Hyperliquid has partnered with market makers to provide initial liquidity for HyperCore, but all of this is based on the expectation that $HYPE will provide market makers with a longer-term share of profits.

As mentioned above, the way to gradually expand HyperBFT nodes is to swap positions, that is, the foundation's token shares are transferred to the market maker nodes in exchange for their long-term liquidity commitments.

$HYPE thus becomes a liability of Hyperliquid, and needs to meet the various needs of market makers, HLPs, and token holders at the same time. It should be noted that the needs of the three are not completely consistent. If the price of $HYPE does not rise for a long time, retail holders will inevitably sell off, causing damage to the interests of market makers. However, it is not good to rise too quickly. Excessively high prices may at best trigger a sell-off by whales, and at worst lead to economic collapse.

The reasonable price of $HYPE should be 10% of $BNB, or $100 USD. However, the volatile market with an average price of $50 leaves enough room for price appreciation, as well as a lower starting point for decline in a bear market, thus alleviating the pressure.

Before the security is sold

Selling liquidity directly is the price of MM, and it must be packaged into a dragon slayer.

Any product/business/model in the cryptocurrency world must solve two core problems:

1. What are you selling as assets?

2. How to sell

Before the launch of HyperEVM, facing accusations of excessive market centralization, the Hyperliquid team began expanding HyperBFT nodes, gradually introducing external participants, and launched HyperUnit in early February to facilitate the entry of external funds into HyperCore, laying the groundwork for connecting external public chains with HyperEVM.

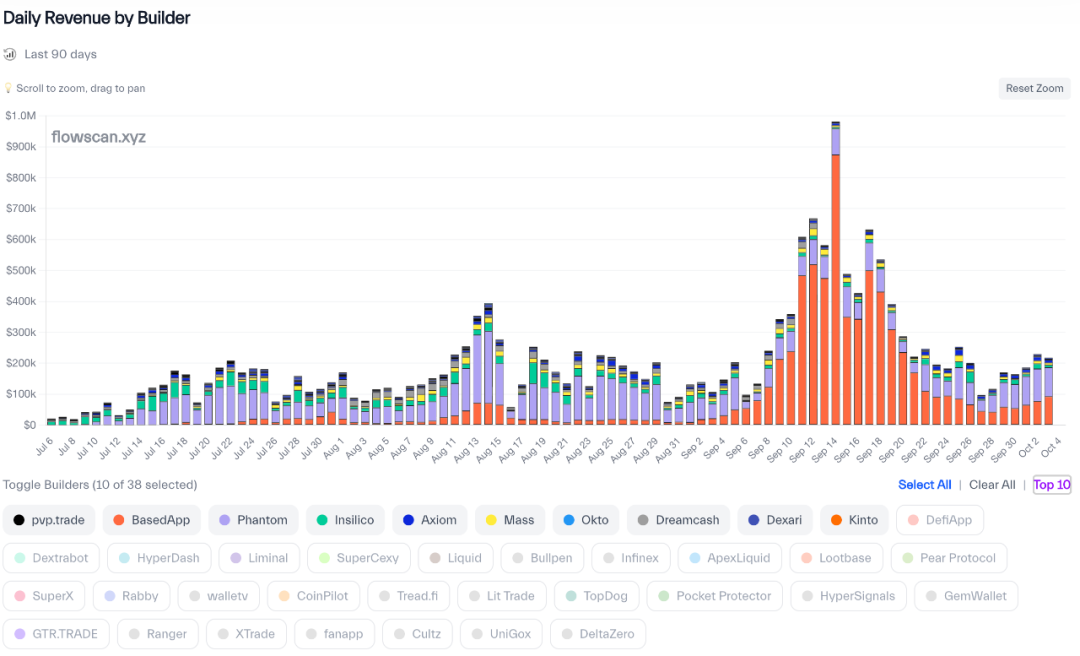

Just like the launch of Builder Codes in October 2024, and the integration of Phantom in July 2025 to ignite market traffic.

Image Caption: HyperEVM Main Node

Image source: @zuoyeweb3

In February 2025, HyperEVM was launched. Subsequently, precompiled contracts for reading and writing HyperCore and HyperEVM were gradually formed from April to July, followed by the gradual launch of ecological projects.

What really inspires us is that after the 31% token airdrop, there was a huge sell-off pressure on Hyperliquid to switch positions. The launch of HyperEVM three months after the HyperCore airdrop is unjustifiable without pre-research. A more reasonable explanation is that they chose the right time to do it:

1. At this point, $HYPE nodes are slightly more dispersed to meet public expectations;

2. The price hovers below $25, making it relatively affordable for all parties involved in node operations.

3. The Hyperliquid team faces less pressure to “pull up the market”.

Nodes are decentralized, exchange is enabled, and security is sold to nodes as an asset. Before migrating HyperCore security to HyperEVM, $HYPE completes the first phase of large transactions.

Projects are created on the chain and assets are issued on exchanges.

The crypto network effect can be roughly equal to that of public chains and CEXs. Stablecoins are the only outliers that have jumped out of crypto and moved towards the traditional world and people.

Looking at the crypto timeline after the FTX collapse, the focus of ETH L2 is not ZK, but the "Solana"-like high-performance L2 of MegeETH and other projects. Monad/Berachain/Sonic (Fantom) all stimulate liquidity around their own mainnet tokens, and liquidity has no long-term preference for them.

In the exchange competition, how to face Binance is the main task of offshore exchanges such as OKX/Bybit/Bitget, compliant exchanges such as Coinbase/Kraken, and the up-and-coming Robinhood. They all chose to "trade everything". Robinhood chose L2, prediction markets and altcoins such as $CRV, Kraken moved towards wallets, L2, USDG and listing, Bybit promoted Mantle, OKX redesigned XLayer, and Bitget UEX (Panoramic Exchange) came to the rescue.

Whether it is an exchange or a public chain, they all hope to open up the circulation of liquidity and tokens. Before the issuance of coins, it is relatively simple for tokens to stimulate liquidity in a one-way manner. After the issuance of coins, liquidity empowers tokens, and then the two-way circulation of tokens feeding back liquidity is mostly not established. This is true from Berachain to Sonic of the crypto king AC.

The history of all cryptocurrencies is the history of asset creation. Since Bitcoin, public chains have become the place where asset creation and issuance networks take place. However, the high entry cost has made completely decentralized platforms such as CEX a powerful intermediary for attracting new users and listing new coins, and even developed dependent products such as exchange public chains based on this.

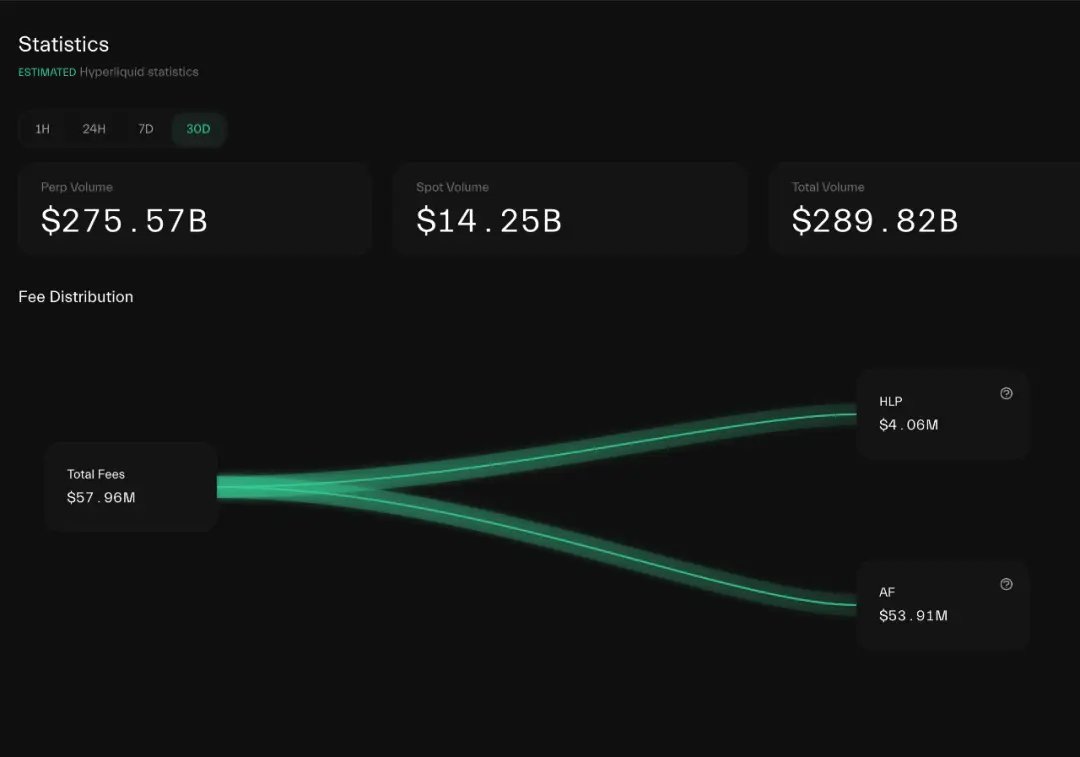

Image caption: Hyperliquid fee flows

Image credit: @hypurrdash

If we only observe the market performance of $HYPE, it is difficult to distinguish it from token-stimulated projects. After all, more than 92% of its revenue is used for simple and crude repurchases.

Hyperliquid's liquidity is also stimulated, but through a relatively smooth rotation model, the team's own restraint, and a centralized unlocking and selling mechanism without traditional VC, the liquidity of HyperCore and the relative stability of $HYPE prices have been stabilized.

Therefore, after replicating the liquidity of CEX, HyperCore must move towards an open public chain architecture to make $HYPE more like ETH and become a "currency" with real consumption scenarios. At present, it is far from achieving this.

Image Caption: App Capital

Image credit: @ryanberckmans

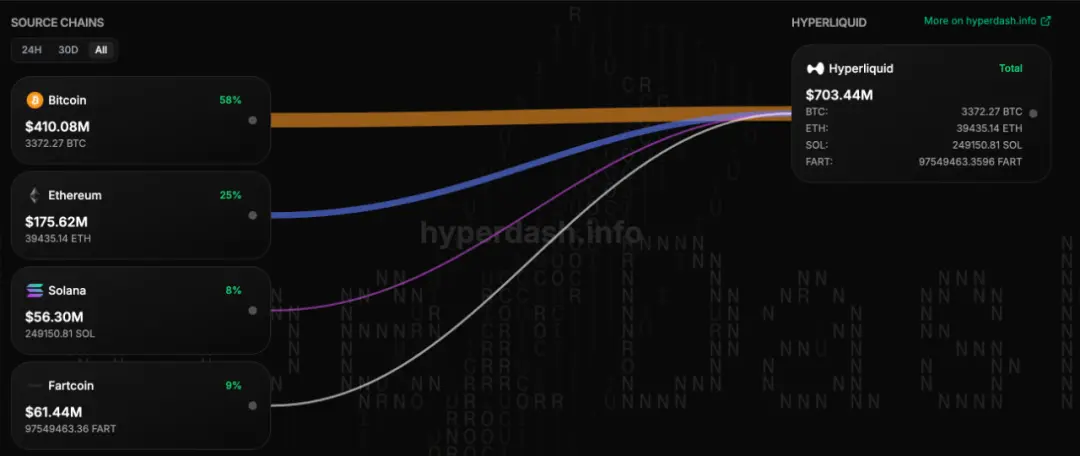

According to the App Capital indicator, Ethereum relies on altcoins and stablecoins to reach a circulation scale of 600 billion US dollars. Tron relies on stablecoins to stand out. Solana has a relatively healthy structure, with stablecoins, altcoins and memes dividing the world into three parts, but the scale is relatively small. Hyperliquid is mainly stablecoins and altcoins, reaching a scale of 10 billion.

Note

App Capital measures the true capital flow scale of the public chain. It does not take into account the value of the main network's own tokens, and only calculates the circulation value of the tokens on it, rather than FDV or TVL.

Or it can be said that the assets on Hyperliquid, in addition to BTC/ETH/SOL bridged by Unit, are mainly enabled by $HYPE. This does not conflict with not counting mainnet tokens, because $kHYPE wrapped by LST such as Kinetiq is also a "DeFi" token. Morpho/HyperLend also entered the HyperEVM ecosystem mainly based on the stimulation of $HYPE.

We will mainly explain the latter. On the surface, HyperEVM does not rely on buybacks or subsidies to develop its own ecosystem. However, in reality, ecological projects have two characteristics:

1. LST, lending, and yield are mainly developed around $HYPE derivative assets;

2. Neutral tools such as DEX cannot generate volume, and HyperSwap TVL is very low.

Taking Kinetiq as an example, it is more like an on-chain re-issuer of $HYPE. It started with the Lido version of LST and gradually entered various product lines such as lending, stablecoins, and Yield. Its TVL is around US$25 billion, and Kinetiq itself is also one of the HyperBFT nodes.

In comparison, the TVL of HyperSwap, the main AMM DEX on HyperEVM, is only about 44 million US dollars. Although it conflicts with the positioning of HyperCore, it is still extremely inferior to Pancakeswap's 2.5 billion TVL and Uniswap's 5.5 billion TVL.

This also verifies the importance of App Capital. The assets on HyperEVM are still a redistribution channel for $HYPE and are still a long way from becoming an independent ecosystem.

After selling liquidity

Choice is an illusion created between those with power and those without.

Although Hyperliquid is trying hard to create a closed loop of HyperEVM's value, as of now, it is still centered around $HYPE and HyperCore liquidity, and the value of HyperEVM itself is not coordinated with it.

This conflicts with our daily conceptual framework. In any material we see, the great significance of HIP-3, Core Writer, and Builder Codes is mentioned, as if these three allow the liquidity of HyperCore to be seamlessly migrated to HyperEVM.

But this is an "illusion". Through the above technological innovations, HyperCore sells a kind of "liquidity" deployment rights, which does not mean providing trading liquidity for the project.

To put it more bluntly, Hyperliquid sells HyperCore's technical architecture, just like Aave's friendly fork.

Tip

Aave DAO is designed with a friendly fork model. Third parties can directly use Aave's code for development, but they must share part of the protocol revenue with Aave. HyperLend is an example.

From Read Precomplies to Write Precomplies (i.e. CoreWriter System), the ability to directly read and write HyperCore data on HyperEVM is built. This is actually a common mode for connecting the two, that is, opening up access rights to HyperCore.

Access rights ≠ liquidity initialization. Any HyperEVM project that wants to use HyperCore liquidity must seek funds to initiate liquidity on its own.

Hyperliquid will not provide subsidies, which requires each project party to show its unique skills. HyperBeat seeks external financing, while Hyperlend insists on community-led development.

This creates an asymmetric relationship where Hyperliquid will not provide $HYPE incentives to HyperEVM projects, but will induce them to build around $HYPE to promote the real use of tokens.

From Invite Code to Builder Codes

In fact, this has already been revealed on Builder Codes. In the past, CEX rebates highlighted the use of invitation codes to distinguish sources, which tested the "pyramid selling" and conversion capabilities of local promoters and community leaders. Therefore, CEX would frantically invest in KOLs of all sizes.

However, Hyperliquid follows the Taobao rebate model and does not mind you changing your appearance. It encourages developers and project parties to start businesses around HyperCore liquidity and build their own brands and front-ends. HyperCore is willing to assume the role of liquidity provider.

Image Caption: Builder Codes revenue ranking

Image credit: @hydromancerxyz

HyperCore provides a unified liquidity backend, BasedApp can create its own Robinhood experience, and Phantom can embed its contracts into its own ecosystem, customize them at will, and share the profits.

From fixed contracts to custom contracts

Following the example of Builder Codes, Hyperliquid launched the HIP-3 proposal, allowing users to build any contract market on HyperCore, including prediction markets, foreign exchange, or options.

From a product perspective, this is a contract auction mechanism following the spot auction, which still has a 31-hour cycle, but requires a $HYPE deposit of 500,000 (approximately US$25 million).

However, through the supplement of the Core Writer protocol, HIP-3 is actually opening up the circular leverage from HyperEVM to HyperCore. HIP-3 was originally proposed by the LST protocol Kinetiq, and Kinetiq itself also runs a HyperBFT node.

Through CoreWriter and HIP-3 protocols, the $HYPE that Kinetiq directed to the DeFi protocol on the HyperEVM chain will now flow back to HyperCore, triggering de facto deflation.

Furthermore, Kinetiq also provides crowdfunding auction services, where everyone can form a group to raise funds to bid for the creation rights. It can be imagined that the $HYPE pledged on HyperCore will eventually become the contract margin of HyperCore.

1. Users raise funds or project owners provide 500,000 $HYPE to participate in the auction;

2. After the project is launched, it will be deployed on HyperCore and the initial trading liquidity will be solved by itself;

3. The project owner will receive 50% of the commissions in $HYPE.

4. Hyperliquid will confiscate the staked $HYPE proportionally if the project misbehaves.

For a better understanding, HyperCore trading volume is the valuation basis of $HYPE, and HyperEVM is the valuation amplification of $HYPE, allowing the ecosystem to game the price benchmark, increase actual usage, and get rid of excessive reliance on buybacks.

Under the dual-architecture system, the controllable HyperCore requires the free HyperEVM. Only by completing the open permissions can the value of $HYPE spiral upward.

Under HyperCore's repurchase mechanism, Hyperliquid's growth story can only be to become a complete Binance. HyperEVM gives $HYPE itself the option to trigger secondary liquidity.

Image Caption: Unit Bridge Asset Classification

Image credit: @hypurrdash

This is similar to the purpose of introducing BTC/ETH with Unit to promote the growth of $HYPE as transaction fees. Don’t forget that the end of $FTT as FTX’s main asset reserve is collapse.

HIP3 and the CoreWriter system completely change the valuation and positioning of Hyperliquid. $HYPE will launch as a complete public chain + exchange.

Conclusion: From S1 to S3

I don't wear my heart upon my sleeve.

This article focuses on piecing together how Hyperliquid organizes the initial liquidity of HyperEVM, and pays less attention to the current status of the HyperEVM ecosystem.

Now HyperEVM can basically be regarded as a package and leverage amplifier of $HYPE. There is no project or mechanism that has truly broken away from its dependence on $HYPE. Most of them are migrations or imitations of ETH projects.

Suddenly, Hyperliquid launched NFTs for Season 2 users. Considering that Season 1 examined Perp trading volume and Season 2 examined spot + Perp trading volume, S3 will most likely examine HyperEVM trading volume.

When facing attacks from competitors such as Aster, Hyperliquid "reissued" S2 NFT, which not only promoted HyperEVM transaction volume, but also laid a good foundation for S3. It was really amazing that each link was connected.

First make the controllable HyperCore, then make the open HyperEVM. You may think that the linker is the CoreWriter system, but it is actually the dual function of $HYPE.