By Nicky, Foresight News

Bio Protocol's token, BIO, has recently seen impressive performance. According to Bitget data, BIO's price rose from $0.056 on August 6, 2025, to a peak of $0.2081 on August 22, representing an increase of over 270%.

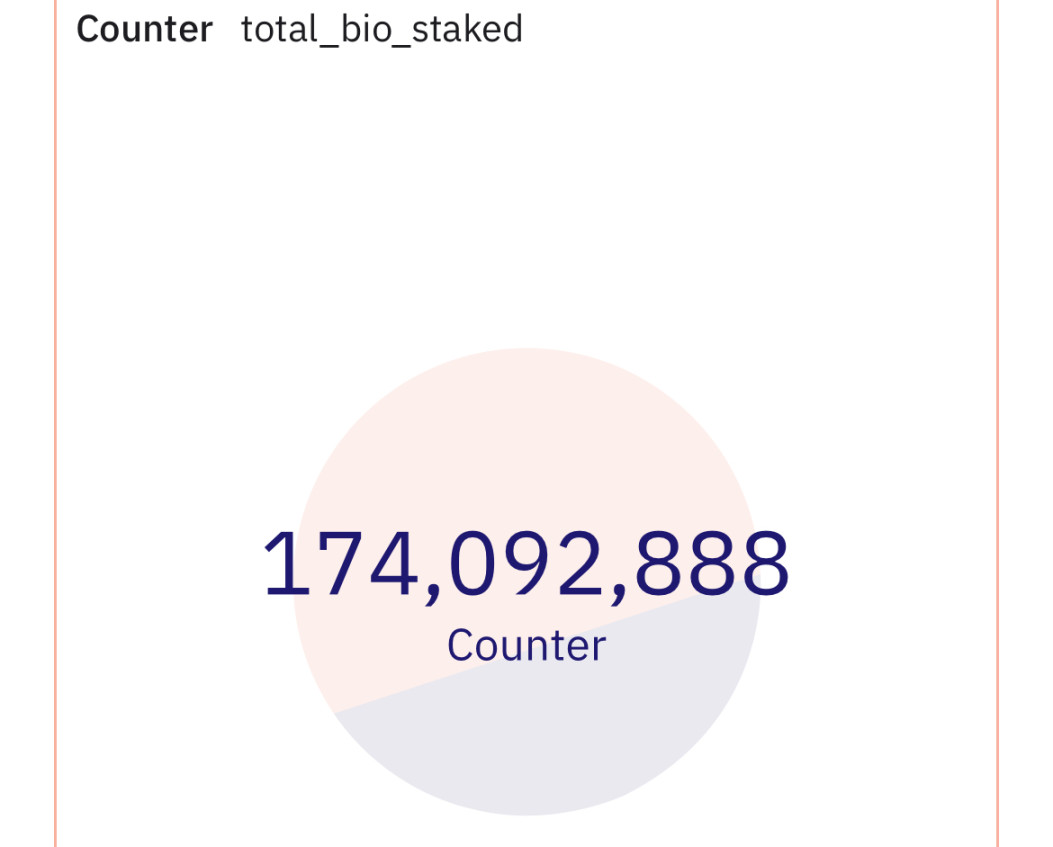

Currently, the staked amount of BIO has reached approximately 174 million, accounting for approximately 9.3% of the total circulating supply of 1.854 billion. BIO has also been listed on several major exchanges, including Binance, Coinbase, and Bithumb.

The DeSci craze of late 2024 lasted only a few months. Since its launch on Binance, BIO's token performance has been disastrous, reaching an all-time high of $0.80 upon launch before steadily declining. By August 2025, the token's price had hovered around $0.05, a drop of over 90% from its all-time high. So what has revived BIO?

Looking back at the project's origins, on November 8, 2024, Binance Labs (now YZi Labs) announced its investment in Bio Protocol. Although the details of the investment were not disclosed, this move signaled mainstream capital's recognition of the DeSci track.

As a representative project in the DeSci track, Bio Protocol's core goal is to "transform the funding and commercialization model of early-stage biotechnology research" and build a network of biotechnology DAOs.

Through blockchain technology, we enable scientists, patients, and investors worldwide to participate in the development of new drugs, addressing the pain points of traditional scientific research, where funding is concentrated in large pharmaceutical companies and research results are closed. We help global participants fund and participate in the development of new drugs, particularly for rare diseases, longevity research, and emerging health issues.

On June 3, 2025, the DeSci project token PYTHIA started to rise, rising from $0.0168 to $0.122 on August 14, an increase of 626%.

On July 31, 2025, Coinbase simultaneously launched two DeSci project tokens, BIO and RSC, marking DeSci's return to the mainstream Western digital currency market.

Since then, VITA, the token of the DeSci project VitaDAO, has continued to rise, from $1.17 on August 1st to a high of $2.22 on August 22nd, a total increase of 89%. Cerebrum DAO's NEURON token also performed well in August, surging over 180% this month. Meanwhile, CryoDAO's CRYO token has surged over 200%, ValleyDAO's GROW token has risen 76%, and HairDAO's HAIR token has surged 67.5%. These signs indicate that DeSci is recovering.

Aubrai: How AI scientists are rewriting the rules of longevity research

Entering 2025, Bio Protocol is accelerating its iterations. On August 21st, Bio Protocol partnered with VitaDAO to launch its first BioAgent Launch project, Aubrai, marking the official launch of its "decentralized scientific research agency" initiative. This sale lasted only 24 hours, allowing users to participate by staking BioXP and investing BIO tokens. The AUBRAI token's Time General Election (TGE) will take place on August 25th.

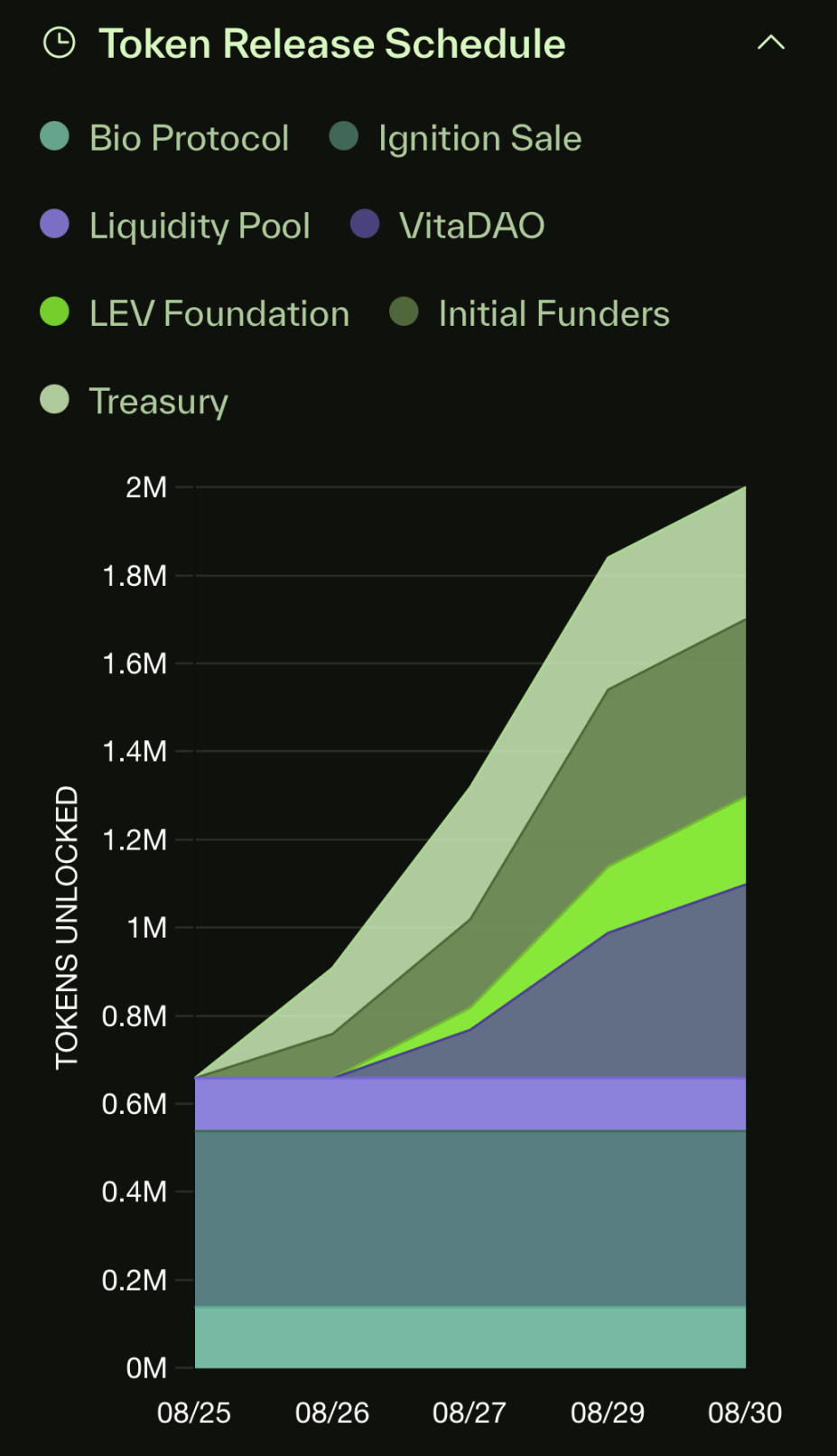

Currently, the token economics of AUBRAI has been announced, with a total supply of 2 million tokens. The token distribution is: 20% for sales, 6% for liquidity pools, 15% owned by the treasury, 20.1% for initial funders, 10% for the LEV Foundation, 22% for VitaDAO, and 6.9% for Bio Protocol.

Aubrai stems from the private laboratory data of longevity research pioneer Dr. Aubrey de Grey, who developed the "Engineered Negligible Senescence Strategy" (SENS) to prevent age-related diseases by repairing damage to senescent cells. De Grey holds a bachelor's degree in computer science and a doctorate in biology from the University of Cambridge. He has authored books such as "The Mitochondrial Free Radical Theory of Aging" (1999) and "Ending Aging" (2007).

de Grey is currently the President and Chief Scientific Officer of the LEV Foundation. The foundation focuses on longevity research. Its flagship project, "Robust Mouse Rejuvenation," tests combinations of late-stage intervention therapies through large-scale mouse lifespan studies. These studies, in collaboration with Ichor Life Sciences, emphasize damage-repair approaches, avoiding early interventions such as genetic modification, to accelerate clinical translation to humans.

Another LEV project, "Transplants on Demand," explores tissue engineering and supports Keinice Bio's cryopreservation technology, which uses ultra-cold helium to vitrify organs. This avoids the toxicity of traditional cryogens and aims to provide "off-the-shelf" young organ replacements to combat organ failure associated with aging.

The LEV Foundation also supports the Alliance for Longevity Initiatives, a 501(c)(4) nonprofit organization that promotes U.S. government policy support for longevity research. The organization collaborates with experts to raise public awareness of aging-related chronic diseases and secure national funding.

Through these studies, his private laboratory has accumulated thousands of unpublished research notes, internal experimental data, and the collective knowledge of the global longevity field. These "private scientific research assets" that were once only available to the core team are now integrated into Aubrai as training data.

In practice, Aubrai has transformed de Grey's team's workflow. It manages over a dozen complex longevity studies, reducing manual review times from weeks to days. It also identifies dosing conflicts, timing mismatches, and hidden biases, even uncovering new issues the team hadn't noticed.

According to the official roadmap, Aubrai has received joint funding from Bio Protocol and VitaDAO for the RMR2 pilot study, which aims to validate candidate interventions and optimize drug delivery. Community scientists can experience its collaborative capabilities as "co-scientists" through the closed beta CHAT UI. The wallet also supports self-hosted EOA wallets built on the Coinbase Developer Platform, which feature limited transaction authorization.

In the future, Aubrai will launch a semi-autonomous agent (integrated with Base AgentKit to support full transaction execution and financial autonomy) in the fourth quarter of 2025, and open the FAILURE DB database (recording negative results and design flaws to avoid repeated errors), ultimately achieving "fully autonomous research" - a full-process scientific output from hypothesis generation, experimental design to wet experiment execution and paper publication.

V2 Upgrade: Building an Efficient "Scientific Research-Capital" Cycle

Aubrai's launch is inseparable from the support of Bio Protocol V2. Its V2 version adopts the "launch and grow" concept, achieving sustainable growth through a community-driven launch pad:

- Low valuation launch: Referring to the platform model of Pump.fun, the project's initial valuation is reduced to US$205,000 FDV, 37.5% of the tokens are sold directly, and each user can subscribe to a maximum of 0.5% of the total tokens sold;

- Sustainable liquidity: All funds raised after the initial offering (BIO tokens) will automatically form an LP pool and be combined with 12.5% of the token supply. A 1% handling fee will be charged on each secondary market transaction (70% goes to the project treasury and 30% to the protocol), creating a positive cycle of "active trading - increased research funding - advanced research results - renewed market enthusiasm";

- Points incentive mechanism: Users earn BioXP points through staking, governance voting, community communication, and participation in new launch projects. Points can be used to subscribe to quotas for undervalued projects.

The implementation of these mechanisms has elevated Bio Protocol from a "research funding platform" to a "research ecosystem operating system." This not only addresses funding challenges but also improves the efficiency of research results translation through community incentives and automated tools. (Related reading: " Bio Version Upgrade: Aims to Activate a Flywheel System, Creating DeSci's Ultimate Capital Efficiency Platform? ")

DeSci's "Long-Termism" and the Future

BIO's market performance and Aubrai's launch have brought the DeSci field back into the public eye. However, challenges remain: long research cycles (even with Aubrai's accelerated trials, longevity therapies still take years to move from the bench to the clinic), short market patience (cryptocurrency investors are accustomed to rapid ups and downs), and regulatory uncertainty (high compliance costs for human trials).

In this regard, Binance founder Changpeng Zhao stated in an exclusive interview with Foresight News: "DeSci and Meme Coin are two completely different extremes. DeSci's project cycle is long, while investors in the cryptocurrency industry generally have a short attention span. Meme Coin is very popular, but projects like this have received less attention. However, in the long run, these projects will make significant contributions to humanity and society. I believe they will develop in the future, but I'm not sure when."