Article written by Prathik Desai

Article compiled by: Block unicorn

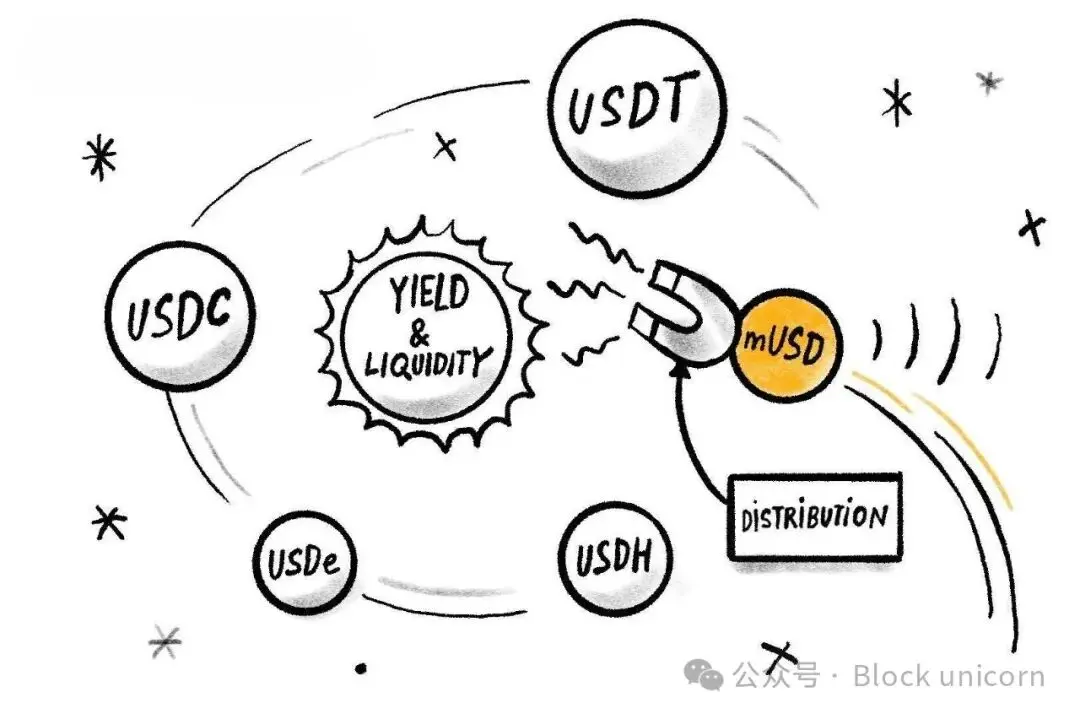

Lately, every week feels like déjà vu—another stablecoin launch, another attempt to shift the direction of value. First, we saw the bidding war for Hyperliquid's USDH offering; then we discussed the trend toward verticalization to capture US Treasury yields. Now, there's MetaMask's native mUSD. What ties all these strategies together? Distribution.

The ability to distribute has become a cheat code, not just in cryptocurrency but across all sectors, for building a thriving business model. If your community has millions of users, why not leverage it and simply put tokens in their hands? However, this doesn't always work. Telegram tried to do this with TON, boasting 500 million messaging users who never migrated on-chain. Facebook tried to do the same with Libra, believing its billions of social media accounts could form the basis of a new currency. In theory, both projects seemed destined for success, but in practice they failed.

That’s probably why MetaMask’s mUSD (with the fox ears and the “$” symbol on top) caught my eye. At first glance, it looks like any other stablecoin—backed by regulated, short-term U.S. Treasuries and issued through a framework developed by Bridge.xyz using the M0 protocol.

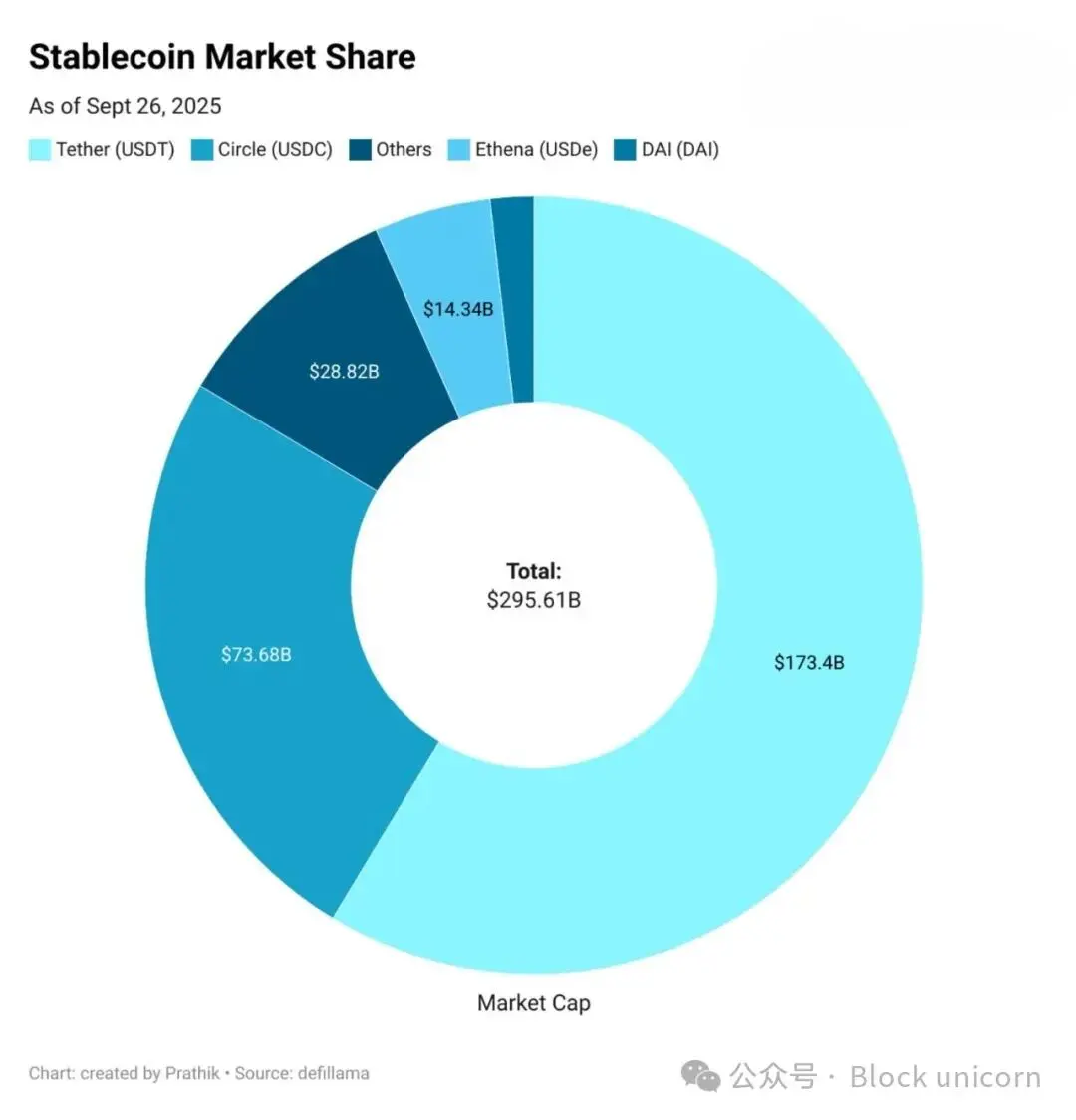

But what makes Metamask’s mUSD different in the $300 billion stablecoin market, which is currently dominated by a duopoly?

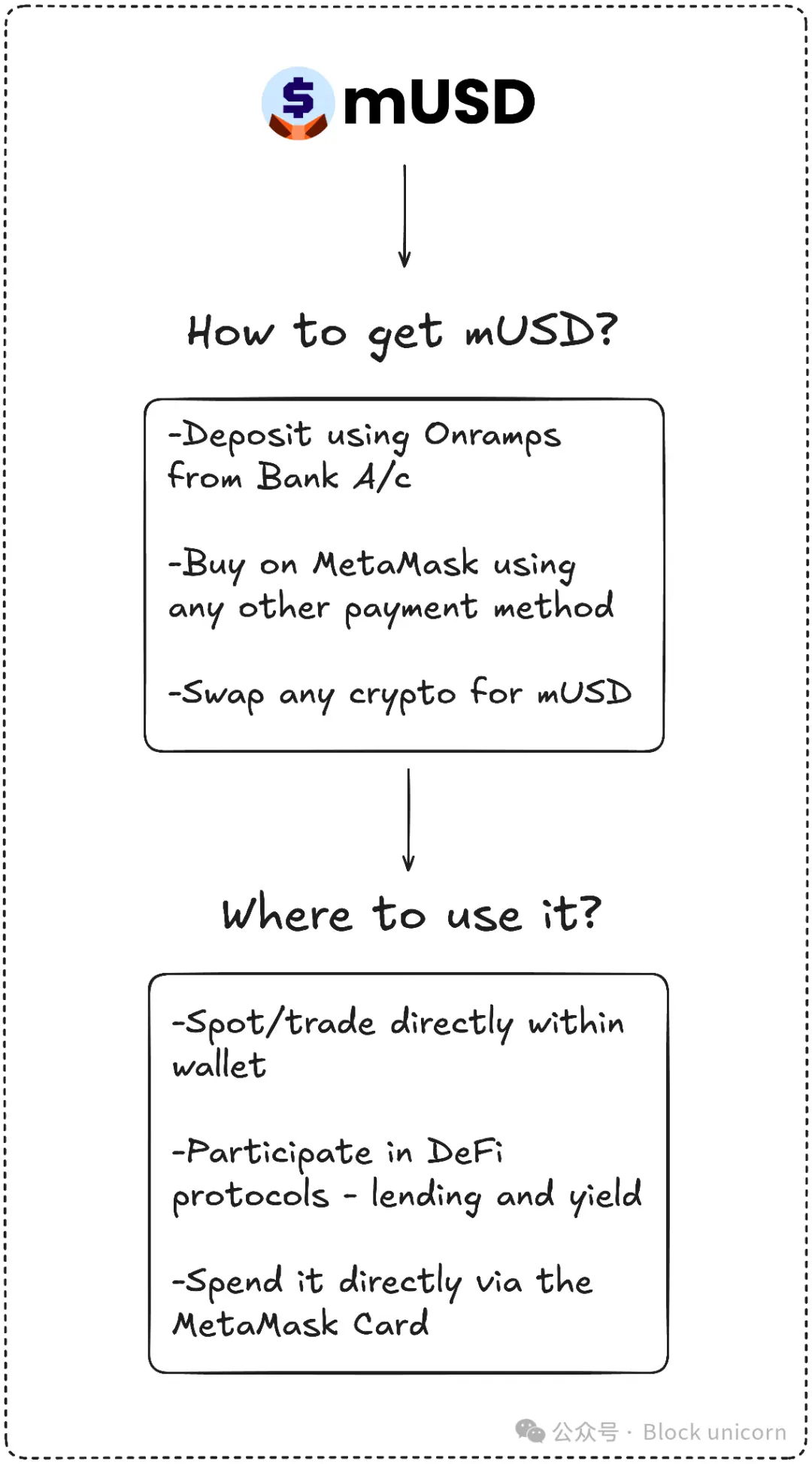

MetaMask may be entering a crowded field, but it possesses a unique selling point that rivals can't match: decentralization. With 100 million annual active users worldwide, MetaMask boasts a user base that's virtually unmatched. mUSD will also be the first stablecoin natively issued within a self-custodial wallet, allowing users to purchase and exchange it with fiat currency, and even spend it in stores using the MetaMask card. Users no longer need to search between exchanges, bridge chains, or deal with the hassle of adding custom tokens.

Telegram lacks this kind of product-to-user fit, while MetaMask does. Telegram seeks to migrate its messaging users to the blockchain for decentralized finance applications. MetaMask, on the other hand, enhances the user experience by integrating a native stablecoin into the app.

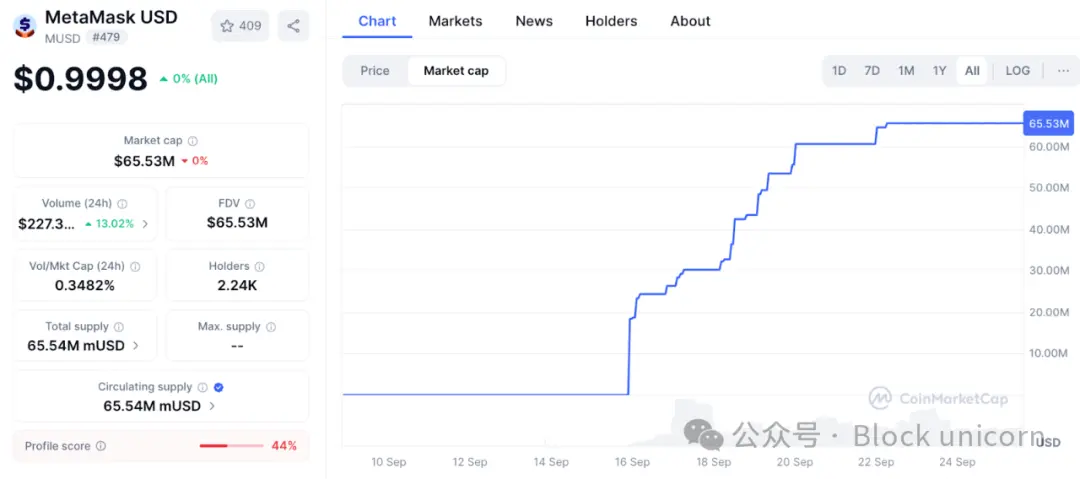

Data shows that the adoption rate of this initiative has been very fast.

MetaMask's mUSD market capitalization surged from $25 million to $65 million in less than a week. Nearly 90% of this funding came from Linea, ConsenSys's internal Layer 2 platform, demonstrating the MetaMask interface's ability to effectively channel liquidity. This leverage is similar to past exchanges: in 2022, Binance automatically converted deposits to BUSD, causing circulating supply to surge overnight. Whoever controls the users controls the token. With over 30 million monthly active users, MetaMask has the largest user base in the Web3 space.

This distribution capability will differentiate MetaMask from earlier entrants who have tried and failed to build sustainable stablecoins.

Telegram's grand plan was partially thwarted by regulatory concerns. MetaMask circumvented this by partnering with Bridge, an issuer owned by Stripe, and backing each token with short-term Treasury bonds. This satisfied regulatory requirements, and the newly enacted US GENIUS Act provided the legal framework from day one. Liquidity will also be key. MetaMask is injecting mUSD trading pairs into Linea's DeFi, betting that its internal network can solidify its adoption.

However, distribution is no guarantee of success. MetaMask’s biggest challenge will come from incumbents, especially in a market already dominated by a few giants.

Tether's USDT and Circle's USDC have captured nearly 85% of all stablecoins. Ethena's USDe ranks third, with $14 billion in circulation and attracting users due to its yield. Hyperliquid's USDH recently launched, aiming to reinvest exchange deposits into its ecosystem.

Which brings me back to the question: What exactly does MetaMask want mUSD to be?

USDT and USDC seem unlikely to see direct challengers. Liquidity, exchange listings, and user habits all favor the incumbent giants. mUSD may not need direct competition. Just as I expect Hyperliquid's USDH to benefit its ecosystem by delivering more value to the community, mUSD is likely designed to extract more value from existing users.

Every time a new user deposits through Transak, every time someone converts ETH to a new stablecoin within MetaMask, and every time they swipe their MetaMask card at a store, mUSD will be the first choice. This integrates stablecoins as the default option within the network.

This reminds me of the days when I needed to bridge USDC between Ethereum, Solana, Arbitrum, and Polygon, depending on what I needed to do with my stablecoin.

mUSD puts an end to all the cumbersome bridging and swapping.

And then there's another important takeaway: yield.

With mUSD, MetaMask will be able to earn interest on the U.S. Treasury bonds that back the token. Every billion USD in circulation means tens of millions of dollars in interest flowing back to ConsenSys annually. This will transform the wallet from a cost center into a profit engine.

If just $1 billion of mUSD were backed by an equivalent amount of U.S. Treasuries, it would generate $40 million in interest income annually from proceeds. By comparison, MetaMask earned $67 million from fees it collected last year.

This could open up another passive, significant revenue stream for MetaMask.

However, there's one element that makes me uneasy. For years, I've viewed wallets as neutral tools for signing and sending. mUSD blurs that line, turning a neutral infrastructure tool I once trusted into a business unit profiting from my deposits.

Distribution, therefore, presents both an advantage and a risk. It could make mUSD the default, sticky choice, but it could also raise questions about bias and lock-in. If MetaMask adjusts the redemption process to make its own token path cheaper or prioritized, it could make the world of open finance less open.

There is also the issue of fragmentation.

If every decentralized wallet started issuing its own USDT, it could create a variety of closed currencies, rather than the fungible USDT/USDC duopoly we have now.

I don't know where this will go. MetaMask has done a great job closing the financial loop for buying, investing, and spending by integrating mUSD with cards. Its first-week growth suggests it can overcome initial launch hurdles. However, the dominance of the incumbent giants demonstrates how challenging the climb from millions to billions will be.

I don't know where this is headed. MetaMask has done a great job completing the financial cycle of buying, investing, and spending mUSD by integrating it with cards. Its first week of growth suggests it can overcome the initial hurdles of a launch. However, the dominance of the incumbent giants demonstrates how challenging the climb from millions to billions will be.

Between these realities may lie the fate of MetaMask’s mUSD.

That concludes this week’s in-depth analysis, and we’ll see you in the next article.