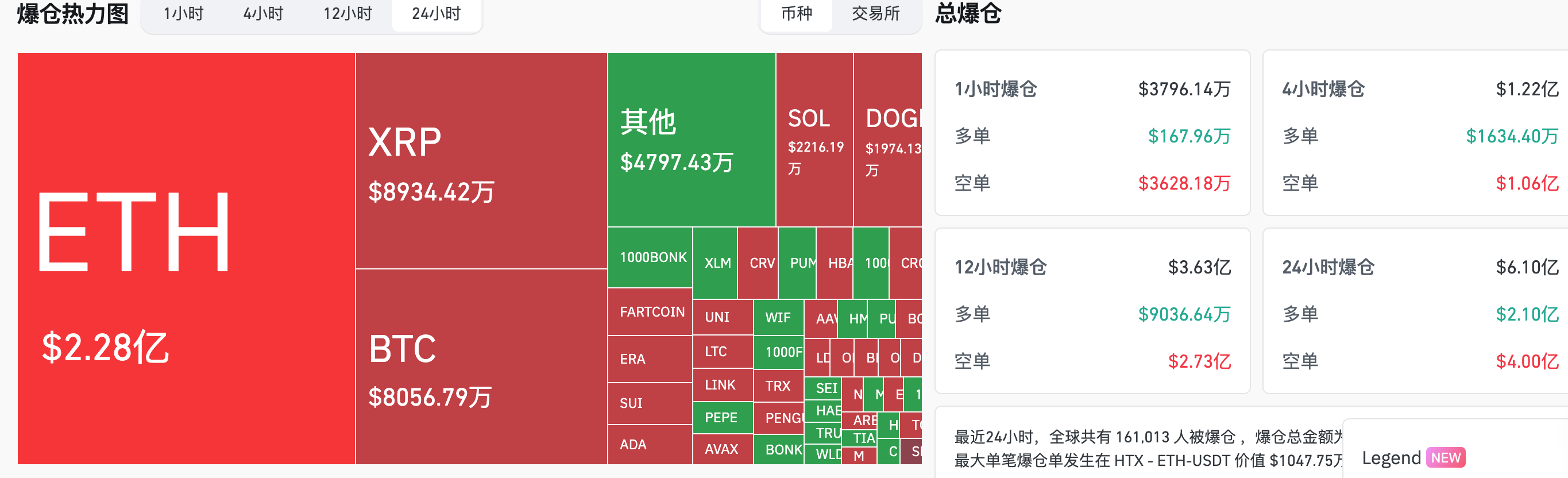

24-hour liquidation data: A total of 161,013 people were liquidated worldwide, with a total liquidation amount of US$610 million, including BTC liquidation of US$228 million, ETH liquidation of US$80.5679 million, and XRP liquidation of US$89.3442 million.

BTC medium- and long-term trend channel: upper channel line ($116,841.19), lower channel line ($114,527.50)

ETH medium and long-term trend channel: upper channel line ($2997.71), lower channel line ($2938.35)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 17)

Bitcoin ETF: +$523 million, 11 consecutive days of net inflows

Ethereum ETF: +602 million USD, the second highest in history

4. Today’s Outlook

Official Trump (TRUMP) will unlock about 90 million tokens at 8 am on July 18, accounting for 45% of the current circulation, with a value of about US$878 million;

Cloud (CLOUD) will unlock approximately 125 million tokens at 11:00 pm on July 18, accounting for 37.92% of the current circulation, worth approximately $10.3 million;

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8 am on July 18, accounting for 4.07% of the current circulation and worth approximately US$5.2 million.

The biggest gainers in the top 100 by market capitalization today: Lido DAO (LDO) up 22.2%, Hedera (HBAR) up 20.6%, Cronos (CRO) up 18.7%, Flare (FLR) up 18.4%, and UNI up 17.3%.

5. Hot News

Arthur Hayes allegedly purchased $1 million of LDO and $1 million of AAVE

Solana ecosystem DEX Raydium has repurchased over $190 million worth of tokens

Publicly listed BitMine Immersion reveals that its Ethereum holdings are worth more than $1 billion

Listed company GameSquare plans to raise $70 million through rights issue to continue purchasing ETH

Publicly listed Enlightify Inc. plans to purchase up to $20 million of CYBER tokens within 12 months

BSTR plans to be listed in the U.S. through a SPAC merger with 30,021 BTC when it is launched

Plasma officially launches XPL public sale, token economic model announced

Yala announces token economics: total supply 1 billion, 3.4% allocated to airdrops

ETH perpetual contract trading volume surpasses BTC, topping the market

World Liberty Fi invested tens of millions of dollars to purchase 3007.4 Ethereum

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.